Joining a Series A Startup for Career Growth

If you're looking for that perfect blend of startup excitement and real-world stability, a Series A company is where you want to be. It’s the sweet spot—that ideal middle ground between the raw, chaotic energy of a seed-stage venture and the established, often rigid, structure of a big corporation.

This is the point where a startup has proven its concept and found product-market fit. Now, with fresh funding in hand, it's all about hitting the gas. You get to be part of the build-up, but with a lot less of the "will we be here next month?" anxiety.

Why Series A Is the Startup Sweet Spot

Think about a startup's life in distinct phases. The seed stage is pure survival mode—it's all about proving the core idea. Much later, you have late-stage giants focused on optimizing systems that have been in place for years. For example, a seed-stage company might be a team of 5 trying to get their first 100 users, while a public company like Salesforce is optimizing its sales process for the 150,001st customer.

But Series A? That phase is defined by one word: growth.

After clearing those early hurdles and securing a serious chunk of investment—typically ranging from $10 million to $20 million—these companies are laser-focused on scaling everything—their teams, their operations, and their footprint in the market.

For anyone looking for a new role, this translates into an environment that’s absolutely buzzing with opportunity. You’re not just a cog in a machine; your work has a direct and immediate impact on the company's growth story. You can get a deeper understanding of how this funding transforms a company by exploring the venture capital funding process.

The Growth Engine Is Hiring

And I'm not just speculating here—the numbers back it up. A recent three-month analysis of the startup scene showed that Series A companies posted a whopping 153,412 job openings. For comparison, Seed stage companies posted around 50,000, while late-stage giants posted hundreds of thousands, but for much more specialized roles.

This isn't just about adding headcount. This is the moment a company transitions from a scrappy founding team to a more structured organization. They're building out foundational teams in engineering, product, sales, and marketing, creating a ton of chances to get in on the ground floor of something big.

Joining at the Series A stage means you are not just executing a pre-written playbook; you are helping to write it. The blend of validated potential and raw opportunity offers an unmatched environment for rapid professional and personal development.

A Unique Career Blend

So, what does this actually feel like for you?

Unlike a seed-stage company where survival is a daily concern, a Series A startup has a solid financial runway, usually for the next 18-24 months. This gives you a level of stability that lets you focus on building, not just surviving. Yet, you still get all the good stuff that makes startup life so appealing.

Here’s a quick breakdown of what’s in it for you:

- Real Impact: Your contributions will directly move the needle on key business goals. For example, a single marketing campaign you launch could realistically double the company's lead flow. No busy work here.

- Hyper-Growth Learning: You'll almost certainly wear multiple hats, which means you'll gain cross-functional skills way faster than you ever could in a siloed corporate job. An engineer might find themselves helping with customer support calls to understand user pain points directly.

- Meaningful Equity: Getting in at this stage often comes with a more significant equity stake than you'd see later on, but with a much lower risk than joining at the very beginning. It's the difference between owning 0.5% of something promising versus 0.001% of something established.

To really see where Series A fits in, it helps to compare it to the other stages.

Startup Stages at a Glance Seed vs Series A vs Late Stage

This quick table breaks down the key differences between the major startup funding stages, highlighting why Series A offers such a unique combination of opportunity and stability.

| Characteristic | Seed Stage | Series A | Late Stage (Series C+) |

|---|---|---|---|

| Primary Goal | Prove the idea / Product-Market Fit | Scale the business / Capture market share | Optimize & dominate the market / Profitability |

| Team Size | 2-15 people (mostly founders) | 15-100 people (hiring key leaders) | 100s-1000s of employees (specialized roles) |

| Your Role | Do-it-all generalist | Specialist with ownership / Build processes | Highly specialized contributor |

| Risk Level | Very High (Approx. 75% fail to raise Series A) | Moderate (Approx. 50% fail to raise Series B) | Lower |

| Equity Potential | Highest (but very risky) | High | Lower |

| Company Culture | Chaotic, informal, high-energy | Structured but fast-paced & adaptable | Established, process-driven, more corporate |

As you can see, joining a Series A company puts you right at a critical inflection point. It’s a chance to use your skills to help transform a promising young company into a genuine market leader.

