12 Best Startup Company Database Platforms in 2025

- 1. FundedIQ

- 2. Crunchbase

- 3. PitchBook

- 4. CB Insights

- 5. Dealroom

- 6. Tracxn

- 7. PrivCo

- 8. Owler

- 9. S&P Capital IQ Pro (S&P Global Market Intelligence)

- 10. Orbis (Bureau van Dijk / Moody's Analytics)

- 11. Craft.co (Craft Intelligence Portal)

- 12. StartUs Insights Discovery Platform

- Top 12 Startup Company Databases — Comparison

- Choosing Your Growth Engine: Final Thoughts on the Right Database

In the high-stakes world of venture capital, B2B sales, and strategic recruitment, timely information is the ultimate advantage. Agencies need to find clients the moment they receive funding, investors must spot emerging trends before they become mainstream, and job seekers want to connect with the next high-growth company. A study by McKinsey found that data-driven organizations are 23 times more likely to acquire customers. The right startup company database isn't just a list; it's a dynamic map to opportunity, packed with funding details, decision-maker contacts, and critical buying signals.

But with dozens of platforms all promising the most accurate data, how do you choose the one that truly aligns with your specific goals and budget? This guide cuts through the noise. We have meticulously analyzed the 12 leading platforms for 2025, providing a clear-eyed view of their strengths, weaknesses, and ideal use cases. For each entry, you'll find direct links and screenshots to give you a real feel for the user experience.

This deep dive examines everything from data freshness and API access to pricing models and unique features, helping you move from searching for information to closing your next big deal. To fully appreciate the strategic advantage a powerful startup database offers, it's beneficial to understand how these platforms fit within the broader ecosystem of the best competitive intelligence software tools available. Let's find the perfect tool to fuel your growth.

1. FundedIQ

FundedIQ distinguishes itself in the startup company database landscape by acting less like a static repository and more like a high-precision, strategic lead-generation service. Its core value proposition is delivering a fresh, hand-curated list of recently funded startups directly to subscribers each week. This model is meticulously designed to help agencies, consultants, and investors engage prospects at the peak of their buying intent, right after a significant capital injection. For example, a startup that just closed a $5M Series A is statistically more likely to invest in marketing, sales, and HR services within the next 3-6 months.

Unlike sprawling databases that often require extensive filtering and validation, FundedIQ focuses on quality and timeliness. Each entry is manually researched and enriched with data from over 15 premium sources, a process that yields remarkably accurate contact information. This “waterfall” enrichment method results in up to 40% more reachable emails than many competitors, directly addressing the common industry pain point of high bounce rates and wasted outreach efforts.

Key Differentiators & Use Cases

The platform excels by providing not just contact details but a suite of actionable buying signals. For a growth agency, seeing that a company just raised a Series A, is rapidly hiring for sales roles, and recently adopted new marketing automation software provides the perfect context for a highly personalized pitch. A recruitment firm can leverage the same hiring surge data to connect with key decision-makers before competitors.

Core Strengths:

- Actionable Buying Signals: Data points like hiring surges, tech stack changes, and increased ad spend are included to help you prioritize and personalize outreach.

- Manual Curation & Validation: A human-in-the-loop approach ensures higher data quality and relevance, filtering out the noise common in larger, automated databases.

- High-Intent Timing: By focusing exclusively on recently funded companies, the lists are filled with organizations actively looking to invest in growth.

FundedIQ is sold on a flat-rate monthly subscription (currently $47/month) with no long-term contracts and a 60-day money-back guarantee, making it a low-risk, high-reward tool for targeted prospecting. While its focused scope may not suit users needing broad enterprise data, its specialized approach makes it an invaluable asset for anyone looking to capitalize on funding events as a primary growth trigger.

Website: https://fundediq.co

2. Crunchbase

Best For: Self-serve prospecting and real-time market intelligence.

Crunchbase is a household name in the tech world, renowned as a go-to startup company database for tracking funding rounds, investors, and company profiles. Its strength lies in its user-friendly, self-serve model, allowing individuals and small teams to quickly sign up and begin prospecting without a lengthy sales process. The platform offers a clean interface and robust filtering capabilities, making it easy to build targeted lists based on industry, location, funding stage, employee count, and more. For example, a sales rep could build a list of all SaaS companies in California that raised a Seed round in the last 6 months in under five minutes.

