What Is Prospect Research Explained

Think of prospect research as the detective work behind successful fundraising or sales. It’s the art and science of digging deep into potential donors or clients to figure out who they are, what they care about, and whether they’re a good fit for your organization. This goes way beyond just pulling a list of names.

We're talking about a genuine investigation into someone’s background, financial situation, and personal passions to see if there's a real, authentic connection to be made. For example, a university fundraiser might discover an alumnus who recently sold their tech company for a nine-figure sum (capacity), has a public history of donating to STEM education (inclination), and whose parents both attended the same university (affinity). This is the level of detail that turns a cold call into a strategic conversation.

The Foundation of Strategic Outreach

At its heart, prospect research turns a mountain of random data into a clear, actionable roadmap for building relationships. It’s what allows your team to stop making generic, cold asks and start having warm, meaningful conversations with people who are already primed to care about your mission. In a world of tight budgets and limited time, making every single outreach effort count is non-negotiable.

Here’s a startling reality check: while a whopping 90% of nonprofits collect data, a mere 5% actually use it to inform their decisions. That massive gap is exactly where prospect research proves its worth. It’s the critical link that transforms raw information into a smart, effective fundraising strategy. If you're curious, you can explore more fundraising data trends on deepsync.com to see just how important this has become.

The Three Pillars of Identification

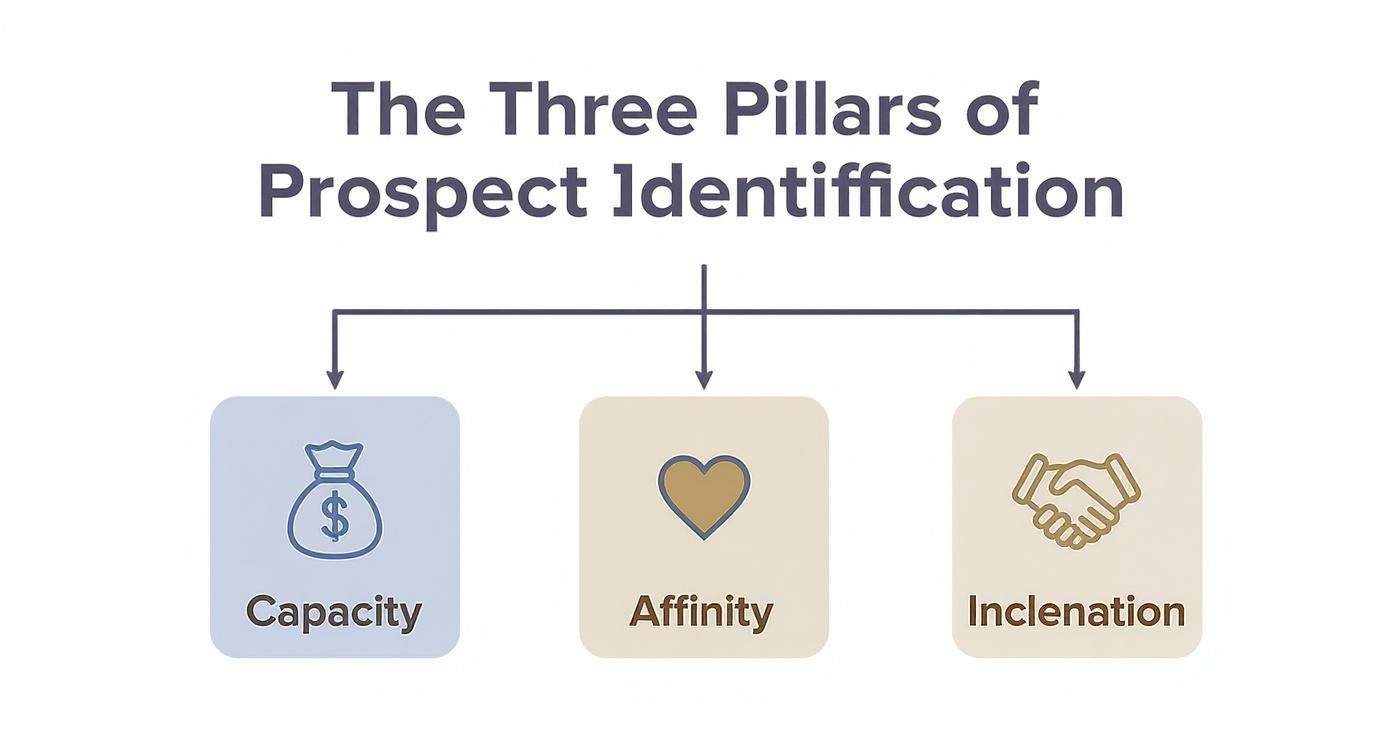

To do this well, you need to evaluate every potential prospect against three core criteria. I like to think of it as a three-legged stool—if you take away any one of the legs, the whole thing topples over. The same goes for finding the right prospect; you need a solid foundation built on all three pillars.

