8 Crucial Startup Diversity Statistics for 2025

- 1. Only 2.3% of VC funding goes to female-founded startups

- 2. Black and Latino founders receive less than 3% of VC funding combined

- 3. Diverse founding teams are 70% more likely to break into new markets

- 4. 40% of Fortune 500 companies were founded by immigrants or their children

- 5. Women-led startups generate 10% higher cumulative revenue over 5 years

- 6. Only 8% of startup accelerator participants are Black founders

- 7. LGBTQ+ founders represent less than 1% of funded startups

- 8. Diverse teams are 35% more likely to outperform homogeneous teams

- Startup Diversity Statistics Comparison

- From Statistics to Strategy: Building a More Equitable Future

In the fast-paced world of startups, 'diversity' and 'inclusion' have become familiar terms. But what do the numbers actually say? While conversations around equity are frequent, the hard data often reveals a landscape where rhetoric and reality diverge significantly. This article moves beyond anecdotal evidence to present a data-driven look at the startup ecosystem, providing a clear-eyed view of where the industry currently stands.

We have compiled eight critical startup diversity statistics that reveal the stark realities of funding gaps, the surprising performance of underrepresented founders, and the powerful economic case for building inclusive teams. These aren't just abstract figures; they represent tangible barriers and missed opportunities within the venture capital and startup communities. For investors, founders, and talent alike, understanding these metrics is the first step toward making more informed and strategic decisions.

Throughout this comprehensive roundup, each statistic is paired with factual data, real-world examples, and actionable insights to provide a complete understanding of the challenges and opportunities ahead. You will learn not only about the disparities in venture capital allocation but also about the proven financial and innovative advantages that diverse teams bring to the table. By examining the data, we can better understand the systemic issues at play and identify the strategic advantages that true diversity unlocks. This is a look at the hard numbers that define the current state of startup diversity and illuminate the path forward.

