A Guide to Series D Financing for Ambitious Startups

So, what exactly is Series D financing? Think of it as the final, high-stakes funding push for a mature startup that’s on the verge of either total market domination or a major exit, like an IPO. This isn't about keeping the lights on; it's strategic fuel for a company that’s already winning and now wants to own the entire racetrack. For example, Reddit raised a $250 million Series D in 2019 to redesign its platform and expand internationally, long after it had established itself as a major internet destination.

What Series D Financing Really Means for a Company

If building a startup is like constructing a skyscraper, the early rounds (Seed, Series A, B, and C) are all about laying the foundation and building the core structure. Series D is when you add the penthouse, polish the marble in the lobby, and get ready for the grand opening. It’s a make-or-break moment that separates a fast-growing business from a true industry leader.

At this stage, the company is long past proving its business model. The goal now is to execute that proven model on a massive, often global, scale. The ambitions are huge and very specific, shifting from finding product-market fit to achieving complete market capture. To really get a feel for this stage, it helps to understand all the essential sources of funding for startups, including VCs and see just where this round fits into the big picture.

The Shift From Growth to Dominance

Early funding is all about product development and getting your first real customers. Series D is different. It’s about cementing the company’s legacy. The money raised is almost always earmarked for big, strategic moves that cost a lot of capital.

You’ll typically see the funds used for things like:

- Aggressive Global Expansion: Taking the business into new international markets to build a true worldwide footprint. A practical example is fintech company Klarna using its late-stage funding to aggressively launch and scale in the U.S. market.

- Strategic Acquisitions: Buying out smaller competitors or snapping up companies with complementary tech to consolidate market share or add new features. For instance, Databricks has used its significant funding to acquire smaller AI startups like Einblick to enhance its platform.

- Preparing for an IPO: Beefing up the balance sheet, tightening up internal processes, and proving consistent profitability before going public.

