The 12 Best Startup Funding Database Platforms of 2025

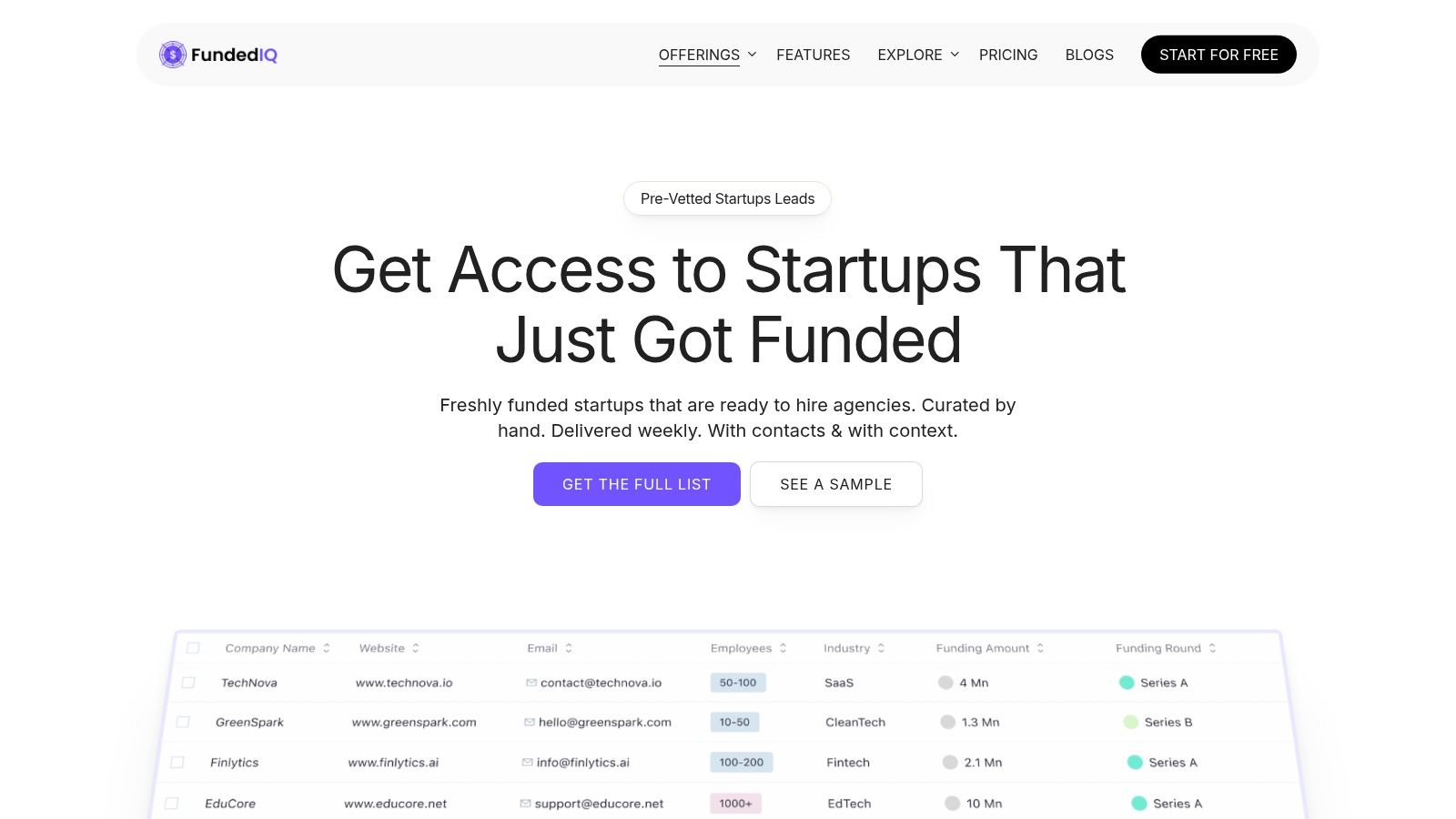

- 1. FundedIQ

- 2. Crunchbase

- 3. PitchBook

- 4. CB Insights

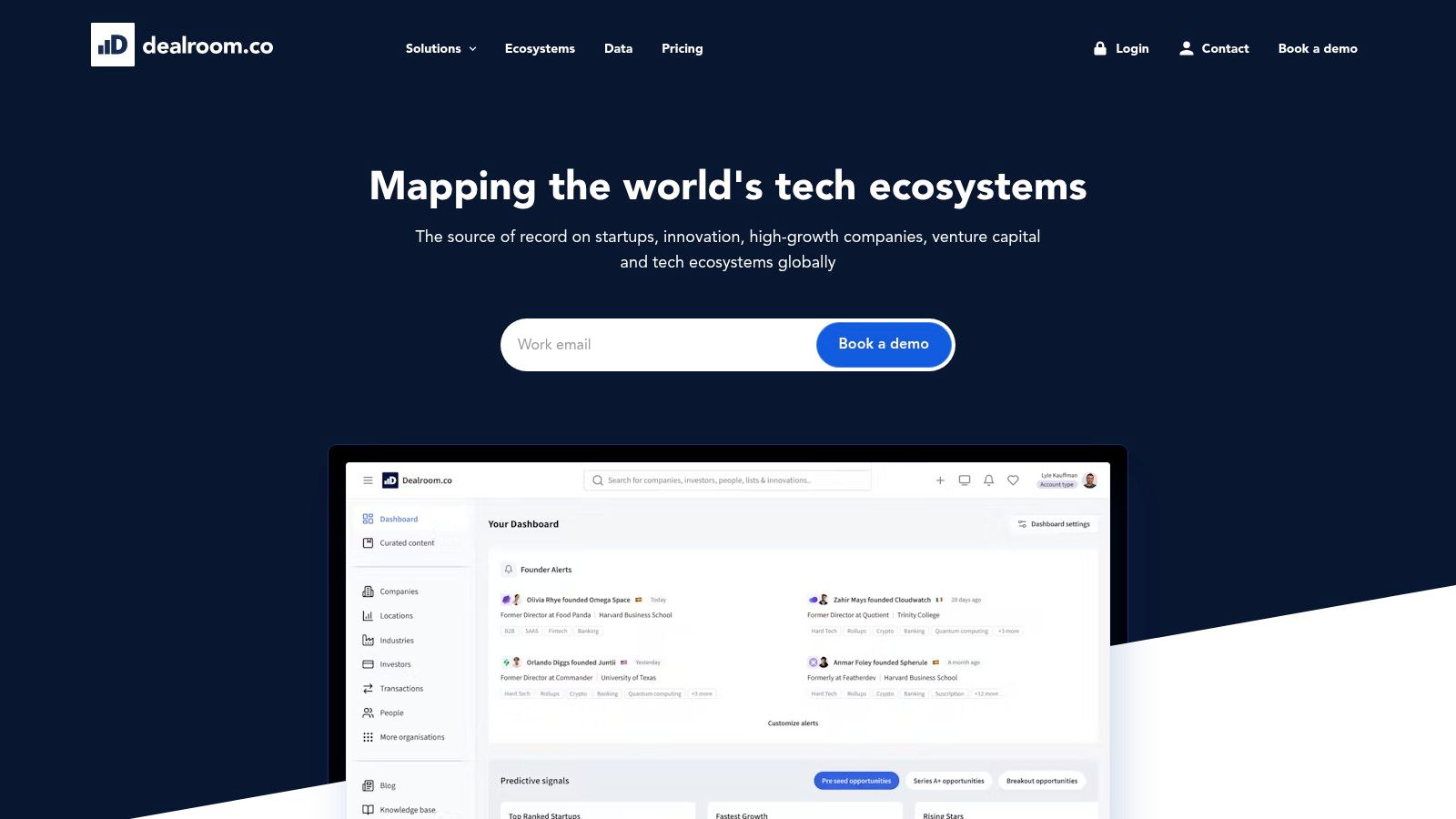

- 5. Dealroom

- 6. Tracxn

- 7. Fundz

- 8. Gust (Investor Directory + Startup Ops Suite)

- 9. Signal by NFX

- 10. OpenVC

- 11. Grants.gov (US Federal Grants Portal)

- 12. SBIR.gov (US SBIR/STTR Programs)

- 12 Startup Funding Database Comparison

- Making Your Data Actionable: The Final Step

In today's competitive landscape, securing capital or finding high-value clients requires more than just a good idea-it demands precision, timing, and intelligence. For context, global venture funding reached over $285 billion in 2023, spread across tens of thousands of deals. The right startup funding database can transform your approach to tapping into this capital, turning a scattergun effort into a surgical strike. These platforms are no longer just static lists of investors; they are dynamic ecosystems tracking capital flow, identifying growth signals, and revealing key decision-makers.

This guide moves beyond marketing hype to provide a practical, comparative overview of the best tools available. We'll analyze 12 leading platforms, from enterprise-grade behemoths like PitchBook to nimble, niche tools perfect for lead generation. For those specifically targeting non-dilutive funding, understanding what a grant research database is and its unique function is a critical first step.

Each entry includes a direct link, screenshots, and an honest assessment of its strengths and limitations. Our goal is to help you choose the platform that aligns perfectly with your specific needs-whether you're a founder seeking investment, an agency hunting for freshly-funded clients, or an analyst mapping market trends. Let's dive into the options that will give you a decisive strategic advantage.