1. Only 2.3% of VC funding goes to female-founded startups

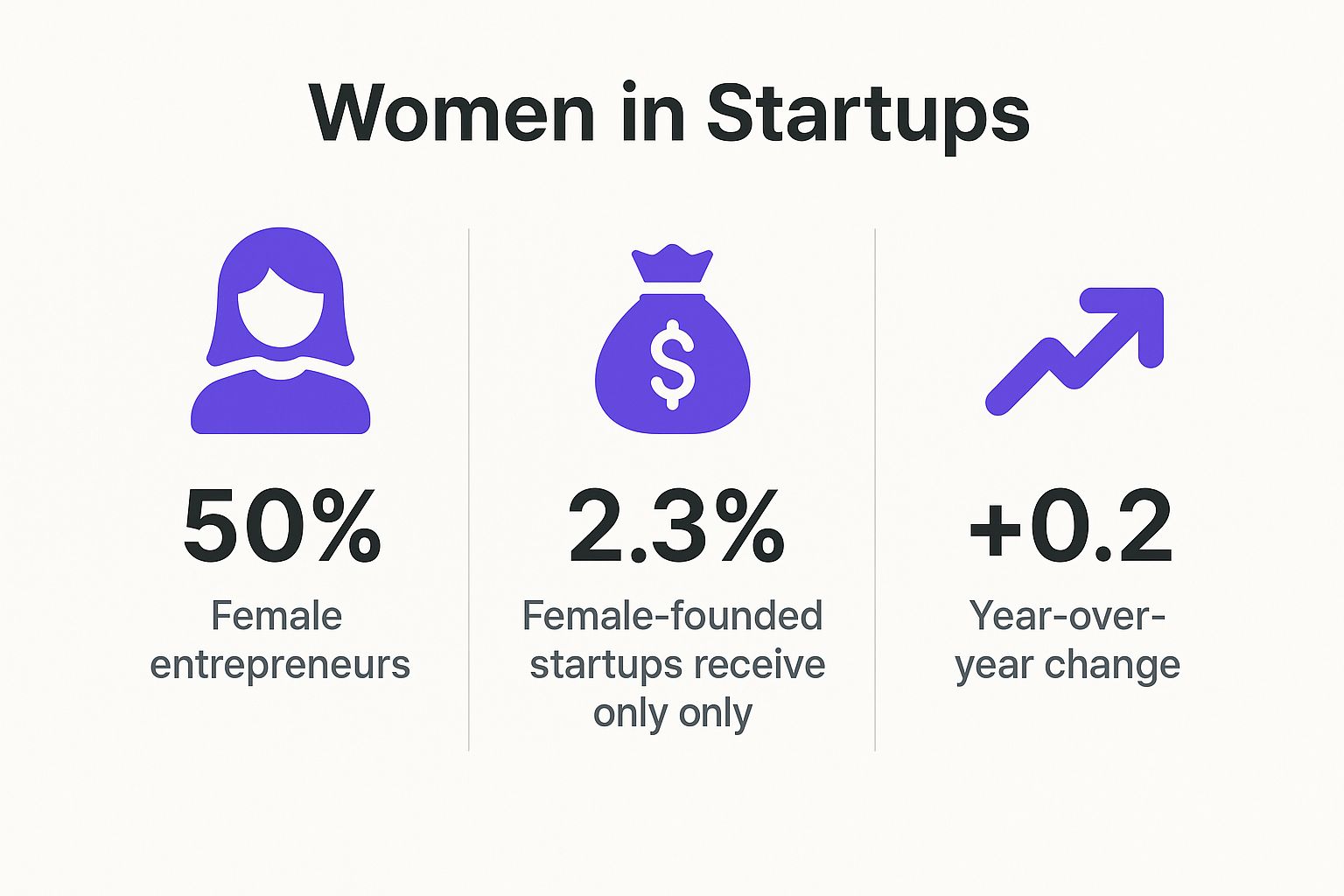

One of the most persistent and widely cited startup diversity statistics reveals a significant gender disparity in venture capital. Despite women comprising roughly half of the population, startups founded exclusively by women received only 2.3% of the total capital invested by venture capitalists in 2022. This statistic starkly illustrates the systemic barriers and biases female entrepreneurs face when seeking funding to scale their businesses.

This funding gap isn't just a number; it represents a massive missed opportunity for innovation and economic growth. Companies with female founders have been shown to perform exceptionally well over time, yet they consistently struggle to access the same level of financial backing as their male counterparts. This discrepancy underscores a critical challenge within the entrepreneurial ecosystem that organizations like All Raise and Female Founders Fund are actively working to address. For instance, Whitney Wolfe Herd's Bumble became a multi-billion dollar company, yet its early funding journey reflects the broader struggle many female founders face.

The Stark Reality of Funding Disparity

The disparity in funding is a clear indicator that the playing field is not level. While there has been some progress, the pace of change is incredibly slow. To better understand the numbers, the following infographic highlights the core data points that define this challenge.

The infographic demonstrates a profound imbalance: women represent a huge portion of the population but receive a tiny fraction of venture capital, with year-over-year improvement being minimal at best.

Actionable Strategies for Female Founders

Navigating this challenging landscape requires a strategic and resilient approach. Founders can take specific steps to improve their chances of securing investment.

- Seek Out Aligned Investors: Target VC firms and angel investors with a stated commitment to diversity or a portfolio that includes a significant number of female-founded companies. Funds like the Female Founders Fund, BBG Ventures, and Halogen Ventures specialize in this area.

- Build a Strong Support Network: Actively engage with communities of female entrepreneurs and allies. Organizations like All Raise and The Wing provide mentorship, resources, and networking opportunities that can be invaluable.

- Anticipate and Prepare for Bias: Research from Harvard Business Review shows that investors often ask female founders "prevention-focused" questions (e.g., about risk and losses) versus "promotion-focused" questions for men (e.g., about growth and opportunity). Prepare to reframe prevention-based questions with promotion-oriented answers that focus on growth, market potential, and vision.

- Strategically Consider Co-Founders: While not a solution to the systemic issue, data from PitchBook shows that mixed-gender founding teams receive a larger share of funding (17.2%) than all-female teams. This can be a strategic consideration for some entrepreneurs.

