7 Essential Resources for Tracking Startups in Silicon Valley in 2025

Silicon Valley remains the epicenter of global innovation, a fast-paced ecosystem where groundbreaking startups emerge and scale at an incredible rate. For agencies, investors, and job seekers, identifying the right opportunity at the right time is critical. But with thousands of companies at various stages—from pre-seed ventures in a garage to unicorns preparing for IPO—how do you cut through the noise and pinpoint the ventures that truly align with your goals? The challenge isn't a lack of information, but a surplus of it, often scattered across outdated or irrelevant sources.

This guide provides a curated roundup of the seven most powerful platforms for tracking, analyzing, and engaging with high-potential startups in Silicon Valley. We'll move beyond simple lists, offering practical insights and data-driven strategies to help you connect with your ideal prospects. Instead of sifting through endless data, you will learn how to leverage these resources to pinpoint companies with fresh funding—like the over $39 billion in venture capital invested in Bay Area startups in 2023—active hiring signals, and a clear need for your services or expertise. Each entry includes direct links and screenshots to streamline your research.

Our goal is to equip you with a definitive toolkit for navigating this competitive environment. The platforms covered here are essential for anyone looking to build a targeted outreach list, source new deals, or find their next career move. For those seeking an even broader perspective on tools that can enhance your search, especially from an investment standpoint, consider exploring these 12 additional deal sourcing platforms for VC workflow efficiency. Let's explore the tools that will give you a competitive edge in 2025.

1. Crunchbase

Crunchbase stands as a foundational tool for anyone serious about navigating the complex ecosystem of startups in silicon valley. It is one of the most comprehensive private-company databases available, tracking over 1 million companies and their funding rounds. For agencies, investors, or job seekers, it’s less of a simple directory and more of a dynamic market intelligence platform.

What makes Crunchbase indispensable is its powerful, filter-based search functionality. Users can slice and dice the startup landscape with precision, zeroing in on companies based on their location (e.g., Mountain View), industry (e.g., SaaS, FinTech), funding stage (e.g., Series A, Seed), or even by specific investors like Andreessen Horowitz. For example, a user could instantly find all AI startups in Palo Alto that raised a Seed round in the last 6 months. The platform also aggregates news signals and growth metrics directly on company profiles, providing real-time context that is critical for timely outreach.

Key Features & User Experience

The user interface is straightforward, prioritizing data accessibility. The free version offers robust search capabilities, but the platform's true power is unlocked with a Crunchbase Pro subscription. Pro users gain access to AI-powered search, lead recommendations, customizable alerts for funding events or leadership changes, and the ability to export data as CSV files for deeper analysis in external tools.

- Lead Generation: Build targeted prospect lists of Silicon Valley startups that just raised a Series B and are likely hiring.

- Competitor Analysis: Track the funding and growth trajectories of key competitors in your niche.

- Due Diligence: Vet potential partners or investments by reviewing their complete funding history and investor syndicate.

- Talent Sourcing: Identify fast-growing companies with recent funding, a strong indicator of upcoming hiring sprees.

Pricing and Access

Crunchbase operates on a freemium model. Basic company lookups and limited searches are free. For advanced features like CSV exports, alerts, and detailed analytics, a paid subscription is necessary.

| Plan Tier | Key Features | Best For |

|---|---|---|

| Basic (Free) | Company profile search, limited results | Quick, individual company lookups |

| Starter | More search results, basic filters | Individuals needing more than basic search |

| Pro | AI search, CSV exports, alerts, integrations | Sales teams, recruiters, investors |

| Enterprise | API access, dedicated support | Large organizations with custom data needs |

Actionable Tip: Set up alerts for "Series A" and "Series B" funding rounds for companies located in "Silicon Valley". Startups raising a typical Series A (median of ~$10M) have just received significant capital and are often looking for agency partners to scale their marketing, sales, and product development efforts.

