Unpacking Venture Capital AI Investing

For the first time in a generation, we're seeing a seismic shift in how venture capital is being invested. Firms aren't just dipping their toes in artificial intelligence; they're redirecting colossal pools of capital toward AI startups. This isn't just another tech trend—it’s a fundamental rewiring of the investment world, where AI has firmly established itself as the new engine for economic growth.

The sheer scale of the funding is staggering. It reflects a core belief that AI is becoming the new "electricity" that will power the global economy for decades to come, similar to how the internet transformed industries in the late 1990s.

The New Gold Rush in Venture Capital AI

This flood of money into artificial intelligence is less of a gradual change and more of an all-out gold rush. What was once a specialized niche has exploded, becoming the main focus for nearly every major VC firm on the planet. This isn't happening in a vacuum; it’s being fueled by a perfect storm of mature technology, obvious market demand, and the promise of astronomical returns.

Think about it this way: for the last few decades, software was king. Now, AI is the bedrock on which all future software will be built. Grasping this reality has kicked off an unprecedented flow of cash into the sector, creating a moment where one area of technology is commanding the lion's share of investor attention and dollars. For example, prominent VC firm Andreessen Horowitz (a16z) recently closed a $7.2 billion fund, with a significant portion earmarked for AI investments.

The Unprecedented Scale of Investment

The numbers really put this shift into perspective. In the first half of 2025 alone, AI startups snapped up 53% of all global venture capital dollars invested. That's a mind-boggling figure that completely overshadows the investment levels we saw just a few years ago when AI was a much smaller piece of the pie.

This influx of cash is creating an entirely new class of startups and changing the rules of the game. So, what’s behind this investment frenzy?

- Real Technological Leaps: Recent breakthroughs in generative AI, such as the transformer architecture behind models like GPT-4, have taken AI from theoretical to practical, opening the door to tangible business solutions.

- Massive Market Adoption: Companies in every industry imaginable—from healthcare to finance—are scrambling to bring AI into their operations to get more efficient, innovate, and simply stay competitive. A recent McKinsey survey found that 79% of companies have had at least some exposure to generative AI.

- A Clear Path to Profit: Early AI success stories have already shown the technology can disrupt markets and generate serious revenue, convincing investors of its massive financial upside. The rapid growth of companies like OpenAI, valued at over $80 billion, serves as a powerful proof point.

This isn't just about VCs funding small improvements. They are betting on AI to become a true General-Purpose Technology (GPT)—a force as powerful as electricity or the internet that will fundamentally remake every part of our economy.

The momentum is undeniable. Just look at Microsoft's plan to pour $80 billion into AI-ready data centers in FY 2025. This isn't just investors chasing the latest hype; it's a strategic, global reallocation of capital toward what many believe is the most important technological movement of our lifetime.

Mapping the AI Investment Ecosystem

To really get a handle on AI venture capital, it helps to stop thinking of it as one big pool of money. It’s much more like a living ecosystem, with different players and funding stages, each with its own motivations and rules of engagement. Knowing who’s who and what they do is the first step to making sense of it all.

Imagine an AI startup’s path to success as a video game. To get to the next level, you need to unlock a new gate, and each gate requires a different key. These gates are the funding stages, and they are especially important for AI companies that need a ton of cash upfront for top-tier talent, massive datasets, and serious computing power.

The Key Players and Their Roles

Not all money is created equal. Where the investment comes from has a huge impact on the deal, the expectations, and the kind of relationship the startup will have with its backers. Understanding the main types of investors is crucial.

You'll generally run into three main categories:

- Traditional Venture Capital (VC) Firms: Think of firms like Andreessen Horowitz or Sequoia Capital. They raise money from big investors (like pension funds) and invest it in promising startups. In return for cash, they take an ownership stake (equity) and usually get heavily involved, offering advice and opening doors through their networks. They are driven purely by financial returns.

- Corporate Venture Capital (CVC) Arms: These are the investment teams inside big companies, like Google's GV or Microsoft's M12. They have a double mission: make money on their investments, but also get a front-row seat to new tech that could help the main business. For example, Salesforce Ventures invests in AI companies that can integrate with its CRM platform.