By understanding the landscape and employing targeted strategies, female founders can better position themselves for success. To dive deeper into the journey of women in entrepreneurship, you can explore detailed resources that shed light on their unique challenges and triumphs. Find out more about how she turned entrepreneur and navigated the funding world.

2. Black and Latino founders receive less than 3% of VC funding combined

Another of the most troubling startup diversity statistics highlights the profound racial disparity in venture capital allocation. Combined, startups founded by Black and Latino entrepreneurs receive less than 3% of total VC funding. Specifically, Crunchbase data from 2022 showed Black founders secured approximately 1.1% of funding, while Latino founders received 1.5%, despite these communities making up over 30% of the U.S. population. This statistic exposes a deeply rooted systemic bias that significantly limits access to capital for underrepresented founders.

This funding chasm is not just an issue of fairness; it represents a substantial loss of economic potential and innovation. Entrepreneurs from diverse backgrounds often identify and solve problems for overlooked markets, yet they are systematically denied the resources needed to scale their ventures. This underinvestment perpetuates a cycle of inequality within the tech and business landscapes, a challenge that funds like Harlem Capital and organizations like the Latino Startup Alliance are dedicated to dismantling. Tristan Walker, founder of Walker & Company Brands, famously raised over $33 million, but his journey highlights the exception rather than the rule, underscoring the high barriers many others face.

The Stark Reality of Funding Disparity

The gap between population representation and capital investment for Black and Latino founders is a clear signal of an inequitable ecosystem. The infographic below visualizes the core numbers, showing how a significant portion of the entrepreneurial population is left to compete for a sliver of available funding.

The data illustrates a critical failure in the VC world to invest in a proportional and equitable manner, limiting the growth potential of countless innovative businesses led by founders of color.

Actionable Strategies for Minority Founders

To overcome these systemic hurdles, founders must adopt a multi-faceted and strategic approach to fundraising. Taking deliberate steps can help level the playing field and increase the likelihood of securing investment.

- Leverage Minority-Focused Networks: Connect with accelerators and networks specifically designed to support underrepresented entrepreneurs. Programs like Google for Startups Black Founders Fund, SoftBank's Emerge, and accelerators like Techstars provide capital, mentorship, and invaluable connections.

- Highlight Unique Market Insights: Position your background as a competitive advantage. Emphasize your unique understanding of and connection to underserved markets that other founders may overlook, presenting a compelling and authentic investment thesis. For example, a fintech founder from a historically unbanked community can offer unparalleled insight into developing relevant financial products.

- Seek Out Diversity-Focused Funds: Intentionally target VC firms with a clear mandate to invest in founders of color. Funds such as Harlem Capital, Backstage Capital, and Lightship Capital were created specifically to close this funding gap.

- Build a Powerful Advisory Board: Partner with established minority business leaders and industry veterans who can serve as advisors. Their credibility, experience, and networks can open doors to investors who might otherwise be inaccessible.

By strategically navigating the ecosystem and leveraging specialized resources, founders of color can build the momentum needed to secure funding. To better understand the challenges and triumphs, you can explore detailed stories and data about their journeys. Discover more about the landscape for entrepreneurs of color and their fight for funding.

3. Diverse founding teams are 70% more likely to break into new markets

One of the most compelling startup diversity statistics highlights the direct correlation between diversity and market expansion. Research from sources like the Harvard Business Review shows that companies with diverse leadership are 70% more likely to capture new markets. This statistic isn't just about social responsibility; it's a powerful indicator of how varied perspectives, backgrounds, and experiences translate into a tangible competitive advantage.

The ability to break into new markets successfully is often the difference between a startup that stalls and one that achieves global scale. A homogenous team may struggle with blind spots, failing to understand the cultural nuances or unmet needs of different customer segments. In contrast, a diverse team brings a wealth of innate market intelligence, enabling them to identify and resonate with a broader audience. A practical example is how Netflix's investment in diverse content creators and international production teams has been a key driver of its global market penetration, allowing it to tailor offerings to local tastes and preferences.