Here’s a quick breakdown of what we look for when we're trying to determine if a prospect is a good match.

| Pillar | What It Means | Key Questions to Ask | Practical Example |

|---|---|---|---|

| Capacity | This is all about a prospect's financial ability to give. It’s the "can they?" part of the equation. | Can they realistically make a significant contribution? What are their wealth indicators (real estate, stocks, business ownership)? | A real estate search reveals a prospect owns a $5M vacation home and a portfolio of commercial properties. |

| Affinity | This measures their connection and passion for your specific cause. It’s the "do they care?" factor. | Is there a past donation? Have they volunteered? Do they publicly support similar missions? | Your hospital foundation prospect previously served on the board of another local healthcare charity. |

| Inclination | This looks at their past behavior. It’s the "will they?"—based on a proven track record. | Do they have a history of giving to other organizations? Are they known for their philanthropic spirit? | A search of public donor rolls shows the prospect has made consistent five-figure gifts to other arts organizations. |

Ultimately, a strong prospect sits at the intersection of all three. One or two isn't enough; you need the full picture to be confident in your outreach.

This simple framework helps visualize how capacity, affinity, and inclination come together to pinpoint your most promising prospects.

As you can see, the ideal candidate isn't just wealthy or passionate—they're a combination of all three traits. Focusing your energy on prospects who check all three boxes is how you build a pipeline of high-quality, long-term supporters.

Understanding Core Research Methodologies

To really get a handle on who your best prospects are, you need to think like a detective. And like any good detective, you have a couple of core strategies you can use. I like to think of it like fishing. You can cast a wide net into a part of the ocean you know is full of life, or you can use a spear to go after a specific, high-value fish you've already spotted. Both tactics can land you a great catch, but they're used in totally different situations.

In prospect research, we call these two approaches proactive and reactive. Each one answers a very different question. Proactive research asks, "Out of everyone we know, who are the hidden gems we're missing?" Reactive research, on the other hand, asks, "Is this specific person who just popped up on our radar a genuinely good fit?"

Proactive Research: Casting a Wide Net

Proactive research is exactly what it sounds like—it’s about getting out ahead of things. This is your "wide net" approach, where you systematically screen large pools of people to find those hidden gems. Think about your entire alumni database, your email subscribers, or even a list of everyone who attended your last gala. The goal is to spot individuals with the financial capacity and potential interest who, for whatever reason, haven't raised their hand yet.

You’re basically hunting for high-potential prospects who are currently flying under the radar. This method leans heavily on data analytics and wealth screening tools that can sift through thousands of records at once, looking for key indicators of wealth and philanthropic tendencies.

You might kick off a proactive search when:

- Screening Your Database: You decide to run a regular analysis of your whole CRM, segmenting everyone by wealth markers. Insight: A children's hospital ran a screen on its 50,000-person database and found 200 previously unknown major gift prospects, leading to a 30% increase in campaign pipeline within six months.

- Prospecting by Location: You want to identify high-net-worth individuals in a specific zip code where you’re launching a new campaign.

- Analyzing Industries: You notice a tech boom in your city and start looking for founders or executives who might have new wealth and an interest in your cause.

This strategy is absolutely crucial for keeping your pipeline full of fresh, qualified leads. It ensures you're not just waiting for people to come to you but are actively finding supporters who could make a real difference.

Reactive Research: The Deep Dive

If proactive research is the wide net, then reactive research is the spear. It's a deep, focused investigation into one specific person who has already caught your attention. Maybe a first-time donor just made a surprisingly large online gift, or a board member mentioned a wealthy friend you should meet. That's your trigger.

Here, the game changes. You're not just screening for basic data points anymore; you're trying to build a complete, 360-degree profile of this one person. The focus shifts from discovery to deep qualification, gathering the kind of detailed intelligence that helps you build a genuinely personal connection.

