A Practical Guide to Finding Company Information

- Why Accurate Company Information Is Your Secret Weapon

- Mastering the Art of Search Engine Investigation

- Tapping into Official Government and Financial Records

- Digging Deeper with Business Databases and News Archives

- Getting a Feel for Company Culture and Customer Opinions

- Tackling International Company Research

Digging up information on a company is more than just a fact-finding mission; it’s about assembling a complete puzzle to make smarter, more confident business decisions. Whether you're sizing up a competitor, vetting a potential partner, or evaluating a job offer, the quality of your research can make or break your next move. For instance, a sales professional might discover a target company just secured a $10 million Series B funding round—a clear signal they have capital to spend and are likely expanding.

Why Accurate Company Information Is Your Secret Weapon

Before you sign that partnership agreement, accept a new job, or invest a single dollar, how much do you truly know about the company on the other side of the table? Anyone can find the surface-level stuff. It's the deep, verified intelligence that separates a calculated risk from a shot in the dark. This is the heart of effective due diligence, competitive analysis, and strategic vetting.

Think about it in real-world terms. An investor performing due diligence might uncover a history of undisclosed lawsuits in public records—a massive red flag that prevents a potential $1 million loss. Or, a sales team could discover a competitor just landed a major funding round. That's not just news; it's a signal to prepare for increased marketing spend and aggressive hiring from that rival. These aren't just stories; they're the direct results of solid, thorough research.

The Foundation of Smart Decisions

Finding reliable company information is what turns vague goals into concrete, actionable strategies. You get to move past gut feelings and build your plans on a foundation of hard evidence.

This process is absolutely essential for:

- Due Diligence: A 2022 survey by a leading M&A advisory firm found that over 60% of failed deals were due to inadequate due diligence. Verifying financial stability and legal standing is non-negotiable.

- Competitive Analysis: Getting a clear picture of a rival's strengths, weaknesses, market position, and even their product pipeline to find your own competitive edge.

- Sales Prospecting: Pinpointing high-value leads by spotting growth signals like new funding, key executive hires, or expansion plans. For example, a company that just hired a "VP of European Expansion" is an obvious target for international logistics providers.

- Career Vetting: Looking beyond the job description to assess a potential employer's stability, workplace culture, and real growth prospects.

The core principle here is that every piece of information is a dot, and your job is to connect them to see the full picture. This approach is central to making informed choices, a concept you can explore further in our guide to data-driven decision-making.

At the end of the day, the ability to find and correctly interpret company information isn't just a bonus skill anymore. Considering that 90% of the world's data was generated in just the last few years, knowing where to look and how to verify what you find is your most powerful advantage.

Mastering the Art of Search Engine Investigation

Let’s be honest, nearly every investigation kicks off with a Google search. But there’s a massive difference between a casual search and a professional one. The real skill isn't just typing in a company name; it's about making the search engine work for you, forcing it to deliver exactly what you need.

Given that Google fields around 8.5 billion searches every single day and owns over 91% of the search market, it’s the undisputed king of information. You can't ignore it. Learning to wield it properly is the bedrock of good company research.

Going Beyond the Basic Search

If you just search for "ExampleCorp," you'll get the obvious stuff: their homepage, a Wikipedia article, and maybe some recent news. That's fine for a first glance, but it barely scratches the surface.

To really dig deep, you need to get comfortable with advanced search operators. Think of them as special commands that give you precise control over your search. They let you filter out the noise and zero in on specific documents, sites, and phrases.

Here are a few of the most powerful ones I use all the time:

site:This is your sniper rifle. It tells Google to only look within one specific website. For example,site:sec.gov "ExampleCorp"cuts out the entire internet except for the official U.S. Securities and Exchange Commission site.filetype:Need to find a specific kind of document? This operator is your best friend. A search like"ExampleCorp" annual report filetype:pdfis a fantastic way to hunt down official reports and skip all the marketing pages and blog posts." "(Quotation Marks): So simple, yet so effective. Putting a phrase in quotes forces Google to search for those exact words in that exact order. Searching for"ExampleCorp quarterly earnings"gives you far more targeted results than a search without the quotes.