While the data for very early-stage or stealth startups can sometimes be less detailed, Crunchbase's breadth of coverage across the venture-backed world is unmatched. It serves as an essential first stop for building a qualified pipeline and understanding the ever-shifting landscape of Silicon Valley innovation.

Website: https://www.crunchbase.com

2. PitchBook

PitchBook elevates the search for startups in silicon valley from simple data collection to institutional-grade market intelligence. While other platforms offer broad overviews, PitchBook delivers deep, granular data on private capital markets, including venture capital, private equity, and M&A. It is the go-to resource for conducting rigorous due diligence, financial benchmarking, and in-depth research on both emerging companies and the investors who back them.

What sets PitchBook apart is the depth and reliability of its datasets, particularly regarding deal terms, valuations, and capitalization tables, which are often difficult to source. The platform combines technology with an in-house research team to verify data, claiming over 90% accuracy. This makes it an indispensable tool for venture capitalists, investment bankers, and corporate development teams who need to model financial scenarios, analyze comparables (e.g., revenue multiples for SaaS companies), and understand the intricate capital structure of a startup.

Key Features & User Experience

The PitchBook platform is a robust and data-dense environment, which can present a learning curve for new users but offers unparalleled analytical power. Its direct integration with Microsoft Office via an Excel add-in is a standout feature, allowing users to pull data directly into their financial models and workflows. The platform also provides comprehensive analyst coverage and emerging technology market reports, adding a layer of qualitative insight to its quantitative data.

- Deep Due Diligence: Access detailed funding histories, pre- and post-money valuations, and full investor syndicates.

- Financial Benchmarking: Analyze comparable company valuations and deal multiples to inform investment or acquisition strategies.

- Investor & LP Research: Identify active LPs and VCs in Silicon Valley, track their portfolio performance, and map co-investor networks.

- Workflow Integration: Utilize the Excel and CRM plugins to seamlessly integrate private market data into existing team workflows.

Pricing and Access

PitchBook targets institutional and enterprise clients, and its pricing reflects that focus. Access is not offered via a freemium or tiered self-service model; instead, potential customers must request a demo and receive a custom quote. This premium structure ensures high-quality data and dedicated support.

| Plan Tier | Key Features | Best For |

|---|---|---|

| Platform Access | Core database, search & filtering, company profiles | Individual researchers, small M&A teams |

| Integrations | Excel plugin, CRM integrations, API access | VCs, private equity firms, investment banks |

| Custom Research | Access to dedicated research analysts | Large enterprises needing bespoke market analysis |

Actionable Tip: Use the "Comparables" feature to build a list of Silicon Valley startups in a specific niche (e.g., AI-powered B2B SaaS). Analyze their latest valuation multiples and employee growth rates post-funding. This data is invaluable for crafting a pitch that is benchmarked against the market, showing you understand their financial standing and growth trajectory. For instance, you could note that similar companies see a 50% headcount increase within 12 months of a Series A.

While its price point places it out of reach for many casual users, for professionals making high-stakes decisions based on private market data, PitchBook’s depth and accuracy are non-negotiable. It provides the financial x-ray needed to truly understand the competitive and investment landscape of Silicon Valley.

Website: https://pitchbook.com

3. AngelList (Venture) / Wellfound (Hiring)

AngelList and its talent-focused spinoff, Wellfound, offer a dual-sided view into the world of startups in silicon valley. While AngelList Venture provides a direct line of sight into deal flow and investment opportunities, Wellfound serves as the primary hiring marketplace where these same startups source talent. Together, they create a powerful ecosystem for tracking the real-time pulse of growth, hiring intent, and funding momentum.

What makes this duo unique is the direct connection between funding and hiring signals. A startup raising capital through an AngelList syndicate will almost immediately post key roles on Wellfound to deploy that capital. For agencies, recruiters, and job seekers, this provides an unparalleled, near-instantaneous signal of a company's needs and expansion plans. For example, seeing a startup simultaneously close a seed round on AngelList and post five new engineering roles on Wellfound is a clear indicator they are entering a product development sprint.

