Mapping Venture Capital Investment trends

If you're trying to get a handle on the venture capital world right now, you’ve probably noticed a few big shifts. We're seeing a major comeback in global funding, a laser focus on anything related to Artificial Intelligence (AI), and a clear move toward bigger, but fewer, investment deals. It's a different playing field, where massive, late-stage "megarounds" are becoming the main event.

Decoding the Modern Venture Capital Landscape

Welcome to the new reality of venture capital. After a stretch of holding their cards close, investors are back at the table with renewed confidence. This isn't just a random uptick; it's fueled by a stabilizing economy and an undeniable excitement around game-changing technologies.

But it’s not just about more money flowing in—it’s about where that money is going and how it's being invested.

The numbers tell a compelling story. In 2025, global VC funding bounced back in a big way, hitting $97 billion in the third quarter alone. That's a huge 38% jump from the $70 billion we saw in Q3 2024, signaling that investors are ready to make big moves again, especially in the AI space. For context, this resurgence brought quarterly funding back to levels not seen since early 2023.

The Rise of the Megaround

One of the most defining trends right now is the rise of the megaround—those massive investment rounds that top $500 million. These deals aren't just outliers anymore; they're taking up a huge slice of the total funding pie each quarter. For example, in a recent quarter, megarounds accounted for over 40% of all capital deployed.

This trend tells us the market is maturing. VCs aren't just scattering seeds; they're placing enormous bets on a smaller number of established companies they believe can truly dominate their markets. This has real consequences for everyone in the startup world.

- For Early-Stage Startups: Getting that first check is as tough as ever. You need to show a crystal-clear path to making money and leading your market, right from the very beginning. An example is having a detailed financial model projecting positive unit economics within 18 months.

- For Growth-Stage Companies: While the chance to raise a nine-figure round is there, the standards are incredibly high. VCs want to see a rock-solid business model and a commanding market presence before they’ll write those huge checks. This means having proven product-market fit with a low customer acquisition cost (CAC) and a high lifetime value (LTV).

This focus on larger, later-stage investments reflects a strategic pivot. Investors are not just funding ideas; they are fueling market leaders and consolidating industries, especially in high-growth sectors like AI and data analytics.

To help you get a quick snapshot of these changes, the table below breaks down the key trends shaping the VC world today.

Key Venture Capital Funding Trends At A Glance

| Trend | Description | Implication for Startups |

|---|---|---|

| Funding Resurgence | Global VC funding rebounded to $97 billion in Q3 2025, a 38% increase year-over-year. | Increased investor confidence creates more opportunities, but competition remains fierce. |

| AI Dominance | A significant portion of capital is being directed toward AI-native companies and AI integration. | Startups with a strong AI component are in a prime position to attract significant investment. |

| Megaround Concentration | A shift towards fewer, larger deals (>$500M) on established, later-stage companies. | Early-stage funding is tighter, while growth-stage companies face higher expectations. |

| Profitability Focus | Investors now prioritize a clear path to profitability over a "growth at all costs" mentality. | Founders must demonstrate a sustainable business model from the outset. |

This table really highlights the core dynamics at play. The money is there, but it's smarter, more concentrated, and more demanding than ever.

This guide will help you navigate these critical shifts, breaking down what's driving investor decisions and what it all means for founders trying to raise capital. To stay on top of the market, it's always a good idea to monitor the current venture capital trends as they evolve.

A Look at Global Venture Capital Hotspots

Venture capital isn’t some monolithic global market. It's really a patchwork of different ecosystems, each with its own personality, strengths, and appetite for risk. While money flows more freely across borders than ever before, knowing where it’s pooling—and why—is the key to understanding what’s really happening in the VC world. The map of funding tells a story of old guards, fast-moving challengers, and brand-new frontiers.

The United States has long been the undisputed center of the venture capital universe, and that's not changing anytime soon. This isn't just about the sheer volume of cash. It’s built on decades of infrastructure: experienced investors, world-class universities, and a culture that genuinely celebrates taking big, ambitious swings.