- Private Equity (PE) Firms: These investors show up much later in the game. PE firms aren’t interested in early-stage ideas; they look for established, profitable AI companies. Their goal is often to streamline the business to make it even more profitable before selling it or taking it public, as seen in Thoma Bravo's acquisition of AI cybersecurity firm Darktrace.

The activity across this landscape shows just how much faith investors have in AI's future. Global VC activity has stayed incredibly strong. In the second quarter of 2025 alone, software and AI-related companies pulled in about 45% of all VC funding. Corporate VCs were especially busy, accounting for roughly 36% of the total deal value as they chased generative AI and other cash-hungry technologies.

Navigating the AI Funding Stages

Getting an AI startup funded is a marathon, not a sprint. Each stage of funding provides the necessary fuel to hit the next major milestone, whether that’s building the first prototype or expanding into new countries. For AI companies, these funding rounds are typically much larger because the initial development costs are so high.

A strong founding team is paramount. Investors aren't just betting on an algorithm; they're betting on the people who can navigate technical challenges, build a business, and adapt to a rapidly changing market. For instance, the founders of Anthropic, former OpenAI employees, were able to raise massive rounds based on their proven expertise.

Here are the primary stages a startup goes through:

- Seed Stage: This is the very first real money a company raises. It’s used to prove the core idea works, build a basic version of the product (a minimum viable product or MVP), and do some initial market research. For an AI startup, this might mean demonstrating a model's proof-of-concept on a specific dataset.

- Series A: Once the startup has a product that people are actually using and maybe even paying for, it raises a Series A round. This money is for fine-tuning the product and figuring out exactly who the ideal customer is. The goal is to prove product-market fit.

- Series B and Beyond: These later rounds (B, C, D, and so on) are all about growth. The capital is used to expand into new markets, hire more people, and build out sales and marketing to grab as much market share as possible. This is a pivotal stage for many funded startups in Africa looking to go big.

Decoding Key AI Investment Trends

If you want to know where the AI market is headed, you have to follow the money. Investment patterns are the breadcrumbs that lead us to the technologies hitting maturity, the industries on the cusp of a shake-up, and where investors expect the biggest paydays. This isn't just cash being thrown around; it's a series of calculated, strategic bets on what's next.

By digging into these trends, we can start to see the logic driving today's venture capital decisions. The data clearly shows a massive concentration of capital in a few key areas—from game-changing foundational models to practical, industry-specific tools that solve an immediate problem.