Key Features & User Experience

The platforms are distinct but interconnected. AngelList Venture focuses on deal mechanics like syndicates and rolling funds for accredited investors, offering transparency into who is leading rounds. Wellfound is a clean, talent-centric job board where users can filter by role, location, salary, and company stage. The synergy between them is their greatest strength.

- Deal Flow Analysis: Use AngelList Venture to identify influential syndicate leads and see which startups are actively raising capital.

- Hiring Signal Intelligence: Monitor Wellfound for job postings from recently funded startups, which often indicate specific departmental needs (e.g., a rush of sales roles signals a GTM push).

- Talent Sourcing: Recruiters can build targeted candidate pipelines and identify companies actively competing for top tech talent.

- Job Seeking: Wellfound is a premier destination for finding jobs at high-growth startups, often with transparent salary ranges. You can learn more about how to find startup jobs using platforms like this.

Pricing and Access

Both platforms operate on a model tailored to their specific users. Wellfound is largely free for job seekers and companies posting jobs, with paid options for increased visibility. AngelList Venture is free to browse, but participating in investments requires being an accredited investor and involves fees (like carry) specific to each deal.

| Platform | Key Features | Best For |

|---|---|---|

| Wellfound (Free) | Job postings, company profiles, candidate search | Job seekers, startups with limited recruiting budgets |

| Wellfound Recruit Pro | Advanced candidate filters, sourcing tools | Recruiters, hiring managers at scaling startups |

| AngelList Venture | Deal flow, syndicates, fund investing | Accredited investors, VCs, M&A teams |

| AngelList Enterprise | Data access, platform tools for funds | Venture funds, large investment firms |

Actionable Tip: On Wellfound, filter for "Software Engineer" roles at companies in "San Francisco" with "11-50 employees" that have "recently raised" a funding round. These are prime targets for technical recruiting agencies or developer tool providers, as they have fresh capital and a clear mandate to expand their engineering teams. This search might yield 50+ high-quality leads in a matter of minutes.

While investing is restricted, the public information on both platforms is a goldmine. They provide an essential, ground-level view of which startups have the capital and the intent to grow, making them indispensable for anyone looking to engage with the Silicon Valley ecosystem.

Websites: https://angel.co and https://wellfound.com

4. Product Hunt

Product Hunt serves as the daily pulse of the tech product world, making it an essential platform for tracking emerging startups in silicon valley. It is a community-driven discovery site where new products are launched and voted on daily. For agencies, investors, and tech enthusiasts, it offers a real-time, ground-level view of what's capturing the attention of the earliest adopters and tech influencers.

What makes Product Hunt uniquely valuable is its focus on the launch moment. It's not a static database but a dynamic leaderboard where brand new tools, apps, and platforms compete for visibility. This provides a direct signal of market validation and user interest, often before a startup has secured significant funding or media coverage. For example, a startup that finishes as the "#1 Product of the Day" can gain tens of thousands of new users and significant investor attention overnight, presenting a perfect opportunity for outreach.

Key Features & User Experience

The user experience is centered around discovery and community interaction. The homepage features a daily leaderboard of top-voted products, while the comment sections on each product page are a goldmine for understanding user feedback and the founder's vision. The platform is highly intuitive, encouraging browsing and exploration.

- Market Research: Identify emerging competitors and untapped product categories by monitoring daily trending products.

- Lead Generation: Discover early-stage, product-led companies that are actively seeking their first users and are often open to marketing or development partnerships.

- Talent Sourcing: Spot passionate founding teams and engineers who are shipping innovative products, making it a great source for identifying potential hires.

- Community Engagement: Participate in discussions with founders and early users to build relationships and establish your agency as a helpful resource within the ecosystem.

