Build Cold Call Lists That Actually Convert

A cold call list is essentially your sales team's map to potential customers—a curated database of people they'll contact without any prior introduction. This list is the foundation of any outbound sales strategy. Its quality is the single biggest factor determining whether your team spends its day having genuine conversations or just listening to the dial tone. Research from Gartner shows that sales reps spend only 28% of their time actually selling; improving list quality is a direct path to increasing that productive selling time.

Why Your Cold Call Lists Are Failing

Let's cut to the chase: most cold call lists are garbage. If your sales reps are burning through calls but not booking meetings, the problem probably isn't their pitch. It's the list. Too many teams fall into the same old traps, dooming their campaigns before the first dial is even made.

The biggest culprit? Stale data. Contact information goes bad incredibly fast. According to a study by HubSpot, B2B data decays at a rate of over 22.5% per year. People switch jobs, get new phone numbers, or move to different companies all the time. A list that was a goldmine six months ago is likely a graveyard today, leaving your reps frustrated and morale in the gutter.

The High Cost of Bad Data

Another massive pitfall is using a poorly defined ideal customer profile (ICP). A generic list of "VPs of Marketing" is practically useless. What you really need is a laser-focused list, something like "VPs of Marketing at B2B SaaS companies with 50-200 employees that recently hired a Head of Content." Without that level of detail, your outreach feels random and irrelevant, which means it gets ignored. The cost is real: bad data costs U.S. businesses an estimated $3.1 trillion annually, with a significant portion of that coming from wasted sales and marketing efforts.