These operators are the building blocks of expert-level research. If you want a more complete list to work with, this Google Search Operators Cheat Sheet is an excellent resource to keep handy.

A Real-World Example

Let's say you're researching a public tech company, "Innovate Inc.," to check on its financial stability before a sales pitch. A generic search will just give you a firehose of irrelevant information. Time to get strategic.

Instead of just typing "Innovate Inc." into the search bar, you would construct a more powerful query:

"Innovate Inc." investor relations filetype:pdf site:.gov

This single line is a research powerhouse. You've just told Google to find the exact phrase "Innovate Inc. investor relations," but only show you PDF files, and only from government websites. Instantly, your results are filled with official SEC filings instead of PR fluff.

This is how you transform a basic search engine into a precision research tool. It’s all about filtering out the noise to focus on the credible, authoritative sources that give you the real story.

Tapping into Official Government and Financial Records

While a smart Google search gives you a company's public face, the real, hard facts are tucked away in official government and financial records. This is where you get past the marketing spin and into the legally required truth.

For any public company in the U.S., your first stop should always be the Securities and Exchange Commission's (SEC) EDGAR database.

EDGAR—which stands for Electronic Data Gathering, Analysis, and Retrieval—is a massive, free library of every report, filing, and update a public company is required to submit. It might look a little dated, but it's the gold standard for unbiased corporate data and the foundation for any serious research. In fiscal year 2022 alone, over 500,000 filings were submitted to the SEC.

Decoding Key SEC Filings

Diving into EDGAR can feel overwhelming at first. The trick is knowing which documents matter most. For any publicly traded company, there are three filings you absolutely need to know. Each one tells a different part of the story, and together they create a full picture of a company’s health, strategy, and recent activities.

Here are the heavy hitters:

- Form 10-K: Think of this as the company's annual physical. It’s a massive, in-depth report covering everything from audited financial statements and executive pay to detailed discussions of market risks and ongoing legal battles. It's the most comprehensive document you'll find.

- Form 10-Q: This is the quarterly check-in. Filed three times a year, the 10-Q provides an unaudited look at the company's financial performance. It’s perfect for tracking progress and spotting trends that emerge between the big annual reports.

- Form 8-K: This is the "breaking news" alert. Companies file an 8-K whenever a major event happens that shareholders need to know about now. This could be a merger, a bankruptcy filing, the sudden departure of a CEO, or a game-changing new contract.