Pricing and Access

Product Hunt is fundamentally a free platform. Browsing, voting, commenting, and even launching a product are available to all users at no cost. The company monetizes through advertising and premium services for companies looking to maximize their launch impact.

| Plan Tier | Key Features | Best For |

|---|---|---|

| Community (Free) | Browse, upvote, comment, and submit products | Individuals, agencies, and investors monitoring the ecosystem |

| Launch Day Kit | Premium tools for a launch, advanced scheduling | Founders and marketing teams planning a strategic launch |

| Founder Club | Access to deals on software and services | Startup founders looking to reduce operational costs |

Actionable Tip: Filter Product Hunt for categories relevant to your agency's expertise (e.g., "SaaS," "Developer Tools," "FinTech"). Engage with the founders of top-performing products in the comments section, offering genuine feedback or congratulations. This warm, non-salesy interaction can open the door for a future partnership conversation once they secure funding and need to scale.

While a successful launch can provide immense visibility, it's often fleeting. The platform is less useful for tracking long-term company growth compared to a database like Crunchbase. However, for identifying the very newest startups in silicon valley and gauging initial market reception, Product Hunt is an unparalleled resource.

Website: https://www.producthunt.com

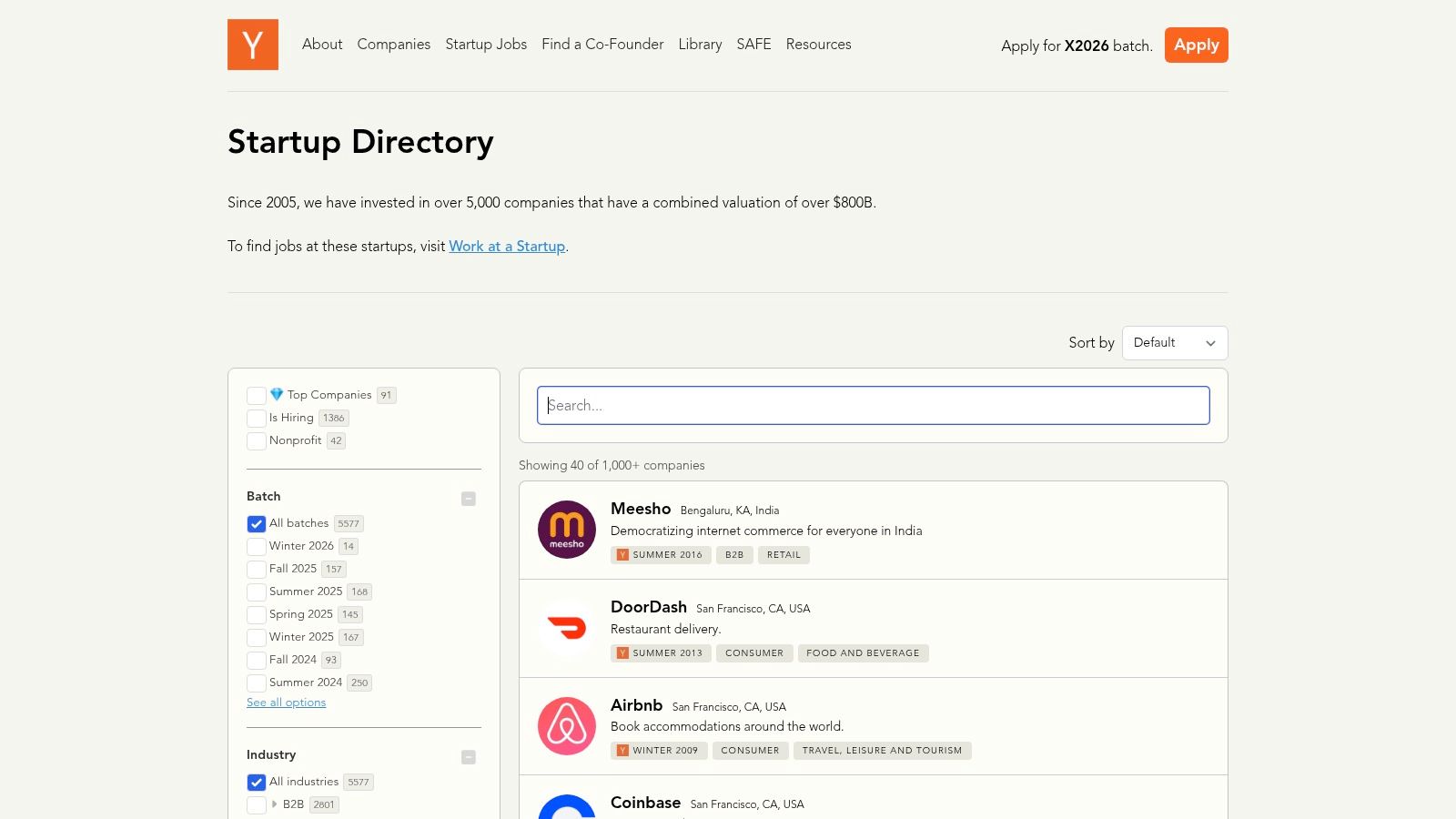

5. Y Combinator Startup Directory

The Y Combinator Startup Directory serves as a direct pipeline into one of the most prestigious ecosystems for startups in silicon valley and beyond. As the public-facing database of companies funded by the renowned accelerator—which counts unicorns like Airbnb, Stripe, and Dropbox among its alumni—it offers a pre-vetted, high-quality list of ventures poised for growth. For agencies, job seekers, and investors, this platform isn't just a list; it's a curated collection of businesses that have passed YC's rigorous selection process, signaling strong potential and a solid foundational team.

What makes the YC Directory uniquely valuable is its focus and simplicity. Unlike sprawling databases, it concentrates exclusively on YC alumni, providing a concentrated source of high-signal opportunities. Users can easily filter the entire portfolio by industry (e.g., B2B SaaS, Healthcare), batch (e.g., S23, W24), company status (Active, Acquired, Inactive), and, most critically, hiring status. This last filter is a goldmine for recruiters and service providers, instantly revealing which of the 4,000+ active companies are in a growth phase and expanding their teams.