1. FundedIQ

FundedIQ distinguishes itself in the startup funding database landscape by moving beyond raw data to deliver curated, actionable intelligence. It is specifically engineered for agencies and service providers aiming to engage with recently funded startups at the precise moment they are poised for rapid scaling and have the capital to invest. For example, a startup that just closed a $5 million Series A is likely to increase its marketing budget by 30-50% within the next quarter, making it a prime target for a marketing agency. Instead of forcing users to sift through vast, unverified datasets, FundedIQ provides a weekly-refreshed list of hand-curated leads, complete with comprehensive company profiles, funding details, and key decision-maker contacts.

What sets this platform apart is its emphasis on signal intelligence. Subscribers gain access to enriched data points like tech stacks, hiring surges, and ad spend estimates, allowing for hyper-personalized outreach. By aggregating contact information from over 15 premium vendors, FundedIQ significantly boosts email deliverability, a common pain point with other databases. This focus on accuracy and timing empowers users to craft relevant proposals that land in the right inboxes.

Key Strengths & Use Cases

- High-Intent Lead Generation: Ideal for growth, creative, or recruitment agencies looking for clients with a demonstrated need and budget for expansion. A practical example would be a PR agency filtering for B2B SaaS companies that just raised a Series A, as this is a common trigger for seeking media exposure.

- Data Accuracy: Manually verified leads and multi-source contact aggregation (claiming up to 40% more reachable emails) maximize campaign effectiveness and ROI.

- Timeliness: Weekly updates ensure users are acting on the most recent funding announcements, a critical advantage in a fast-moving market.

Platform Considerations

The platform's primary strength is also its main limitation: its tight focus on recently funded startups may not suit users targeting bootstrapped companies or mature enterprises. Access is managed through a straightforward monthly subscription of $47, with no long-term contracts and a 60-day money-back guarantee, making it a low-risk, high-reward tool for targeted business development. For those preparing to engage with these companies, FundedIQ also offers resources like its due diligence checklist template to help structure the evaluation process.

2. Crunchbase

Crunchbase is arguably the most recognized name in the startup funding database landscape, known for its comprehensive coverage of over 75 million users and millions of companies. Its user-friendly interface makes it an excellent starting point for founders, sales teams, and investors needing to quickly research a company's funding history, identify key investors, or build lead lists. The platform excels at providing high-level, actionable intelligence with features like AI-powered search and trend signals that highlight companies gaining momentum.

Its real power lies in its accessibility and integration capabilities. Unlike more complex platforms, a solo founder or a small sales team can onboard quickly and start leveraging its data for prospecting. With powerful integrations for CRMs like Salesforce and outreach tools, you can seamlessly push targeted company lists directly into your sales pipeline. A deeper dive into finding company information on Crunchbase shows how to maximize these features for efficient lead generation.

Key Features & Use Cases

- Best For: Sales teams, marketers, and founders needing quick, reliable funding data for prospecting and market research.

- Unique Feature: The "signals" and AI-driven summaries provide quick insights into a company's growth trajectory, leadership changes, and recent funding activity without deep manual analysis.

- Practical Tip: Use the "Saved Lists" and "Alerts" feature to track a portfolio of competitors or potential leads. For instance, set an alert for any AI company in Germany that raises over €2 million. You'll get email notifications when they raise a new round, get acquired, or have a major leadership change.

| Feature | Details |

|---|---|

| Pricing | Limited free version; paid plans start at $29/user/month (Starter). |

| Data Depth | Strong on funding, investors, and acquisitions; less granular on financials. |

| Ease of Use | Very intuitive; ideal for users new to data platforms. |

| Primary Limitation | Contact data and advanced CSV exports often require higher-tier plans. |

| Website | https://www.crunchbase.com |

3. PitchBook

PitchBook is the institutional-grade standard in the private markets, offering an incredibly deep startup funding database used by venture capitalists, investment bankers, and corporate development teams. It tracks over 3.5 million companies and 1.7 million deals. It provides granular data not just on funding rounds but also on deal terms, valuations, limited partners (LPs), and fund performance. Its reputation is built on the accuracy and breadth of its data, which is meticulously researched and verified by an in-house team. This makes it an indispensable tool for serious financial analysis and due diligence.

The platform's real advantage is its comprehensive view of the entire private capital lifecycle, from angel investment to private equity buyouts. Users can build complex screens to identify specific investment targets, analyze market trends with pre-built reports, and even integrate data directly into Excel and PowerPoint for custom modeling and presentations. While its price point places it out of reach for most individual founders, for professional investors and M&A advisors, the depth of its data provides an unmatched competitive edge.

Key Features & Use Cases

- Best For: Venture capital firms, investment bankers, private equity funds, and corporate strategy teams requiring institutional-quality private market intelligence.

- Unique Feature: The platform's extensive data on Limited Partners (LPs) and fund performance metrics allows users to analyze the investors behind the investors, a critical layer for fundraising and competitive analysis.

