A Guide to Joining a Series D Startup

So, you're thinking about joining a Series D startup? Smart move. This isn't your typical garage-based, ramen-fueled venture anymore. We're talking about a company that has survived the early battles, found its footing, and is now gearing up to dominate its market, often with a valuation north of $1 billion, earning it the "unicorn" status.

For anyone looking to make a real impact without the nail-biting uncertainty of a seed-stage company, this is the sweet spot. It's a unique mix of high-growth energy and budding corporate stability. For example, a software engineer joining at this stage isn't just fixing bugs; they're architecting systems to handle millions of users, a challenge with both technical depth and tangible business impact.

Moving from "Break Things" to "Build to Last"

Joining a company at the Series D stage is a world away from the chaotic-but-fun early days. The "move fast and break things" philosophy has likely been retired. Now, the game is all about building robust systems, fine-tuning processes, and scaling thoughtfully to capture as much of the market as possible.

This shift toward operational maturity changes everything. A Series D company has already nailed its product-market fit; they aren't throwing spaghetti at the wall to see what sticks. Instead, the focus is on refining and expanding what already works. This means roles are more specialized, success is tied to clear metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV), and you'll find a more defined organizational chart.

What Does a Series D Startup Really Feel Like?

To get a handle on the environment, you have to appreciate the financial muscle involved. These companies aren't just well-funded—they're often preparing for massive strategic moves, like an IPO or a major acquisition. That long-term vision shapes the entire culture.

You can generally expect a few key things:

- Serious Capital: These startups have raised huge sums of money specifically to fuel aggressive expansion. A real-world example is Databricks, which raised a $500 million Series D to expand its global footprint and invest in its AI platform.

- A Proven Model: The core product and how it makes money are well-established and have been validated in the market. They have a predictable revenue stream and a clear go-to-market strategy.

- A Clear Path to Profit: The conversation has moved beyond growth at any cost. Now, it's about sustainable, profitable growth, with a keen focus on unit economics.

- Structured Operations: Key functions like hiring, product development, and sales are becoming more standardized and professional, often supported by dedicated software like Greenhouse for hiring or Salesforce for sales.

The bottom line is you're being hired as a specialist, not a generalist. Your job isn't to build a function from the ground up, but to take an existing one and optimize it for massive scale. Your impact comes from refinement and efficiency.

In 2025, a typical Series D round lands at an eye-watering $158.4 million on average. Some of the most ambitious companies in this stage pull in even more, with the 75th percentile hitting $250 million. This kind of capital is what separates the contenders from the pretenders.

To give you a better sense of how Series D fits into the broader startup journey, here’s a quick comparison of the different funding stages.

Startup Stages at a Glance

| Characteristic | Series A | Series B | Series C | Series D |

|---|---|---|---|---|

| Primary Goal | Product-Market Fit | Scaling & Growth | Aggressive Expansion | Market Dominance/IPO Prep |

| Team Size | 10-50 | 50-250 | 250-1,000 | 1,000+ |

| Risk Level | Very High | High | Medium | Lower |

| Role Type | Generalist / "Wear many hats" | Specialized with some overlap | Highly Specialized | Deep Functional Expert |

| Culture | Experimental & fluid | Process-driven but agile | More structured & corporate | Established processes & hierarchy |

As you can see, by the time a company hits Series D, it operates on a completely different scale with much more defined roles and expectations.

A Growing Field of Opportunity

The good news for job seekers is that more companies are successfully reaching this mature stage than ever before. This trend points to a healthy late-stage venture ecosystem, which means more high-quality opportunities are becoming available.