The Strategic Value of Diverse Perspectives

This advantage in market capture stems from a deeper, more authentic understanding of different consumer bases. When a founding team reflects the diversity of the world, its ability to innovate for that world grows exponentially. The following video explores how diverse teams drive superior business outcomes and innovation.

As the video illustrates, diversity fosters a dynamic environment where unique insights lead to products and marketing strategies that connect with previously overlooked or underserved populations.

Actionable Strategies for Building a Market-Ready Team

Founders can intentionally build teams poised for global expansion from day one. Integrating diversity into the core of a startup’s strategy is key to unlocking this potential.

- Recruit Beyond Your Network: Actively seek out talent from diverse pools, including historically Black colleges and universities (HBCUs), professional organizations like the Society of Hispanic Professional Engineers (SHPE), and platforms like Jopwell that connect companies with Black, Latinx, and Native American talent.

- Create an Inclusive Culture Immediately: From the outset, establish core values and communication norms that ensure every team member feels psychologically safe to contribute their unique perspective. This foundation is critical for retaining diverse talent. For example, implement structured feedback sessions where all voices are heard.

- Leverage Team Networks for Research: Utilize the diverse personal and professional networks of your team for authentic market research and to gain early feedback from different cultural and demographic groups. This provides low-cost, high-fidelity insights that are hard to obtain through traditional methods.

- Embed Diversity in Product Development: Ensure that product brainstorming, design, and testing phases include a wide range of viewpoints. This practice helps avoid cultural missteps—like the facial recognition software that failed to recognize non-white faces—and creates products with universal appeal.

By strategically building a diverse team, startups not only enhance their innovation but also significantly improve their odds of succeeding in an increasingly globalized marketplace. For more on the connection between diversity and business performance, read the influential study from the Boston Consulting Group.

4. 40% of Fortune 500 companies were founded by immigrants or their children

A powerful and often overlooked entry in the list of startup diversity statistics highlights the immense economic contribution of immigrants. Research from the Center for American Entrepreneurship reveals that 44% of Fortune 500 companies in 2022 were founded by immigrants or their children. This figure underscores the profound impact that diverse perspectives and international experiences have on innovation and large-scale business success in the United States.

This isn't just a historical trend; it's a testament to the entrepreneurial drive and resilience inherent in many immigrant journeys. Companies like Google, co-founded by Russian immigrant Sergey Brin; Pfizer, co-founded by German immigrant Charles Pfizer; and Tesla, led by South African immigrant Elon Musk, are prominent examples of this phenomenon. The statistic powerfully argues that embracing and empowering immigrant talent is not just a social good but a critical driver of economic competitiveness and groundbreaking enterprise.

The Stark Reality of Immigrant Entrepreneurship

The outsized success of immigrant founders provides a compelling case for creating more inclusive pathways to entrepreneurship. Despite facing unique challenges such as language barriers, visa complexities (like the H-1B lottery), and limited local networks, these individuals have created millions of jobs and iconic global brands. This data clearly demonstrates the value of welcoming diverse talent.

Actionable Strategies for Immigrant Founders

Founders with immigrant backgrounds can leverage their unique experiences to build a competitive advantage. The following strategies can help navigate the entrepreneurial landscape and harness the power of their heritage.

- Leverage Unique Cultural Insights: Use your deep understanding of different cultures to identify unmet market needs or create products with global appeal. Your perspective can be a significant advantage in product development and international marketing. For instance, the founders of food delivery service DoorDash leveraged their immigrant experiences to understand the needs of both restaurant owners and consumers.

- Build Bridges Between Markets: Act as a conduit between your home country and U.S. markets. This can unlock unique supply chains, talent pools, and investment opportunities that are inaccessible to others.

- Network Within Immigrant Communities: Connect with established immigrant entrepreneur communities. Organizations like The Immigrant Learning Center or networks of founders from specific countries offer invaluable mentorship, shared experiences, and support systems tailored to the specific challenges you may face.

- Seek Out Targeted Mentorship: Find mentors who are also immigrant business leaders. They can provide guidance on navigating everything from cultural nuances in business negotiations to the complexities of the U.S. legal and financial systems.