- Practical Tip: Use the Excel plugin to pull raw data directly into your financial models. For example, you can create a model that automatically updates with the latest pre-money valuations for SaaS companies in a specific region, saving hours of manual data entry and allowing you to create dynamic dashboards.

| Feature | Details |

|---|---|

| Pricing | Premium, contract-based pricing (typically starting in the five figures annually). |

| Data Depth | Extremely high; includes valuations, deal terms, LP data, and fund performance. |

| Ease of Use | Moderate learning curve; built for financial professionals familiar with complex data. |

| Primary Limitation | High cost makes it inaccessible for early-stage startups, freelancers, or individual users. |

| Website | https://pitchbook.com |

4. CB Insights

CB Insights moves beyond a simple startup funding database, positioning itself as a market intelligence platform for enterprise clients. It combines deep private company data with proprietary research, predictive analytics, and market maps, making it ideal for corporate strategy, M&A teams, and venture capitalists who need to anticipate market trends, not just react to them. For example, a corporation could use CB Insights to track emerging competitors in the quantum computing space long before they become mainstream news. The platform is less about quick lookups and more about in-depth, forward-looking analysis to spot emerging industries and technologies.

Its strength is its analytical rigor and proprietary scoring models. Instead of just presenting raw funding data, CB Insights applies algorithms like the Mosaic score (predicting company health) and Exit Probability scores to help users identify high-potential companies. A detailed look into its role as a venture capital database highlights how its predictive tools are used for deal sourcing and competitive intelligence, offering insights that are difficult to replicate with other tools.

Key Features & Use Cases

- Best For: Enterprise corporate strategy, M&A teams, and institutional investors needing predictive analytics and in-depth market research.

- Unique Feature: The "Mosaic Score" and other predictive models that analyze non-traditional signals (hiring, web traffic, media sentiment) to forecast a private company's future success.

- Practical Tip: Use the "Collections" feature to build and share market maps and analysis on specific technology trends, like AI in healthcare or the future of fintech, to support strategic decision-making. These can be used in board presentations to visually demonstrate market shifts and justify strategic investments.

| Feature | Details |

|---|---|

| Pricing | Enterprise-level pricing, typically starting in the tens of thousands annually. |

| Data Depth | Very strong on predictive analytics, market trends, and proprietary research. |

| Ease of Use | Steeper learning curve; designed for trained analysts, not casual users. |

| Primary Limitation | High cost makes it inaccessible for startups, small agencies, or individuals. |

| Website | https://www.cbinsights.com |

5. Dealroom

Dealroom has carved out a unique space in the startup funding database market with its strong focus on ecosystem intelligence, particularly within Europe. While it provides robust company and funding data, its primary differentiator is its ability to map entire startup ecosystems for governments, VCs, and corporations. For instance, a government agency might use Dealroom to create a real-time dashboard of the Amsterdam tech scene, tracking job creation, funding, and sector growth. This makes it an invaluable tool for understanding market landscapes, identifying regional trends, and discovering emerging tech hubs. Its transparent, tier-based pricing and hands-on onboarding support from its Intelligence Unit are designed for more strategic, data-intensive use cases.

The platform offers unlimited search capabilities on its paid plans, empowering users to perform deep dives without hitting data caps. This is especially beneficial for teams conducting large-scale market analysis or building comprehensive competitor landscapes. While its US coverage is solid, its real strength lies in its granular European data, making it the go-to choice for anyone operating or investing heavily in that region.

Key Features & Use Cases

- Best For: VCs, corporate development teams, and government entities focused on market mapping and ecosystem analysis, especially in Europe.

- Unique Feature: The "Ecosystem Maps" provide a powerful visual and data-driven overview of a specific city, country, or industry, including key players, funding trends, and growth metrics.

- Practical Tip: Leverage the platform’s curated reports and intelligence briefs on specific industries or regions. For example, before expanding into a new European market, you can download Dealroom's report on the local fintech ecosystem to get pre-packaged insights that can save hours of manual research.

| Feature | Details |

|---|---|

| Pricing | Packages are tiered based on features and seat limits, with pricing in Euros. |

| Data Depth | Exceptional for European companies and ecosystem-level data; strong global coverage. |

| Ease of Use | Intuitive for data exploration but requires more setup for API integrations. |

| Primary Limitation | Can be more expensive than competitors for smaller teams; US data may be less detailed. |

| Website | https://dealroom.co |

6. Tracxn

Tracxn positions itself as a comprehensive, VC-grade research platform, offering deep dives into company data, funding rounds, and sector-specific landscapes. It stands out with its extensive global coverage, tracking millions of companies, which makes it a powerful startup funding database for international market analysis. The platform is built for granular research, allowing users to explore niche sectors and emerging trends with a level of detail that appeals to investors, M&A teams, and corporate development professionals.