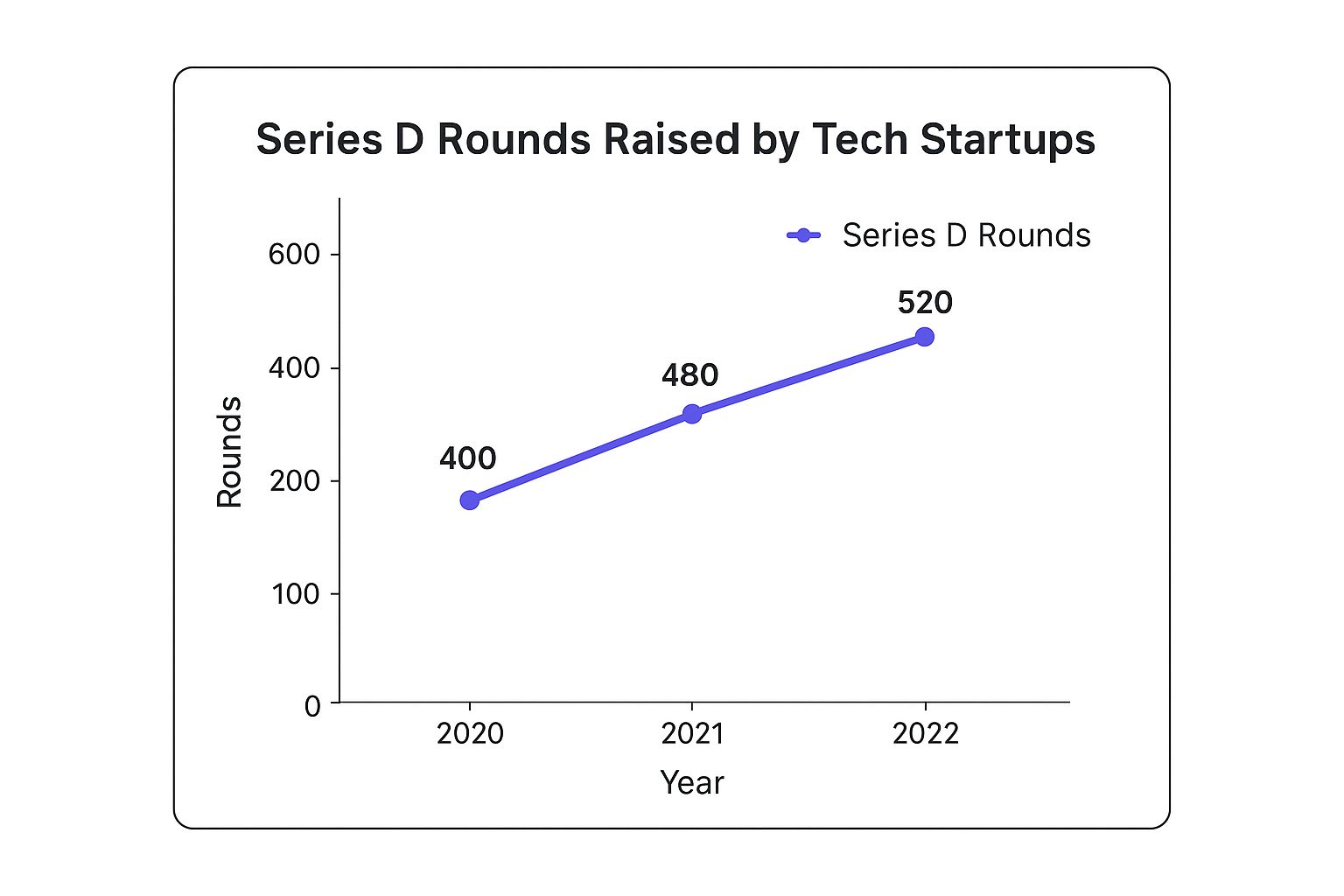

This chart shows just how much the number of Series D rounds has grown in recent years.

The data clearly shows a steady climb, which is great news for anyone looking to join a company on the verge of becoming a household name. To really appreciate how a company gets here, it’s helpful to understand the complete venture capital funding process from start to finish.

How to Find High-Potential Series D Companies

Finding the right Series D startup isn't as simple as scrolling through a job board. At this stage, you have to be selective. Some late-stage companies are rocketing toward an IPO, while others are hitting a plateau. Your job is to tell the difference and find the ones with real momentum.

The easiest way to start is to follow the money. Look at which industries are pulling in the biggest Series D rounds—think fintech, AI, SaaS, and health tech. This is where VCs are placing their most significant bets. For instance, recent funding trends on Revli.com show a massive surge in IT and Services, a clear signal of investor confidence. Targeting a company in one of these hot sectors puts you right at the center of the action.