How to Vet a Series A Startup Like an Investor

When you're looking at joining a Series A startup, you need to completely change your mindset. Forget thinking like a typical job applicant. It's time to start thinking like an investor.

Why? Because you're not just taking a salary—you're investing your most valuable assets: your time, your skills, and the next chapter of your career. This means you need to get under the hood of the company and scrutinize its potential with the same critical eye as a venture capitalist.

To start, you need to look in the right places. Ditch the standard job boards and head straight to where the real action is. Platforms like AngelList, Y Combinator's job board, and the portfolio pages of top-tier VC firms are where you'll find curated lists of high-potential companies that have already been vetted.

Analyze the Core Business Vitals

Once you've got a shortlist, it's time to do some real digging. VCs look for signals of sustainable growth, and that's exactly what you should be hunting for too. The key metrics tell the real story of a startup's health and where it's headed. A healthy Series A company, for instance, is often expected to be growing its revenue by 3x year-over-year.

You won't have access to their full P&L, of course. But you can piece together a pretty clear picture by looking for public signals and asking sharp, insightful questions during your interviews. I always tell people to focus on three core areas that scream "healthy growth engine."

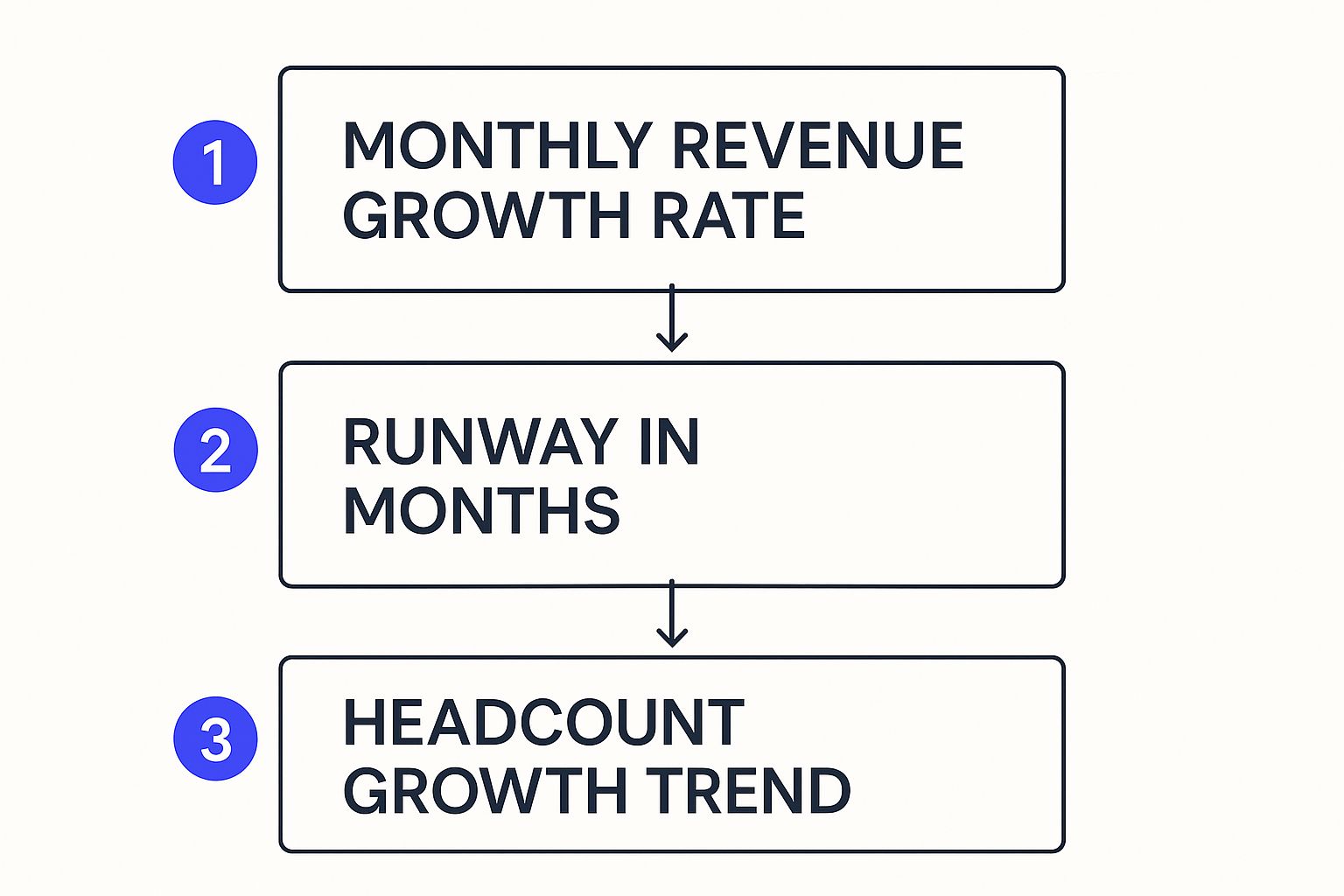

This visual breaks down the key data points to look at, from revenue growth all the way to team expansion.

It's a logical flow. Strong revenue growth justifies a solid runway, which then gives the company the resources it needs to hire great people and keep growing.

Go Beyond the Pitch Deck

A great story is one thing, but a durable business is what actually creates value. Your next move is to look past the shiny pitch deck and evaluate the things that truly determine long-term success.

- Founder & Team DNA: Who is at the helm? Look for founders with deep, relevant industry experience or a proven track record of resilience. For example, a fintech founder who previously worked at Stripe or a major bank is a positive signal. A team that's been through the wringer before is far more likely to navigate future storms.