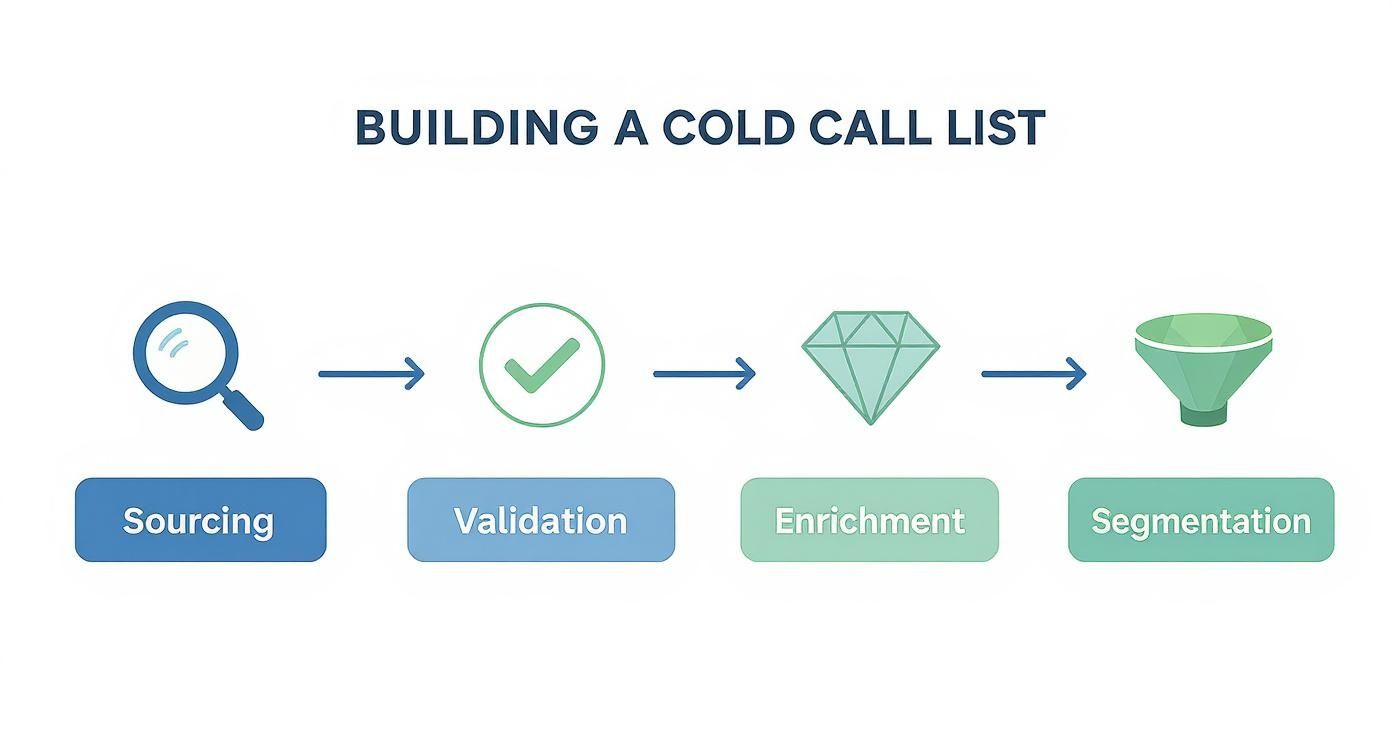

This infographic lays out the modern playbook for building a list that actually performs and sidesteps these common mistakes.

Think of this process—from sourcing all the way to segmentation—as a continuous loop, not a one-and-done task. That's how you keep your data fresh and your outreach sharp.

A Modern Framework for Success

To break out of this cycle of failure, you need a smarter approach. It all comes down to four core pillars:

- Smart Sourcing: Getting raw data from reliable places that actually match your ideal customer.

- Relentless Validation: Constantly checking to make sure emails, phone numbers, and job titles are still correct.

- Deep Enrichment: Adding layers of context—like company funding rounds, their tech stack, or recent hiring trends—to give you an 'in' for personalization.

- Strategic Segmentation: Grouping prospects into small, targeted buckets based on shared traits or buying signals for campaigns that really hit home.

I once worked with a B2B tech company that tripled its meeting rate almost overnight. They didn't call more people; they just stopped using generic lists. Instead, they built a highly targeted list of companies that had just closed a Series A funding round—a perfect signal that they were ready to spend on new tech. This strategy worked because it was timely; a company with fresh capital is 3-4 times more likely to invest in new solutions.

This table gives you a clear snapshot of what separates the lists that drain your resources from the ones that actually drive revenue.

Low-Performing vs High-Performing Cold Call Lists

| Attribute | Low-Performing List (Wastes Time) | High-Performing List (Drives Revenue) |

|---|---|---|

| Data Source | Purchased, outdated, or scraped from public directories. | Sourced from multiple, verified data providers and real-time signals. |

| Accuracy | High bounce rates, wrong numbers, outdated job titles. | Continuously validated for over 95% accuracy on emails and direct dials. |

| Relevance | Broad and generic (e.g., "all marketing managers"). | Hyper-targeted based on a detailed Ideal Customer Profile (ICP). |

| Context | Basic contact info only (name, email, company). | Enriched with buying signals (funding, tech stack, hiring trends). |

| Segmentation | One-size-fits-all, everyone gets the same message. | Micro-segmented for personalized, relevant outreach campaigns. |

| Outcome | Low connection rates, frustrated reps, and wasted budget. | High meeting-booked rates, motivated reps, and a strong sales pipeline. |

Adopting the high-performance model is what turns cold calling from a numbers game into a strategic advantage.

This shift in strategy is absolutely essential. While cold calling is still a go-to tactic, the average success rate is pretty low—only about 2% to 3% of cold calls lead to a meeting. However, top-performing teams who use targeted, data-rich lists can see their success rates jump to 6–10% or even higher. For a more detailed look, check out our comprehensive breakdown of essential cold calling statistics. This modern, data-first methodology is the secret sauce that separates high-growth sales teams from the ones still dialing for dollars with last year's list.

Sourcing and Validating Your Contact Data

A high-performance cold call list isn't something you just buy; it's something you build. It's tempting to think you can just grab a list of a few thousand contacts and get dialing, but I've seen firsthand how that approach fails. The quality of your source data will make or break your entire campaign. Effective sourcing isn't about getting the biggest list—it’s about finding the right contacts and then being absolutely relentless about making sure their information is accurate.