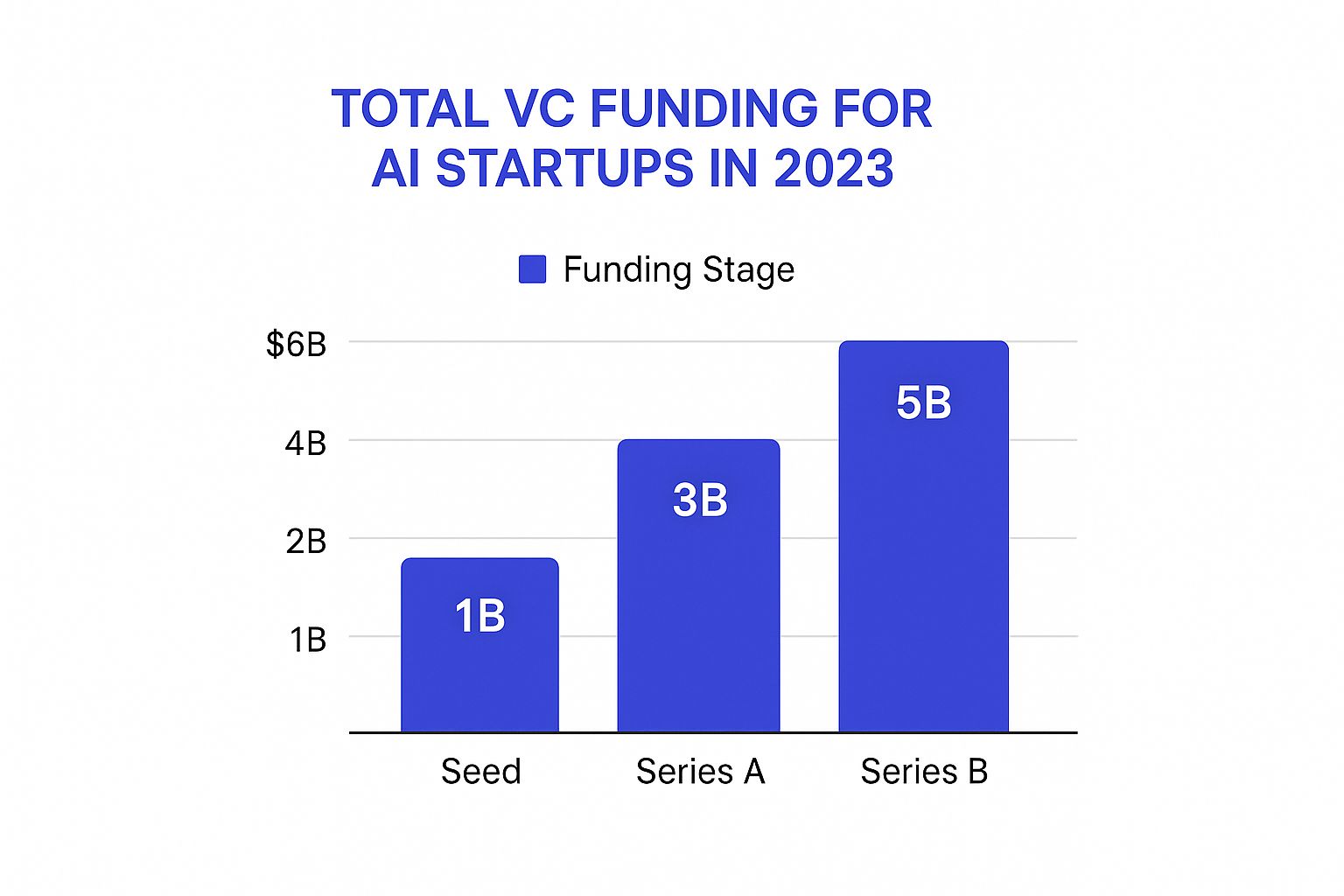

This infographic breaks down how VC funding for AI startups was distributed across the key early stages in 2023.

As you can see, while Seed and Series A rounds pull in a lot of capital, the game completely changes at Series B. That's where the investment scale explodes, showing that investors are doubling down on AI companies that have already proven they have a real market.

The Unstoppable Rise of Generative AI

Right now, the undisputed heavyweight champion of AI investment is Generative AI. This isn't just another trend; it's the main event, pulling in the biggest checks from the most powerful investors. The logic is simple: generative models are seen as the next foundational platforms, much like operating systems or the cloud were in their day.

Startups building Large Language Models (LLMs) or pioneering new image and video generation tools are raising mind-boggling amounts of cash. A practical example is French startup Mistral AI, which raised over $600 million at a $6 billion valuation less than a year after its founding. Investors see them as the kingmakers—the ones providing the core engine that thousands of other companies will build on top of. This creates a "winner-take-most" dynamic where VCs are willing to write colossal checks to back the teams they think can own the market.

To get a clearer picture of this trend, let's look at how AI's share of VC funding has evolved.

AI's Growing Share of Global VC Funding

This table illustrates the dramatic increase in AI's percentage of total venture capital deal value over the past decade, highlighting the recent explosive growth.

| Year | AI Share of Global VC Deal Value | Key Trend |

|---|---|---|

| 2014 | 3% | Niche technology, early adopter interest. |

| 2016 | 6% | Steady growth as early applications prove value. |

| 2018 | 11% | Mainstream adoption begins in key sectors. |

| 2020 | 16% | Pandemic accelerates digital transformation and AI integration. |

| 2022 | 25% | Post-ChatGPT boom begins, generative AI attracts hype. |

| Q2 2025 | 53% | Absolute market dominance, fueled by massive generative model rounds. |

The numbers don't lie. This surge is fueled by enormous rounds like Meta's $14.3 billion investment in Scale AI, which shows just how much capital is flowing into these foundational platforms.