The Established Dominance of North America

When you think of venture capital, you probably picture Silicon Valley. And for good reason. That small corner of California, along with powerhouse cities like New York and Boston, really is the engine room of the global VC world. Their success creates a powerful feedback loop that's hard to break.

You have a mature network of everything from specialized law firms to a deep bench of engineers and executives who've already scaled companies from zero to IPO. This dense concentration of resources acts like a gravitational force, pulling in the best founders and the smartest money.

As of 2025, the U.S. still commands roughly 45% to 50% of global deal volume. This is a massive slice of a global market estimated to be worth over $450 billion annually. For instance, in Q3 2025, U.S.-based startups raised approximately $45 billion, showcasing the region's continued financial might.

The Rapid Ascent of Asia

While the U.S. is still the heavyweight champ, Asia is the fastest-rising contender in the ring. Led by the economic giants of China and India, the region has built a vibrant, self-sufficient venture ecosystem in a remarkably short time. This explosion is fueled by a massive, tech-savvy consumer base and, in many cases, a government-backed push for technological leadership.

- China's Playbook: Investment here is often laser-focused on sectors like advanced manufacturing, fintech, and mobility. The goal is to build homegrown giants in industries deemed critical for the future. A practical example is the significant government and private investment in semiconductor startups to achieve technological self-sufficiency.

- India's Strengths: India’s startup scene is a powerhouse in software-as-a-service (SaaS), e-commerce, and fintech, all built on the back of an enormous pool of skilled tech talent. Companies like Zoho and Freshworks have become global SaaS leaders, validating the market's potential.

These markets are no longer just adopting trends from the West; they're creating their own. They're pioneering unique business models designed specifically for their local populations. For any agency or investor trying to keep up, a good venture capital database is essential for getting real-time intelligence on these dynamic Asian markets.

Europe’s Steady and Sustainable Growth

Europe's venture scene moves to a different beat. It’s often characterized by steady, sustainable growth rather than the "blitzscaling" frenzy you see in Silicon Valley, and this approach is gaining serious credibility. The ecosystem also benefits from strong cross-border funding initiatives, such as the European Innovation Council (EIC) Fund, that are helping to create a more unified investment landscape.

Europe is a clear leader in deep tech and impact investing. There's a tangible emphasis on funding companies that are tackling huge societal problems—from climate change and sustainability to major breakthroughs in healthcare.

Key hubs like London, Berlin, and Paris are magnets for talent and capital, but what's interesting is how much more distributed the ecosystem is compared to the U.S. This creates a rich variety of opportunities across the continent, with different countries carving out their own niches, like Stockholm's dominance in music tech (e.g., Spotify) or Switzerland's strength in biotech.

Spotlighting Emerging Markets

Beyond the big three, exciting new VC hotspots are popping up all over the map. Smart investors are increasingly looking to Latin America, Southeast Asia, and Africa for untapped potential and the next wave of hyper-growth. These markets have their own unique advantages:

- Latin America: Brazil and Mexico are leading the charge, with a boom in fintech and e-commerce startups solving tricky local payment and logistics problems. Nubank, a Brazilian neobank, is a prime example of a local solution achieving massive scale.

- Southeast Asia: Countries like Indonesia and Vietnam are truly mobile-first economies, which has become fertile ground for super-apps and all-in-one digital platforms like Gojek and Grab.

- Africa: Nigeria, Kenya, and South Africa are becoming innovation hubs for mobile payments, agritech, and off-grid energy solutions that are changing lives. M-Pesa in Kenya pioneered mobile money, showcasing the continent's ability to leapfrog traditional infrastructure.

These emerging ecosystems aren’t just cloning Silicon Valley models. They’re building solutions perfectly tailored to their own economic and social realities. For global investors with an eye on the future, these regions represent the next frontier of venture capital—a chance to back the foundational companies of tomorrow.