By embracing their unique backgrounds as a strength, immigrant founders can continue the legacy of building transformative companies. For a deeper analysis of the economic impact of immigrant entrepreneurs, you can explore the comprehensive research conducted by organizations like the Kauffman Foundation.

5. Women-led startups generate 10% higher cumulative revenue over 5 years

One of the most compelling startup diversity statistics directly challenges conventional funding wisdom. Research from Boston Consulting Group found that for every dollar of funding, women-led startups generated 78 cents in revenue, while male-founded startups generated only 31 cents. Another study from First Round Capital showed that companies in their portfolio with at least one female founder performed 63% better than their all-male founding teams. While the exact figures vary, they all point to remarkable capital efficiency and operational excellence.

This performance is even more impressive considering these companies often operate with significantly less initial funding. This statistic is a powerful counter-narrative to the funding gap, suggesting that investing in women-led businesses isn't just about equity; it's a strategically sound financial decision. The data points to a pattern of sustainable growth and resilience, as seen in companies like Spanx, founded by Sara Blakely, which achieved a billion-dollar valuation with just $5,000 in initial investment.

The Stark Reality of Performance vs. Funding

The disconnect between the high performance of women-led startups and the low funding they receive is a critical inefficiency in the market. This data proves that female founders are adept at building robust, revenue-generating businesses, often by prioritizing sustainable growth models over rapid, cash-intensive scaling. This focus on long-term viability creates more resilient companies.

For example, companies like Canva, co-founded by Melanie Perkins, and The Honest Company, founded by Jessica Alba, have demonstrated the ability to penetrate competitive markets and build strong consumer brands through strategic, customer-centric approaches rather than simply relying on massive funding rounds. Their success underscores the immense, often untapped, potential within this founder demographic.

Actionable Strategies for Capital Efficiency

Founders looking to replicate this model of efficient growth can adopt several key strategies, regardless of their gender. These tactics are particularly useful when navigating a tough funding environment.

- Focus on Capital Efficiency and Lean Operations: Prioritize spending on core activities that directly drive revenue and customer acquisition. A practical tip is to adopt a "default to free" mindset, only paying for tools or services when their ROI is clearly proven.

- Leverage Customer Feedback for Iterative Improvements: Build a tight feedback loop with your customers. Use tools like surveys, user interviews, and beta testing groups to guide product development, ensuring you are building something the market truly wants without wasting resources on unproven features.

- Build Strong Customer Loyalty Programs: It is often 5 to 25 times more expensive to acquire a new customer than to retain an existing one. Invest in programs and customer service that foster loyalty and turn customers into brand advocates.

- Emphasize Sustainable Growth Over Rapid Scaling: Chase milestones that demonstrate a healthy business model, such as positive unit economics and a clear path to profitability, rather than vanity metrics like headcount or office size.

By focusing on these fundamental business principles, founders can build more resilient companies that are less susceptible to market volatility. Understanding these dynamics is crucial, as many startups face immense pressure. To learn more about the common pitfalls, explore the data behind startup failure statistics.

6. Only 8% of startup accelerator participants are Black founders

Another critical set of startup diversity statistics highlights a significant gap in the early-stage support system for entrepreneurs. Startup accelerators, which serve as vital launchpads offering mentorship, resources, and access to funding, demonstrate a stark underrepresentation of Black founders. A 2020 report from digitalundivided found that Black women represent less than 4% of participants in major accelerator programs. While the number for all Black founders hovers around 8%, this creates a bottleneck that limits access to the networks and capital necessary for growth.

This disparity in accelerator access is more than just a number; it represents a systemic barrier that stifles innovation and economic opportunity within the Black community. Without equitable access to these foundational programs, promising Black-led startups face a much steeper climb in securing follow-on funding and building the connections needed to scale. This reality underscores a fundamental flaw in the entrepreneurial pipeline that organizations are now actively trying to correct.

The Accelerator Access Gap

The underrepresentation of Black founders in accelerators is a clear indicator that talent is not being matched with opportunity. These programs are often the first major validation for a startup, and being excluded at this stage can have long-lasting negative effects on a company's trajectory. Organizations like digitalundivided and the National Venture Capital Association have brought attention to this issue, pushing for greater transparency and accountability.