Key Takeaway: Reactive research isn't just about confirming someone has money. It’s about uncovering their story—their passions, connections, and motivations. You're looking for the 'why' that will help you build a real relationship, not just make an ask.

For example, imagine an animal shelter receives an unexpected $5,000 online donation from a local business owner. A reactive deep dive would go way beyond just confirming their net worth. You'd be looking for photos of their rescue dog on social media, any past donations to other animal charities, or community involvement awards their business has won. This research might reveal they adopted their beloved dog from your very shelter ten years ago—a powerful emotional connection point for your first conversation.

This kind of detailed insight is a form of sales intelligence. It gives you the context you need to tailor your outreach and make it meaningful. You can learn more about this by checking out our guide on what is sales intelligence.

Key Data Points in Both Methodologies

Whether you're casting a wide net or doing a deep dive, you're always looking for specific clues that build a complete picture. These data points generally fall into two buckets.

Wealth Indicators (Their Capacity to Give):

- Real Estate: How many properties they own and what they're worth. For example, owning multiple properties valued at over $2 million is a strong indicator.

- Stock Holdings: Public records of significant ownership in companies (from SEC filings). Owning more than 5% of a public company is a major wealth event.

- Business Ties: Their role as a founder, C-suite executive, or major shareholder.

- Known Compensation: Publicly available information on salaries, bonuses, or stock options for corporate leaders. Total compensation packages for Fortune 500 CEOs can often exceed $15 million annually.

Philanthropic Clues (Their Affinity & Inclination to Give):

- Giving History: Where else they've donated, especially to causes similar to yours. A pattern of giving $25,000+ annually to other organizations is a strong sign of inclination.

- Foundation Involvement: Serving as a trustee for a private or family foundation.

- Nonprofit Leadership: Any board memberships or significant volunteer roles.

- Personal Interests: Publicly expressed hobbies, passions, and values that align with your mission.

It’s no surprise that this data-first approach is catching on. The market for donor prospect research software was on track to hit around $800 million in 2025, with experts predicting a compound annual growth rate of roughly 12% through 2033. This boom reflects just how much organizations now rely on solid data to guide their fundraising efforts.

Building Your Prospect Research Toolkit

Great research hinges on the quality of information you can get your hands on, and that comes down to the tools you use. Think of it like a mechanic's workshop. You could try to fix an engine with just a wrench and a screwdriver, but the job gets a whole lot easier—and the results are far better—with specialized diagnostic equipment.

The same principle applies here. Your prospect research toolkit can range from free, everyday resources to powerful, subscription-based platforms. The real skill isn't just having the tools; it's knowing which one to grab for the job at hand and how to combine their outputs. A solid strategy involves layering information from different sources to paint a full, accurate picture of a prospect. This way, your outreach is built on real intelligence, not just a hunch.

Premium Philanthropic Databases

At the high end of the spectrum, you’ll find the powerhouse databases built specifically for prospect research. These are the heavy-duty power tools in your kit, designed to crunch massive amounts of public data into clean, searchable profiles.

These platforms are engineered to answer the big questions about a prospect's capacity, affinity, and inclination to give. They pull together wealth indicators, like real estate portfolios and stock holdings, and cross-reference them with philanthropic data, such as past giving history and board memberships.

A few of the major players include:

- iWave: A comprehensive platform prized for its huge dataset and scoring features that help you rank prospects in a snap. It integrates over 40 wealth and philanthropic data sources.

- DonorSearch: Zeroes in on philanthropic indicators, using smart analytics to spot prospects with a proven track record of generosity. Its database contains over 400 million charitable giving records.

- WealthEngine: Delivers a deep dive into wealth and lifestyle details, giving you a 360-degree view of a prospect's financial world, including wealth scores and propensity models.

While these subscriptions are a serious investment, the payoff is in efficiency and depth. They can shrink research time from hours down to minutes and uncover connections you'd likely never find on your own.

Business and Financial Databases

When your ideal prospects are founders, executives, or other corporate leaders, you need tools that speak the language of business. Financial and business-focused databases give you crucial context on a company’s health, an executive's career trajectory, and their professional network.

This is where you dig into the nitty-gritty of corporate filings and financial performance. For example, knowing a company just had a record-breaking quarter tells you its leadership might be in a very different headspace than if they just went through a round of layoffs.