The Unstoppable Rise of AI Investment

Artificial Intelligence isn't just another trend on a venture capitalist's checklist; it's become the gravitational center of the entire investment universe. The sheer volume of cash pouring into AI startups has completely reordered investor priorities, sparked the "megaround" phenomenon, and redefined what it even means to be a high-growth company.

This intense focus comes from a shared conviction among VCs that AI is a fundamental technology shift, on par with the internet or mobile computing. They see it as a horizontal technology that will shake up every single industry, from healthcare and finance to logistics and entertainment. Because of this, investors aren't just backing AI products; they're funding the foundational infrastructure of the next economic age.

The Data Behind the Dominance

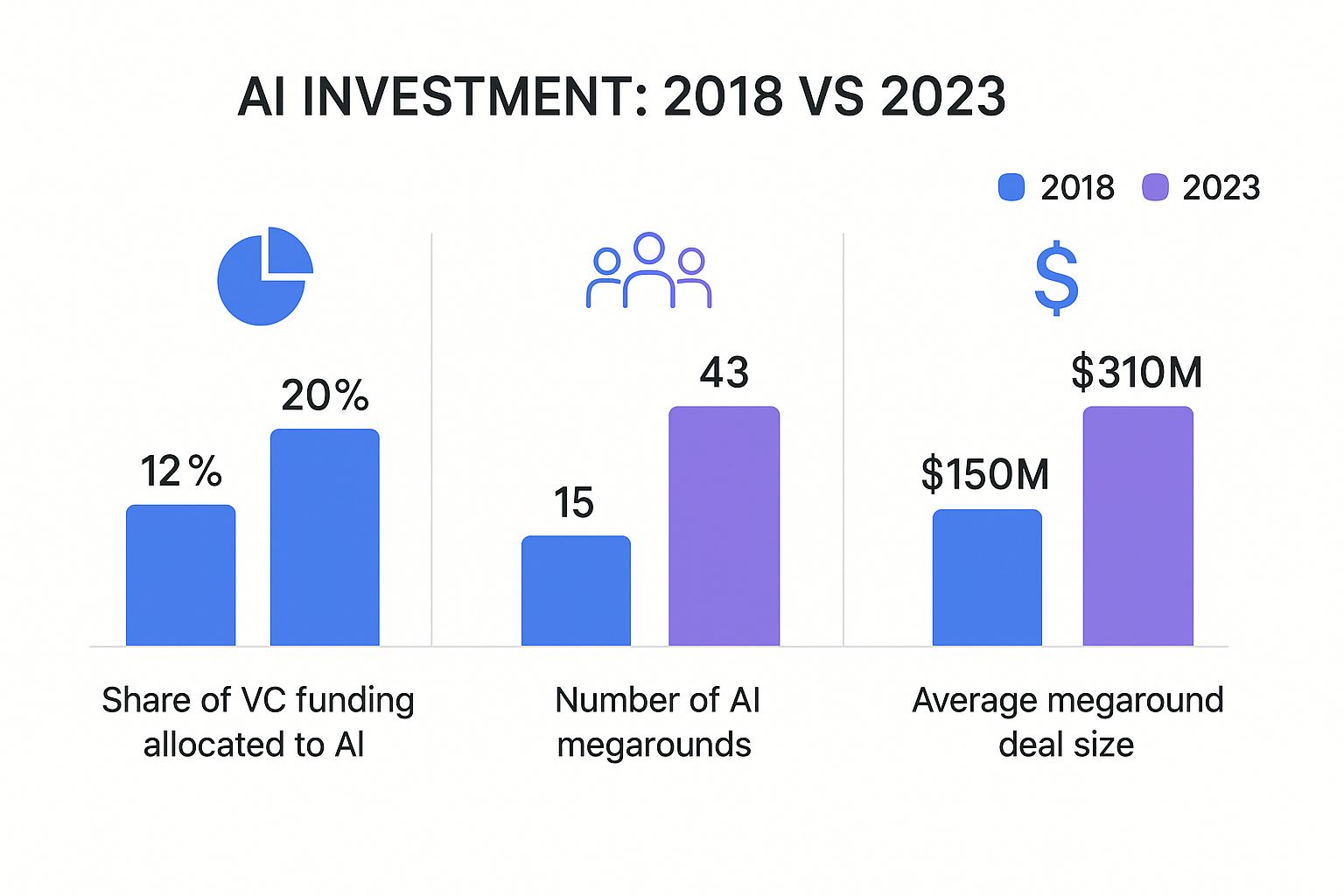

The numbers don't lie—they paint a crystal-clear picture of AI's command over the venture landscape. From 2018 to 2023, the slice of the VC pie going to AI-focused companies absolutely exploded. This tidal wave of funding has also jacked up both the frequency and the size of massive investment rounds.

This infographic breaks down the key data points from 2018 and 2023, showing just how dramatic the growth has been in AI's share of VC funding, the number of megarounds, and the average deal size.

As you can see, we're talking about exponential growth in both the amount and scale of AI investments. This cements its status as the most powerful force in venture capital today.

Key Sub-Sectors Attracting Capital

Instead of just throwing money at "AI" as a broad category, smart VCs are drilling down into specific, high-potential sub-sectors. If you're trying to follow the money, you need to understand these niches.

- Generative AI Platforms: This is easily the hottest ticket in town. Companies building large language models (LLMs) and multi-modal platforms are pulling in absolutely colossal funding rounds. A prime example is Anthropic raising billions to compete in the foundational model space. Investors view them as the foundational layers that countless other applications will be built on.

- Machine Learning Infrastructure (MLOps): As more companies actually start using AI, the demand for tools to build, manage, and monitor machine learning models has gone through the roof. This is a classic "picks and shovels" play, providing the essential plumbing for the entire AI ecosystem. Companies like Databricks and Weights & Biases are key players here.

