Your Guide to Joining a Series C Startup

So, you're thinking about joining a Series C startup? Smart move. This is where a company has moved past the nail-biting, "will this even work?" phase and is hitting the accelerator. Hard. They've found their product-market fit, investors are writing big checks, and the mission has shifted from survival to market domination.

You're not just joining a company; you're stepping onto a rocket ship that's already cleared the launchpad. For example, a company like Stripe was a Series C startup back in 2014. Joining then meant being part of a 200-person team on the verge of becoming a global fintech giant. That’s the kind of opportunity we're talking about.

What to Expect at a Series C Company

Forget the stereotype of a handful of people in a garage. A Series C company is a different beast altogether. The core challenge is no longer about invention; it's about execution at a massive scale. This creates a unique culture that's a fascinating blend of scrappy startup energy and the emerging structures of a more established corporation.

The name of the game is scale. Everything is being rebuilt to handle ten, or even a hundred, times the current load. Sales teams are expanding globally, engineering is re-architecting monoliths into microservices for performance, and marketing is launching multi-million dollar campaigns. You won't just be doing your job—you'll be actively helping to build the systems and processes that will define the company's future.

The Financial Maturity Factor

One of the biggest differences you'll notice is the financial stability. The median Series C funding round in early 2024 hovered around $50 million, a huge leap from the typical $18 million in a Series A. Investors don't part with that kind of cash unless a company has solid revenue, often in the range of $10M to $25M ARR, and a clear path to becoming a market leader. This is also why they can often go two or three years between funding rounds.

That influx of capital changes everything. While the "get it done" mentality is still there, you'll suddenly have the budget for better tools (like Salesforce or Marketo), specialized teammates, and bigger, more strategic projects. If you're curious about the mechanics of how this funding comes together, our guide on the venture capital funding process breaks it down.

Joining at Series C puts you in a sweet spot. You get to make a significant impact on a company that's already de-risked from its early, volatile days but still offers immense opportunities for personal and professional growth before it becomes a corporate behemoth.

To put it in perspective, here’s a quick look at how the stages compare:

Startup Stages at a Glance

| Characteristic | Seed/Series A | Series B | Series C |

|---|---|---|---|

| Primary Goal | Find product-market fit | Optimize and build a repeatable model | Aggressively scale and capture market share |

| Team Size | 10 – 50 employees | 50 – 250 employees | 250 – 1,000+ employees |

| Risk Level | Very High ( > 60% failure rate) | High | Moderate ( < 20% failure rate post-Series C) |

| Role Focus | Generalist; wearing many hats | Specialized roles begin to form | Highly specialized roles with clear departments |

| Funding Raised | $1M – $18M | $20M – $50M | $50M – $100M+ |

This table shows why Series C is often considered the "growth" stage. The foundational work is done, and now it's all about expansion.

Here's what that feels like on the ground:

- Structured Chaos: Don't get me wrong, it's still fast-paced and you'll need to be adaptable. But now, there are emerging processes like quarterly planning cycles and dedicated project managers bringing order to the madness.

- Impactful Roles: Your work has a direct line to a major company goal, whether that's expanding into a new country like Germany, launching a major product feature like an AI-powered analytics suite, or streamlining an internal operation to reduce customer onboarding time by 30%.

- Career Acceleration: With this kind of rapid growth comes opportunity. New teams and leadership positions are created constantly. A senior engineer today could be leading a new squad in six months, gaining experience that could take a decade to get in a more traditional company.

How to Find and Vet the Right Companies

Finding a true breakout company at the Series C stage is less about scrolling through job boards and more about becoming a savvy detective. Your goal isn't just to find a company with a fresh pile of cash, but one with genuine, sustainable momentum.

A great place to start your hunt is on platforms like Crunchbase or PitchBook, where you can track recent funding announcements. Think of this as your initial map of the territory.

But the funding announcement is just the beginning. The real signal is the quality of the investors. Are they top-tier VCs like Sequoia Capital, Andreessen Horowitz (a16z), or Accel, firms with a track record of picking winners? A roster of well-respected investors means that some very smart people have already done a ton of due diligence and bet big on the company's future. It's a powerful first filter.

From there, turn your attention to the leadership team. Jump on LinkedIn and really dig into the backgrounds of the executives. Have they been through this scaling chaos before and come out the other side at a company like Salesforce or Google? Do they have serious expertise in their industry? A leadership team that has already navigated the "scale-up" phase is a massive advantage. This is a totally different game than what's needed when joining a Series A startup, where the challenge is usually just finding product-market fit.

Your Due Diligence Checklist

Once you've got a shortlist of promising companies, it's time to go deep. You need to get a clear picture of the company's real health and its trajectory. To get a sense of what good looks like, it helps to understand different strategies for startup growth and financial milestones.