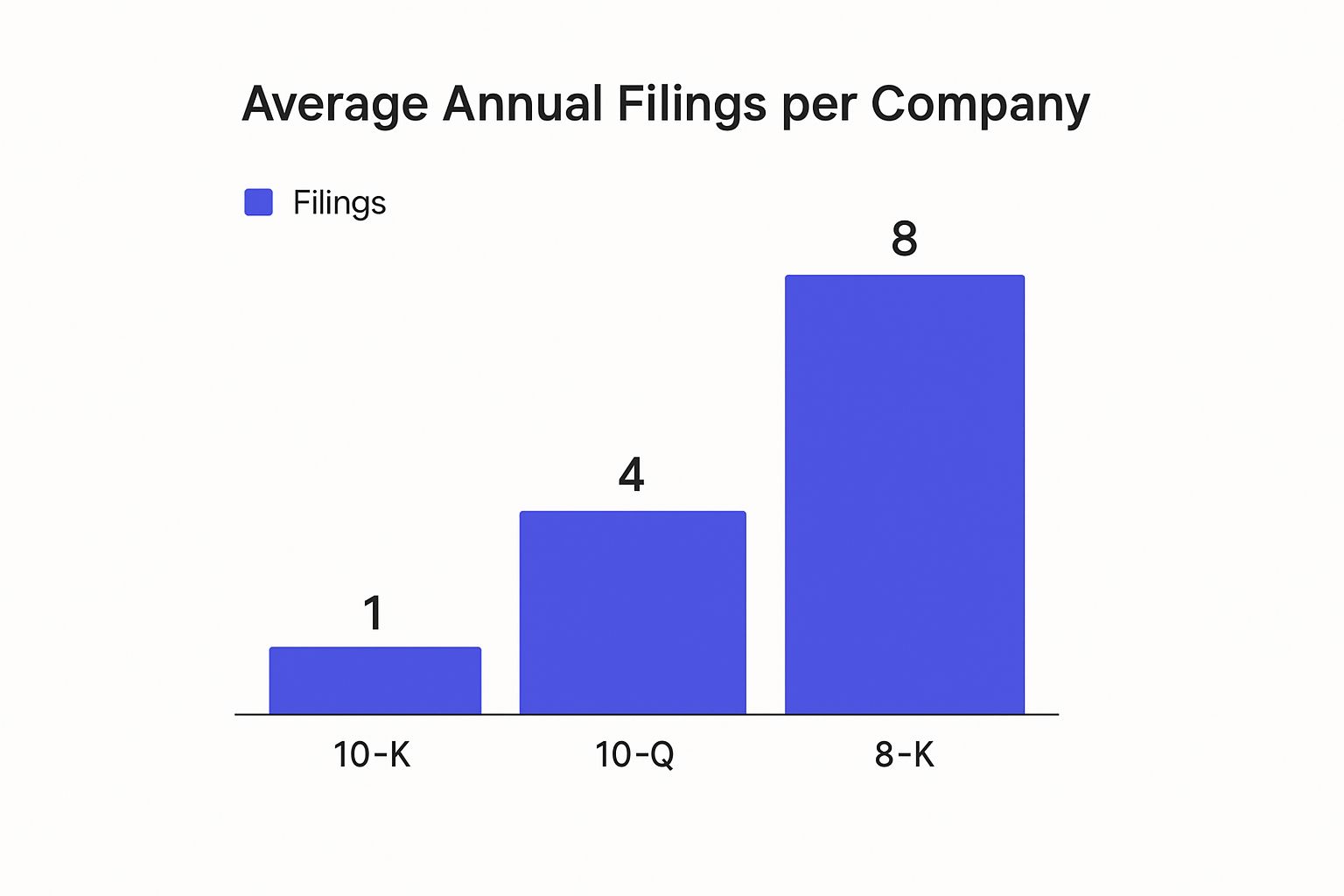

On average, a publicly listed company files one 10-K, three 10-Qs, and around eight 8-Ks per year, giving you a steady stream of event-driven news.

As you can see, the 8-K filings are far more frequent, making them essential for keeping a real-time pulse on a company.

The table below breaks down exactly what you can expect to find in these core documents.

| Filing Type | What Information It Includes | Practical Example of Use |

|---|---|---|

| Form 10-K | Audited financial statements, executive compensation, list of subsidiaries, market risks, legal proceedings. | For a deep, annual analysis of a company’s overall health and long-term strategy. |

| Form 10-Q | Unaudited quarterly financial statements, management discussion, updates on legal issues. | To track performance throughout the year and compare quarter-over-quarter revenue growth. |

| Form 8-K | Mergers & acquisitions, executive changes, earnings releases, bankruptcy, changes in auditors. | For immediate updates on major events, like a CEO's departure, that could signal a strategy shift. |

Understanding these filings gives you a powerful advantage, allowing you to base your analysis on concrete data rather than just headlines.

Uncovering Information on Private Companies

Okay, but what about the millions of private companies that don't file with the SEC? They still leave a paper trail—you just have to look in a different place.

Every single business, whether it's a massive corporation or a local shop, must register with a government agency to operate legally. These registration documents are public records.

These filings contain foundational details like the official company name, its registration date, the address of its registered agent, and often the names of its directors or officers.

In the U.S., you'll find this information at the Secretary of State office for the state where the company is incorporated. Most now offer a simple online business search portal. For businesses outside the U.S., look for national equivalents like the UK's Companies House or Canada's corporate registries. They serve the same purpose. For example, a search on Companies House can reveal a UK private company's annual financial accounts, something not typically available for US private companies.

