A Guide to Joining a Series B Startup

Thinking about joining a Series B startup? It’s a move that puts you right in the middle of a company hitting its stride. They've figured out what works and are now pouring gas on the fire. This isn’t about survival anymore; it's about pure, aggressive growth. For example, a SaaS company at this stage might have just crossed the $10 million ARR (Annual Recurring Revenue) mark and is now aiming for $50 million.

This makes the experience completely different from the chaos of an early-stage company or the predictability of a large corporation. You’re joining a team that’s laser-focused on scaling proven strategies, not just throwing ideas at the wall to see what sticks.

What Joining a Series B Startup Really Means

When a company raises a Series B, it means they've found product-market fit and now have serious capital to expand. The name of the game is capturing more market share, growing the customer base, and building a more sophisticated organization. It’s a definite shift away from the "wear-all-the-hats" culture of a seed or Series A startup where a team of 20 might be doing everything.

The scrappy energy is still there, but it's now balanced with a real need for structure and process. I like to think of it as graduating from a nimble speedboat to a powerful destroyer. The company is bigger and faster with more firepower, but it also takes a lot more coordination to steer. For instance, the engineering team might grow from 15 to 50, requiring the introduction of squads, guilds, and formal sprint planning.

The Shift From Discovery to Execution

The mission itself fundamentally changes at this stage. Instead of running experiments to find what works, the team is now expected to execute flawlessly on what’s already been proven. The focus shifts from raw innovation toward optimization and making things scalable.

This environment brings its own set of challenges you won't find anywhere else:

- Hardening Internal Processes: Let’s be real—what worked for a team of 30 people will absolutely break when you hit 100. New systems for everything from communication (moving from Slack DMs to formal channels) to project management (implementing Jira or Asana company-wide) have to be built on the fly.

- Managing Rapid Team Growth: The company is hiring fast, which can put a massive strain on the culture and how new people are brought on board. You'll likely see new layers of management pop up, such as introducing Directors to manage teams of Managers.

- Fending Off Competition: Success shines a big spotlight, and competitors will start coming out of the woodwork. A Series B company has to defend its turf while still growing, which adds a whole new layer of pressure. A real-world example is when a larger, established company launches a "copycat" feature to neutralize the startup's main advantage.

The Financial Reality of a Growth-Stage Company

We’re talking about significant money here. According to recent data, the median Series B deal size in Q1 2024 was $25 million. That kind of cash signals huge investor confidence.

But it also means you’re walking into a high-stakes world where performance is everything. You're expected to deliver.

A common misconception is that a Series B company is just a bigger Series A. They’re a different animal entirely. The challenge flips from survival to disciplined, rapid scaling, and that requires a completely different mindset from everyone on the team.

This transition from a small, tight-knit crew to a more structured organization is what defines the Series B experience. You'll have more resources than an early-stage venture, sure, but you'll also face much higher expectations to deliver measurable results. It’s critical to understand this dynamic before you jump in.

And as companies grow even bigger, you might find yourself curious about joining a Series C startup.

How to Vet a Series B Opportunity

Let's be real: not all Series B companies are created equal. Some are genuine rocket ships with solid foundations, while others are just burning through cash with no clear path to profitability. Before you even polish your resume, you need to put on your analyst hat and do some serious homework. This means looking past the splashy funding announcements to get a real sense of the company's health.

Your main goal here is to figure out if the company is built for the long haul or just riding a wave of investor hype. This involves digging into their financials, understanding their place in the market, and scrutinizing their growth metrics. Honestly, this is the most critical step in deciding if a Series B startup is the right move for you.

Decoding the Financial Health

First things first, you have to investigate the company's financial stability. You need to understand how they make money, how fast they're spending it, and how much time they have before they need another cash infusion. You don't need to be a CPA, but you do need to ask the right questions.

Kick off your investigation with these key areas:

- Funding and Runway: How much did they actually raise in their Series B round? And who led it? Seeing names of reputable VCs like Andreessen Horowitz or Sequoia Capital is a great sign. More importantly, what’s their runway—how many months can they operate before the bank account hits zero? A healthy runway is typically 18-24 months.