Specialized AI Is Finding Its Niche

While generative AI grabs all the headlines, a quieter but equally vital trend is the rise of specialized, or "vertical," AI. These are companies applying AI to solve very specific problems within a single industry. Instead of trying to build a massive, do-everything model, they train smaller, more focused models on highly specific data.

This targeted approach has a few key advantages that smart VCs love:

- A Clearer Path to Money: Vertical AI startups are often solving a direct and painful problem for a known customer, which makes selling the product and generating revenue much easier, much earlier. For instance, Harvey AI, focused on legal work, quickly secured law firms as paying customers.

- Deeper Moats: By gathering unique datasets within an industry—think legal tech or biotech—these companies build a competitive wall that's tough for bigger, generalist models to climb.

- Lower Capital Burn: Training a specialized model is usually far less expensive than building a frontier LLM from scratch. That means every dollar of venture capital goes further.

Think of it this way: Generative AI is building the interstate highway system—a massive, expensive infrastructure project. Vertical AI is building the specialized vehicles, like delivery trucks, ambulances, and tractors, that use that highway to do specific, valuable jobs.

Sectors like healthcare (AI for drug discovery), legal tech (AI for contract analysis), and defense are seeing huge investments. Anduril's $2.5 billion funding round is a perfect example of the massive potential investors see when advanced AI is applied to specialized, high-stakes industries.

Geographical Hotspots and Growing Round Sizes

The map of AI venture capital is still pretty concentrated. Silicon Valley remains the epicenter, attracting the lion's share of funding thanks to its unmatched network of talent, top-tier research labs, and seasoned investors. Overall, the United States is leading the pack, with its AI startups receiving 64% of all VC dollars invested in the country.

But the game is slowly going global. We're seeing other hubs emerge in cities like London, Beijing, and Toronto. This mirrors what's happening in other tech scenes, a pattern you can explore further in our guide on funded startups in Latin America.

Another trend that's impossible to ignore is the sheer size of funding rounds, even at the very beginning. Seed rounds for promising AI companies are ballooning, often hitting numbers that used to be reserved for Series A or B deals. For example, some AI seed rounds now exceed $10 million. This reflects the high upfront costs of building an AI company—hiring top engineers and paying for massive computing power—and the intense competition among VCs to get a piece of the next big thing. This "mega-seed" phenomenon shows just how much conviction investors have in AI's future.

Navigating High Stakes Risks and Opportunities

The flood of cash pouring into venture capital AI certainly looks like a gold rush, but like any gold rush, it’s fraught with risk. The sheer speed and size of the investments have created a high-stakes game where the line between a brilliant move and a costly blunder is incredibly thin. You have to look past the hype to see what’s really going on.

For every AI success story you read about, there are serious risks lurking beneath the surface. The staggering amount of capital needed just to build and train foundational models puts up a huge wall for newcomers. On top of that, sky-high valuations are setting some pretty wild expectations for growth. Acknowledging these hurdles gives you a much clearer picture of the field.

The Double-Edged Sword of Market Concentration

One of the biggest risks right now is market concentration. A small number of mega-deals are sucking up a massive slice of the investment pie, which creates a top-heavy system that could be more fragile than it looks. It's a sign that the market is maturing, sure, but it also brings a new set of problems.

The AI boom has completely reshaped startup funding. By mid-2025, deals involving AI made up 51% of the total VC deal value worldwide—a huge leap from just 12% back in 2017. But that money isn't spread around evenly. In the second quarter of 2025, just 16 companies soaked up nearly a third of all venture investment. This shows a clear trend where a few AI giants are dominating the funding scene. You can find more details in this global AI report and see what it means for the market.