You can't separate an executive's professional life from their potential as a prospect. A major business success, like a company sale or IPO, is often a primary trigger for a significant philanthropic gift or a major B2B purchase.

Here are some go-to resources for corporate intelligence:

- SEC EDGAR Database: The official source for all public company filings in the U.S. It's a goldmine for details on executive compensation, stock ownership, and insider trading. Practical Tip: Use Form 4 filings to track when insiders buy or sell company stock, a key indicator of their personal financial activity.

- Dun & Bradstreet: Offers deep data on both public and private companies, including financials, corporate family trees, and industry benchmarks.

- LinkedIn Sales Navigator: An indispensable tool for mapping organizational charts, identifying key decision-makers, and understanding their professional history. When it comes to finding company information for strategic outreach, platforms like this are essential.

Free and Publicly Available Sources

Not every tool has to break the bank. There's a surprising amount of high-quality information out there for free—if you know where to look. These public sources are perfect for double-checking details from your premium tools or for organizations that are just dipping their toes into formal research.

Think of these free resources as the finishing touches. Layering this data on top of insights from your subscription platforms makes for a much richer, more reliable prospect profile.

- Property Records: Most county assessor websites offer public access to real estate ownership records and assessed property values.

- Political Contribution Databases: Sites like OpenSecrets.org track political donations, which can be a powerful indicator of both financial capacity and personal values.

- News Archives and Search Engines: A well-crafted Google search or a dive into news archives can uncover articles, interviews, and press releases that shed light on a prospect’s career wins, personal passions, and community involvement. Practical Tip: Use advanced search operators like

"John Doe" AND "philanthropy"or"Jane Smith" AND "foundation"to narrow your results.

Comparison of Prospect Research Tool Types

To help you visualize where each type of tool fits, here’s a quick breakdown of the different categories, their main purpose, and who they’re best for.

| Tool Category | Primary Function | Examples | Best For |

|---|---|---|---|

| Philanthropic Databases | Aggregates wealth, philanthropic, and biographical data for comprehensive nonprofit fundraising profiles. | iWave, DonorSearch, WealthEngine | Nonprofits and fundraisers needing to assess donor capacity and affinity. |

| Business/Financial Data | Provides in-depth information on public and private companies, executive roles, and financial health. | SEC EDGAR, Dun & Bradstreet, LinkedIn Sales Navigator | B2B sales teams, M&A analysts, and fundraisers targeting corporate leaders. |

| Public/Free Sources | Offers access to publicly available information for verifying details and initial research. | Google, County Records, OpenSecrets.org | Organizations on a tight budget or researchers looking to supplement premium data. |

Choosing the right mix of tools from these categories depends on your specific goals and budget. The most effective researchers rarely rely on a single source, instead weaving together insights from multiple platforms to build a truly comprehensive and actionable profile.

How AI Is Shaping the Future of Research

Artificial intelligence isn't just a buzzword; it's fundamentally changing how we approach prospect research. For years, the discipline was reactive, focused on analyzing past actions to guess what might happen next. AI flips that script, turning research into a predictive powerhouse that can forecast future behavior with startling accuracy.

This evolution is driven by machine learning algorithms that sift through enormous datasets, spotting subtle patterns that a human researcher would almost certainly miss. The result? A much smarter, more strategic way to find and connect with the right people.

The Rise of Predictive Scoring

One of the biggest game-changers is predictive scoring. You can think of it as a supercharged, data-driven version of traditional prospect ratings. Instead of just looking at wealth and past giving history, AI models crunch hundreds of data points at once to rank your prospects.

What kind of data are we talking about?

- Behavioral Signals: Things like website visits, email open rates, and event attendance.

- Demographic Data: Age, location, professional background, and known interests.

- Transactional History: The frequency, recency, and size of past contributions.

- External Data: Public information like social media activity or financial indicators.

By weighing all these variables, AI generates a dynamic score that tells you not only who can give, but who is likely to give soon. For example, a university using a predictive model found that alumni who visited the "planned giving" section of their website were 15 times more likely to make a major gift within the next year, allowing them to prioritize outreach to this highly engaged group. This lets your team focus their time and energy on the conversations that are most likely to pay off. For a closer look at the mechanics, it’s worth exploring different AI in research methodologies.