Key Features & User Experience

The directory's user interface is clean, minimalist, and built for speed. It prioritizes direct access to essential information without the clutter of complex analytics. Each company profile provides a concise summary, a link to its website, and often a direct link to its careers page or a list of open roles. This streamlined approach makes it an excellent tool for initial discovery and quick qualification before diving deeper with other platforms.

- Targeted Prospecting: Identify recently graduated YC companies in your target vertical that are likely seeking their first agency partners.

- Talent Acquisition: Use the "Hiring" filter to build a real-time list of rapidly growing startups with immediate staffing needs.

- Market Research: Analyze trends by observing the types of companies funded in recent YC batches.

- Partnership Development: Discover potential tech partners or complementary services within the trusted YC network.

Pricing and Access

The Y Combinator Startup Directory is completely free to access and use. There are no paid tiers, subscriptions, or hidden features. This open-access model democratizes the ability to find and connect with some of the world's most promising startups.

| Plan Tier | Key Features | Best For |

|---|---|---|

| Free | Full directory access, filtering by batch, industry, and hiring status, direct company links | Anyone seeking to discover, track, or connect with YC-backed companies |

Actionable Tip: Filter for companies from the two most recent YC batches that have the "Hiring" tag active. These startups have fresh capital (YC invests a standard $500,000) and a mandate to grow quickly, making them prime candidates for marketing, sales automation, and recruitment services. Craft your outreach to acknowledge their recent YC participation.

While its scope is limited to YC-funded entities, this focus is its greatest strength. It cuts through the noise, presenting a high-quality, actionable list of vetted startups in silicon valley and other global hubs. For those looking to engage with the next wave of breakout companies, the YC Directory is an indispensable and efficient starting point.