Key Features & Use Cases

The platform excels with its AI-powered features like "Crunchbase Scout" and "AI Search," which proactively recommend relevant companies based on your activity, saving significant research time. For agencies and sales teams, the ability to create and monitor dynamic lists with customizable alerts is invaluable for tracking competitor funding or identifying new market entrants. For users requiring automated data extraction beyond the platform's native capabilities, a Crunchbase Companies Scraper can significantly streamline data collection for in-depth analysis.

A key limitation is that contact data often requires a paid add-on, and starter plans impose export limits, such as a cap of 2,000 rows per CSV export. Despite this, its vast, frequently updated dataset—boasting over 75 million company profiles—and flexible workflow make it a powerful tool for deal sourcing and competitive analysis.

- Pros: Easy self-serve sign-up with a 7-day free trial, extensive startup coverage, and a flexible prospecting workflow.

- Cons: Contact data is often an extra cost, and entry-level plans have data export limitations.

- Website: https://crunchbase.com

3. PitchBook

Best For: Institutional-grade private market intelligence and deep deal-sourcing.

PitchBook is an authoritative force in the private markets, offering a premium startup company database tailored for institutional investors, M&A professionals, and large corporate development teams. Its core strength is the depth and reliability of its data, which covers the entire private capital lifecycle from early-stage venture to private equity and M&A. The platform is designed for users who require granular financial details, valuations, and comprehensive investor profiles for high-stakes decision-making, tracking over 3.5 million private companies and 1.9 million deals.

Key Features & Use Cases

PitchBook excels with its powerful workflow integrations, including plugins for Excel and CRM systems, which allow for seamless data management and analysis. Users can leverage saved screeners and customizable alerts to monitor specific industries or track competitor investment activity. For example, an analyst can set an alert to be notified any time a portfolio company of a rival VC firm raises a new round. The platform also provides access to a dedicated research center and customer success teams, ensuring users can maximize the value of its extensive datasets. For those evaluating similar high-end options, you can see how PitchBook stacks up against other databases.

The platform’s institutional focus is reflected in its custom, quote-based pricing, which is significantly higher than self-serve alternatives. It is best suited for organizations with multi-seat or enterprise-wide needs where the depth of data and dedicated support justify the investment for complex due diligence and deal sourcing.

- Pros: Very deep private-company and investor coverage, strong workflow tools and integrations (including CRM), and robust export options for institutional use.

- Cons: Pricing is custom and typically higher than SMB tools; best value is realized with multi-seat or enterprise use.

- Website: https://pitchbook.com

4. CB Insights

Best For: Corporate strategy, M&A, and in-depth tech trend analysis.

CB Insights positions itself as a premium market intelligence platform, moving beyond a simple startup company database to provide strategic insights into emerging tech markets and competitive landscapes. Its core strength is its synthesis of data, offering predictive analytics and expert-curated research that helps corporate development and venture capital teams identify future trends and acquisition targets before they become mainstream. The platform is designed for deep-dive analysis rather than high-volume, surface-level prospecting.

Key Features & Use Cases

The platform's standout features include the "Expert Collection" briefings and the "Analyst" tool, which uses machine learning to predict a startup’s success or identify look-alike competitors. For instance, its Mosaic Score algorithm analyzes non-traditional signals (hiring, media sentiment, web traffic) to rate a private company's health. This is particularly valuable for corporate strategy teams mapping out new markets or M&A teams performing due diligence. Users can generate competitor maps, scout for specific technologies, and receive tailored alerts on market shifts, making it a powerful engine for strategic decision-making.

A significant consideration is its enterprise-focused sales model; pricing is quote-based and not publicly available, indicating a higher price point than self-serve tools. While it offers a short free access period for evaluation, the platform’s depth may be excessive for teams needing basic prospecting or simple lead generation.

- Pros: Strong strategy-oriented insights beyond raw data, useful for corporate innovation and competitive strategy, and a short free access offer to evaluate fit.

- Cons: No public pricing and is enterprise-oriented, and may be more than needed for basic prospecting.

- Website: https://www.cbinsights.com

5. Dealroom

Best For: Mapping emerging tech ecosystems and discovering high-growth companies.

Dealroom is a European-born global startup company database that excels in providing deep intelligence on startups, scaleups, and tech ecosystems. Its platform is recognized for strong coverage of early-stage ventures and its powerful data visualization tools, such as market landscapes and heatmaps. This makes it particularly useful for investors, policymakers, and corporate development teams looking to understand and engage with specific innovation hubs or industry verticals. For instance, a government agency could use Dealroom to create a public-facing portal showcasing all FinTech startups in its capital city.