This creates a few precarious situations:

- Starving the Long Tail: While a few companies raise billions, thousands of smaller, genuinely innovative startups are left fighting for scraps. This can easily stifle fresh ideas and diverse approaches.

- Dependency on a Few Players: The entire market becomes too reliant on the success of a handful of companies building foundational models. If one of these giants stumbles, it could send shockwaves everywhere. A prime example is the heavy reliance of many startups on OpenAI's API.

- Inflated Valuations: With so much money chasing a few top-tier deals, valuations can get pushed to levels that just aren't sustainable. This seriously increases the risk of a market correction down the road.

Overvaluation and the Correction Risk

The feverish excitement around AI has sent valuations soaring, often based more on a dream of the future than on actual revenue or a solid business plan. It’s a classic high-risk, high-reward situation. When a company is worth billions before it has a clear path to making money, the pressure to deliver explosive growth is immense. For example, Inflection AI was once valued at $4 billion but was later effectively acquired by Microsoft for a fraction of that, highlighting the volatility.

The current venture capital AI climate feels a lot like past tech booms. The real question investors are asking isn’t if AI will be huge, but which companies will actually survive the inevitable shakeout to capture that value.

This kind of environment makes a major market correction more likely. If a few big-name, overvalued AI startups fail to deliver on their promises, investor confidence could evaporate, leading to a funding pullback that hurts everyone in the sector.

Turning Risks Into Strategic Opportunities

For all the challenges, these market dynamics also open the door for smart founders and investors. The big, general-purpose models have left a ton of room for more specialized, focused applications. This is where I think we'll see the next wave of real value being created.

Think about it: a startup that builds a hyper-accurate AI for analyzing legal contracts in a specific industry can carve out a defensible niche that a giant like OpenAI probably won't bother with. Going "niche" is how smaller players can win.

Here are a few strategic openings to watch for:

- Vertical AI Solutions: Instead of trying to boil the ocean, companies are developing AI tools for specific industries like agriculture, manufacturing, or healthcare. They solve clear, monetizable problems and aren't competing head-to-head with the big model builders.

- AI Integration and Services: A lot of established businesses want to use AI but have no idea how. This creates a massive opportunity for agencies and consultants who can help integrate AI into existing company workflows.

- "Pick-and-Shovel" Plays: Forget building the models themselves. Some of the smartest companies are selling the "picks and shovels" for the gold rush—the essential infrastructure, tools, and data services that all AI developers need. A great example is Scale AI, which provides data labeling services essential for training models. Their success is tied to the growth of the entire sector.

A Practical Playbook for Founders and Investors

Knowing the trends in venture capital AI is one thing, but actually using that knowledge to build a strategy is a completely different ballgame. Founders chasing capital and investors hunting for the next big thing both need a solid plan. This is where we translate all that high-level market talk into real, actionable steps.

For founders, the rules have changed. There's a ton of money out there, but it's all chasing a handful of massive ideas. Having impressive tech just isn't enough anymore. You have to build a story that resonates with what VCs are looking for right now.

And for investors or agencies, that funding data is pure gold. It’s a bright, flashing sign that tells you which companies are ready to spend on growth, hire talent, and invest in new services. Learning to read those signals is how you find high-intent prospects before your competition even knows they exist.

Positioning Your AI Startup for VC Success

The market is flooded with AI pitches, so standing out is everything. Founders have to prove they’re offering more than just another cool algorithm. VCs are backing businesses, not science experiments, which means your pitch has to be all about commercial potential.

To cut through the noise, you need to show undeniable strength in one of three key areas:

- A Clear Path to Monetization: Show them the money. You need to demonstrate exactly how your AI solves a painful, expensive problem for a very specific customer. A practical tip is to come with early letters of intent (LOIs) or pilot customers, even if they aren't paying much yet.

- A Defensible Technological Moat: If your secret sauce is the tech itself, you have to prove it can't be easily copied. This could be a unique dataset nobody else has, a groundbreaking model architecture, or a team with expertise so specialized that competitors simply can't recruit their way to your level.