From Data Points to Actionable Insights

AI’s real strength is its ability to turn all that raw data into clear, strategic guidance. It can analyze patterns to predict not just who might give, but also when they are most likely to do so and at what level. This is how you create outreach that feels perfectly timed and personal.

For instance, an AI tool might spot a group of mid-level donors who share key traits with your past major givers, flagging them as the next group to cultivate. This often involves data enrichment, a process where AI fills in the missing pieces of your contact records to build a complete picture. If you're curious, you can learn more by checking out our guide on what is data enrichment.

Despite its potential, many organizations are still on the sidelines. A recent analysis revealed that only 13% of nonprofits are using predictive AI for prospecting. This is a huge missed opportunity, especially since 41% of nonprofit leaders say they believe AI would be a major benefit to their work.

Balancing Promise with Practicality

Of course, jumping into AI isn't without its hurdles. There are important ethical questions to consider, especially around data privacy and algorithmic bias. If the data you feed an AI model is skewed, its predictions will be too, which could cause you to overlook great prospects who don't fit a conventional mold.

The Goal of AI: It's not about replacing researchers. Think of AI as a powerful assistant. It automates the tedious work of gathering data and finding patterns, freeing up your team to focus on the human side of the equation: strategy, storytelling, and building genuine relationships.

At the end of the day, AI is expanding what’s possible in prospect research. It gives organizations the power to work smarter, turning mountains of data into a clear roadmap for success.

Putting Prospect Research into Action

All the theory and methods are great, but the real magic happens when prospect research leads to actual results. Good research is what connects dry data points to a major win, whether you're in fundraising or sales. It’s all about finding the story behind the data—a story that helps you connect with someone on a human level.

To see how this works in the real world, let's walk through a couple of examples that show the entire journey, from that first spark of discovery to a successful engagement. Each story shows how specific bits of information led to a smarter outreach strategy and, ultimately, a fantastic return on investment.

From Mid-Level Donor to Major Philanthropist

A large public university had a long list of dependable, mid-level donors. One of them, an alumna from the business school, had been giving a steady $2,500 every year for more than a decade. While they certainly appreciated her support, this pattern had her filed away in the "loyal but not major" category. She never received any kind of personalized outreach.

Then, during a routine screening of their donor database, the university's research team saw a flag on her profile. Her giving history was modest, sure, but the wealth indicators were telling a completely different story. A deeper dive revealed that the small software company she founded 20 years ago had just been acquired by a tech giant in a deal worth hundreds of millions.

The Actionable Intelligence:

- Capacity: The company sale was a huge liquidity event, meaning her financial ability to give had just skyrocketed.

- Affinity: Her consistent annual donations, even when she wasn't exceptionally wealthy, showed a deep-seated loyalty to the university.

- Inclination: The team found out she served on the board of a local youth mentorship nonprofit, signaling a real passion for education and creating opportunities.

Armed with this complete picture, the development officer reached out. They didn't ask for money. Instead, they sent a simple, personal note congratulating her on the incredible success of her company. That one gesture led to a meeting where they talked about her passion for helping first-generation students.

The result? A seven-figure gift to create a new scholarship fund. It was a massive leap from her previous giving, all because the research team looked beyond her donation history.

Closing an Enterprise Deal with Personal Insight

A B2B SaaS company was hitting a brick wall trying to get a meeting with the CTO of a major retail corporation. Their generic emails about "improving efficiency" were getting deleted on sight, lost in a sea of similar pitches. Frustrated, the sales team decided to dedicate some serious time to researching the CTO himself.

They went beyond just his current role. They dug up articles and interviews from a previous job where he'd managed a massive—and notoriously difficult—data migration project. In those pieces, he talked openly about the headaches of integrating legacy systems and the critical importance of getting users to actually adopt new tools. The team also noticed on his LinkedIn that he was constantly engaging with posts about data security and compliance.

This is where research shifts from simple data collection to strategic empathy. Understanding a prospect's past professional challenges allows you to frame your solution not as a product, but as a direct answer to their known pain points.

The sales team scrapped their old pitch and wrote something new and incredibly specific. Instead of a generic subject line, they referenced the challenges of legacy system integration. The email body highlighted their platform’s specific features for secure data migration and user-friendly onboarding, touching on every single pain point he had publicly discussed.

The CTO replied in less than an hour. That email led to a demo and, ultimately, a major enterprise deal. The research turned a cold outreach into a relevant, problem-solving conversation that hit home immediately.