Key Features & Use Cases

The platform offers access to over 3 million company profiles, enriched with predictive signals like growth and talent metrics to help identify promising opportunities early. Paid plans provide unlimited search results and generous export allowances, while an API is available for custom data integration. Dealroom also powers numerous public ecosystem portals for cities and governments, offering a free glimpse into its data capabilities. More detailed insights on how Dealroom's data can be leveraged are available in this comprehensive venture capital database analysis.

A key consideration is that its pricing, while transparent, is geared toward enterprise-level budgets, which may be a barrier for smaller firms or individual users. Additionally, granular data points on specific funding rounds or key personnel are often reserved for the highest-tier plans.

- Pros: Strong European and ecosystem data with growing US coverage, transparent tiered pricing, and many free public ecosystem portals.

- Cons: Pricing can be prohibitive for SMEs, and deeper data is often gated behind higher-priced tiers.

- Website: https://dealroom.co

6. Tracxn

Best For: Detailed sector mapping and taxonomy-driven market discovery.

Tracxn positions itself as a comprehensive global startup company database, offering deep dives into niche sectors and emerging industries. Its strength is its meticulous, taxonomy-driven approach, allowing users to browse and discover companies within highly specific categories, from "AI in Drug Discovery" to "Vertical Farming Tech." This granular organization is ideal for venture capitalists, corporate development teams, and market researchers who need to understand the competitive landscape of a particular micro-sector. The platform offers a free Lite tier, providing a risk-free way to explore its vast data.

Key Features & Use Cases

With data on over 4.9 million companies, Tracxn is a powerful tool for building market maps and sourcing deals. Its deal flow CRM functionality helps teams manage their pipeline directly within the platform, while its curated lists and reports provide quick insights into trending sectors. For enterprise users, Tracxn provides advanced data solutions like API access and bulk data delivery, enabling programmatic integration and large-scale analysis. For example, a VC firm could use the API to automatically pull data on all newly founded B2B SaaS companies into its internal systems. This makes it a scalable solution that can grow from individual use to supporting entire data science teams.

A notable drawback is the lack of public pricing for premium tiers, which requires engaging with a sales team. Additionally, certain features like analyst support or extensive data exports might be credit-based or require add-on purchases. Despite this, its expansive coverage and free access tier make it an excellent starting point for in-depth startup intelligence.

- Pros: Generous free tier for platform evaluation, broad company coverage with deep industry taxonomy, and data solutions for enterprise needs.

- Cons: Premium pricing is not transparent and requires a sales call; some advanced features may incur extra costs.

- Website: https://tracxn.com

7. PrivCo

Best For: Analyzing US-based private company financials and growth signals.

PrivCo is a specialized startup company database with a strong focus on the financials and growth metrics of private U.S. companies, including many small and medium-sized businesses (SMBs). Its key differentiator is providing access to detailed financial data like revenue estimates, employee counts, and funding specifics, which can be difficult to find elsewhere. The platform is particularly useful for teams that need reliable financial signals to qualify leads or conduct due diligence on private market competitors. For example, a sales team can filter for companies with estimated revenues between $5M and $10M that have shown 50% year-over-year employee growth.

Key Features & Use Cases

PrivCo offers a transparent, self-serve "Select" plan, making it accessible for smaller teams without requiring a lengthy enterprise sales process. The platform’s advanced search allows users to filter companies, investors, and deals based on specific financial criteria. For financial analysts and M&A teams, the ability to view recent financials and growth trends is invaluable for preliminary company valuations. The platform also includes contact data allowances, helping users connect directly with key personnel at target companies.

A limitation is that its global coverage is less extensive than larger platforms, and accessing full historical financial data requires upgrading to an Enterprise plan. Nevertheless, for US-focused market research, PrivCo offers a powerful and cost-effective solution for uncovering private company data.

- Pros: Transparent self-serve pricing with a 7-day free trial, strong focus on U.S. private-company revenue and staffing signals, and good value for recurring research needs.

- Cons: Historical data depth and higher quotas are locked behind an Enterprise plan, and its international company data is limited.

- Website: https://www.privco.com

8. Owler

Best For: Real-time competitive intelligence and sales trigger monitoring.