Unlike platforms focused solely on high-level data, Tracxn provides curated reports and a highly detailed taxonomy system. This allows users to quickly understand a specific market vertical, identify key players, and track deal flow with precision. For example, you can drill down into a sub-sector like "AI-powered drug discovery platforms" and instantly see the top-funded companies, recent deals, and key investors. While its pricing is less transparent and geared toward enterprise clients, the free "Lite" tier provides a valuable opportunity to test the depth of its data before committing to a premium plan, which unlocks features like data exports, API access, and analyst support.

Key Features & Use Cases

- Best For: Venture capitalists, corporate M&A teams, and market researchers needing detailed, sector-specific global data.

- Unique Feature: Its granular, sector-based taxonomy and curated "Soonicorn" (soon-to-be-unicorn) tracker provide forward-looking insights not easily found elsewhere.

- Practical Tip: Use the platform’s curated industry landscapes and reports to quickly get up to speed on a new market. For instance, if you are considering an investment in the cultivated meat sector, the Tracxn report can provide a comprehensive overview in minutes, covering key players, funding trends, and technological milestones.

| Feature | Details |

|---|---|

| Pricing | Limited free "Lite" plan available; premium pricing is quote-based. |

| Data Depth | Excellent for global coverage and detailed sector landscapes; broad scope. |

| Ease of Use | More complex than entry-level tools; built for professional researchers. |

| Primary Limitation | Pricing is not publicly listed, and lower-tier plans have export limits. |