Website: https://www.ycombinator.com/companies

6. Plug and Play Tech Center

Plug and Play Tech Center is a cornerstone of the innovation ecosystem, functioning as one of the most active accelerators and corporate innovation platforms for startups in silicon valley. Headquartered in Sunnyvale, it bridges the gap between agile startups and established corporations, providing physical space, structured programs, and invaluable matchmaking opportunities. For agencies and service providers, Plug and Play's ecosystem is a curated environment to find high-potential startups that are actively seeking pilot projects and partnership opportunities.

What distinguishes Plug and Play is its sheer volume and deep corporate integration. Unlike traditional VCs, its primary model revolves around connecting its portfolio startups with its vast network of 500+ corporate partners (like Mercedes-Benz, P&G, and PayPal) for pilot programs and strategic investments. This focus on corporate-startup collaboration means that companies within their programs are often vetted, validated, and primed for scalable solutions, making them ideal clients for agencies looking to engage with growth-stage businesses.

Key Features & User Experience

The website serves as a portal to Plug and Play's diverse offerings, from industry-specific accelerator programs to events and corporate partnership details. While some startup data is presented in reports or requires contact, the platform clearly outlines its various "verticals" or focus areas, such as FinTech, Health, and IoT. This allows agencies to quickly identify programs that align with their own industry expertise.

- Corporate Matchmaking: Identify startups that have been selected for pilot programs with major corporations, signaling validation and a need for scalable infrastructure.

- Industry Vertical Scouting: Monitor specific verticals (e.g., "Enterprise Tech") to find cohorts of B2B SaaS startups that may need targeted marketing or sales automation services.

- Event Networking: Use the platform to identify upcoming Demo Days or Summits, which are prime opportunities to connect directly with founders and innovation leaders.

- Ecosystem Access: For agencies with physical operations, the co-working spaces in Sunnyvale and other locations offer a direct entry point into the community.

Pricing and Access

Access to Plug and Play's core benefits is typically program-based. Startups apply to join specific accelerator batches, and corporations join as partners. Information about participating startups is often shared through events or gated reports, rather than a publicly searchable database.

| Access Method | Key Features | Best For |

|---|---|---|

| Website & Reports | Program info, event calendars, industry reports | Agencies researching specific tech verticals |

| Events & Summits | Direct access to startup pitches and networking | Building direct relationships with founders |

| Startup Programs | Mentorship, funding, pilot opportunities | Founders seeking acceleration and corporate access |

| Corporate Partnership | Curated startup scouting, innovation services | Corporations looking to innovate with startups |

Actionable Tip: Follow Plug and Play's vertical-specific social media channels and sign up for their newsletters. They frequently announce new accelerator batches and highlight participating startups. Reaching out to a startup right after it has been accepted into a program (e.g., "I saw you were just accepted into the P&P FinTech batch") demonstrates timely, relevant interest.

While it isn't a searchable database like Crunchbase, Plug and Play is an essential resource for identifying curated groups of high-potential startups that have already passed a significant validation milestone by being accepted into the ecosystem.

Website: https://www.plugandplaytechcenter.com

7. F6S

F6S serves as a global community and application hub for founders, making it a valuable, ground-level resource for discovering emerging startups in silicon valley. While its scope is international, the platform is a beehive of activity for early-stage companies seeking to join accelerators, secure grants, or find co-founders. For agencies and service providers, F6S offers a window into the pre-seed and seed-stage ecosystem, revealing startups at their earliest, most formative moments.

What makes F6S unique is its focus on action and opportunity. Instead of just listing company data, the platform is built around applications: founders are actively applying to programs, many of which are based in or focused on the Bay Area. This provides a strong signal of intent and ambition. For example, an agency can filter opportunities geographically to monitor which new ventures are applying to prominent Silicon Valley accelerators, indicating they are serious about growth and seeking foundational support.