Actionable Strategies for Black Founders

Navigating an ecosystem with inherent biases requires a proactive and strategic approach. Black founders can take specific steps to find the right support and increase their chances of acceptance and success in an accelerator program.

- Target Diversity-Focused Programs: Seek out accelerators with a specific mission to support underrepresented founders. Programs like NewME, Lightship Capital's accelerator, and the Google for Startups Black Founders Fund are explicitly designed to provide resources and capital to Black entrepreneurs.

- Leverage Mentor Networks: Build relationships within communities dedicated to Black founders and tech professionals. Groups like Black Men Talk Tech and Black Women Talk Tech offer invaluable mentorship, warm introductions to accelerator decision-makers, and shared knowledge about which programs are most inclusive.

- Connect with Accelerator Alumni: Reach out to founders who have previously completed programs you are interested in. Alumni can provide honest feedback about their experience, offer tips for the application process, and potentially make an introduction to the program's leadership. Use LinkedIn to find and connect with these individuals.

- Showcase Traction and Vision: In your application and interviews, clearly articulate your startup's progress, market potential, and unique value proposition. Use data—like user growth, revenue, or a successful pilot—to build a compelling case that demonstrates your ability to execute and scale your vision.

By focusing on programs committed to equity and strategically building a strong support system, Black founders can better navigate the landscape and secure a coveted spot in an accelerator. To explore programs making a tangible impact, learn more about how Black-focused accelerators are changing the game.

7. LGBTQ+ founders represent less than 1% of funded startups

Another critical area where startup diversity statistics reveal a profound funding gap is within the LGBTQ+ community. Despite representing an estimated 7.1% of the U.S. adult population with significant economic influence, startups with at least one openly LGBTQ+ founder receive less than 1% of total venture capital funding, according to data from StartOut. This statistic highlights a severe underinvestment in a talented and resilient pool of entrepreneurs.

This funding disparity represents a significant missed opportunity for investors and the broader economy. The LGBTQ+ community possesses an estimated annual spending power of over $1.4 trillion globally, indicating a massive market that LGBTQ+ founders are uniquely positioned to understand and serve. Organizations like StartOut and Out Leadership are working to bring visibility to this issue and create ecosystems that support these entrepreneurs, but systemic change remains slow.

The Stark Reality of Funding Disparity

The lack of funding for LGBTQ+ founders is a clear signal of the implicit and explicit biases that persist within the venture capital world. This underrepresentation not only stifles innovation from a creative and diverse community but also perpetuates economic inequality. The limited data available often groups LGBTQ+ founders into broader categories, further obscuring the true scale of the challenge.

Companies with openly LGBTQ+ leaders, such as Grindr, founded by Joel Simkhai, and the fintech company Daylight, have demonstrated significant market success, proving the viability and potential of businesses that cater to or are led by this community. Their success stories underscore the untapped potential that VCs are largely overlooking.

Actionable Strategies for LGBTQ+ Founders

Navigating an ecosystem with such inherent biases requires a proactive and strategic approach. LGBTQ+ founders can implement specific strategies to increase their visibility and improve their chances of securing investment.

- Connect with LGBTQ+ Entrepreneur Networks: Build relationships within organizations dedicated to supporting LGBTQ+ founders. Groups like StartOut and Lesbians Who Tech & Allies offer invaluable mentorship programs, networking events, and access to accelerators.

- Seek Out Aligned Investors: Identify and target investment firms with a clear commitment to diversity and inclusion. VCs like Kapor Capital and venture communities like Gaingels have explicit mandates to invest in underrepresented founders, including those from the LGBTQ+ community.

- Leverage Unique Market Insights: Authentically connect with the LGBTQ+ consumer base by developing products and services that meet their specific needs. Founders can use their lived experiences as a competitive advantage to build brands that resonate deeply with this powerful demographic.

- Build an Inclusive and Authentic Brand: Be strategic about how and when to be open about identity. For many, building an authentic brand that embraces their identity can attract a loyal customer base and signal a strong, inclusive company culture to potential investors and talent.