Owler carves out a niche as a competitive intelligence platform that doubles as a startup company database. While not as deep on funding data as VC-focused tools, its strength is its dynamic competitor graph, which visually maps out market relationships across 20 million company profiles. This feature is excellent for agencies and sales teams looking to quickly understand a prospect's competitive landscape. The platform also excels at providing real-time news and alerts, tagging events like funding rounds, acquisitions, and leadership changes. A salesperson receiving an alert that a target account's competitor just got acquired can use that insight for a timely outreach call.

Key Features & Use Cases

The platform is designed around proactive monitoring. Users can create watchlists and receive customized email digests, making it easy to stay informed without constant manual checks. For sales teams, these real-time event triggers are invaluable for timely and relevant outreach. A free Community tier allows for quick setup to track a handful of companies, while paid Pro and Enterprise plans offer advanced search, unlimited watchlists, and broader data access for more extensive market research.

Owler’s primary limitation is that its financial and funding data isn't as comprehensive as specialized databases like PitchBook or Crunchbase. However, for identifying sales triggers and mapping competitive ecosystems, it provides a unique and powerful workflow.

- Pros: Generous free Community tier for basic monitoring, strong competitor mapping tools, and excellent real-time news alerts for sales triggers.

- Cons: Financial and funding data is less detailed than top-tier databases, and official pricing for Pro/Enterprise plans is not transparent.

- Website: https://www.owler.com

9. S&P Capital IQ Pro (S&P Global Market Intelligence)

Best For: Enterprise-grade financial analysis and integrated public/private market intelligence.

S&P Capital IQ Pro is an institutional-grade platform designed for deep financial analysis, offering extensive data on public and private companies, including startups. It stands out by combining a robust startup company database with comprehensive M&A, financing, and public market data, making it a powerhouse for corporate development, investment banking, and private equity firms that require a holistic market view. Its strength lies in its professional workflow tools and data integrity, backed by S&P Global's reputation for providing data on over 99% of the world's market capitalization.

Key Features & Use Cases

The platform excels at detailed company screening, financial modeling, and market analysis, supported by powerful Excel plug-ins and AI-driven document intelligence for parsing filings and transcripts. For investors tracking venture capital trends, it provides in-depth data on funding rounds, valuations, and investor profiles, all integrated within a single interface. The platform is ideal for users who need to blend startup research with broader economic and sector-specific data for comprehensive due diligence and strategic planning.

A key limitation is its enterprise-focused model, which involves quote-based pricing and a significant budget commitment, making it inaccessible for individuals or small teams. The interface is complex and built for financial professionals, requiring a steeper learning curve than more self-serve alternatives.

- Pros: Very broad, deep datasets with professional workflow tools, strong enterprise reliability, and continually expanded content.

- Cons: Quote-based enterprise pricing with a high cost, and best ROI is for multi-seat professional teams.

- Website: https://www.spglobal.com/marketintelligence/en/solutions/sp-capital-iq-pro

10. Orbis (Bureau van Dijk / Moody's Analytics)

Best For: Deep corporate structure analysis and institutional research.

Orbis, a product of Bureau van Dijk (a Moody's Analytics company), is one of the most comprehensive global private-company databases available. It stands out for its staggering breadth, covering over 400 million company profiles worldwide. Its primary strength lies in mapping complex corporate ownership structures, making it an indispensable tool for compliance, M&A due diligence, and supply chain analysis rather than simple startup prospecting. For example, a bank could use Orbis to verify the ultimate beneficial owners of a new corporate client to comply with anti-money laundering (AML) regulations.

Key Features & Use Cases

The platform excels at providing standardized, multi-year financial data and detailed ownership linkages, which is invaluable for deep financial modeling and cross-border research. For those in academia or corporate finance, Orbis is often the gold standard. A significant advantage is that it’s frequently available through institutional subscriptions at universities and large corporations, which can be an excellent resource for finding company information that is otherwise behind a steep paywall.

However, Orbis is not a self-serve tool for the average user; access is typically granted via enterprise-level, quote-based pricing. The user interface and data export rights can also vary significantly depending on the specific license an institution holds, which can sometimes be a limitation.

- Pros: Unmatched global private-company coverage, exceptional for mapping corporate hierarchies, and often accessible via institutional subscriptions.

- Cons: Enterprise-only pricing model (not self-serve), and the interface can be less intuitive than modern SaaS platforms.

- Website: https://www.bvdinfo.com

11. Craft.co (Craft Intelligence Portal)

Best For: Enterprise-level supplier due diligence and supply chain risk monitoring.