- Investor Quality: The names on the cap table are a huge signal. When you see top-tier VCs like Andreessen Horowitz, Sequoia Capital, or Accel on board, it's more than just a check. It’s a massive vote of confidence in the startup's vision and its ability to execute. These firms have extensive networks and expertise they bring to their portfolio companies.

- Product Necessity: Is this product a "vitamin" (nice to have) or a "painkiller" (absolutely essential)? Companies selling painkillers solve urgent, expensive problems, which gives them a much stronger, more defensible market position from day one. For example, a cybersecurity tool that prevents costly data breaches is a painkiller.

A critical piece of your due diligence is sizing up the competition. Is this startup truly unique? A company with a genuine, hard-to-replicate advantage—whether that’s through proprietary tech, powerful network effects (like a marketplace), or a killer brand—has a much better shot at building something that lasts.

Finally, you have to consider your own piece of the pie. The equity you're offered is a massive part of your potential compensation, and you need to understand what it could be worth. To get a handle on this, check out our deep dive on https://fundediq.co/startup-equity-data/. It will teach you how to benchmark your offer and truly grasp the financial upside, so you can evaluate the opportunity based on its long-term potential, not just the base salary.

How to Ace the Startup Interview Process

When you’re interviewing with a Series A startup, you have to think like a founder. They aren’t just filling a role; they’re investing in someone who can make an immediate, tangible difference. This means your entire approach needs to be laser-focused on results.

Forget listing job duties on your resume. Instead, tell a story of impact with numbers. Highlighting how you "drove a 25% growth in MQLs by implementing a new content strategy" is infinitely more powerful than simply saying you "managed customer acquisition."

To really get their attention, your application materials should scream "ROI."

- Showcase impact metrics that prove you generate value.

- Detail the scope of your projects—mention budgets managed ($50k/quarter), team sizes led (team of 3), and your specific leadership role.

- Emphasize your cross-functional skills and times you’ve worn multiple hats. That’s just life at a startup.