- AI-Powered Enterprise Software: This is all about embedding AI into existing business software to automate tasks, improve decision-making, and make companies more productive. VCs are betting big on SaaS companies that can show a clear, AI-driven return on investment for their customers, such as an AI-powered CRM that increases sales efficiency by 30%.

The current AI investment cycle is all about a flight to quality. VCs are placing massive bets on companies with proprietary data, defensible technology, and a clear path to making money. This is what's driving the sky-high valuations for market leaders.

The Strategic Implications for Startups

For founders, this environment is a bit of a double-edged sword. On one hand, the chance to land a massive funding round is very real. On the other, the competition is absolutely brutal, and the expectations are through the roof.

VCs aren't just falling for the hype anymore; they're digging deep into the fundamentals. To get funded in this climate, a startup needs to prove it has more than just a slick algorithm. You need to demonstrate a deep understanding of a real-world problem, a unique data advantage that competitors can't easily copy, and a business model that can actually scale.

The applications for AI are branching out constantly, with niche AI in Sports market trends showing just how diverse its impact can be.

Ultimately, the surge in AI investment is the defining feature of modern venture capital. For agencies and founders, understanding how this ecosystem operates isn't just helpful—it's essential for navigating what's ahead.

A Closer Look at Key Investment Sectors (Beyond AI)

It’s easy to think the venture capital world revolves entirely around Artificial Intelligence right now. While AI is definitely commanding the spotlight, focusing on it alone means you're missing a massive part of the story. Experienced investors know that game-changing innovation is happening everywhere, and they're placing big bets on resilient, high-growth sectors that are quietly reshaping our future.

The truth is, even as AI deals dominate the headlines, areas like FinTech, HealthTech, and more specialized fields like mobility and defense tech are pulling in serious, strategic funding. This isn't just noise; it’s a sign of a healthy, diversified market where VCs are building strong portfolios that go far beyond a single technology.