Here are the key areas to probe:

- Financial Runway: You don't need exact figures, but you should have a sense of how long the company can operate with its current funding. A healthy answer after a Series C round is typically "18-24 months." It's perfectly fair to ask about their burn rate, capital efficiency, and general plans for the future.

- Real Growth Metrics: Look past the vanity metrics. Ask about Annual Recurring Revenue (ARR) growth, customer acquisition costs (CAC) to lifetime value (LTV) ratio (a healthy SaaS ratio is 3:1 or higher), and net revenue retention (top-tier companies exceed 120%). These numbers tell the story of a healthy, scaling business.

- The Competitive Moat: Who are they up against? More importantly, what makes them different? This could be proprietary technology, a powerful network effect (like LinkedIn), or deep operational efficiencies. You need to understand their unique value proposition and why they're positioned to win in a crowded market.

Joining a Series C startup puts you right in the middle of a massive scaling effort. To give you an idea of the scale, in the first part of this year alone, dozens of these rounds closed with a mean funding amount of $119.2 million. The Information Technology sector, in particular, is seeing a huge amount of this action.

Don't forget: This is a two-way street. You are interviewing the company just as much as they are interviewing you. A great Series C company will be open about its growth, its challenges, and its vision for the future. Any evasiveness is a serious red flag.

Nailing the Growth-Stage Interview

Get ready, because interviewing with a Series C company is a different beast altogether. They aren't just looking to fill a vacancy; they're searching for people who can build, refine, and scale processes for the long haul. This means the interview process will feel more structured—often involving a take-home assignment or a panel interview—than at an early-stage startup, but still far more agile than a corporate behemoth.

The core of your mission here is to prove you're a builder, not just someone who can follow a playbook. Expect a heavy dose of behavioral questions aimed at uncovering how you handle ambiguity, take ownership, and push projects across the finish line in a high-speed environment. This is absolutely central to joining a series c startup.

Show Them You Can Scale

At this stage, hiring managers are obsessed with one thing: scalability. They need to be confident that you can handle 10x the volume, complexity, and customer demands that are just around the corner.

Be ready to tackle questions like these:

- "Tell me about a time you had to overhaul a process that was breaking under pressure."

- "How do you take an idea from a rough concept to a fully launched project with minimal hand-holding?"

- "Walk me through a situation where you had to get other teams on board with a new system or way of working."

When you answer, tell a story using the STAR method (Situation, Task, Action, Result). Don't just list what you did. Use a clear narrative: set the scene, detail the specific actions you took, and—most importantly—quantify the results. For instance, instead of a vague "I improved efficiency," try something like, "I automated our weekly reporting using a Python script, which saved the team 15 hours of manual data entry per week and slashed our error rate by 40%."

The trick is to frame your past experiences as mini-case studies in scalability. You need to show you’ve not only done the work but have also thought deeply about how to do it better and bigger. That’s the forward-thinking mindset they’re desperate to find.

For more on getting ready, these crucial job interview preparation tips provide a fantastic foundation for any interview, especially at a fast-growing company.