| Website | https://tracxn.com |

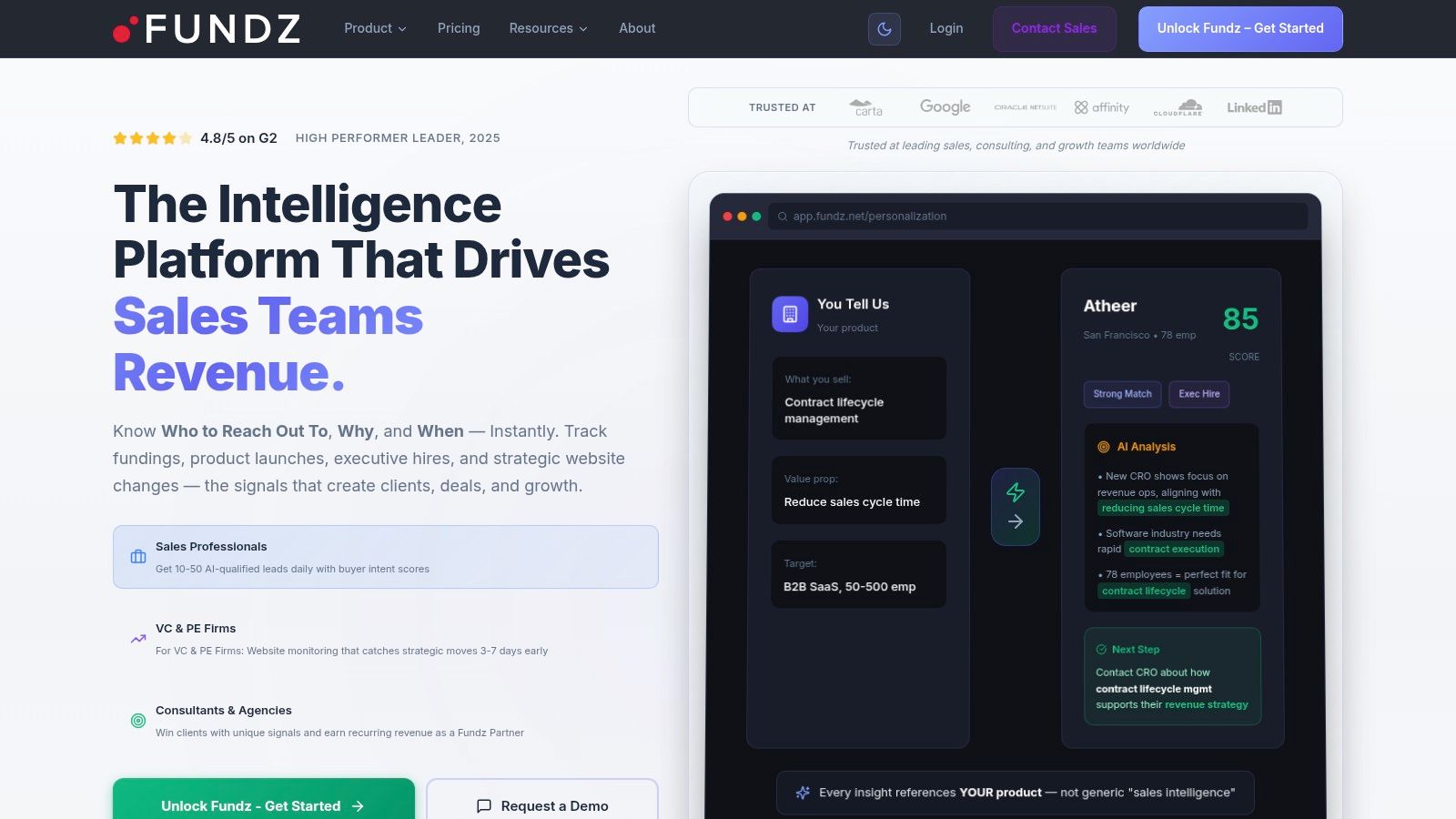

7. Fundz

Fundz is a specialized startup funding database designed for action-oriented sales and marketing teams who need real-time, trigger-based alerts. Instead of focusing on deep historical analysis, it excels at providing immediate notifications for events like new funding rounds, acquisitions, leadership hires, and product launches. This makes it an invaluable tool for teams looking to capitalize on "timing," reaching out to companies the moment a significant growth signal occurs.

The platform is built around a simple, powerful workflow: receive an alert, access key company and contact details, and push that lead directly into your CRM. With integrations for Slack, webhooks, Salesforce, and HubSpot, it streamlines the process from signal to outreach. Its affordability and focus on actionable triggers make it a practical alternative to more complex, enterprise-level databases for teams that prioritize speed and efficiency in their prospecting efforts.

Key Features & Use Cases

- Best For: Sales development reps (SDRs) and marketing teams who need timely, actionable funding alerts for trigger-based outreach.

- Unique Feature: The real-time notification system, delivered via a Chrome extension, Slack, or email, is its core strength, ensuring you're one of the first to know about key company events.

- Practical Tip: Configure your Slack integration with specific keywords (e.g., "AI," "SaaS," "Series A") to create dedicated channels that feed your sales team highly relevant, real-time leads throughout the day. This turns a passive tool into an active, automated lead generation engine.

| Feature | Details |

|---|---|

| Pricing | Offers a free trial; paid plans start from $79/user/month (Fundz Pro). |

| Data Depth | Strong on recent funding events and executive contacts; less historical data. |

| Ease of Use | Very straightforward; designed for immediate action and minimal learning curve. |

| Primary Limitation | Lacks the deep analytical tools and comprehensive historical data of larger platforms. |

| Website | https://www.fundz.net |

8. Gust (Investor Directory + Startup Ops Suite)

Gust occupies a unique space in the startup funding database world by combining an investor directory with a suite of operational tools for founders. It’s less of a pure data-sourcing platform and more of an end-to-end solution for early-stage companies. Founders can use it to incorporate their business, manage their cap table, and then directly apply to angel investor groups and accelerators that use the Gust platform for their application intake, creating a streamlined fundraising workflow.

The platform's key distinction is this direct application pipeline. Instead of just finding investor names, you build a company profile and submit it to over 800 investor organizations within their network. This integrated approach simplifies the administrative burden of fundraising, allowing founders to manage legal documents like SAFEs and NDAs alongside their investor outreach efforts. It is particularly valuable for first-time founders who need guidance and tools for foundational company setup.

Key Features & Use Cases

- Best For: First-time founders needing an all-in-one platform for incorporation, cap table management, and applying to angel groups.

- Unique Feature: Direct application workflows to a network of angel groups and accelerators, turning the database into an active fundraising tool.

- Practical Tip: Complete your Gust company profile thoroughly before applying. Since many investors on the platform use it as a primary screening tool—reviewing dozens of applications per week—a detailed and professional profile with clear traction metrics significantly increases your chances of getting noticed.

| Feature | Details |

|---|---|

| Pricing | Free to create a company profile; Gust Launch (ops suite) starts at $300/year. |

| Data Depth | Focused on investor groups in its network, not the entire venture universe. |

| Ease of Use | Functional, though the interface and documentation can feel less modern. |

| Primary Limitation | The investor directory is not comprehensive; it's limited to organizations using Gust. |