- Dominance in a High-Growth Vertical: Go deep, not wide. Pick a specific industry—think legal tech, biotech, or advanced manufacturing—and become the go-to solution. Prove you have deep domain knowledge and show how your AI can become an indispensable tool for that entire sector.

Investors are looking for founders who get it: the business model is just as crucial as the AI model. A brilliant algorithm without a clear customer or a way to get paid is a high-risk bet many are no longer willing to make.

At the end of the day, your job is to make the investment feel less like a gamble. When you present a concrete plan for making money, defending your turf, or owning a niche, you give VCs the confidence they need to write a check in a very crowded market.

Turning Funding Data into a Lead Generation Engine

For agencies, consultants, and B2B service providers, a company’s recent funding announcement is one of the strongest buying signals you can get. It means they’re armed with fresh capital, have an aggressive mandate for growth, and will urgently need help with marketing, hiring, and tech infrastructure.

But you can't just spray and pray. Using this data well requires a methodical approach. It’s not about just finding out who got funded; it’s about understanding what that funding means and tailoring your outreach to be immediately relevant. A practical insight is to check the press release for what the funds are earmarked for—is it "hiring," "marketing," or "product development"?

Here’s a simple workflow to turn funding news into qualified leads:

- Identify Recently Funded Companies: Use platforms that track venture capital AI deals to build a list of startups that just closed a round. You can filter by funding stage, industry, and location to find your perfect client profile.

- Analyze the Funding Stage: A Seed-stage company needs help building its brand from the ground up. A Series B company, on the other hand, is probably focused on scaling its sales team and expanding into new markets. Your pitch has to speak to their immediate needs.

- Refine Your Service Offering: Seeing a huge influx of cash into AI-powered healthcare startups? That's your cue. It might be the perfect time to develop a specialized marketing package just for that vertical. Use the market trends to figure out what clients need before they even ask.

When you start treating funding data as a strategic tool, you stop sending cold, generic emails. Instead, you can start warm, relevant conversations with companies that have both the budget and the motivation to say yes.

The Future Horizon of AI Investment

With the initial frenzy of venture capital AI funding starting to settle, the big question on everyone's mind is: what’s next? It looks like we're moving past the era of building massive, all-purpose models and into a new phase focused on real-world, practical applications. That means investment is getting smarter and more targeted, shifting away from blank checks for general AI and toward companies solving specific, tangible problems.

Let's be honest, the days of billion-dollar mega-rounds for every new LLM builder probably aren't sustainable. The sheer amount of cash needed to play at that level puts up a huge wall, and not many can climb it. So instead, we're seeing money flow into more specialized, niche areas where AI can make an immediate impact.

Emerging Frontiers for AI Funding

Generative AI grabbed all the headlines, but the next wave of funding is already building in more specific, applied technologies. Think of these sub-sectors as the next layer, building on top of the foundational models we now have.

Investors are now hunting for companies that can deliver a clear, immediate ROI in well-established industries. It’s all about practical value.

Here are a few of the areas picking up serious steam:

- AI Agents: These are autonomous systems built to handle complex tasks, and they're getting a lot of attention. Imagine an AI agent that doesn't just automate a single step but manages an entire workflow—from logistics and finance to customer service. Companies like Adept AI, which raised $350 million, are pioneers in this space.

- Biopharma and Health Tech: AI is on the verge of radically changing drug discovery and patient care, slashing costs and timelines. For example, a company called Mandolin recently raised $40M to automate access to specialty drugs. It's a perfect example of the huge potential in this space.

- Robotics and Embodied AI: This is where AI software gets a physical body. VCs are placing big bets on startups putting advanced AI into robots for manufacturing, agriculture, and logistics. Figure AI, which builds humanoid robots, raised a staggering $675 million from investors like Jeff Bezos and Microsoft.

The future of venture capital in AI isn't just about making models smarter; it's about making them useful. The entire conversation is shifting from "What can AI do?" to "What problems can AI solve for us right now?" This practical mindset is what will shape the next chapter of investment.