The whole process starts with figuring out where you're going to get your data. Generally, you have three options: buy a pre-made list, use a professional data provider, or manually dig up contacts from public sources. Each path has its own distinct pros and cons.

Buying a list is the quickest way to get started, but it's also the riskiest. These lists are cheap and easy to find, but they're infamous for being packed with stale, inaccurate, or just plain irrelevant contacts. Using them is a fast track to high bounce rates, terrible connection rates, and a damaged brand reputation if you start getting flagged as a spammer. In fact, some purchased lists can have an inaccuracy rate as high as 40-60%.

Choosing Your Data Acquisition Method

A much more reliable strategy is to work with established data providers. Platforms like ZoomInfo, Cognism, or Apollo have invested a ton of resources into gathering and verifying contact information. They give you powerful filters to really home in on your ideal customer profile (ICP), serving up direct dials and verified emails that are worlds better than what you’d get from a static list you bought online. If you're looking to get even more sophisticated, it's worth exploring how modern tech is changing the game; check out these AI-Powered Lead Generation Strategies.

This screenshot from ZoomInfo gives you a peek at the level of detail you can get into when building a list.

You can see how it lets you narrow your search by industry, employee count, and even the specific technologies a company uses. That's how you ensure a high degree of relevance right from the get-go.

For those who want maximum control, manual sourcing using a tool like LinkedIn Sales Navigator is the way to go. You can personally vet every single prospect against your ICP, which is perfect for highly targeted or account-based sales. The obvious catch? It takes an enormous amount of time and simply doesn't scale. In my experience, a hybrid approach often works best: use a data provider to build the initial list, then use manual research to enrich and double-check your most high-value prospects.

Comparing Data Sourcing Methods

Choosing how to source your data involves a classic trade-off between cost, quality, and the time you're willing to invest. This table breaks down the most common methods to help you decide which one makes the most sense for your team's goals and budget.

| Sourcing Method | Typical Cost | Data Quality | Scalability | Best For |

|---|---|---|---|---|

| Buying Pre-made Lists | Low | Very Low | High | Not recommended for serious outreach. |

| Manual Sourcing (LinkedIn) | Medium (Time & Tools) | Very High | Very Low | Highly targeted, low-volume campaigns (e.g., ABM). |

| Data Providers (ZoomInfo, etc.) | High (Subscription) | High | High | Teams that need quality data at scale for consistent outreach. |

| Hybrid Approach | Varies | High-Very High | Medium | Balancing quality and scale for strategic sales motions. |

Ultimately, the best method depends entirely on your strategy. For broad-market plays, a great data provider is a must. For a spear-fishing campaign targeting a handful of dream clients, manual sourcing is king.

The Critical Importance of Data Validation

Getting your hands on the data is only half the battle. The moment you acquire that list, it starts to go stale. This is especially true for B2B data, which decays at a shocking rate of about 2.1% per month. That adds up to 22.5% annually. Think about that: a list that was perfect on January 1st is nearly a quarter useless by the time the holidays roll around.

This is why data validation can't be an afterthought. It has to be a core part of your sales process. It’s all about cleaning, verifying, and updating your data to make sure your reps are calling the right people with the right information.

A simple data hygiene routine can make a world of difference. Here's what that looks like in practice:

- Email Verification: Before a single email goes out, run it through a verification tool. These services check if an address is active without sending anything, which is crucial for keeping your bounce rate down. A bounce rate above 2% can negatively impact your sender reputation.

- Job Title and Company Check: A quick peek at a prospect’s LinkedIn profile confirms they still work where you think they work. This five-second check saves you from calling someone who left their job three months ago.

- Phone Number Verification: Always prioritize direct-dial mobile numbers. Landlines are often guarded by gatekeepers, but a cell number gets you straight to the decision-maker. The average connection rate for a direct dial is around 15%, while a switchboard number is closer to 2-3%.

A huge mistake I see teams make is validating a list once and calling it "done." Data hygiene has to be a continuous effort. A solid rule of thumb is to re-verify any contact you haven't touched in 90 days before adding them back into a campaign.