Key Features & User Experience

The user interface is functional and community-oriented, designed to connect founders with opportunities quickly. The main value lies in its extensive, filterable directories of programs, grants, and startup deals. While the quality of listings can vary, the sheer volume makes it a worthwhile channel for uncovering hidden gems before they appear on more mainstream platforms like Crunchbase.

- Accelerator Sourcing: Identify startups applying to top-tier accelerators like Y Combinator or 500 Global, signaling high growth potential.

- Grant Monitoring: Find startups that have secured or are applying for grants, indicating early validation and non-dilutive funding.

- Service-for-Equity Deals: Discover very early-stage founders who may be open to creative partnerships or service-for-equity arrangements.

- Early-Stage Lead Generation: Build lists of ambitious, pre-seed startups that need foundational services like branding, MVP development, or legal setup.

Pricing and Access

F6S is predominantly a free platform for both founders and those looking to browse the ecosystem. This low barrier to entry is a core part of its appeal, fostering a large and active user base of over 4 million founders.

| Plan Tier | Key Features | Best For |

|---|---|---|

| Founder (Free) | Create startup profile, apply to programs, access deals | Founders and early-stage startups |

| Community (Free) | Browse startups, programs, and opportunities | Agencies, investors, and job seekers |

Actionable Tip: Use the platform's search filters for programs located in the "United States" and sectors like "SaaS" or "AI". Monitor the startups that are publicly listed as applicants. These are founders actively seeking resources to grow and are prime candidates for outreach with service offerings tailored to early-stage needs, such as pitch deck design or financial modeling.

While F6S requires more manual filtering to isolate Silicon Valley-specific startups compared to other platforms, it provides unparalleled access to the raw, unfiltered ambition of the founder community at the very start of their journey.

Website: https://www.f6s.com

Silicon Valley: Top 7 Startup Platforms Comparison

| Item | 🔄 Implementation complexity | ⚡ Resource requirements | 📊 Expected outcomes | 💡 Ideal use cases | ⭐ Key advantages |

|---|---|---|---|---|---|

| Crunchbase | Low — web UI; optional Pro setup | Moderate — paid Pro for exports/AI features | Broad prospect lists, growth signals; variable early-stage depth | Market mapping, lead generation, startup tracking | Wide coverage of Silicon Valley companies; fast pipeline building |

| PitchBook | High — enterprise onboarding and training | High — premium pricing, integrations for teams | Deep diligence outputs: deal terms, valuations, comparables | Institutional research, financial diligence, benchmarking | Very deep private‑market datasets and robust workflow tools |

| AngelList / Wellfound | Low–Medium — simple signups; platform rules for investing | Low for job posts; investing limited to accredited investors and vehicle fees | Access to deal flow (syndicates/SPVs) and large hiring marketplace | Syndicate investing, sourcing startup talent, job hunting | Direct access to deal flow and a large recruiting marketplace |

| Product Hunt | Low — browse or submit; launch timing matters | Low — free to use; promotion and community effort required | Short-term visibility spikes, early-user feedback and trends | Product launches, early customer discovery, competitor signals | High signal for early-stage products; strong community engagement |

| Y Combinator Startup Directory | Low — searchable directory with simple filters | Low — free to browse; limited profile depth | Vetted list of YC startups with links and hiring info | Finding venture‑backed startups, recruitment, partnership outreach | Concentrated pool of vetted, YC‑backed companies |

| Plug and Play Tech Center | Medium — program applications and partnership coordination | Medium — program commitments; workspace or partner fees possible | Corporate pilots, partner introductions, physical workspace access | Accelerator participation, corporate‑startup pilots, co‑working | Strong corporate matchmaking and Silicon Valley presence |

| F6S | Low — sign up and apply to listings | Low — free platform; some external application redirects | Access to many accelerator/grant openings; listing quality varies | Finding accelerator calls, grants, founder programs | Centralized, free access to numerous program opportunities |

From Data to Deals: Turning Insights into Revenue

Navigating the dynamic landscape of startups in Silicon Valley is no longer about who you know; it's about what you know and how quickly you can act on it. The seven platforms detailed in this guide, from Crunchbase to F6S, are more than just databases. They are strategic intelligence hubs, offering a real-time pulse on the funding, hiring, and product milestones that signal a startup's readiness to invest in growth.