The numbers back this up. In the first half of 2025, global private equity and venture capital investments hit a staggering $189.93 billion. That’s a 25% jump from the $152.24 billion invested during the same timeframe in 2024. A lot of that growth came from a surge of activity in North America, with FinTech, HealthTech, mobility, and defense tech leading the charge. You can dig deeper into this global funding data from S&P Global.

The Unshakeable Power of FinTech

FinTech has long been a heavyweight in VC portfolios, and it's not going anywhere. But the industry has evolved. We've moved past the initial wave of digital banks and slick payment apps. Now, the real money is flowing into the foundational infrastructure that makes modern finance actually work.

The action has shifted to embedded finance, where financial services—think lending, insurance, or payments—are seamlessly woven into non-financial apps and websites. That "buy now, pay later" option you see at checkout from companies like Klarna is a perfect example. VCs are actively funding the B2B companies that build these invisible, yet essential, financial engines.

Another area drawing major investment is compliance and regulatory technology (RegTech). As financial regulations get tighter and more complex, startups that can automate fraud detection, verify identities, and streamline reporting are becoming absolutely critical. Companies like Chainalysis, which provides blockchain analysis tools, solve a massive headache for institutions navigating crypto regulations.

HealthTech and the Dawn of Personalized Medicine

HealthTech continues to be a top priority for investors, fueled by a powerful shift toward more personalized and accessible healthcare. We're past the point of just digitizing old paper records; today’s investments are about using technology to fundamentally improve health outcomes.

Some of the most exciting venture capital investment trends here include:

- Precision Medicine: This is all about tailoring treatments to a patient's unique genetic makeup. Startups creating new diagnostic tools and therapies based on genomics, like Tempus, are seeing a flood of investment.

- AI-Powered Drug Discovery: While it uses AI, the mission is pure healthcare. Companies are using machine learning to analyze immense biological datasets, allowing them to spot potential drug candidates far faster and more cheaply than ever before. It's a huge market just waiting to be tapped.

- Decentralized Clinical Trials: Technology is now making it possible to run clinical trials remotely. This makes them faster, more inclusive, and way more efficient. VCs are backing the platforms that manage these trials, seeing them as the future of pharmaceutical R&D.

HealthTech is a long game, but the potential returns are astronomical. Investors are backing companies that can tangibly lower healthcare costs, create better patient outcomes, and set entirely new standards of care.

Niche Sectors Catching Fire

Beyond the titans of FinTech and HealthTech, a few specialized sectors are gaining serious traction with investors. These are often tough markets to break into, but the rewards for those who succeed can be market-defining.

One of the big ones is mobility and logistics. Self-driving cars get all the hype, but the real investment is pouring into electric vehicle (EV) charging infrastructure, next-generation battery technology, and automating the supply chain. Asia, for example, has become a global hub for autonomous vehicle development and innovative mobility solutions, drawing a lot of focused capital.

At the same time, defense technology is seeing a major comeback in the VC world. Startups are creating next-gen solutions for drone technology, advanced cybersecurity, and satellite communications. Companies like Anduril and Shield AI have attracted significant venture funding by applying modern tech to defense challenges. Because these companies often land stable, long-term government contracts, they represent an appealing asset for investors.

The following table provides a quick comparative look at some of these key investment sectors, their driving forces, and where VCs are focusing their capital.

Top Investment Sectors Comparison

| Sector | Key Drivers | Investment Focus Examples | Regional Strength |

|---|---|---|---|

| FinTech | Digital transformation, regulatory complexity, consumer demand for seamless experiences. | Embedded finance, RegTech, B2B payment infrastructure, decentralized finance (DeFi). | North America, Europe |

| HealthTech | Aging populations, rising healthcare costs, demand for personalized medicine. | Precision medicine, AI drug discovery, telehealth platforms, decentralized clinical trials. | North America |

| Mobility | Electrification, sustainability goals, urbanization, and supply chain inefficiencies. | EV infrastructure, battery technology, autonomous vehicle systems, logistics automation. | Asia, North America |

| Defense Tech | Geopolitical instability, need for advanced security solutions, government modernization. | Drones & counter-drone tech, cybersecurity, satellite communications, advanced sensors. | North America, Europe |

These sectors prove that while AI is a dominant theme, the venture capital landscape is incredibly rich and diverse. For agencies and founders alike, understanding these parallel venture capital investment trends is the key to spotting the next wave of high-growth, well-funded startups.