Think of this as your high-level filter. It helps you cut through the noise and start building a focused list of potential employers.

Building Your Target List with Data Platforms

Once you have a few industries in mind, it's time to get specific. This is where data platforms become your best friend. Tools like Crunchbase and PitchBook are goldmines for tracking fresh funding announcements and identifying companies that are about to go on a hiring spree.

My advice? Set up alerts for any company that has just closed a Series D round. A fresh injection of cash almost always means one thing: growth. And growth means hiring.

Here's a simple framework I've used to build a target list:

- Recent Funding is Key: Zero in on companies that raised their Series D within the last 6-12 months. They're actively deploying that capital. For example, a company that just raised $200M is likely expanding its sales team to enter new markets or its engineering team to build out enterprise-grade features.

- Check the Investor Roster: Are top-tier VCs like Sequoia, Andreessen Horowitz, or Kleiner Perkins on the cap table? Their stamp of approval is a powerful indicator of a company's potential.

- Watch the Headcount: Hop on LinkedIn and look at their employee growth over the last year. A 25-50% jump is a very healthy sign that they're scaling effectively.

This data-first approach helps you avoid wasting time on companies that look good on paper but aren't actually growing.

Looking Beyond the Funding Numbers

Funding is a great starting point, but it's just one piece of the puzzle. The real gems are the companies that show strong qualitative signs of health—the kind of signals that hint at what's coming next.

A big funding round gets a company on your radar, but strategic leadership hires and major product launches are what should keep it there. These actions demonstrate a clear vision for using that capital effectively.

Keep an eye out for these tell-tale signs of a company that’s being managed well and is ready to take off:

- Strategic Leadership Hires: Did they just bring in a CRO from a public competitor like Salesforce or a CFO who has IPO experience from a company like Snowflake? These aren't random hires; they're chess moves signaling big ambitions.

- Major Product Launches: A company that’s constantly innovating, expanding its product line, or breaking into new markets is a company with a plan. It shows they can execute. For example, a fintech company launching a business banking product after succeeding in consumer payments.

- Grabbing Market Share: Dig into industry reports, press releases, or news articles. Is the company being mentioned as a serious competitor to the established players? Look for mentions in Gartner Magic Quadrants or Forrester Wave reports.

When you combine the hard numbers from funding announcements with these softer, qualitative signals, you develop a much sharper, more accurate picture. This is how you find a role where you can truly make an impact and join a Series D startup that’s built for the long haul.

Evaluating the Opportunity and Assessing Risk

Alright, you’ve got your shortlist of promising companies. Now it’s time to switch hats. Stop thinking like a candidate and start thinking like an investor—because that's what you are. You're investing your time, talent, and career capital into this next move.

Joining a Series D startup isn't a small decision. A flashy valuation and a big new funding round can look amazing on the surface, but you need to do some real due diligence. Your job is to peek behind the curtain to make sure the company’s foundation is as solid as its press releases claim.

This means digging into the numbers, the competition, and the people running the show. A massive funding announcement is a fantastic start, but you have to understand the story behind it, especially with how much the venture world has tightened up recently.

Decoding the Financial Health

Getting a handle on the company's financial stability is non-negotiable. No, they won't hand over their full balance sheet, but you can learn a ton by asking smart, direct questions during your interviews. This isn't about being aggressive; it's about being informed.

Here are the kinds of questions that get to the heart of the matter:

- "With this new funding, what does the company's current runway look like? Are we talking 18, 24, or 36 months?"

- "What are the specific, key milestones this Series D round is meant to help you hit? For instance, are you aiming for $100M in ARR or expanding into the APAC region?"

- "Could you talk about the general trend of the company's valuation over the last couple of rounds?"

- "What's the leadership's philosophy on the path to profitability?"

A leadership team that's on top of its game will have clear, confident answers. If you get vague responses or they dodge the question, that could be a red flag. It might signal a lack of a coherent strategy or even some internal turmoil.

It’s also crucial to understand the broader market context. Even with a lot of capital floating around, late-stage funding is facing some serious headwinds. In Q1 2025, venture deal activity actually dropped to its lowest point since 2018.