Leveraging Technology for Maximum Accuracy

Manually checking every contact simply isn't feasible when you're working at scale. Thankfully, technology can handle most of the heavy lifting. There are now AI-powered tools that can cross-reference data from multiple sources in real-time to confirm details with incredible accuracy. While standard phone verification might get you to around 87% accuracy, these advanced tools can push that number all the way to 98%.

Email validation is non-negotiable here. It doesn't just ensure your messages get delivered; it protects your domain's sending reputation. If you keep sending emails to dead addresses, you'll get flagged as a spammer, which hurts the deliverability of all your future outreach. For a complete breakdown, check out our guide on how to https://fundediq.co/how-to-validate-email-addresses/ and keep your domain safe.

By combining smart sourcing with a disciplined approach to validation, you turn a simple contact list into a powerful strategic asset. This foundational work ensures your team is spending their valuable time talking to the right people, at the right companies, every single time.

Enriching and Segmenting for Personalized Outreach

If a validated list is your foundation, enrichment is the skyscraper you build on top of it. This is where you layer basic contact info with the kind of context that turns a truly cold call into a relevant, well-timed conversation. Without it, you’re just guessing what a prospect actually cares about.

A basic list gives you a name, title, and company. An enriched list tells you a story: their company just landed $15 million in Series A funding, they’re hiring a new sales team, and they’re stuck using a competitor’s notoriously clunky software. All of a sudden, you have a real reason to pick up the phone.

To really dig into transforming raw contacts into actionable intel, it’s worth understanding the strategies behind B2B Data Enrichment. Mastering these techniques is what separates an outreach strategy that resonates from one that just makes noise.

Beyond the Basics: What Data Points Really Matter?

Not all data is created equal. Sure, knowing a company’s annual revenue is handy, but other, more dynamic data points are far better indicators of buying intent. These are the details that let you ditch the generic pitch for a tailored solution.

You’ll want to focus your intelligence gathering on a few key areas:

- Firmographics: Go deeper than just industry and employee count. Look for parent-subsidiary relationships and specific office locations. You might find untapped opportunities hiding within an account you're already targeting. For example, knowing a prospect is headquartered in London but has a growing sales office in New York helps you tailor your approach.

- Technographics: What software and tools are they using right now? Knowing their tech stack lets you speak directly to integration possibilities or highlight a competitor’s known weaknesses. For instance, if you sell marketing automation software and see they use Salesforce, you can lead with your native integration.

- Buying Signals & Trigger Events: This is the goldmine. Keep an eye on things like new executive hires, recent funding rounds, major company news, or even a sudden spike in their ad spend. These events almost always create an urgent need for new solutions.

A huge mistake I see people make is treating enrichment as a one-time data dump. Real strategic enrichment is an ongoing process. A company’s needs can change overnight after a funding announcement or the arrival of a new C-level executive.

By constantly monitoring these trigger events, your team can time their outreach perfectly, catching prospects at the exact moment they’re most open to hearing new ideas. If you want to go deeper on this, our guide on what is data enrichment breaks down how to turn this data into a true strategic advantage.

From Broad Lists to Hyper-Targeted Micro-Segments

Once your data is enriched, the real magic happens: segmentation. The days of blasting the same generic message to a thousand "sales leaders" are long gone. That approach gets abysmal results because it completely ignores the nuances that actually drive decisions. The goal now is to create small, incredibly specific micro-segments.

Instead of one giant list, your cold call lists should be broken down into dozens of smaller ones. Each one should be centered around a shared, specific trait. This is what allows you to craft messaging that speaks directly to a prospect’s immediate situation and pain points.

Think of it this way: a generic list is a shotgun blast—it makes a lot of noise but rarely hits anything important. A micro-segmented list is a sniper rifle. It hits its target with precision, every time.

A Practical Playbook for Smart Segmentation

Creating these segments doesn't have to be overly complicated. The trick is to start combining different data points to identify groups with a clear, unified need.