Craft.co positions itself as a company intelligence platform with a strong emphasis on supplier and vendor risk management. While not exclusively a startup company database, its comprehensive profiles on millions of companies, including emerging ones, make it a valuable resource for enterprises evaluating startups as potential partners or vendors. The platform aggregates a vast array of data points, including financial health, operational risks, cybersecurity posture, and compliance indicators. For example, a large manufacturer could use Craft to monitor the cybersecurity ratings of a small but critical software startup in its supply chain.

Key Features & Use Cases

Craft’s strength lies in its Enterprise Intelligence Portal and API, which allow procurement, sales, and risk management teams to integrate company data directly into their workflows. Users can create custom dashboards and set up alerts to monitor specific companies or entire supplier ecosystems for changes in risk signals. This is particularly useful for assessing the stability and viability of younger, less established startups before entering a business relationship.

The platform is geared toward corporate clients, meaning its sales process is enterprise-led, and pricing is not publicly available. While some company data is visible for free, the most valuable risk metrics and monitoring tools are behind the paywall. It offers a unique, risk-centric lens that many traditional sales-focused databases lack.

- Pros: Excellent for vendor due diligence and risk assessment, powerful API for data integration, and comprehensive company profiles.

- Cons: Pricing is not public and requires a sales consultation; less focused on startup prospecting and more on supplier intelligence.