What’s more, a significant 19% of all new funding rounds were "down rounds," where companies had to accept a lower valuation than before. You can discover more insights about the state of private markets on Carta.com to really get a feel for these trends.

Assessing Leadership and Vision

A strong, steady leadership team is just as critical as a healthy bank account. By the time a company hits Series D, the original founders should be surrounded by seasoned executives who know how to scale. You want to see leaders who’ve been through this before—people with experience at public companies or who have guided other startups through this exact growth stage.

But don’t just look at their resumes. Try to get a real feel for their vision and how transparent they are. Do they lay out a clear, believable plan for winning the market? Are they refreshingly honest about the hurdles they expect to face, such as specific competitive threats or product challenges?

A company with a solid financial footing and a clear-eyed vision is one you can feel good about betting on. To keep all your research organized, it helps to use a structured approach. Check out this comprehensive due diligence checklist template to make sure you're not missing anything important. It's the best way to avoid any nasty surprises after you've already signed on the dotted line.

Frame Yourself as a Growth Engine, Not Just Another Hire

When you’re targeting a Series D company, your resume is more than a list of jobs. It’s your pitch—a story that proves you’re not just looking for a role, but that you are the solution to their next big growth challenge.

These companies have outgrown the need for generalists. They are actively seeking proven specialists who can walk in the door and start executing on day one. Your entire professional presence, from your LinkedIn down to your resume bullet points, has to scream scale, process, and measurable results.

Forget the generic job descriptions. You need to translate every accomplishment into the language of a company that's preparing for an IPO or major market expansion. Talk about the processes you professionalized, the complex projects you quarterbacked, and the cross-functional wins you delivered.

Prove You Can Handle Scale

Series D startups are looking for people who can take a department from good to great—or from great to world-class. The “wear multiple hats” startup chaos is over. Now, it's all about bringing in deep, specialized expertise to dominate a market.

Comb through your career and find every example of when you operated at a significant scale. Did you manage a P&L over $1M? Grow a user base by 500%? Build an operational system that supported thousands of daily transactions? These are the data points that will make a hiring manager stop scrolling.

A recruiter at this stage isn't just thinking, "Can they do the job?" They're thinking, "Can they do the job when we've doubled our revenue and headcount in 18 months?" Your resume needs to answer that question with a confident "yes."

Focus on how your skills solve the unique problems of a company in hyper-growth. This means highlighting your experience creating playbooks, building teams, and establishing best practices that can withstand pressure.

When you're applying to a late-stage startup, they're looking for specific skills that prove you can handle their next phase of growth. Here are some of the most sought-after competencies.

Key Skills for Series D Startups

| Department | Top Skill/Experience | Why It's Important |

|---|---|---|

| Engineering | Building Scalable Architecture | The tech stack must support exponential user growth without failing. Example: Migrating from a monolith to microservices. |

| Marketing | Performance Marketing at Scale | They need experts who can efficiently manage multi-million dollar ad budgets. Example: Optimizing a $5M annual Google Ads budget. |

| Sales | Enterprise Sales Playbooks | Moving upmarket requires a repeatable process for closing large, complex deals. Example: Implementing MEDDIC sales methodology. |

| Product | Data-Driven Roadmapping | Decisions must be based on rigorous data analysis, not just founder intuition. Example: Using tools like Amplitude or Mixpanel. |

| Operations | Process Optimization & Automation | Efficiency is key to improving margins and preparing the business for public scrutiny. Example: Automating lead routing with HubSpot. |

| Finance | IPO Readiness / FP&A | Financial controls and forecasting must be sophisticated enough for public markets. Example: Experience with SOX compliance. |

Having direct experience in these areas gives you an immediate advantage. It shows you've already solved the problems they're facing right now.

Let the Numbers Do the Talking

Metrics are the lifeblood of a Series D startup. Every single claim on your resume needs to be backed by cold, hard numbers. Fluffy statements like "improved efficiency" are an instant red flag.