Here are a few examples of powerful micro-segments you can build from enriched data:

-

The "Recent Funding" Segment:

- Criteria: Companies that closed a funding round (Series A or B) in the last 90 days.

- Why It Works: Fresh capital means they have a budget and are actively looking for tools to fuel growth. Your outreach can start by congratulating them, then position your product as the key to scaling effectively.

-

The "Key Hire" Segment:

- Criteria: VPs of Sales at companies that just hired a Head of RevOps in the last 60 days.

- Why It Works: A new RevOps leader is almost always tasked with evaluating and overhauling the tech stack. This is the perfect time to get on their radar while they're actively looking for improvements.

-

The "Competitive Dissatisfaction" Segment:

- Criteria: Companies using a specific competitor's product known for a particular weakness (e.g., poor support, a missing feature). You can often find this information in G2 reviews or forum discussions.

- Why It Works: Your messaging can be incredibly direct. You can highlight how your solution solves the exact frustration they're likely dealing with every single day.

This level of segmentation completely changes the game. A call to someone on the "Key Hire" list isn’t really "cold" anymore. It’s a timely, relevant conversation about a problem they are trying to solve right now. This is how a simple cold call list becomes a predictable revenue engine.

Crafting Your Outreach Cadence and Scripts

Even the most carefully curated cold call list is just static data until you bring it to life with a dynamic outreach strategy. A great list gets you to the right door, but it’s a smart cadence and a flexible script that actually get you inside. This is where you turn raw data into real conversations.

The biggest mistake I see is teams treating a cold call as a single, make-or-break event. The reality of modern outreach is that it’s about persistence and using multiple channels to stay on a prospect's radar. A well-designed cadence weaves calls, emails, and even social media touchpoints into a sequence that builds familiarity over time, not annoyance.

Designing a Multi-Touchpoint Cadence

Persistence is everything in cold outreach, but it has to be structured. You can’t just call someone every day and hope for the best. The data shows it takes an average of three attempts just to connect with a lead, and it might take a full eight attempts to truly engage them. That alone proves why a single call is almost never enough. You can dig into more of these stats in this great breakdown on Cognism.com.

So, what does a good, non-invasive cadence look like? Here's a simple but effective two-week sequence:

- Day 1: Send a personalized email in the morning, then follow up with a cold call in the afternoon.

- Day 3: Send a follow-up email and a LinkedIn connection request.

- Day 5: Time for a second call attempt. Reference the email you sent.

- Day 8: Share something of value—a relevant case study, an interesting article, or a helpful tip.

- Day 11: Make your final call attempt.

This multi-channel approach significantly increases your chances of getting noticed without being aggressive. You’re showing respect for their time while also signaling that you’re serious about connecting.

Timing Your Calls for Maximum Impact

When you do pick up the phone, timing is critical. Calling a CEO at 9 AM on a Monday is a surefire way to get shut down immediately. You have to be smarter than that.

The data consistently points to two prime windows for reaching decision-makers: between 8:00 AM and 11:00 AM and again from 3:00 PM to 5:00 PM in their local time zone. A study by Gong.io found that Wednesdays and Thursdays are generally the best days to make calls.

Think about it. You're catching them before the day's chaos fully kicks in or as they're winding down and planning for tomorrow. Calling within these windows dramatically boosts your odds of having a real conversation instead of leaving yet another voicemail.

Moving from Rigid Scripts to Flexible Frameworks

Let’s be honest: the word "script" makes everyone think of a robotic, one-size-fits-all monologue. It’s time to throw that idea in the trash. Your reps don't need a rigid script; they need a flexible framework. This is a set of key talking points, powerful questions, and potential pivots they can adapt based on who they're talking to and how the conversation flows.

A great call framework is like a GPS. It gives you a clear destination (booking a meeting) and a few recommended routes, but it lets you take a detour if an interesting opportunity comes up. A rigid script is like reading turn-by-turn directions from a piece of paper—you can't react to what's happening around you.

This framework should be built directly from the micro-segments you created earlier. The way you approach each segment has to be different because their context, challenges, and motivations are different.