- Burn Rate: This is the net amount of cash the company is losing each month. A high burn rate isn't automatically a dealbreaker if it’s fueling smart growth (like hiring engineers or a sales team), but you need to understand where that money is actually going. For example, a $1 million monthly burn is more concerning if revenue is flat than if it's growing 20% month-over-month.

- Revenue Growth: Look for strong, consistent growth in Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR). For a SaaS company at this stage, 2-3x year-over-year growth is a really strong benchmark.

Digging into the financials helps you separate a company with a strong business model from one that simply has a good story. Healthy unit economics are a sign that the business is fundamentally sound and scalable.

To get the full picture, you’ll need to go deeper. For instance, understanding the nuances of a company’s balance sheet can be critical, as articles discussing topics like Figma's financial health can reveal a lot about a startup's operational efficiency.

Analyzing Market Position and Product Metrics

Beyond the balance sheet, a great Series B company has a product that customers love and a solid grip on its market. They've already found product-market fit; now, the game is about scaling up and dominating their niche.

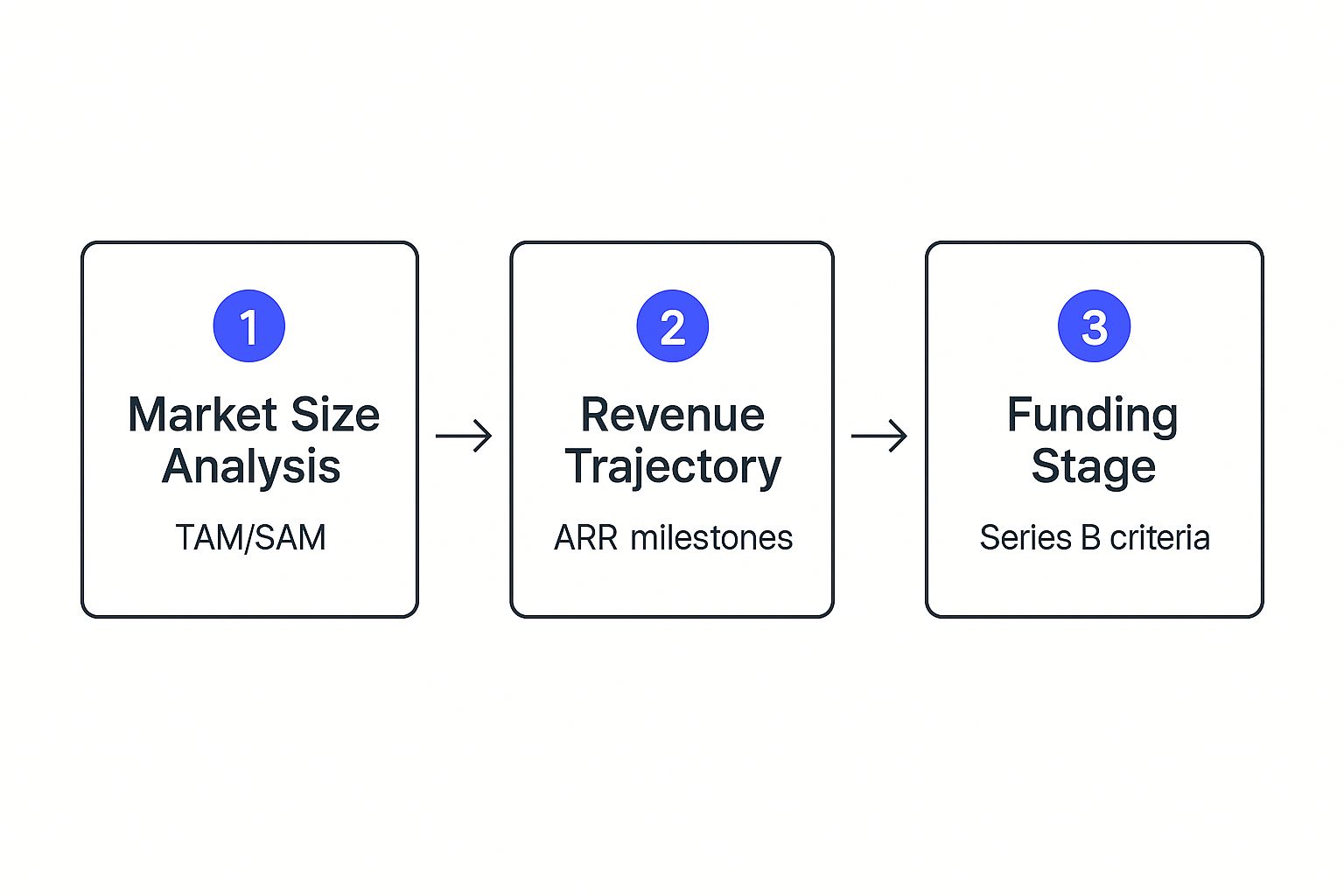

This flow chart breaks down how to think about a company's potential, from the size of the market all the way down to its specific funding stage.

As you can see, it connects the dots from the big-picture market opportunity (TAM/SAM) to concrete business performance (ARR) and finally, the validation that comes with a Series B investment.

A crucial metric to look into is the ratio of Customer Acquisition Cost (CAC) to Lifetime Value (LTV). A healthy LTV/CAC ratio is at least 3:1. This means that for every dollar they spend to get a customer, they expect to get at least three dollars back over that customer's lifetime. If this ratio is weak, their growth engine is probably unsustainable.

To keep your research organized, a checklist can be a lifesaver. This detailed due diligence checklist template is an excellent resource to make sure you don't miss anything important.

To help you structure your own investigation, here is a breakdown of the key areas you should be looking into.

Series B Startup Due Diligence Checklist

Key areas to investigate when evaluating a Series B startup opportunity to gauge its stability and growth potential.

| Area of Investigation | Key Questions to Ask | Red Flags to Watch For |

|---|---|---|

| Financials | What's the runway post-Series B? Is the burn rate justifiable? What does ARR/MRR growth look like QoQ and YoY? | A runway under 12 months. High burn with stagnant growth. Vague answers about unit economics. |