The key takeaway is this: raw data is only the starting point. True competitive advantage comes from transforming that data into a strategic outreach plan. By identifying specific triggers like a recent Series A funding round, a surge in engineering hires, or a successful Product Hunt launch, you can move from generic, cold outreach to highly relevant, timely engagement. You stop being just another vendor and become a timely solution provider.

Synthesizing Your Strategy: From Platform to Pitch

The real power lies not in using a single tool, but in synthesizing insights across multiple platforms to build a comprehensive picture. For example, you might identify a promising company in the Y Combinator directory, validate their recent funding on Crunchbase, assess their hiring needs on Wellfound, and then gauge early market reception on Product Hunt. This multi-layered approach provides the context needed to craft a pitch that is not just personalized, but deeply informed.

Remember, each platform offers a unique advantage. Choosing the right one depends entirely on your agency’s specific goals and target client profile.

- For Broad Market Analysis & Financial Triggers: Crunchbase and PitchBook are indispensable. They provide the most reliable, high-level data on funding rounds, investors, and acquisitions, making them perfect for agencies targeting well-capitalized, post-seed stage startups.

- For Early-Stage & Talent-Focused Opportunities: AngelList (Venture), Wellfound, and the Y Combinator Directory offer direct lines to the earliest stage startups in Silicon Valley. These are ideal for recruitment agencies and service providers who thrive on getting in on the ground floor, often before major funding is publicly announced.

- For Product-Led & Community-Driven Signals: Product Hunt and F6S are your go-to sources for identifying companies with fresh market traction. A successful launch or participation in an accelerator program signals immediate needs for marketing, user acquisition, and branding support.

Activating Your Insights: A Practical Checklist

Before you dive in, consider these implementation factors to maximize your return on investment, whether that investment is time or subscription fees:

- Define Your Ideal Startup Profile: Be specific. Are you targeting B2B SaaS companies that just raised a $5M-$10M Series A? Or D2C brands with a team of 10-50 people? A clear profile makes your search across these platforms exponentially more efficient.

- Establish Your "Trigger" Criteria: What specific event makes a startup a perfect prospect for you? It could be a funding announcement within the last 30 days, a new C-level hire, or crossing 50 employees. Set up alerts on platforms like Crunchbase to automate this discovery process.

- Develop Templated, Yet Personalizable, Outreach: Don't reinvent the wheel for every email. Create a core pitch template for each trigger event (e.g., a "Post-Series A Growth" template, a "New CMO" template) and then personalize 20% of it with specific details you found about that particular startup. Reference their product launch or a recent quote from their CEO.

- Integrate with Your CRM: Manually tracking prospects is a recipe for missed opportunities. Use integrations or Zapier to pipe prospects from your chosen platform directly into your CRM, tagging them with the relevant data points like funding stage and trigger event.

Ultimately, the goal is to create a systematic, repeatable process for identifying and engaging high-potential startups in Silicon Valley. The tools provide the map, but your strategy dictates the journey. By focusing on timely triggers and crafting hyper-relevant messaging, you transform market intelligence into measurable revenue and build a pipeline of clients poised for explosive growth.

Tired of manually piecing together data from multiple platforms to find the right sales signals? FundedIQ streamlines this entire process by delivering a curated feed of recently funded startups in Silicon Valley, complete with verified contact data and actionable growth triggers. Stop hunting for insights and start closing deals by visiting FundedIQ to see how our targeted intelligence can build your pipeline faster.