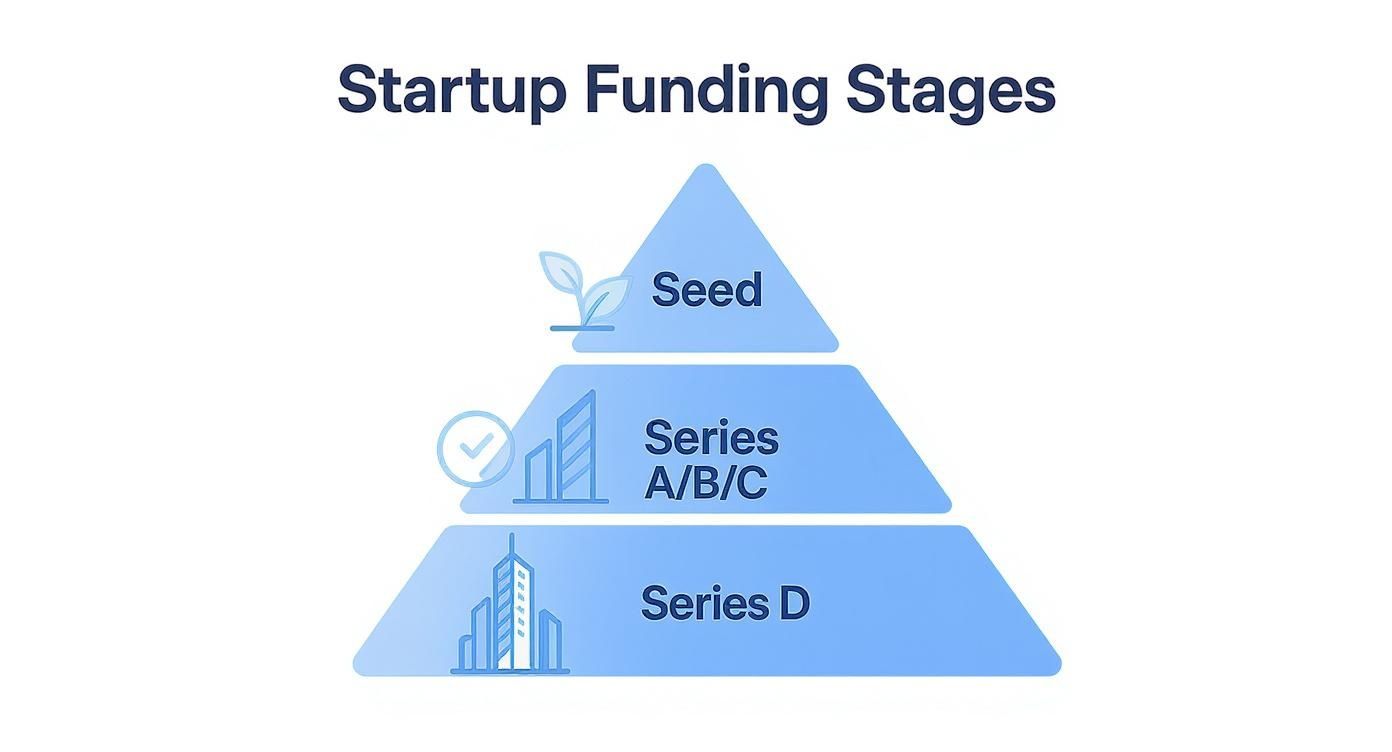

This diagram shows you exactly where Series D sits in the funding journey.

As you can see, Series D is right at the top of the private funding pyramid. It’s a signal that a startup has grown from a tiny seed into a towering institution.

Venture Capital Funding Stages at a Glance

To better contextualize Series D, let's look at how it compares to the rounds that come before it. Each stage has its own unique purpose and set of players.

| Funding Stage | Primary Goal | Company Status | Typical Investors |

|---|---|---|---|

| Seed | Validate the idea, build a prototype (MVP) | Pre-revenue or very early revenue | Angel investors, friends & family, early-stage VCs |

| Series A | Achieve product-market fit, scale revenue | Consistent revenue, clear business model | Traditional Venture Capital firms |

| Series B | Build out the team, expand market reach | Established user base, scaling aggressively | Venture Capital firms, growth equity firms |

| Series C | Capture market share, scale internationally | Market leader, profitable or near-profitable | Late-stage VCs, private equity firms, corporate VCs |

| Series D | Prepare for an exit (IPO), M&A, dominate | Mature, highly valuable, profitable | Private Equity, hedge funds, investment banks, late-stage VCs |

This table highlights the evolution from a simple idea to a market-dominating force, with Series D representing the final strategic push before a major liquidity event.

Understanding the Scale of Investment

The sheer size of a Series D round says everything about its strategic importance. The investments are massive because they have to be—they’re funding huge operational plays.

Recent data from Carta shows the median Series D funding size in Q1 2024 was $92 million. While this figure fluctuates with market conditions, deals frequently land in the $50 million to $250 million range, which just shows how much capital is flowing at this stage.

You can dive deeper into these mechanics in our guide on https://fundediq.co/what-is-a-funding-round/. But the key takeaway is that this level of investment attracts a whole new class of sophisticated investors, like private equity firms and hedge funds, who demand a clear and profitable path to an exit.

Key Signals Your Startup Is Ready for Series D

Thinking about Series D funding? This isn't a "hope for the best" kind of situation. This late stage of financing is reserved for companies that have graduated from growth projections to proven, repeatable success. Investors at this level are looking for stone-cold evidence that your startup isn't just a strong player—it's on the path to becoming a market titan.

The single most important signal is a predictable and scalable revenue engine. It needs to be a well-oiled machine. You should be able to walk into a room and say with total confidence, "If we invest X dollars in marketing and sales, we will generate Y dollars in new annual recurring revenue (ARR)." This isn't about guesswork; it’s about data-backed certainty.

A SaaS company that's truly ready for Series D, for instance, can show that for every dollar spent to land a new customer, it generates five or six dollars back over that customer's lifetime. That’s the kind of math that demonstrates not just growth, but profitable, sustainable growth that a huge capital injection can amplify.

The Metrics That Matter Most

Top-line revenue is a great start, but late-stage investors will put your unit economics under a microscope. They need to see a fundamentally healthy and efficient business model that’s ready for the immense pressure of scale. Vague promises won’t fly—you need to bring the numbers.

Here are the key metrics that scream "Series D ready":

- Strong LTV to CAC Ratio: A solid Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio is usually 3:1 or higher. A company like HubSpot, in its later private years, consistently demonstrated a ratio above this benchmark, proving its marketing engine was a profitable investment.