Tailoring Your Framework to Different Segments

Your opening line is your first—and maybe only—chance to prove this isn't just another random cold call. You have less than ten seconds to demonstrate relevance. Let's see how you'd adapt your framework for the two segments we talked about.

Example 1: The "Recent Funding" Segment

- Opener: "Hi [Prospect Name], I saw your company just closed its Series B—congratulations. Companies at your stage often find [mention a common challenge], and I was calling to see how you're approaching it."

- Value Prop: Focus squarely on scalability and ROI. They have new capital, and your job is to show them how to make the most of it.

- Objection Handling: If they say, "We're too busy right now," your response should be, "That's exactly why I called. Our solution helps teams like yours automate [specific task] so you can focus on growth."

Example 2: The "Competitive Dissatisfaction" Segment

- Opener: "Hi [Prospect Name], my research shows you're using [Competitor Product]. I specialize in helping companies that run into issues with [known competitor weakness], and I had a few ideas for you."

- Value Prop: Directly contrast your strengths against the competitor's known flaws. Be specific and confident.

- Objection Handling: If they say, "We're happy with what we have," try this: "That's great to hear. If you could change one thing about it, what would it be?" This question is a master key for unlocking hidden pain points.

By tailoring your approach to the specific context of each segment, you transform a cold interruption into a welcome and relevant business conversation. This is how a well-researched cold call list becomes a powerful engine for building a tangible sales pipeline.

Navigating Compliance and Measuring Success

So you've built a killer cold call list and a slick outreach cadence. That's the engine of your sales program. But without a steering wheel (compliance) and a dashboard (metrics), you're just driving blind. Sooner or later, you’ll either crash or run out of gas.

Let's be honest, navigating the legal side of cold calling can feel like a minefield. But it doesn't have to be. The core idea behind laws like the Telephone Consumer Protection Act (TCPA) in the U.S. and GDPR in Europe is simple: respect people's privacy. They’re designed to stop spammers and bad actors, not to prevent genuine business conversations.

Staying on the Right Side of the Law

You don't need to be a lawyer, but you do need to build good habits. The absolute cornerstone of compliance is managing Do-Not-Call (DNC) lists. This is non-negotiable.

Scrubbing your lists against the national DNC registry is a must before you dial anyone. The fines for violations are steep, potentially exceeding $40,000 per call, and the damage to your brand’s reputation can be even worse.

Here’s a quick checklist to keep you on track:

- Scrub National DNC Lists: Always cross-reference your cold call lists with the national DNC registry and any relevant state-level lists before launching a campaign.

- Keep an Internal DNC List: If someone says, "Take me off your list," you do it. Immediately. Your CRM should have a rock-solid process to flag these contacts so they are never contacted by anyone on your team again.

- Watch the Clock: The TCPA is clear: you can only call between 8 a.m. and 9 p.m. in the prospect's local time. A good sales engagement platform can automate this, saving you from costly mistakes.

- Identify Yourself Clearly: Start every call by stating your name and your company. It’s professional, it builds a sliver of trust, and it's required by the Telemarketing Sales Rule (TSR).

A common misconception is that DNC rules are just for B2C. While B2B calling generally has more flexibility, regulations around using auto-dialers and calling mobile numbers are just as strict. When in doubt, it’s always smart to consult with a legal professional.

The Metrics That Actually Matter

With your compliance framework in place, it’s time to shift your focus to performance. You can’t improve what you don’t measure. Tracking the right data turns cold calling from a guessing game into a science, giving you the insights to constantly refine your lists and approach.

Forget about vanity metrics like "dials per day." That just measures activity, not progress. Instead, zoom in on the Key Performance Indicators (KPIs) that directly tell you if you're building a healthy pipeline. These numbers create a feedback loop, showing you whether your lists are gold or if you need to head back to the drawing board.

Here are the KPIs you absolutely have to watch:

- Connection Rate: What percentage of your calls actually get answered by a real person? If this number is low (hovering below 5-10%), it's a massive red flag. It usually means your contact data is stale or just plain wrong.