While these state-level records won't reveal detailed financials, they are absolutely essential for one critical task: verifying that the company legally exists and identifying its official leadership. It's a non-negotiable first step in any serious vetting process.

To keep all this information organized, our due diligence checklist template can provide a structured framework for your research.

Digging Deeper with Business Databases and News Archives

Official filings give you the facts, but they rarely tell the full story. To really get a feel for how a company operates in the wild—its reputation, its funding, who’s actually running the show—you have to look beyond government records.

This is where specialized business databases and news archives come into play. These tools are built to gather and sort through the kind of information government sites just don't track. They help you uncover the narrative behind the numbers and connect the dots between a company's legal status and its real-world market presence.

Tapping into Third-Party Databases

Think of official records as a company's birth certificate; they prove it exists. Business databases, on the other hand, act like its ongoing health record, tracking its pulse. These platforms monitor everything from fundraising rounds to executive shuffles, giving you a much richer, more dynamic picture of a company's operations. For anyone serious about what competitive intelligence is, these tools are indispensable.

Here are a few of the heavy hitters and what they're best for:

- Crunchbase: Your go-to for funding history. For example, you can see that a SaaS startup raised a $5M seed round 18 months ago, making them a prime candidate for a Series A round soon. It's fantastic for identifying key investors and spotting well-funded startups.

- LinkedIn Sales Navigator: Don't mistake this for just a networking tool. It’s a powerful way to map out an entire company org chart. You can set alerts to be notified when a key executive at a target account leaves, creating a potential sales opportunity at their new company.

- PitchBook: When you need granular financial data, PitchBook is the gold standard. It's a premium service used by finance professionals to find specific M&A deal multiples and private company valuations, which is nearly impossible to find for free.

The real magic happens when you start layering the data from these sources. For instance, you might spot a new C-level hire on LinkedIn Sales Navigator. A quick check on Crunchbase could reveal a recent funding round, telling you they just brought in a seasoned executive to manage their new cash influx.

Each database offers a unique angle. When you combine them, you start to build a truly three-dimensional view of your target company.

Unearthing the Story in News Archives

Databases deliver clean, structured data points. News archives give you the messy, unstructured story—a company’s public journey, warts and all. This is where you find out how a business has been covered in the media, from splashy product launches to reputation-damaging crises.

Archives from sources like Bloomberg, Reuters, and The Wall Street Journal are goldmines of historical context. A few simple searches can reveal a ton:

- Product launch history: Did their "revolutionary" product from 2019 quietly disappear from their website?

- Old executive interviews that offer a window into their strategic thinking (and potential broken promises).

- Reports on lawsuits or regulatory headaches that might not be obvious in SEC filings.

- Evolving market sentiment and how the company's reputation has shifted over time.

By stitching this timeline together, you move past just collecting data. You start to understand a company's trajectory, its resilience, and its actual standing in the industry. Combining hard data from databases with the context from news archives is the only way to get a complete, comprehensive picture.

Getting a Feel for Company Culture and Customer Opinions

Financial statements and official records give you the hard facts, but they don't tell you what a company is really like. To understand its personality—how it treats its people, what customers think, and the overall vibe—you have to dig into where people are talking.

This has become a huge part of due diligence. A 2023 survey revealed that roughly 66% of B2B buyers check out companies on third-party review sites before engaging with a salesperson. You can see more of the data behind this trend in this Google search statistics report. A company's digital footprint is no longer just a marketing tool; it's a core part of its identity.

What Employees Are Saying on Glassdoor

If you want the inside scoop on company morale and leadership, employee review sites like Glassdoor are indispensable. But don't just glance at the star rating and move on. The real story is always in the comments.

Look for patterns. Are multiple reviews, written months apart, all mentioning a poor work-life balance? Or do you see consistent praise for a specific manager or a great training program? I find that reviews from former employees are often the most revealing, as they have little reason to hold back.

Here’s how I get the most out of it:

- Track recurring themes. One-off complaints can be ignored, but if 10 out of 15 recent reviews mention "micromanagement," that's a significant data point.

- Filter by department. This can show you if a problem is company-wide or isolated to a specific team, like the sales department versus engineering.