| Website | https://gust.com |

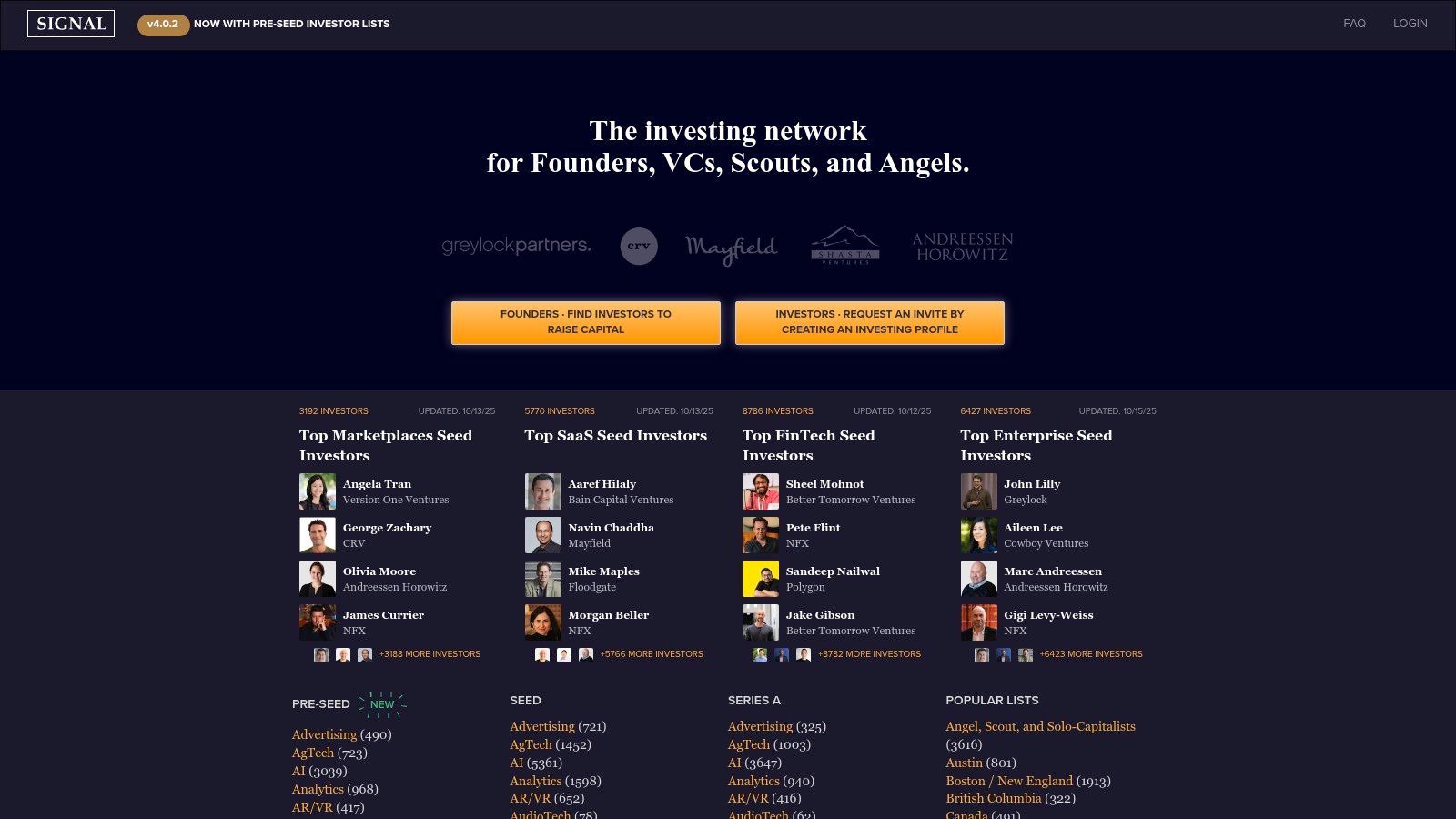

9. Signal by NFX

Signal by NFX is not a traditional startup funding database but rather a specialized, free tool designed for a singular purpose: connecting early-stage US founders with the right investors. It functions as a highly curated, searchable directory of VCs and angel investors, focusing on creating pathways for warm introductions. Instead of just listing historical funding rounds, Signal helps founders build a targeted list of investors based on their stage, sector, and location, then identifies shared connections to facilitate a warmer first contact.

The platform’s real value is in its founder-centric workflow and emphasis on quality over quantity. By providing "firm quality signals" and mapping out introduction routes, it moves beyond the cold outreach dynamic common with larger databases. It’s an indispensable resource for pre-seed and seed-stage founders navigating their first fundraising efforts, giving them a strategic edge in a crowded market where a warm intro can increase response rates by over 10x.

Key Features & Use Cases

- Best For: Early-stage US-based founders looking to build a targeted investor list and find warm introduction pathways.

- Unique Feature: The warm introduction mapper is its core differentiator, identifying shared contacts between a founder and a target investor to avoid cold emails.

- Practical Tip: Before starting your outreach, use Signal to map your entire professional network against your target investor list. You may discover surprising connections through colleagues, advisors, or past investors that can provide a powerful introduction. This simple step can be the difference between a reply and an ignored email.

| Feature | Details |

|---|---|

| Pricing | Completely free for founders. |

| Data Depth | Focused on investor profiles, firm details, and intro paths; not deals data. |

| Ease of Use | Very simple and intuitive, with a clear focus on the matchmaking workflow. |

| Primary Limitation | Limited to the US market and not a comprehensive company research tool. |