8. Diverse teams are 35% more likely to outperform homogeneous teams

One of the most compelling startup diversity statistics is not about funding, but about performance. Landmark research from McKinsey & Company reveals that companies in the top quartile for ethnic and cultural diversity on their executive teams were 36% more likely to have financial returns above their national industry medians. This powerful data point shifts the conversation from diversity as a social imperative to diversity as a strategic business advantage.

For startups, where agility, innovation, and problem-solving are paramount, this statistic is particularly resonant. Building a diverse team from the outset can directly influence a startup's trajectory, enhancing its ability to tackle complex challenges and connect with a broader customer base. A prime example is the tech company Asana, whose co-founder Dustin Moskovitz has publicly emphasized the importance of building a diverse and inclusive team from the early stages to foster better decision-making and product development.

The Stark Reality of Performance Disparity

The performance gap between diverse and homogeneous teams underscores a fundamental truth: variety in thought, experience, and background is a catalyst for innovation. A lack of diversity is not just a missed opportunity for inclusion; it's a competitive disadvantage. These statistics clearly illustrate that diverse teams are more likely to outperform homogeneous ones, underscoring the comprehensive business benefits of diversity.

This data challenges the traditional startup model of hiring from within familiar networks, which often perpetuates homogeneity. The evidence is clear that a broader range of perspectives leads to more robust decision-making and better financial outcomes, making diversity a key performance indicator for forward-thinking startups.

Actionable Strategies for Building Diverse Teams

Cultivating a diverse team requires intentional effort, especially in the crucial early stages of a startup. Founders can implement specific strategies to build a team that reflects the world they aim to serve.

- Prioritize Diversity in Early Hiring: Make diversity a core criterion from your very first hire. A practical step is to implement a "Rooney Rule"-style policy, ensuring at least one underrepresented candidate is interviewed for every open role.

- Create an Inclusive Culture: Diversity without inclusion is ineffective. Establish communication practices, feedback mechanisms, and company policies that ensure every team member feels valued. For example, create employee resource groups (ERGs) early on to provide support and community.

- Leverage Diverse Perspectives in Strategy: Intentionally incorporate different viewpoints into your product development, marketing, and strategic planning processes. This can uncover blind spots and unlock innovative solutions that a uniform team might overlook.

- Measure and Track Diversity Metrics: What gets measured gets managed. Set clear, measurable goals for team diversity (e.g., "achieve 50% female representation in leadership by 2026") and regularly track your progress. Use this data to identify areas for improvement and hold leadership accountable.

Startup Diversity Statistics Comparison

| Item Title | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Only 2.3% of VC funding goes to female-founded startups | Low – Data tracking and reporting | Moderate – Requires VC and funding data | Raises awareness of gender funding gap; drives equity | Gender equity advocacy; policy making | Highlights systemic barriers; prompts initiatives |

| Black and Latino founders receive less than 3% of VC funding combined | Low – Data aggregated from multiple sources | Moderate – Demographic and funding data | Raises diversity funding awareness; supports targeted programs | Minority founder support programs | Drives diversity investment funds and initiatives |

| Diverse founding teams are 70% more likely to break into new markets | Medium – Team building and recruitment | High – Access to diverse talent and networks | Higher market expansion and revenue growth | Startups targeting global or multiple markets | Better innovation and market insight |

| 40% of Fortune 500 companies were founded by immigrants or their children | Medium – Long-term cultural integration | Moderate – Leveraging immigrant networks | Strong economic impact; job creation | Large-scale business development | Cultural insights and resilience |

| Women-led startups generate 10% higher cumulative revenue over 5 years | Medium – Operational efficiency focus | Low to Moderate – Lean operational resources | Superior long-term financial performance despite funding gap | Sustainable growth and capital efficiency strategies | Higher revenue with less capital |

| Only 8% of startup accelerator participants are Black founders | Low – Participation and outreach | Moderate – Accelerator program data | Highlights underrepresentation; improves mentorship access | Early-stage founder support programs | Drives diversity in accelerators |

| LGBTQ+ founders represent less than 1% of funded startups | Low – Self-reported demographic data | Moderate – Inclusive funding tracking | Raises awareness of LGBTQ+ funding gap; encourages targeted investment | LGBTQ+ focused funding and networking | Promotes inclusive investment and advocacy |

| Diverse teams are 35% more likely to outperform homogeneous teams | Medium – Team diversity initiatives | High – Investment in diverse hiring | Better financial and innovation performance | Executive and startup team building | Enhanced profitability and decision making |