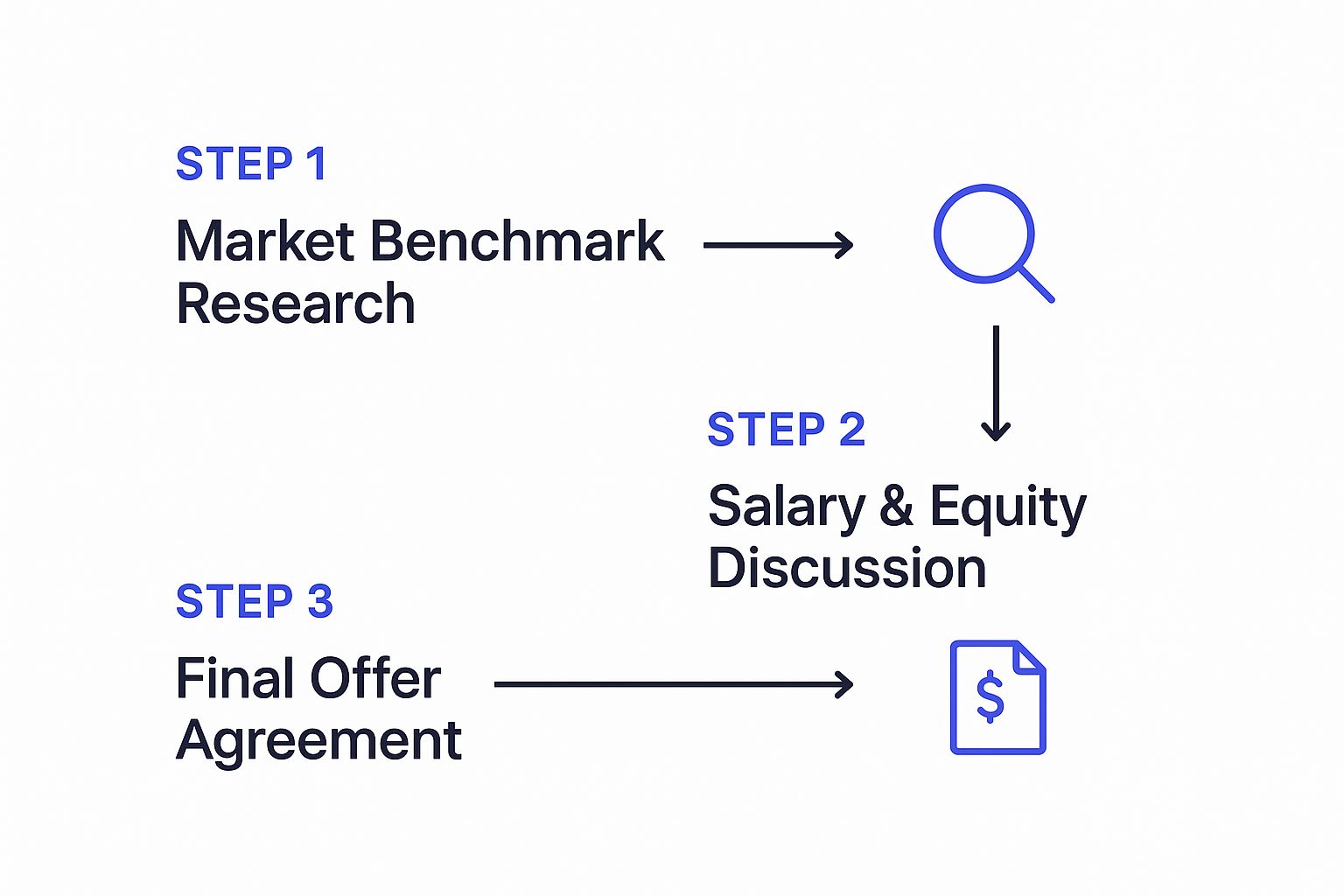

Decoding Your Startup Compensation Package

When an offer from a Series C startup lands in your inbox, don't just look at the base salary. That's only part of the story. The real potential often lies in the mix of cash and equity—your personal stake in the company’s future.

Unlike a big public company where the stock price is updated by the second, startup equity feels a bit more abstract. Your offer will almost certainly include stock options, which give you the right to buy shares at a set price, or Restricted Stock Units (RSUs), which are shares granted to you outright over time. At the Series C stage, RSUs become more common as companies move closer to a potential IPO.

Getting a Handle on Equity

To really size up your offer, you have to learn the language of startup equity. Knowing a few key terms will help you ask smarter questions and figure out what your compensation could actually be worth one day. It’s the difference between guessing and making an informed career decision.

If you’re just getting started, here’s a simple breakdown of the most common terms you’ll see in an offer letter.

| Key Equity Terms Explained | ||

|---|---|---|

| Term | What It Is | Why It Matters |

| Strike Price | The fixed price you'll pay per share to buy your stock options. | A lower strike price means a bigger potential profit if the company's value goes up. |

| 409A Valuation | An independent appraisal that determines the fair market value of the company's stock. | This valuation is what sets your strike price. At Series C, this valuation could be in the hundreds of millions or even billions. |

| Vesting Schedule | The timeline for earning full ownership of your equity grant. | A typical schedule is four years with a one-year "cliff." Leave before one year, and you get nothing. After the cliff, you typically vest monthly. |

Think of it this way: the goal is to join a company where the future value of the stock skyrockets past your strike price. That gap is where life-changing money is made.

The Impact of Market Conditions

The startup world doesn't exist in a vacuum. The broader economic climate plays a huge role in a company's valuation, which directly affects your equity's potential.

Lately, we’ve seen a market correction leading to more "down rounds"—when a startup raises money at a lower valuation than its previous round. In a recent quarter, roughly 19% of all funding rounds were down rounds. This isn't a sign of panic; it's a shift toward sustainable growth over inflated hype. For more on this, Carta’s Q1 2025 report offers some great insights into private market trends.

Believe it or not, this can be a good thing for new hires. A lower valuation means your stock options come with a lower strike price, giving you more room for financial upside if the company grows. For more benchmarks, you can explore our deep dive into startup equity data. Your job is to negotiate a package that balances a solid salary for today with an equity stake that has a real chance to be worth a fortune tomorrow.