| Product & Market | Who are the top 3 competitors? What is the unique value proposition? What is the LTV/CAC ratio? | A crowded market with no clear differentiator. LTV/CAC ratio below 3:1. High customer churn rate (>10% annually). |

| Team & Culture | Who is on the leadership team? What is their track record? What is the average employee tenure? How are key decisions made? | High turnover on the executive team. Founder-led sales with no scalable process. Glassdoor reviews mention a toxic culture. |

| Growth Strategy | What is the go-to-market strategy? Is the company expanding into new markets or launching new products? How are sales and marketing teams structured? | No clear plan for using the new funding. Growth is dependent on a single channel. Over-reliance on "heroics" vs. scalable processes. |

This checklist isn’t exhaustive, but it provides a solid framework. By systematically working through these areas, you can build a much clearer picture of the company's prospects and decide if it's the right place for you to make your next move.

Getting Your Application Ready for a Series B Startup

When you’re targeting a Series B company, your application needs a different kind of energy. They aren't looking for cogs in a corporate machine who need months of hand-holding. But they’ve also outgrown the need for pure generalists who only function in chaos.

What they really need is a hybrid. They want someone with enough structure and experience to build scalable systems, but who still has the scrappiness to navigate ambiguity and get their hands dirty.

Your entire application—from your resume to your cover letter—needs to tell the story of how you are that person. It's all about proving you can take ownership, drive results with limited resources, and build processes from the ground up. This is your chance to translate your past accomplishments into the high-impact language that resonates with a growth-stage company.

Speak Their Language: Translating Your Corporate Wins

Let's be honest, corporate achievements can sound stuffy and slow to a startup founder. Vague descriptions like "managed a cross-functional team" or "contributed to strategic planning" will fall flat. You have to reframe your experience to scream impact, speed, and ownership.

Focus on accomplishments that prove you can:

- Build Better Systems: How did you make something faster, cheaper, or more efficient? Did you introduce a new tool or workflow that saved the team 15 hours per week? That's gold. For example, "Automated a manual reporting process using Zapier, reducing time spent on weekly updates from 4 hours to 15 minutes."

- Lead and Develop Talent: Don't just say you "managed." Frame it as building. Talk about how you hired key team members, created a new training program, or mentored junior colleagues who got promoted.

- Collaborate Without Silos: Highlight projects where you successfully worked with other departments to hit a common goal. This shows you can get things done without rigid corporate hierarchies getting in the way.