- Website: https://craft.co

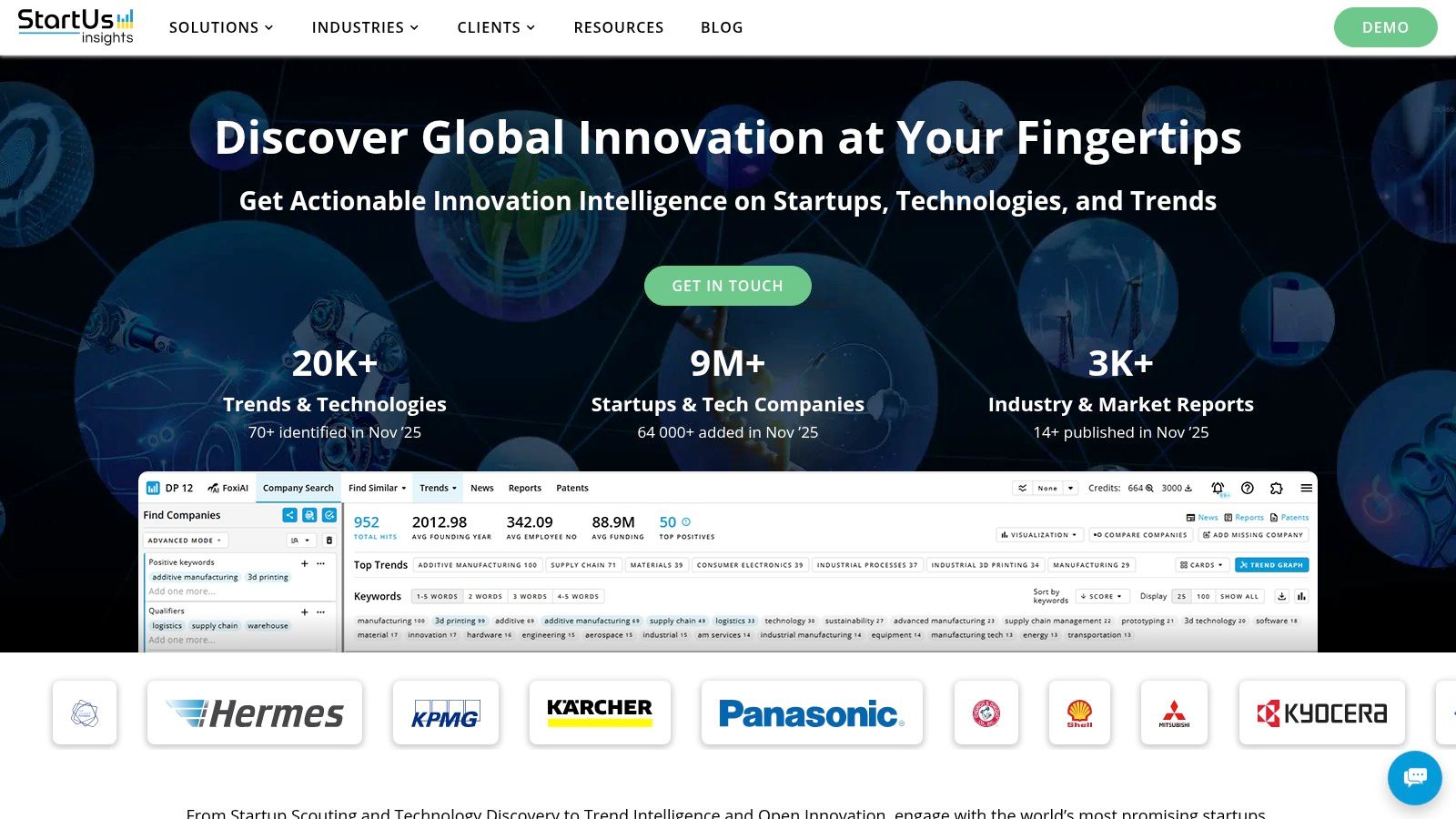

12. StartUs Insights Discovery Platform

Best For: Corporate innovation teams and trend-first technology scouting.

StartUs Insights offers a powerful discovery platform focused on scouting emerging technologies and innovative startups on a global scale. Unlike transactional, VC-focused databases, its core strength is in thematic and trend-driven research, making it a preferred startup company database for corporate innovation departments and R&D teams. It indexes millions of companies and tags them with over 20,000 specific technology and trend keywords, enabling deep-dive searches for niche solutions. For example, an automotive company could search for all startups working on "solid-state battery technology" to identify potential R&D partners.

Key Features & Use Cases

The platform excels at data-driven matchmaking, connecting corporates with relevant startups for partnerships, pilot projects, or investments. Users can build custom discovery workflows and request curated scouting reports, leveraging the platform’s analyst team for on-demand research. This hybrid approach, combining a massive automated database with human expertise, is ideal for identifying early-stage innovators that might not appear in traditional funding-centric databases.

A key drawback is the lack of transparent self-serve pricing, as access typically requires a sales-led engagement. The platform also provides less granular detail on funding round terms compared to competitors like PitchBook. However, for organizations prioritizing technology discovery and strategic partnerships over pure financial prospecting, its global scope and analyst support provide significant value.

- Pros: Excellent for trend-based and thematic scouting, combines automated discovery with analyst support, and has a strong global scope.

- Cons: Pricing is not publicly available and requires a sales call, and it offers less financial detail than VC-focused platforms.

- Website: https://www.startus-insights.com

Top 12 Startup Company Databases — Comparison

| Service | Core features | Quality & Reach ★ | Price / Value 💰 | Best for 👥 | Unique selling points ✨ |

|---|---|---|---|---|---|

| 🏆 FundedIQ | Weekly hand-curated lists, verified decision-makers, funding + buying signals | ★★★★★ curated & validated, up to +40% reachable emails | 💰 $47/mo flat, 60‑day money-back | 👥 Growth, creative, content, recruitment, tech agencies | ✨ Hand research + 15+ vendor waterfall, real-time hiring/ads/expansion signals |

| Crunchbase | Company & investor DB, AI search, alerts, exports | ★★★★ broad startup coverage, frequent updates | 💰 Freemium → paid plans; contact add‑ons | 👥 SMB teams, startups, scouts | ✨ AI discovery, easy self-serve workflows |

| PitchBook | Institutional private markets, valuations, API & plugins | ★★★★★ deep VC/PE data for institutions | 💰 Quote-based (enterprise, high) | 👥 VCs, PE, corporate strategy, investment banks | ✨ Comprehensive private-market analytics & integrations |

| CB Insights | Market intelligence, scouting, trend synthesis | ★★★★★ strategy-focused insights | 💰 Quote-based (enterprise) | 👥 Corporate innovation, strategy teams | ✨ Predictive reports, competitor maps, analyst synthesis |

| Dealroom | Global startup coverage, ecosystem portals, API | ★★★★ strong EU coverage, growing US data | 💰 Tiered pricing (published tiers; higher for depth) | 👥 Ecosystem builders, growth teams | ✨ Transparent tiers, strong European datasets & heatmaps |

| Tracxn | Large company counts, taxonomy browsing, APIs | ★★★★ extensive counts (millions), curated lists | 💰 Free Lite → Premium (sales-led) | 👥 Sector researchers, enterprise scouts | ✨ Taxonomy-driven discovery + API/bulk delivery |