And please, don't send a generic cover letter. Tailor it specifically to their mission and recent wins, maybe even referencing a milestone they hit with their new funding. For example: "I was excited to see your recent launch of the new AI feature mentioned in TechCrunch, and my experience in scaling machine learning models could help accelerate its adoption."

Crafting Your Impact Narrative

Your "elevator pitch" needs to be a highlight reel of your biggest professional wins. I always tell people to lean on the STAR method (Situation, Task, Action, Result) to keep their stories tight and powerful. It’s a classic for a reason.

Here’s a pro tip: during the initial screening call, ask if you can have a brief, informal chat with a potential teammate. This is a savvy move. It shows you’re serious about understanding the ground-level challenges and that you value team dynamics.

“Use concrete numbers to bring your accomplishments to life and stand out among applicants.”

Before you ever speak to a founder, do your homework. Dig into their background, read up on their investors, and understand what the market is saying about them. This level of preparation fuels smarter questions and shows you're not just looking for any job, but this job.

For a deeper dive into sharpening your interview game, these expert job interview preparation tips are a great resource.

Ultimately, interviewers are testing your comfort with ambiguity. They need to know you won't freeze when things get chaotic. Be ready with a story about a time you had to pivot or solve a problem with a shoestring budget.

Mastering Interview Questions

Get ready for case-style questions that mirror real-world fires they're trying to put out. They might hit you with something like, "Our customer churn is at 3% monthly. How would you cut it in half in the next three months?"

Don't just jump to an answer. Instead:

- Walk them through your thought process, step by step. Start by asking clarifying questions: "Is the churn higher in a specific customer segment? What have you tried so far?"

- Talk about the metrics you’d use to define success and how you'd iterate. "I'd start by analyzing user engagement data to find a leading indicator for churn, then run A/B tests on a few retention tactics."

- Most importantly, connect every part of your solution back to their core business goals.

And what about after the interview? Don't let the momentum die. A well-crafted follow-up can make all the difference. We have a whole guide on how to follow up politely in email: https://fundediq.co/how-to-follow-up-politely-in-email/

Finally, remember that you’re interviewing them, too. The questions you ask reveal your priorities and strategic thinking. Try these:

- How does the team balance hitting short-term targets with building toward the long-term vision?

- What does the feedback loop between leadership and the rest of the team actually look like?

- Which upcoming product features are the founders most excited about right now?

Setting Final Impressions

Never underestimate the power of a genuine, well-written thank-you note. It’s your last chance to make a great impression.

Personalize it by mentioning something specific you discussed that resonated with you. It shows you were paying attention.

- Reference a key insight you gained from the conversation. For example, "I particularly enjoyed our discussion about expanding into the European market…"

- Reiterate how your skills directly address a need they mentioned. "…and it reinforced my belief that my experience with GDPR compliance could be a valuable asset."

This isn’t just about being polite; it’s about reinforcing your value and enthusiasm one last time. In a sea of qualified candidates, small things like this help you stand out.

Own your story, show them you can handle the heat, and you'll be in a great position to land the role.

Navigating Your Offer and Understanding Equity

Getting an offer after weeks of interviews feels incredible, but now comes the tricky part. At a Series A startup, the offer letter is a lot more than just a salary figure. It’s a complex package, and the equity component is where the real long-term value lies.

Think of it this way: your salary pays the bills today, but equity is your ticket to sharing in the company's future success. You're not just an employee; you're becoming an owner. Grasping what that actually means is the key to making a smart decision.

Decoding Your Equity Grant

The equity part of your offer will be packed with jargon. Don't let it intimidate you. The most common form of equity you'll see is stock options, which are essentially a promise that you can buy company shares at a fixed price down the road.

That fixed price is called the strike price, and it's based on the company's valuation at the time of the grant (the "409A valuation"). The whole game is for the company to grow so much that its shares are eventually worth far more than your strike price. The difference is your profit. A low strike price is what you want to see.

The most common mistake I see is people thinking they own their stock from day one. That's not how it works. You have to earn it over time through what's called a vesting schedule.