From Statistics to Strategy: Building a More Equitable Future

The data presented throughout this article paints a clear and compelling picture. The current landscape of startup diversity statistics reveals a system rife with disparities, where access to capital and opportunity remains disproportionately concentrated. We’ve seen that female-founded startups receive a mere 2.3% of venture capital funding, and that Black and Latino founders combined secure less than 3% of the total pie. These are not just numbers; they represent systemic barriers that stifle innovation and limit economic potential.

However, the data also illuminates a powerful, unassailable truth: diversity is not just a social imperative, it is a significant competitive advantage. The statistics demonstrate a direct correlation between diversity and superior business outcomes. We’ve explored how diverse founding teams are 70% more likely to capture new markets and that the most ethnically diverse companies are 36% more likely to financially outperform their counterparts. Furthermore, women-led startups have been shown to be more capital-efficient, generating higher revenue per dollar invested. This is the undeniable business case for equity.

The Duality of Data: A Problem and a Solution

The statistics serve a dual purpose. On one hand, they are a diagnostic tool, highlighting the deep-seated biases within the venture capital and startup ecosystems. The fact that only 8% of accelerator participants are Black founders or that LGBTQ+ founders represent less than 1% of funded startups signals a critical need for structural change.

On the other hand, this same data provides a strategic roadmap for founders, investors, and ecosystem builders. It points directly to undervalued talent pools and untapped market opportunities. For investors, ignoring these trends is not just an ethical oversight; it's a poor financial strategy that leaves significant returns on the table.

Key Takeaway: The conversation about startup diversity has evolved beyond a moral argument. It is now a data-backed discussion about performance, market expansion, and sustainable growth. The most successful companies of the future will be those that recognize and act on this reality today.

Actionable Pathways to a More Inclusive Ecosystem

Understanding these startup diversity statistics is the first step, but action is what creates change. Moving beyond the numbers, businesses can implement various impactful diversity recruiting strategies to build more representative teams from the ground up. Here are three core areas where stakeholders can drive meaningful progress:

- For Founders and Startup Leaders: Make intentionality your mantra. This means actively creating inclusive job descriptions, diversifying your hiring panels, and establishing partnerships with organizations that support underrepresented talent. Track your own internal diversity metrics with the same rigor you apply to your KPIs and growth targets.

- For Investors and VCs: Widen your aperture. Proactively expand your networks beyond the traditional hubs and Ivy League alumni circles. Implement blind review processes for initial pitch decks to mitigate unconscious bias and mandate diversity metrics reporting from your portfolio companies. Championing underrepresented founders is not charity; it is smart, forward-thinking portfolio management.

- For the Entire Community: Foster transparency and accountability. We must continue to collect, share, and analyze startup diversity statistics to measure progress and identify persistent gaps. Support platforms and initiatives that amplify the voices of underrepresented founders and create spaces for mentorship, sponsorship, and genuine connection.

The journey toward a truly equitable startup landscape is a marathon, not a sprint. The data we've examined is a sobering reminder of the work that lies ahead, but it is also a source of immense opportunity. By leveraging these insights to inform our strategies, challenge our biases, and rebuild our networks, we can collectively construct an ecosystem where the best ideas, not the best-connected individuals, are the ones that win. This is how we unlock the full spectrum of innovation and build a more prosperous and equitable future for all.

Ready to find your next opportunity or hire top talent from a diverse pool of innovators? FundedIQ provides the most comprehensive database of recently funded startups, allowing you to filter by industry, location, and funding stage to connect with the companies shaping the future. Discover your next career move or investment at FundedIQ.