Navigating the Future of Venture Capital

While we can get caught up in the current headlines, the venture capital world is already laying the groundwork for its next chapter. The trends we’re seeing right now—the dominance of AI, deeper sector specialization, and a sharp focus on profitability—are really just the opening act. These forces are setting the stage for more fundamental shifts in how VCs make decisions and deploy capital.

If you’re a founder or an investor, simply keeping up isn't enough. The key to staying ahead is anticipating where the puck is going. The future of VC isn't just about what gets funded, but how. We're moving toward a model that's more data-driven, highly specialized, and deeply conscious of its real-world impact. This calls for a whole new playbook.

The Rise of AI in Venture Capital Operations

It’s one thing for VCs to pour money into AI startups; it’s another for them to start using the technology themselves. And that’s exactly what’s happening. The traditionally relationship-driven, gut-feel world of venture capital is beginning to embrace data science to find an edge. This isn't about replacing human intuition, but rather augmenting it to make faster, smarter, and more objective decisions.

Think about it: AI-powered platforms can crunch millions of data points to spot promising companies long before they hit a competitor's radar. This tech can track everything from patent filings and hiring sprees to web traffic and social media buzz, all to pinpoint startups showing signs of breakout potential. For example, firms like EQT Ventures use their proprietary AI platform, Motherbrain, to source and evaluate deals.

AI is also making the due diligence process far more efficient. Instead of an analyst spending weeks manually researching market size or mapping out the competitive landscape, algorithms can deliver those insights almost instantly. This frees up the partners to focus on what humans do best: judging the founding team's grit, understanding their vision, and building a genuine relationship.

Specialized Funds and Decentralized Models

The age of the generalist VC fund, the one that invests in everything from SaaS to CPG, is slowly fading. In its place, we’re seeing a new breed of highly focused, vertical-specific investors. As complex fields like climate tech, synthetic biology, and quantum computing mature, having deep domain expertise is no longer a "nice-to-have"—it's a must.

These specialized funds bring a lot more than just a check to the table. They offer founders an invaluable network of industry insiders, guidance on navigating tricky regulations, and strategic advice that a generalist firm simply can't provide. A prime example is The Engine, a fund spun out of MIT that focuses exclusively on "tough tech" companies.

At the same time, we're seeing entirely new investment structures pop up. Decentralized Venture Capital (DeVC), often built on blockchain technology, is a fascinating example. DeVC aims to break open the traditionally closed-door process of startup investing, allowing a broader community of experts to source, vet, and fund new companies. It’s a direct challenge to the old model and could unlock entirely new pools of capital.

ESG as a Core Due Diligence Pillar

Not too long ago, Environmental, Social, and Governance (ESG) criteria were a niche concern. Today, they are moving to the very center of the investment process. Investors have come to realize that companies with strong ESG principles aren't just "doing good"—they often deliver better long-term financial performance and are more resilient to market shocks. This is no longer about philanthropy; it’s about smart, risk-adjusted investing.

Today, a company's impact on the planet and society is not just a footnote in an investment memo—it's a critical factor in determining its valuation and long-term viability.

This shift has real-world implications for founders. VCs are actively screening for ESG risks and opportunities during due diligence, which means you need to be ready to articulate your strategy. A practical example is a climate tech startup being asked to quantify its potential carbon reduction impact or a SaaS company being questioned on its data privacy policies. This is now a standard part of any comprehensive tech due diligence checklist.