- Significant Market Share: You have to show you've carved out a meaningful piece of your target market. Investors are looking to back a category leader, not just another face in the crowd. This could mean being a top 3 player in your industry.

- Low Customer Churn: For any subscription business, a low and stable churn rate is non-negotiable. For a mature SaaS company, an annual revenue churn rate below 10% (or even net negative churn) is a powerful signal. It proves your product has staying power and that you have a loyal customer base generating predictable revenue.

Beyond the Balance Sheet

While strong financials are the ticket to the game, they don’t tell the whole story. A company going after Series D funding must also show qualitative strengths that prove it can manage the complexities of becoming a massive enterprise. After all, investors are betting on your ability to execute a plan worth hundreds of millions of dollars.

Your operational infrastructure must be robust enough to support rapid global expansion without cracking. This includes everything from your finance and legal departments to your customer support and engineering teams—all must be prepared to operate at a much larger scale.

A seasoned executive team is another make-or-break element. Your C-suite needs people who have been there before—managing large teams, complex budgets, and high-stakes strategic moves. For example, bringing on a CFO who has previously taken a company public is a common and powerful signal to investors. Investors need to believe your leadership can actually navigate the choppy waters of market domination.

Finally, you need a clear, defensible moat. What’s stopping competitors from eating your lunch? It might be proprietary technology, a powerful brand, deep network effects, or sticky customer integrations. This moat is your ultimate defense and a huge part of why an investor will feel confident writing a nine-figure check for your Series D financing round.

Navigating Late-Stage Valuations and Investor Mindsets

When a company gets to its Series D round, the whole conversation about its value changes. It's a completely different ballgame. Early-stage funding is fueled by vision, potential, and a killer story. By the time you hit the late stages, though, valuations are built on a foundation of cold, hard data and a proven track record.

The dreamy optimism of a seed round gets replaced by the kind of intense scrutiny you’d expect from a pre-IPO audit.

This shift happens because the investors sitting across the table are a different breed. The days of charming a small VC firm with a slick pitch deck are long gone. Now, you’re in the big leagues, talking to institutional heavyweights—private equity firms, corporate VCs, hedge funds, and sovereign wealth funds. These investors think like the public markets. Their focus is way less on "what if" and almost entirely on "what is."

How Late-Stage Valuations Are Calculated

At this stage, investors aren't guessing. They use sophisticated, data-driven methods to figure out exactly what your company is worth. The back-of-the-napkin math is out, replaced by complex financial models that project future performance with a high degree of confidence.

Two of the most common methods you'll encounter are:

- Discounted Cash Flow (DCF): This analysis forecasts all the cash your company will generate in the future and then "discounts" it back to what it’s worth today. It's a direct look at your ability to generate real money, which makes it a favorite for investors who are laser-focused on profitability.

- Comparable Company Analysis (CCA): This approach is all about benchmarking. Investors look at the valuation metrics of similar public companies or private ones that were recently acquired. They'll dig into multiples like Enterprise Value to Revenue (EV/R) or Enterprise Value to EBITDA to see how you stack up. For a SaaS company, an investor might compare its ARR multiple to that of publicly traded leaders like Salesforce or ServiceNow.

As you gear up for a Series D, getting a handle on how these investors see and calculate your company's worth is absolutely critical. It's worth digging deeper into the process of unlocking your startup's true value to make sure you’re truly ready for these high-stakes conversations.

The New Players and Their Demands

The investor profile for a Series D financing round is unique. These aren't just funders; they are strategic partners who expect a clear, predictable, and massive return on their investment. They’re looking for a level of operational maturity that’s light-years beyond what was needed in your earlier rounds.

Late-stage deal counts have fallen from their 2021 peak, making the environment more competitive. According to PitchBook data, global late-stage deal value was approximately $24.9 billion in Q1 2024. While lower than the boom years, this still represents significant capital for top-tier companies.

Late-stage investors are not just buying into your growth story; they are buying into your exit strategy. They need to see a clear, tangible path to a liquidity event—whether it's an IPO or a strategic acquisition—within a specific timeframe, typically 2-5 years.