A typical vesting schedule is four years with a one-year cliff. This is standard practice. It means you get absolutely nothing until you hit your first anniversary. On that day, 25% of your total options "vest," and they're yours. After that, the rest of your options usually vest monthly for the next three years. It’s the company's way of making sure you stick around for the long haul.

Key Equity Terms Explained

To really get a handle on your offer, you need to speak the language. Here's a quick cheat sheet for the terms you'll run into most often.

| Term | What It Means for You |

|---|---|

| Stock Options | The right to buy a set number of company shares at a fixed price in the future. You don't own the stock yet. |

| Strike Price | The predetermined price you'll pay per share when you decide to exercise (buy) your options. Lower is better. |

| Vesting | The process of earning your options over time. You can only exercise options that have vested. |

| Cliff | A waiting period before your vesting starts. A one-year cliff means you must stay for 12 months to get your first chunk of equity. |

| Exercise Window | The period you have to buy your vested options after leaving the company. This can be short (e.g., 90 days), so it's a critical detail. |

| Dilution | When the company issues new shares (like in a new funding round), the value of your existing shares decreases as a percentage of the whole. It's a normal part of growth. |

Understanding these terms puts you in the driver's seat. It allows you to ask the right questions and truly compare one offer against another.

Evaluating the Complete Offer

Now, let's zoom out and look at the entire package. It's easy to get fixated on the base salary, but that's a mistake. A Series A startup might not be able to match the cash offer from a giant like Google or Microsoft. Where they compete is with ownership.

A slightly lower base salary might be a great trade-off for a larger equity grant that could be worth a fortune in a few years.

Here’s how to weigh the whole thing:

- Salary Benchmarking: Don't compare your offer to a Fortune 500 company. Use resources like AngelList's salary data or Pave to see what’s competitive for your role at a startup of a similar stage and funding level. For example, a senior software engineer in San Francisco at a Series A company might expect a base salary between $160k-$200k.

- Equity Upside: Try to figure out what your options are actually worth as a percentage of the company. It's a fair question to ask your recruiter, "How many total shares are currently outstanding?" This helps you calculate your ownership stake. A typical grant for an early engineer at this stage might be between 0.1% and 0.5%.

- The Other Stuff: Don't sleep on the perks. A signing bonus, a budget for courses and conferences ($2,000/year is common), or a stipend for your home office can add thousands of dollars in real value. These are often easier to negotiate than base salary.

Negotiating an offer at this stage is all about balancing your immediate needs with your belief in the company's future. The right offer makes you feel valued today while giving you a meaningful piece of the exciting journey ahead.

How to Succeed in Your First 90 Days

You got the job. Fantastic. But now the real work starts. Your first three months at a Series A startup are a mad dash—a period of intense learning, quick adjustments, and, most critically, delivering something real. Success here isn’t just about ticking boxes on your job description; it’s about thriving in organized chaos and proving you can actually move the needle.

The most valuable people in this environment are "T-shaped." This just means you have deep expertise in your specific role (the vertical part of the 'T'), but you also have enough breadth to collaborate and help out across the company (the horizontal part). A Series A company is way too small for rigid silos. Your ability to jump in and solve problems outside your immediate lane is a huge advantage.

Master the Learning Curve

Your number one goal is to become an information sponge. This goes way beyond just learning the product. You need to get inside the heads of your customers, understand the market you're competing in, and figure out the internal team dynamics. To really make an impact fast, you have to get good at knowing how to learn effectively using proven methods.

Start by setting up short, casual chats with people across different teams—engineering, sales, customer support. Don't make it a formal interrogation. Just ask two simple, but incredibly insightful, questions:

- What’s the single biggest challenge you’re dealing with right now?

- What does a successful next quarter look like for you and your team?

The answers will give you a panoramic view of the business, helping you connect your own priorities to the company’s most pressing problems.

Identify and Deliver an Early Win

In a startup, momentum is everything. Your job is to find a small but significant project you can own and complete within your first month. This isn’t about trying to solve the company's biggest strategic problem on day one. It's about showing you're competent, you can be trusted, and you have a bias for action.