Ultimately, founders who can clearly demonstrate a commitment to sustainability, diversity, and ethical governance will hold a powerful advantage when raising money from the investors shaping the future.

Common Questions About VC Trends

The world of venture capital can feel like a moving target. To help you get your bearings, let's break down some of the most common questions people have about the current investment landscape.

Think of this as a quick chat with an insider—just clear, straightforward answers to help you make smarter decisions.

What Is the Single Biggest Venture Capital Investment Trend Right Now?

Hands down, it's Artificial Intelligence. But to call AI just another trend would be an understatement; it's the gravitational force pulling the entire VC universe into its orbit right now.

You see it everywhere. AI companies are the ones landing the massive funding rounds—the "megarounds" that top $500 million—and they’re eating up a huge slice of the total venture funding pie. Investors are betting big because they see AI as a fundamental technological shift, the kind that will completely reshape just about every industry you can think of.

So, what are VCs actually looking for? They're hunting for companies with a unique data advantage, AI models that can scale, and a crystal-clear way to make money. A practical example is an AI startup with an exclusive dataset for training models in a specific niche like legal contract analysis, giving it a defensible moat.

How Do Investment Trends Differ Between the US, Europe, and Asia?

While big themes like AI are global, you can definitely see distinct regional flavors in what gets VCs excited. Understanding these local nuances is crucial if you're trying to read the global venture capital investment trends.

-

United States: The U.S. is still the undisputed heavyweight champion in deal volume. It’s the epicenter for massive AI and software deals, powered by a mature ecosystem with deep pockets, seasoned talent, and an entrepreneurial spirit that's been cultivated for decades.

-

Europe: Across the pond, European investors often lean into deep tech, climate tech, and startups that have a serious sustainability or ESG mission baked in. It’s a ecosystem that’s getting a major boost from cross-border funding initiatives aimed at nurturing innovation for the long haul.

-

Asia: Led by powerhouses like China and India, the region is a hotbed for mobility—think autonomous vehicles and EVs—as well as FinTech and massive e-commerce platforms. While AI is huge here too, you’ll see it applied in very different ways depending on the local market needs.

As a Startup Founder, How Can I Align My Pitch with Current VC Trends?

This is the million-dollar question, isn't it? Aligning your pitch with what's hot is about more than just peppering your deck with buzzwords. It’s about showing you understand where the market is headed.

First off, you have to prove you’re not just chasing a trend. If you’re an AI company, dig deeper. What's your unique data advantage? What makes your model defensible? What specific, high-value problem are you solving for a customer who will actually pay for it?

Second, the "growth at all costs" era is over. VCs are now laser-focused on profitability and sustainable growth. They want to see your unit economics and a believable roadmap to revenue. For instance, show a clear path to achieving a CAC:LTV ratio of at least 1:3.

Investors are looking for resilience. A pitch that demonstrates a thoughtful business model and a grasp of financial fundamentals will stand out far more than one based purely on an ambitious vision.

Finally, you have to get your pitch in front of the right people.

- Do Your Homework: Don't spray and pray. Research VC firms and find the ones who have already invested in your space. Use tools like PitchBook or Crunchbase to identify partners with relevant domain expertise.

- Show Scalability: Those megarounds are a clear signal that VCs are hunting for businesses with the potential for enormous market impact. Your pitch needs to tell that story of massive scale, convincingly.

- Demonstrate Traction: Now more than ever, proof is in the pudding. Early signs of product-market fit, sticky user engagement, or even your first few dollars of revenue are pure gold. Metrics like a low churn rate or high net promoter score (NPS) are powerful validators.

Nail these elements, and you'll craft a story that truly connects with what today’s venture capitalists care about.

Ready to connect with the next wave of high-growth startups? FundedIQ delivers a hand-curated list of recently funded companies directly to your inbox every month. Stop wasting time on cold, outdated leads and start engaging high-intent prospects at the perfect moment. Get your first list of actionable leads from Funded.co.