- Conversation Rate: Of the people you connect with, how many turn into a real conversation (say, over two minutes)? This metric reveals if your opening line is landing and if you're talking to the right people in the first place. A good benchmark to aim for is 20-30% of your connections.

- Meetings Booked: This is the big one. It's the most direct measure of success, showing that your list was relevant, your pitch was compelling, and you created enough value to earn time on someone's calendar.

- Cost Per Lead (CPL): Don't forget the bottom line. Tally up all your campaign costs—salaries, software, data purchases—and divide that by the number of qualified leads you generated. This tells you the true ROI of your cold outreach efforts.

Your CRM and sales engagement tools are your best friends for this. They can track these KPIs automatically, giving you real-time dashboards to see what's working. This data-driven approach is what separates the pros from the amateurs, ensuring every list you build is better than the last.

Your Questions About Cold Call Lists, Answered

Even with a great plan, you're bound to run into questions when you're in the trenches building and working your cold call lists. Let's walk through some of the most common ones I hear to help you stay on track.

Should We Build Our Own List or Buy One?

Building your own list almost always wins on quality, even though it takes more work upfront. When you build it yourself, you control every single detail, making sure each prospect is a perfect fit for your ideal customer profile (ICP). The result? Higher relevance and much better conversations.

Buying a list is the fast-food option—it’s quick, but you're taking a massive gamble on quality. Too often, these lists are a graveyard of outdated contacts, which kills morale, wastes time, and can even tarnish your brand's reputation.

A hybrid approach is often the sweet spot. Use a quality data provider like ZoomInfo or Apollo.io to get a starting point, then have your team dive in to manually verify and enrich the data. You get the speed of a purchased list without sacrificing the quality you need to actually close deals.

How Often Do I Really Need to Update My Lists?

B2B data goes stale incredibly fast—we're talking over 20% a year. People switch jobs, companies get acquired, and phone numbers change. Because of this, data hygiene can't be a one-and-done task. It has to be an ongoing part of your process.

At the bare minimum, you should verify a contact’s info right before you drop them into a sequence. For any list you plan to use over the long haul, a full refresh every 90 days is a solid rule of thumb. This simple habit is one of the easiest ways to keep your connect rates high and stop your reps from chasing ghosts.

What's the Single Most Important Factor for a Good List?

One word: relevance.

A small, laser-focused list of 50 prospects who have a clear, immediate need for what you sell will run circles around a generic list of 5,000. List size is just a vanity metric; relevance is what actually drives revenue.

So, where does real relevance come from? It starts with deeply understanding your ICP and then layering on data that signals intent. Look for those critical trigger events—a fresh round of funding, a new executive hire, or a surge in job postings for a certain department. These signals turn a generic cold call into a timely, strategic conversation.

A list's value isn't measured by how many names are on it, but by how many of those names have a genuine reason to talk to you right now. Relevance trumps volume, every single time.

What Are the Big Legal Rules I Should Know for Cold Calling?

Navigating the legal side of things can feel intimidating, but it boils down to a few key regulations, mainly the TCPA in the U.S. and GDPR in the E.U. The TCPA is mostly concerned with automated dialers and calls to cell phones, which often require consent. GDPR, on the other hand, requires you to have a "legitimate interest" for contacting someone and gives people strong rights to be forgotten.

To keep your outreach compliant and ethical, stick to these core principles:

- Always scrub your lists against national Do-Not-Call (DNC) registries.

- Keep your own internal DNC list and honor every opt-out request instantly.

- Respect calling time restrictions (usually 8 a.m. to 9 p.m. in the prospect's local time).

- State your name and company clearly at the start of every call.

When you're not sure, don't guess. It’s always smart to talk to a legal expert to make sure your process is buttoned up for the specific regions you're targeting.

Stop chasing stale data and start connecting with decision-makers at the exact moment they're ready to buy. FundedIQ delivers hand-curated lists of recently funded startups, complete with verified contacts and critical buying signals. Get your first high-intent prospect list today.