- Never skip the "Advice to Management" section. It’s often where you’ll find the most direct and honest feedback.

How Customers Feel on G2 and Trustpilot

The same logic applies to customer reviews. Sites like G2, Capterra, and Trustpilot give you a direct window into how people actually experience a company's products and services. This is where you can gauge customer loyalty and product quality beyond the marketing spin.

I always tell people to skip the glowing five-star reviews at first. The most constructive feedback is usually buried in the three- and four-star ratings, where customers tend to offer a more balanced view. For example, a three-star review might say, "The product is powerful, but the customer support is incredibly slow," revealing an operational weakness.

Pay close attention to how a company handles negative reviews. A thoughtful, problem-solving reply to a frustrated customer says more about their commitment than ten generic "Thanks for the feedback!" comments on positive reviews. It shows they're actually listening.

Beyond review sites, a company’s social media presence on platforms like LinkedIn or X (formerly Twitter) provides a real-time feed of its priorities and how it interacts with the world. Active social media reputation monitoring helps you see their brand voice in action. What do they post? Who do they engage with? This human element is often the final, crucial piece you need to complete the picture.

Tackling International Company Research

When your research takes you across international borders, you have to throw your old playbook out the window. The methods that work like a charm in the U.S. or Europe can easily lead to dead ends in Asia or South America. Your go-to first step, a simple Google search, often won't cut it.

Why? Because the digital world isn't a single, unified space. While Google seems to be everywhere, holding around 90% of the global market share, local preferences matter a great deal. If you're digging into a Russian company, you need to know that Yandex commands a significant portion of the search traffic there. For China, it’s all about Baidu. These aren't just alternatives; they are the primary tools for local business discovery, indexed and prioritized for local languages and regulations. You can find more data on the global search engine market share on Statista.

This means your first move for any international search should be figuring out which search engine the locals actually use. It’s the only way to surface the regional news, business directories, and official filings that Google's algorithm might completely miss.

Finding and Using International Business Registries

Just like a U.S. company registers with its Secretary of State, businesses around the world have to file with a national authority. The real challenge, though, is that these registries are all over the map in terms of what they offer and how easy they are to access.

Disclosure laws are far from universal. In some countries, like the UK, you can pull up detailed financial statements for private companies for free. In others, you'll be lucky to find more than a registration date and an address.

Here’s how I typically start the hunt for these registries:

- Go straight to the source. I start by searching for phrases like "[Country Name] business registry" or "companies register [Country Name]." This usually points me toward an official government portal.

- Embrace the language barrier. Don't be surprised if the official site is only in the local language. Browser translation tools are a lifesaver here, but tread carefully. They can mangle important legal or financial terminology.

- Hunt for the official identifier. Every country has its own version of an Employer Identification Number (EIN), such as a "CRN" (Company Registration Number) in the UK. Finding this unique registration number is often the master key that unlocks all other available records for that company.

My Pro Tip: When you're relying on a translation tool, double-check your work. Translate key terms (like "annual report" or "board of directors") into the target language using a tool like Google Translate, and then search for that native phrase on the local search engine. This helps you find the right documents instead of a weird, literal translation.

Don't Forget the Cultural and Regulatory Context

Beyond the technical steps, you have to account for the local culture. Business norms, common corporate structures, and even what "transparency" means can be wildly different from what you're used to.

For instance, in many cultures, private, family-owned businesses (like Germany's "Mittelstand") keep their cards very close to their chest. You simply won't find detailed information about them in official channels because it's not culturally expected or legally required.

This is where you need to get creative. You might have to lean more on local news outlets, niche industry publications, or even the social media platforms that are popular in that specific region to piece together a full picture. Developing a global research mindset is all about being flexible—adapting your tools, your strategy, and your expectations to fit the local landscape. It's the only way to ensure your findings are both accurate and truly meaningful.

Ready to stop guessing and start targeting the right companies at the right time? FundedIQ delivers a curated list of recently funded startups directly to your inbox every month, complete with verified decision-maker contacts and critical buying signals. https://fundediq.co