What does an early win look like?

- For a marketer: Find and patch a leaky hole in the conversion funnel, increasing sign-ups by 5%.

- For an engineer: Ship a small, requested feature that solves a real customer pain point, reducing support tickets by 10%.

- For a salesperson: Close a small, strategic deal that gets a foothold in a new industry.

Your first 90 days are less about executing some grand strategy and more about proving you can get things done. Focus on tangible results that create immediate value. That’s how you build the credibility needed to tackle bigger projects down the road.

This proactive mindset is non-negotiable in the startup world. According to Startup Genome's 2023 report, the global startup economy created nearly $4 trillion in value, demonstrating the massive scale and intense competition within this space. That kind of environment creates an intense demand for people who can adapt and deliver results quickly, which is why your initial impact is so important.

Decode the Culture and Build Relationships

Finally, you need to learn the unwritten rules of the road. How do decisions actually get made? Who are the people who have influence, even without a fancy title? How does the team react when things go wrong? Figuring out these cultural quirks is key to navigating the company effectively.

Building real relationships is just as crucial as the work itself. Go to the team lunches, participate in the social channels, and just be a curious, helpful human being. Your long-term success after joining a Series A startup will depend just as much on the trust you build with your colleagues as it will on your skills.

Common Questions About Startup Careers

Jumping into a Series A company is a big deal, and it’s smart to have questions. Let's get straight to what it’s really like on the inside by tackling some of the most common concerns I hear from professionals thinking about making the switch.

What Is the Biggest Risk Involved?

Let's not sugarcoat it: the primary risk is instability.

A fresh Series A round gives a startup a runway, but it’s not a golden ticket. That cash is meant to last 18-24 months, and during that time, the pressure is on to prove the business model and scale like crazy to attract the next round of investors. Historical data from Mattermark suggests that only about 50% of Series A companies successfully go on to raise a Series B.

If the company misses its key metrics, things can get rocky. We’re talking about tough pivots, layoffs, or even shutting down completely. That’s the reality. Unlike at a big public company, your equity could end up being worth nothing. This risk is the fundamental trade-off for the massive potential upside—both for your career and your bank account.

How Does the Work Culture Differ?

It’s a different world. Forget the rigid structure of a large corporation. At a Series A startup, you can expect a much faster pace, less formal structure, and a whole lot of ambiguity. It's just part of the game.

Decision-making happens quickly and isn't always top-down. You'll definitely be expected to wear multiple hats. For example, a product manager might also be tasked with writing blog posts and managing the social media accounts for an upcoming launch. Your job description is more of a starting point than a set of rules. You’ll be tackling problems that aren't technically "your job" simply because they need to get solved. This kind of environment creates an incredible sense of ownership and lets you see the direct impact of your work, which is something you rarely get at a larger company.

"The demands of customer discovery require people who are comfortable with change, chaos, learning from failure and are at ease working in a risky, unstable with no roadmap.” – Blank & Dorf, The Startup Owner’s Manual

How Can I Evaluate the Mission and Culture?

You have to look past the slick "About Us" page. The interview process is your chance to do some real digging. This is your due diligence phase.

Don't be afraid to ask tough, specific questions that get to the heart of their culture.

- "Can you tell me about a time the team failed or hit a major setback? How did you handle it?"

- "What specific actions or behaviors get someone recognized and rewarded here?"

- "Could you walk me through how a recent major decision was actually made?"

Try to talk to as many people as you can—not just the founders or your potential boss. Ask them what the most challenging part of their job is. A true culture fit isn't about liking their mission statement; it's about whether your values, work style, and appetite for risk match the day-to-day reality of the business.

Ready to find your next opportunity at a high-growth startup? FundedIQ delivers curated lists of recently funded companies, complete with verified decision-maker contacts and critical business insights. Stop searching and start connecting with the startups that are actively hiring and scaling. Find your next role with FundedIQ.