Making an Impact in Your First 90 Days

So, you’ve landed the job. Congratulations! Now the real work begins. Your first three months at a Series C startup are your proving ground. This isn't just about settling in; it's about strategically building momentum and showing them they made the right choice. The best way I've seen this done—and the method I always recommend—is to follow a classic 30-60-90 day plan.

The First 30 Days: Absorb Everything

Your first month is all about being a sponge. Seriously, your main job is to listen and learn.

Forget about trying to make sweeping changes or prove your genius right away. Instead, focus on understanding the machinery of the business. Get deep into the product documentation on Confluence, figure out the existing workflows in Jira, and start building relationships. Set up short coffee chats with at least 10-15 people on your team and in other departments. Your goal is to understand the landscape before you try to change it.

The Next 30 Days: Start Making Your Mark

Alright, you've got the lay of the land. Now it's time to shift from pure learning to active contribution.

This is when you start tackling your core responsibilities and, just as importantly, hunting for some quick wins. These are small, tangible victories. Maybe it’s fixing a persistent bug that’s been annoying the sales team or streamlining a clunky process in a Google Sheet that everyone dreads. These wins demonstrate your competence and show you can deliver value without needing constant hand-holding.

The groundwork you laid in the earlier stages—from your initial research to signing the offer—is what sets you up for this moment.

Days 61-90: Take the Reins

By the third month, you should have enough context to move from contributor to owner. You're no longer just executing assigned tasks; you're proactively identifying problems and bringing solutions to the table.

This is your chance to take initiative on a new project or suggest an improvement based on your observations from the first two months. For instance, you could draft a proposal for a new A/B testing framework for the marketing team or create a playbook for handling a specific type of customer support ticket. Show your manager and your team that you can think independently and drive things forward. This is what separates a good hire from a great one.

The entire point of these first 90 days comes down to one thing: building trust. When you show you can learn fast, deliver results, and take ownership, you stop being "the new person" and start becoming a go-to member of the team.

This structured approach doesn't just help you survive; it proves you can thrive in the fast-paced, high-growth world of a Series C startup and cements your place in its future.

Common Questions About Series C Startups

https://www.youtube.com/embed/CzObef7SZmI

Even with a solid game plan, you're bound to have some questions buzzing around. Let's dig into some of the most common ones that pop up when people get serious about jumping into a Series C company.

Is It a Safe Bet?

For the most part, yes. By the time a startup hits Series C, it has a proven product and serious financial backing. Data from organizations like Startup Genome suggests that the failure rate for startups drops significantly after a Series B or C round, falling to well below 20%. This significantly dials down the "will we be here next year?" anxiety you might feel at a seed-stage company.

The data backs this up. While research shows 46% of UK tech companies offer equity to all employees, the stability of a Series C startup means that equity has a much better shot at actually being worth something someday.

But let's be real—the risk isn't zero. The pressure is on to scale, dominate the market, and chart a clear course to profitability or an IPO. These are massive hurdles.

What’s the Work-Life Balance Really Like?

Think of it as a hybrid. It’s not the 24/7 chaos of a ten-person startup, but it's definitely not the slower, structured pace of a massive corporation either.

You can expect a high-energy environment where performance and results are everything, but you'll likely have more predictable hours than in earlier stages. The big advantage here is that you'll have better systems and more resources (like dedicated support teams) to do your job well, which can help you avoid the burnout that’s so common in the earlier stages.

If the leadership team gets cagey about the company's financial health or runway, that’s a huge red flag. A well-run Series C company should be open about its growth metrics, market position, and how it plans to use that new pile of cash.

What Are the Biggest Red Flags to Watch Out For?

Besides getting fuzzy answers about the financials, here are a few other warning signs to keep on your radar.

- A Revolving Door: Pay attention to employee turnover on LinkedIn, especially in leadership. If VPs or Directors are constantly leaving after less than 18 months, it could point to a toxic culture or deep-seated instability.

- Product Stagnation: Is the product evolving? Check their release notes or company blog. If competitors are shipping major features every month and they're only making minor tweaks, it might signal bigger problems with strategy or execution.

- Gut-Check on Culture: During your interview, ask specific questions like, "How are disagreements handled on the team?" or "Can you give me an example of how the company lives its values?" If the answers are generic or the company’s vibe doesn’t align with how you like to work, it’s just not going to work out long-term.

Ready to find your next opportunity? FundedIQ delivers curated lists of recently funded startups, complete with decision-maker contacts and key growth signals, so you can connect with high-growth companies at the perfect moment. Find your next role at a funded startup.