Of course, once you gather this kind of information, you have to organize it effectively. To make your research data truly actionable for these strategic decisions, explore some proven knowledge management best practices.

These stories prove that prospect research isn't just about finding rich people or sniffing out C-suite titles. It’s about discovering the right information to build a bridge, turning a generic ask into a personal, irresistible invitation.

Got Questions About Prospect Research? We’ve Got Answers.

Even after you get the hang of what prospect research is, a few practical questions always seem to pop up as teams start to dig in. To help you get past those "what ifs" and move forward, we’ve put together answers to the most common questions we hear, covering everything from ethics to the nitty-gritty of costs and skills.

Let's clear up those lingering uncertainties.

Is Prospect Research Ethical?

Yes, absolutely—when it’s done right. Ethical prospect research is built on a foundation of integrity and uses 100% publicly available information. This isn't about secret spy tactics; it's about piecing together a puzzle from data that's already out in the open.

Think about sources like news articles, public real estate records, SEC filings, or professional profiles on sites like LinkedIn. The whole point, as championed by groups like APRA (Association of Professional Researchers for Advancement), is to understand a person's potential connection to your mission, not to invade their privacy.

The heart of ethical research is finding alignment, not prying into someone's private life. It's a transparent process of connecting a person's known passions and capacity with a cause they might genuinely care about, all while respecting data privacy laws like GDPR.

How Much Does Prospect Research Cost?

This is a "how long is a piece of string?" question. The cost can swing wildly depending on how you tackle it. On one end, you can get started for free with nothing more than Google and public databases, but that approach will eat up your time and often leave you with an incomplete picture.

For better results and efficiency, most organizations invest in dedicated tools or talent.

- Subscription Platforms: These can run from a few thousand dollars a year for basic access to tens of thousands for premium databases packed with advanced analytics and wealth screening features.

- Consultants: Hiring a freelance researcher or a consulting firm is another route. They usually charge by the hour ($75-$250/hour is a common range) or by the project, which can be a smart move for specific, high-stakes campaigns.

The best way to think about this is as an investment, not an expense. The right intelligence can uncover a single major gift or high-value client that pays for the entire service many times over. Industry data suggests that for every $1 invested in fundraising, nonprofits can see an average return of $4. Effective research is a key driver of that ROI.

What Skills Make a Good Prospect Researcher?

A great prospect researcher is part data analyst, part storyteller, and part detective. It's not just about finding numbers; it's about understanding the human story behind them.

To really excel in this role, you need a few core skills:

- Analytical Prowess: You have to be able to spot meaningful patterns and insights buried in large, often messy, sets of data.

- Deep Curiosity: A genuine inquisitiveness is key. It's what drives you to dig one level deeper, ask "why," and find the hidden threads connecting seemingly random facts.

- Strong Communication: You need to be able to distill complex findings into clear, concise, and actionable reports that give your team a clear path forward.

- Technical Proficiency: Being comfortable with research databases, spreadsheets, and other analytical software is non-negotiable.

Ultimately, the most important trait is a persistent, puzzle-solving mindset. The best researchers get a real thrill from the hunt and the satisfaction of connecting the dots to reveal the full picture.

How Is Research Different for Sales and Fundraising?

While the core techniques of gathering and analyzing information are nearly identical, the end goal is what changes the game. The specific information you prioritize is driven by whether you're fundraising or selling.

In fundraising, the researcher is on the hunt for philanthropic indicators. They’re looking for things like:

- A history of giving to other nonprofits.

- Involvement on foundation or charity boards.

- Publicly stated values that echo the organization's mission.

The main goal here is to connect a person's personal passion to a cause.

For sales, the focus shifts to business intelligence. A sales researcher is looking for:

- A company’s financial health and recent growth trajectory. (e.g., Did they just secure a Series B funding round?)

- Strategic challenges, industry trends, and known "pain points." (e.g., Are they struggling with supply chain logistics?)

- The key decision-makers and their professional backgrounds.

Here, the main goal is to connect a business's practical need to a product or service that delivers tangible value. One is about personal values; the other is all about business value.

Ready to stop guessing and start targeting the right prospects? FundedIQ delivers curated lists of recently funded startups, complete with decision-maker contacts and critical business intelligence. Engage high-intent leads at the perfect moment and accelerate your agency's growth. Discover your next client at https://fundediq.co.