To get them on board, you have to have your house in perfect order. This means proving you have:

- A Clear Path to Profitability: The "growth at all costs" mantra is dead. Investors need to see a realistic plan for sustainable profit, backed by solid margins and efficient operations.

- Airtight Corporate Governance: Your financial reporting, legal structures, and board oversight have to be impeccable. Any hint of disorganization is a huge red flag that will send them running.

- A Well-Defined Exit Strategy: You can't be vague. You need to lay out a credible, detailed plan for how investors will get their money back, and then some. "Going public someday" just won't cut it.

How Winning Companies Use Series D Funding

A nine-figure investment from a Series D round isn't just about padding the bank account. It’s a war chest, plain and simple, meant for making the kind of decisive moves that define an entire market.

By this stage, a company has a proven model that works. The funding is less about starting a fire and more about pouring gasoline on one that’s already burning bright. The goal is to transform a market leader into an industry juggernaut.

Strategic objectives are almost always ambitious, zeroing in on massive scale or prepping the company for a major exit. Forget the early days of just trying to find customers; Series D is all about owning the ecosystem.

Scaling and Dominating New Markets

One of the most common plays for a Series D company is aggressive global expansion. A business that has already conquered its home turf now sets its sights on international dominance.

This isn’t as simple as translating a website. We’re talking about establishing physical offices, hiring local teams, navigating complex regulations, and launching huge marketing campaigns in completely new territories.

Another primary goal is making a game-changing acquisition. Instead of building a new feature or entering a new vertical from scratch, a Series D company might just buy a smaller competitor or a business with complementary tech. This kind of M&A activity can instantly:

- Eliminate a competitor: A straightforward way to consolidate market share and ease competitive pressure.

- Acquire new technology: Quickly bolt on valuable intellectual property or product features that would have taken years to build.

- Gain a talented team: Bring on an experienced group of engineers or executives through an "acqui-hire."

Fueling Innovation and Preparing for an Exit

Sometimes, the capital is aimed inward, fueling massive investments in research and development (R&D). This isn't about minor product tweaks. It’s about funding entirely new product lines that could open up billion-dollar revenue streams or building a technological moat so deep that no competitor can cross it.

For example, Wiz, a cloud security company, raised a $300 million Series D at a $10 billion valuation. This capital was earmarked to accelerate R&D in AI-powered security and expand their global footprint, demonstrating a dual focus on innovation and market expansion.

A critical, though less glamorous, use of Series D financing is preparing the company for an Initial Public Offering (IPO). This involves strengthening the balance sheet, overhauling financial reporting systems to meet public company standards, and hiring executives with public market experience.

Finally, a chunk of the funding is often used to provide liquidity to early employees and investors. By allowing them to cash out some of their shares, the company can retain top talent and tidy up its capitalization table ahead of an IPO. It’s a way of making sure everyone is aligned for that final push.

For a closer look at companies currently making these moves, you can explore detailed profiles of recently funded startups in Series D.

Crafting Your Pitch for Series D Investors

Pitching for a Series D round is a totally different ballgame than any funding story you’ve told before. Your narrative has to shift from one of promise to one of undeniable proof. Early-stage rounds are often won with vision and a big dream; this late stage is won with cold, hard data, market dominance, and a clear, almost inevitable, path to an exit.

The conversation is no longer about "what we could become." It's about "what we already are and where we're going next." Your pitch needs to land with sophisticated investors like private equity firms and hedge funds who think in terms of risk-adjusted returns and predictable outcomes.

Frame the Narrative Around Market Leadership

Your story has to be built on a foundation of market leadership. You’re not the disruptive underdog anymore; you're the established leader, and this funding round is all about cementing that position.

Instead of just talking about rapid user growth, you need to showcase your market share, your defensible moat, and how your unit economics blow the competition out of the water. The pitch has to scream that your company is the undisputed category winner and this capital injection will make your lead insurmountable. It's about showing investors you are the safest and most lucrative bet in the space.

Take GenAI platform Harvey as an example. When they raised their funding, they didn't just talk about potential—they highlighted their explosive 4x ARR growth and a client roster that included most of the top law firms in the US. That wasn't just growth; it was proof of market capture among the most valuable customers imaginable.