Instead, get specific. Don't just say you "grew social media engagement." Say you "increased organic reach by 40% and drove $50,000 in attributed revenue over two quarters." Instead of "improved efficiency," state that you "reduced customer onboarding time by 25% by implementing a new software."

This numbers-first approach shows you have a commercial mindset and understand how your work directly impacts the bottom line. It’s also crucial for getting your resume seen in the first place. To get past the automated screeners, you have to create the perfect ATS resume to land interviews packed with these kinds of powerful, quantifiable results.

Let’s look at a couple of real-world examples:

-

Before: "Responsible for managing marketing campaigns."

-

After: "Managed a $1.2M annual marketing budget, delivering a 3.5x return on ad spend and generating over 5,000 qualified leads."

-

Before: "Worked on a new product feature."

-

After: "Led a cross-functional team of six to launch a key product feature that increased user retention by 15% in the first quarter."

This is the level of detail that proves you’re the high-impact specialist they need to fuel their next stage of growth.

Navigating the Interview and Offer Negotiation

The interview process at a Series D startup is a whole different ballgame. If you’re expecting casual chats with the founders over coffee, think again. What you’ll find is a structured, multi-stage gauntlet designed to really put your skills, problem-solving chops, and cultural fit to the test.

You can almost always count on a formal loop. This usually starts with a recruiter screen, moves to a deep-dive with the hiring manager, and then branches into several peer interviews, a hands-on case study, and a final sit-down with a department head or even a C-suite executive. They’re not just checking boxes to see if you can do the job; they're trying to figure out if you can fundamentally elevate the entire function.

This means you have to show up ready to talk specifics. Vague stories about past wins won’t get you far. Be prepared to break down not just what you did, but exactly how you did it and—most importantly—what the measurable result was.

Mastering the Case Study and Proving Your Value

The case study is where the rubber meets the road, and honestly, it’s where a lot of candidates stumble. This isn’t some abstract, theoretical exercise. It’s a direct simulation of a real problem the company is probably wrestling with right now. They want to see how you think on your feet, how you bring structure to chaos, and how clearly you can communicate a plan.

For instance, if you're a marketing candidate, you might get a prompt to build a go-to-market plan for a new expansion into Europe. A product manager might be tasked with roadmapping a new feature designed to boost user retention.

This is your moment to shine by demonstrating:

- Structured Thinking: Break the problem down into logical, manageable pieces. For the GTM plan, this might mean defining the target audience, budget, channels, and KPIs.

- A Data-Driven Approach: Use real metrics and thoughtful assumptions to justify your strategy. Don't just pull numbers out of thin air. You could say, "Assuming a 2% conversion rate based on US performance, we'd need X amount of traffic to hit our lead goal."

- Cross-Functional Awareness: Show that you get how your plan will affect sales, product, engineering, and other teams. Acknowledge that a European launch requires product localization and local sales support.

Think of it as your audition. It’s the single best opportunity to prove you’re a strategic operator who can handle the scale and complexity of a Series D company.

Decoding and Negotiating Your Compensation Package

Once you’ve made it through the interview marathon, the negotiation begins. And at a Series D company, this conversation is way more complex than just talking about your base salary. The equity component is a massive piece of the puzzle, and you absolutely need to understand its nuances.

At this stage, many companies have moved on from stock options and now grant Restricted Stock Units (RSUs). Options give you the right to buy shares at a set price, but RSUs are shares given to you outright as they vest. This means they carry a more predictable—and often more immediate—value, especially as the company inches closer to an IPO.

It's not just about the number of shares they offer you. You have to ask for the company’s latest 409A valuation and the total number of fully diluted shares outstanding. With that info, you can calculate the actual paper value of your equity grant. For example, 10,000 RSUs in a company with a $20 share price is a $200,000 grant.

Getting this right is crucial. The days of a potential 100x return are likely gone, but the equity you receive is far less speculative and holds tangible value. To get a feel for what’s competitive, you can explore comprehensive https://fundediq.co/startup-equity-data/ to see how your offer stacks up against industry benchmarks.

When the offer finally lands, look at the whole picture, not just one number.

- Base Salary: Do your homework. Research the market rates for your specific role and experience level at a company of this size and funding stage using sites like Levels.fyi.