Geopolitical and Regulatory Headwinds

The flow of AI capital isn't just happening in a vacuum; it’s being shaped by powerful external forces. Geopolitical tensions, especially between the U.S. and China, are starting to redraw the investment map. Governments now see AI as a critical national resource, which is leading to new policies designed to protect homegrown tech and put limits on cross-border deals.

At the same time, the shadow of regulation is getting longer. As AI sinks its teeth deeper into our daily lives, governments will have no choice but to step in. For example, the EU's AI Act is one of the first comprehensive legal frameworks for AI. They'll need to tackle tough issues like data privacy, algorithmic bias, and the impact on jobs. This uncertainty could make some investors nervous, but it also creates opportunities for new startups focused on AI governance, ethics, and compliance. How this all plays out will depend on how well the industry can navigate these choppy waters.

Common Questions About Venture Capital and AI

If you're trying to wrap your head around the world of AI venture capital, you're not alone. It’s a fast-moving space, and things can get confusing. Let's break down a few of the most common questions people have.

What Are VCs Actually Looking for in an AI Startup?

Beyond a clever algorithm or a cool demo, venture capitalists are hunting for a real business. When they look at an AI startup, they’re trying to see past the tech and find signals of genuine, long-term potential.

So, what gets them to write a check? It usually boils down to a few key things:

- Solving a Real Problem: Is the startup tackling a genuine pain point for a specific group of customers? More importantly, are those customers willing to pay to make that pain go away? VCs look for startups that can quantify the problem in terms of cost savings or revenue generation for their clients.

- A "Moat" or Unfair Advantage: What does this company have that no one else can easily copy? This could be a unique, proprietary dataset, a groundbreaking model architecture, or a rockstar team with expertise that's impossible to replicate.

- A Path to Massive Scale: VCs aren't interested in small, sustainable businesses. They need to see a clear plan for how the company can grow its revenue and user base exponentially without costs spiraling out of control. An ideal AI business has low marginal costs for adding new customers.

At the end of the day, investors need to see more than just a piece of technology. They need to believe in a company that’s built to dominate a market.

Why Are AI Funding Rounds So Incredibly Large?

You see these headlines about AI companies raising hundreds of millions of dollars, and it's easy to wonder if it's all just hype. The truth is, those huge funding rounds are a direct reflection of the massive upfront costs of building a serious AI company from scratch.

It all comes down to the two most expensive ingredients in the AI recipe: world-class talent and mind-boggling computing power. You need to attract the best engineers and researchers—who command sky-high salaries—and then give them the resources to train their models, which can mean burning through millions of dollars in cloud computing credits.

This isn't your typical software startup that can get by on a shoestring budget. A single training run for a large model can cost millions. The capital-intensive nature of AI means that even a "seed" round can look like a later-stage deal from just a few years ago. Investors know that skimping on funding is a death sentence, so they're willing to go big to give their companies a fighting chance.

Is It Too Late to Jump into the AI Market?

It’s true that the race to build the biggest, most powerful foundational models is dominated by a few giants. But if you think that means the game is over, you're missing the bigger picture. The real opportunity is just beginning to unfold in applied AI.

Think about it like the early days of the internet. A handful of companies built the underlying infrastructure (the "plumbing"), but the real explosion of value came from the thousands of businesses built on top of that infrastructure. We're seeing the exact same pattern play out in AI right now.

The doors are wide open for startups focused on specific, practical applications, such as:

- AI tools that analyze complex legal documents in seconds.

- AI platforms that accelerate drug discovery for pharmaceutical companies.

- Smart automation for messy, real-world problems in manufacturing or logistics.

The future of venture capital in AI isn't just about building another ChatGPT. It's about finding clever ways to use these powerful tools to solve real-world problems and deliver immediate value. There's still plenty of room on the field for new players.

Stop chasing cold leads. With FundedIQ, you get a curated list of recently funded startups delivered to your inbox every month—complete with verified decision-maker contacts and critical business insights. Start smarter conversations with companies ready to buy. Find your next client at https://fundediq.co.