A well-structured resume is your best tool for this. If you need some inspiration on framing your impact, checking out a few of the 12 Best Product Manager Resume Template Options can show you how the pros do it.

Prove Your Impact with Cold, Hard Numbers

Numbers are the universal language of startups, especially at the Series B stage. Founders, executives, and investors are obsessed with metrics, and your resume needs to show you get it. Wherever possible, connect your actions to a measurable business outcome.

The most compelling applications tell a story of quantifiable impact. Instead of saying you "improved user engagement," state that you "launched a feature that increased daily active users by 22% in three months." The latter proves you think in terms of results.

For example, don't just write that you "led a marketing campaign." That’s a task. Show the outcome.

Try this instead: "Developed and executed a multi-channel marketing campaign with a $50,000 budget, which generated over 800 qualified leads and resulted in $250,000 in new ARR." See the difference? This version proves you can handle a budget and deliver a clear return on investment.

This data-driven approach does more than just list your skills. It shows you’re a strategic thinker who understands how your work directly fuels the aggressive growth targets of a scaling company. It proves you’re ready for the challenge.

Navigating the Interview and Proving Your Value

Walking into an interview at a Series B startup isn't just a skills test. It's an audition for a critical part in a high-stakes growth story. They're not just trying to fill a seat; they're looking for resilient problem-solvers who thrive in the organized chaos of scaling a business.

Your main goal? Show them you're a builder, not just an operator who can maintain the status quo. The conversation will quickly go beyond your resume, digging into how you actually think about scale, process, and ownership. Expect a multi-stage process where you'll talk with your potential manager, peers from other teams, and almost certainly one of the founders.

Mastering the Technical and Behavioral Rounds

In the early days of a startup, they want people who can wear a dozen hats. By Series B, they're looking for a different kind of flexibility—someone who brings deep expertise but can apply it in a constantly shifting environment.

You have to prove you can bring structure without creating soul-crushing bureaucracy.

- For technical roles: Get ready for deep dives into system design and scalability. Can you build something for 10,000 users today that won't fall over when you hit 1 million next year? Be prepared to discuss specific architectural choices, like choosing between a monolithic or microservices approach for a new feature.

- For business roles: Be prepared to talk specifics on go-to-market strategies, optimizing messy workflows, and how you’d build out a team. Show them how you took a clunky manual process—like lead qualification in a spreadsheet—and turned it into an automated, repeatable system using a CRM like HubSpot.

When you're answering behavioral questions, everyone knows the STAR method (Situation, Task, Action, Result). I recommend adding an "L" for Learning. End your stories by explaining what you learned from the experience and, crucially, how you’d apply that lesson to their specific problems. It shows you’re self-aware and always looking to improve.

Keep in mind, these companies are gearing up to dominate their market. The involvement of well-known investors means they have serious capital and expertise behind them. For you, this means a well-resourced company poised for aggressive growth, backed by VCs who expect top performance from every new hire. You can get a better sense of this by looking into the key players in Series B funding and the standards they set.

Asking Questions That Reveal Your Strategic Value

The questions you ask are just as revealing as the answers you give. Forget generic questions about company culture. This is your chance to prove you’ve done the research and are already thinking like a partner, not just a prospective employee.

This is how you turn a standard interview into a real, collaborative conversation about their business.

Think about asking questions that get right to their biggest growth pains:

- "What's the single biggest operational bottleneck you're dealing with as you scale from 100 to 250 employees?"

- "I saw you're expanding into a new market. What are the key assumptions in your GTM strategy that keep you up at night?"

- "How does the team measure success for [your function] right now, and where do you see the biggest gap or opportunity for improvement? For example, are you more focused on new logo acquisition or net revenue retention?"

Questions like these signal that you get the unique pressures of this growth stage. You’re not just looking for a job; you're looking for a problem you can own and solve. When you’re thinking about joining a Series B startup, that proactive, ownership-driven mindset is precisely what will make them see you as someone who can make an impact from day one.

Negotiating Your Offer and Equity Package

Getting an offer from a Series B company is a huge win. But don't pop the champagne just yet. The offer letter isn't the finish line; it's the start of a critical conversation about your compensation.