- Performance Bonus: Is it a sure thing, or is it tied to company and individual goals? Ask for the specific formula and what targets you need to hit.

- Equity Grant: As we discussed, dig into the details. Know if it's options or RSUs, understand the vesting schedule (typically 4 years with a 1-year cliff), and calculate its current value.

- Title and Growth Path: Make sure the title accurately reflects your responsibilities and ask pointed questions about the path to promotion. For example, "What does the career ladder for a Senior Product Manager look like here?"

Having an offer in hand is the starting line, not the finish. It’s time to review some smart strategies for negotiating your salary after receiving an offer. When you walk into that conversation armed with data, confidence, and a clear sense of your value, you're positioned to secure a package that truly reflects what you bring to the table.

Common Questions About Joining a Series D Startup

Once you get deep into the process with a late-stage company, the big questions start to surface. These aren't just interview questions—they're the tough, personal ones you need to answer for yourself. Getting them right can be the difference between a great career move and a frustrating one. Let's dig into the questions I hear most often from people considering a jump to a Series D startup.

How Does the Culture Shift from Early to Late Stage?

The biggest change you'll feel between an early-stage company and a Series D veteran is the shift from organized chaos to structured growth. It's a fundamental rewiring of how work gets done.

In the early days, say at a Series B, you're often building the playbook from scratch. Roles are fluid, and everyone wears multiple hats because that's what it takes to survive. By Series D, that playbook is largely written. Your job isn't to create it; it's to execute it with precision, find ways to optimize it, and help scale it up. The "move fast and break things" mantra has been replaced by a more mature "build things to last." It's still a world away from a stuffy corporation, but process and predictability start to matter a whole lot more.

What Should I Look for in an Equity Offer?

At this stage, you have to shift your mindset and evaluate your equity offer more like a public market investor. The lottery-ticket potential of a seed-stage startup is off the table. What you're looking for now is a more predictable, but likely smaller, financial outcome.

First, you need to know what you’re getting. Is it stock options or Restricted Stock Units (RSUs)? RSUs are much more common at this stage because they have a clear value and don't require you to buy them, which is a huge plus.

To figure out what your grant is actually worth, you need two numbers, and don't be shy about asking for them:

- The company's latest 409A valuation. This is the official fair market value of a single share.

- The total number of fully diluted shares outstanding.

With that info, you can do the math and see the current paper value of your equity. It’s also smart to ask about the valuation trend over the last few funding rounds. Is it climbing steadily? That momentum is a good sign.

Is It Really Less Risky Than an Early-Stage Startup?

The risk profile is definitely different, but "less risky" doesn't mean "no risk." The existential threat—the very real possibility of the company just running out of cash and folding—is dramatically lower. They have a product that works and a bank account to prove it.

The risk you're taking on now is different. It’s about valuation and opportunity cost. You could be joining right at a peak valuation, which could cap your equity's upside, especially if the IPO market turns sour or the exit takes longer than planned. There's also the risk that the company just gets stuck in this late-stage phase, unable to make that final leap to market dominance or a public offering. A recent example is the number of "decacorns" (companies valued over $10B) that have delayed IPOs and seen their private valuations stagnate or fall.

When you join a Series D startup, the risk is less about survival and more about the ultimate return on your time and career capital. You're trading a moonshot for a higher-probability—but more modest—payout.

What Kind of Impact Can I Realistically Make?

Your impact will be deep, not wide. Forget about defining a whole department from scratch; that's already been done. Instead, you'll be brought in to take an existing function and scale it to a completely new level of performance and sophistication.

Think of it this way: you won't be the first marketer, but you might be the expert who cracks their international go-to-market strategy. You won't be the first engineer, but you could be the one who re-architects a core system to handle 10x the traffic. Your impact comes from being a specialist who can execute at an incredibly high level, helping the company hit massive milestones like crossing $100M in revenue or launching on a new continent.

Ready to find your next opportunity at a high-growth startup? FundedIQ delivers hand-curated lists of recently funded companies, complete with verified decision-maker contacts. Stop searching and start connecting with the startups that are actively hiring and scaling right now. Find your ideal prospect at FundedIQ.