| PrivCo | US private-company financials, revenue estimates | ★★★★ focused US depth, good financial signals | 💰 Self-serve Select + Enterprise (mid) | 👥 SMB researchers, revenue-focused teams | ✨ Revenue/financial estimates and generous quotas |

| Owler | Competitor graphs, news/event triggers, watchlists | ★★★ real-time event monitoring, large profile counts | 💰 Free Community → Pro/Enterprise (mid) | 👥 Market researchers, SMBs tracking rivals | ✨ Strong competitor graph & news-trigger alerts |

| S&P Capital IQ Pro | Extensive company, transaction, filings, screening | ★★★★★ enterprise-grade datasets & tools | 💰 Quote-based (high) | 👥 Banks, corporates, research teams | ✨ Integrated public/private coverage + AI doc tools |

| Orbis (BvD) | Global private-company ownership & standardized financials | ★★★★★ unmatched global breadth (400M+) | 💰 Quote-based (enterprise) | 👥 Universities, corporates, financial institutions | ✨ Ownership hierarchies & standardized multi-year financials |

| Craft.co | Firmographics, risk & supplier monitoring, API | ★★★★ good enterprise monitoring & risk signals | 💰 Enterprise sales-led (mid-high) | 👥 Procurement, vendor risk, enterprise teams | ✨ Risk/resilience lens + monitoring dashboards |

| StartUs Insights | Startup scouting, trend tags, curated research | ★★★★ trend-focused discovery (9M+ profiles) | 💰 Sales-led / custom pricing (mid) | 👥 Corporate innovation, pilot scouting teams | ✨ Thematic scouting with analyst-supported reports |

Choosing Your Growth Engine: Final Thoughts on the Right Database

Navigating the expansive landscape of startup intelligence platforms can feel overwhelming, but making an informed choice is a critical step in building a sustainable growth pipeline. We've explored a dozen powerful tools, from the enterprise-level behemoths like PitchBook and S&P Capital IQ Pro to specialized discovery platforms such as Craft.co and StartUs Insights. The key takeaway is clear: the "best" startup company database is not a one-size-fits-all solution. Your ideal platform is the one that aligns precisely with your team's specific objectives, workflow, and budget.

From Data Overload to Actionable Intelligence

A common pitfall is paying for a massive dataset when you only need a specific, high-signal slice of it. For venture capitalists or M&A teams conducting deep due diligence, the comprehensive financial data and market analysis offered by platforms like PrivCo or CB Insights are indispensable. Their extensive filtering capabilities and historical data are designed for complex, research-intensive tasks.

Conversely, a fast-moving sales or marketing agency doesn't need to sift through a decade of funding history for every company. Their primary goal is to identify and engage with recently funded startups that have immediate hiring and spending needs. For this use case, efficiency and signal quality are paramount. A tool that delivers curated, actionable leads directly into their workflow provides a far greater return on investment than a complex research terminal.

Key Factors for Your Final Decision

As you weigh your options, move beyond the feature checklists and ask these critical questions about your operational needs:

- Objective: Are you prospecting for new clients, conducting competitive analysis, performing due diligence for an investment, or recruiting top talent? Your primary goal will dictate the necessary data depth. For instance, a recruiter needs hiring trend data, while a VC needs valuation metrics.

- Workflow Integration: How will this tool fit into your team's daily routine? Do you need a platform with robust API access and CRM integrations, or is a weekly curated email digest more effective for your process? A high-volume sales team needs CRM sync, while a solo consultant might prefer a simple CSV.

- Signal vs. Noise: How much time can your team afford to spend filtering and qualifying data? For many, the raw, unfiltered firehose of a massive database creates more work, not less. Evaluate whether a curated, high-intent list is more valuable than an exhaustive but noisy dataset.

- Budget and ROI: Consider the total cost of ownership, including the time your team will spend using the platform. A lower-cost tool that requires significant manual effort can be more expensive in the long run than a specialized service that delivers ready-to-use opportunities. Calculate the cost per qualified lead, not just the monthly subscription fee.

Ultimately, selecting the right startup company database is an investment in your growth engine. By carefully matching a platform's strengths to your unique strategic needs, you transform a simple data repository into a powerful, proactive tool that fuels your pipeline and accelerates your success.

Tired of sifting through noisy, outdated databases to find your next client? FundedIQ eliminates the manual work by delivering a curated list of the most promising, recently funded startups directly to your inbox every week. Stop researching and start connecting by trying FundedIQ today.