Showcase Operational Excellence and a Proven Team

Late-stage investors are betting as much on your team's ability to execute as they are on your business model. Your pitch has to radiate operational maturity.

The core message is simple: you have built a well-oiled machine capable of managing immense scale.

You need to highlight the strength of your executive team, the robustness of your financial controls, and the sheer efficiency of your go-to-market engine.

Your financial data should be pristine, transparent, and forward-looking. Come prepared with detailed cohorts, churn analysis, and a clear path to sustained profitability. This shows you have the discipline and infrastructure to responsibly manage a nine-figure investment and deliver the returns they expect.

Articulate a Believable Path to Exit

Finally, your Series D financing pitch must lay out a clear and compelling exit strategy. These investors aren't signing up for a ten-year journey; they need to see a tangible timeline for a liquidity event, whether that’s an IPO or a strategic acquisition.

Your growth strategy has to directly support this exit story. Detail exactly how the funds will be used for specific initiatives—like international expansion, M&A, or final IPO preparations—and connect each one to a concrete increase in enterprise value. Be ready for tough questions about market timing, potential acquirers, and public market comparables. Your job is to make the exit feel not just possible, but inevitable.

Common Questions About Series D Financing

Diving into the world of late-stage funding can feel a little intimidating. Whether you're a founder steering the ship, an investor placing a bet, or a professional considering your next career move, getting your head around the details of a Series D financing round is essential. Let’s tackle some of the most pressing questions that come up.

Is a Series D Round a Sign of Trouble?

Not anymore. It’s a fair question, because a decade ago, a Series D round might have signaled that a company was struggling to go public or get acquired and needed a "bridge round" just to stay afloat. But the game has changed completely.

Today, raising a Series D is more often a power move. Many of the most successful companies raise these later rounds to aggressively seize more market share, acquire smaller competitors, or simply stay private longer to keep growing without the pressures of the public market. Think of it less as a sign of distress and more as a strategic play to solidify dominance. The real story is always in the details—what are the terms of the deal, and what does the company plan to do with the new cash?

How Does Dilution Work in a Series D Round?

The mechanics of dilution are the same as in earlier rounds, but the numbers are a lot bigger, which raises the stakes for everyone involved. When a company issues new shares for Series D investors, the ownership percentage of all existing shareholders—founders, employees, and early investors—goes down.

But here’s the upside: the company's valuation is usually so much higher by this stage that the cash value of their smaller stake often jumps significantly. For instance, if you own 1% of a company valued at $500 million (worth $5 million) and it raises a Series D at a $1.5 billion valuation, your stake might dilute to 0.75%, but it would now be worth $11.25 million. It's crucial to remember that late-stage investors often negotiate for protective clauses like liquidation preferences or anti-dilution provisions. These terms can have a major impact on how much money earlier stakeholders actually get when the company exits. If you're thinking about a career change, it's worth learning more about the pros and cons of joining a Series D startup.

The core trade-off is owning a smaller piece of a much more valuable pie. While your percentage of ownership shrinks, the absolute value of your equity should, in a successful round, become much larger.

What Happens if a Company Cannot Raise a Series D?

When a late-stage startup fails to close a Series D round it was counting on, things can get serious, fast. That expected infusion of cash was likely already earmarked for major growth initiatives, so without it, the company has to make some tough pivots to survive.

Here are the most common outcomes:

- Drastic Cost-Cutting: This is usually the first step. It often means painful layoffs, pulling back on expansion plans, and putting R&D projects on hold just to keep the lights on longer.

- Seeking an Acquisition: The company might start looking for a buyer, but it will be negotiating from a position of weakness. This almost always leads to a lower sale price than they would have gotten otherwise.

- Exploring Alternative Financing: Options like venture debt might be put on the table, but these loans come with their own pressures and aren't a guaranteed solution.

Ultimately, a failed Series D forces a company into a difficult, and often public, re-evaluation of its entire business model and its future.

Are you an agency looking to connect with startups at their growth inflection point? FundedIQ provides hand-curated lists of recently funded companies, complete with verified decision-maker contacts and critical business intelligence. Stop wasting time on cold outreach and start engaging high-intent prospects right when they have the capital to invest. Get your first lead list today at https://fundediq.co.