What you’re looking at is a blend of cash today and potential wealth tomorrow. The base salary is important, of course, but the real game is played in the equity portion of the package. This is where you need to focus your energy and do your homework.

Deconstructing the Equity Offer

Most of the time, your equity will be granted as stock options. Think of these not as free stock, but as a special ticket that gives you the right to buy company shares at a locked-in price—the strike price. If the company does well, you get to buy low and hopefully see the value of those shares skyrocket.

But there's a catch: you don't get them all at once. Your options are tied to a vesting schedule. The industry standard is typically a four-year schedule with a one-year "cliff." In simple terms, you have to stick around for at least one full year to get your first chunk of options (25%). If you leave before your first anniversary, you walk away with nothing. After that one-year mark, the rest of your options usually vest in small increments every month for the next three years.

Equity is designed to make you think and act like an owner. When the company wins, you win. A meaningful equity grant is a powerful signal that the leadership team believes you'll be a core part of making that future success happen.

Assessing the Real Value

A big number of options can sound impressive, but it's completely meaningless on its own. To figure out what your offer is actually worth, you need more context.

You have to know the company’s last valuation and the total number of shares outstanding. These two numbers let you calculate what percentage of the company you're actually being offered. For most non-executive roles at this stage, a grant between 0.05% and 0.25% is a pretty standard ballpark. For a deeper dive into the numbers, our guide on startup equity data has some great industry benchmarks.

External factors matter, too. The tech market goes through cycles. In a tough climate, some startups might have to raise a "down round," meaning they accept a lower valuation than their previous one. This can directly impact the potential of your equity. You can stay on top of these private market trends to understand the environment.

When you have a handle on these details, you're no longer just guessing. You can walk into the negotiation with confidence, ready to make a clear case for why you deserve a package that reflects the value you’re about to create.

Let's Tackle a Few Big Questions

If you're thinking about jumping into a Series B startup, you probably have some questions swirling around. This is a unique moment in a company's life—that awkward, exciting phase between a scrappy, all-hands-on-deck crew and a more established corporation. Let's get you some clear answers so you can make your next move with confidence.

Most people want to know how different this stage really feels. It's a great question, because the day-to-day can be a world away from other startup phases.

What’s the Biggest Cultural Vibe Shift from Series A to Series B?

The single biggest change is the shift from finding product-market fit to aggressively scaling it. A Series A company is all about experimentation. Everyone wears a dozen hats, and the culture is built around figuring out what sticks.

Once a company hits Series B, the game changes. The focus snaps to creating repeatable, scalable processes. Teams get built out, and roles get a lot more defined as the company balloons from 30-50 people to over 100. Your job is less about throwing spaghetti at the wall and more about building a cannon to launch it, consistently and efficiently.

How Much Job Security Can I Really Count On?

Think of it as the middle ground. A Series B startup has way more runway than its Series A or Seed-stage cousins. They've proven their model and have a serious war chest, so the immediate risk of the lights turning off is much, much lower.

But here’s the trade-off: the pressure to perform is immense. Investors are expecting big returns, and growth targets are aggressive. Your job security is directly hitched to performance—both the company’s and your own. You have to make a measurable impact. Given that only about 13% of startups that raise a Series A successfully go on to raise a Series B, you're joining an environment where results aren't just appreciated; they're demanded.

At a Series B startup, stability comes from impact. The company has cash, but they expect every single hire to be a growth accelerant. Performance is the currency of job security here.

Is It Better to Be a Specialist or a Generalist?

This is where specialists really start to shine. Early-stage startups need generalists—people who can write copy, run a sales call, and fix the printer. But Series B companies are building for scale, which means they need experts.

They're looking for people to build out entire functions: a marketing leader to create a demand-gen engine, a senior engineer to own a core part of the product, or a sales director to build a repeatable playbook.

The ideal hire is what’s often called "T-shaped." You have deep, hard-earned expertise in one area (the vertical part of the T), but you also have the breadth to collaborate effectively with other teams (the horizontal part). You’re brought in for your specialized skills, but your success depends on your ability to work cross-functionally without getting stuck in a silo.

At FundedIQ, we know that timing is everything. We give you curated lists of recently funded startups and the contacts for their decision-makers, so you can get in front of the right people at the right moment. Find your next role with FundedIQ.