| Website | https://signal.nfx.com |

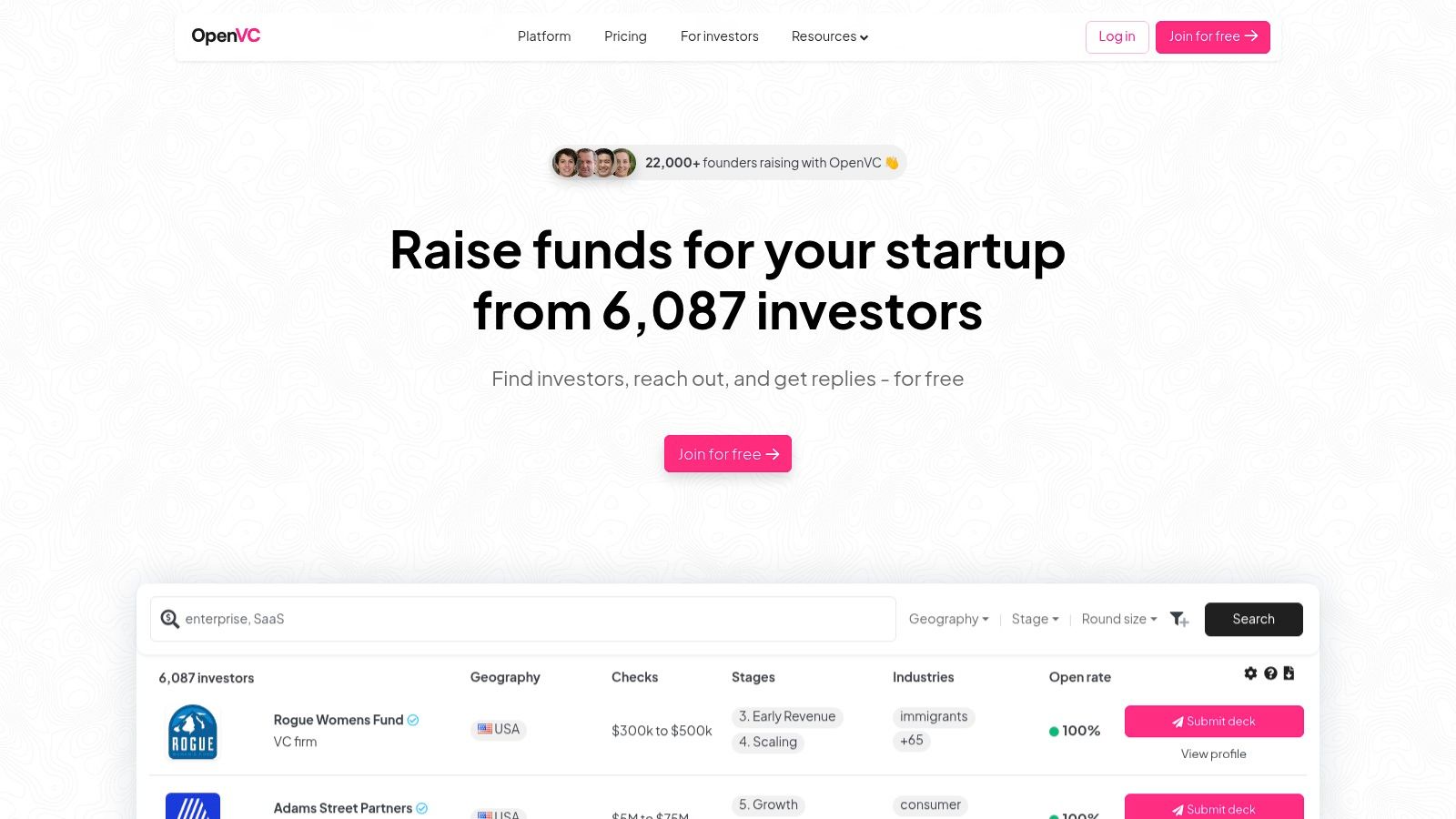

10. OpenVC

OpenVC positions itself as a founder-first fundraising tool, moving beyond a simple list of investors to offer a complete workflow management system. It provides a free, community-driven database of over 20,000 verified investors, allowing founders to search by investment thesis, stage, and geography. Its core value is in democratizing access to venture capital contacts, which are often hidden behind expensive paywalls or require established networks.

The platform is more than just a startup funding database; it integrates practical tools like a fundraising CRM to track investor conversations, pitch deck analytics to see who is engaging with your materials, and an intro finder. This combination makes it a powerful, all-in-one solution for early-stage founders managing their first fundraising process on a tight budget. It streamlines the entire outreach and follow-up sequence in one place.

Key Features & Use Cases

- Best For: Early-stage founders who need a free, actionable investor list combined with tools to manage their fundraising outreach.

- Unique Feature: The integrated "Intro Finder" helps you discover mutual connections with investors, facilitating warm introductions rather than cold outreach.

- Practical Tip: Use the pitch deck analytics to gauge investor interest. If a VC views your deck multiple times or spends more than three minutes on your "Team" or "Traction" slides, that's a strong signal of interest. Prioritize them for a follow-up.

| Feature | Details |

|---|---|

| Pricing | Core investor database is free; paid plans offer premium CRM features. |

| Data Depth | Focuses on investor contact info and thesis; less on company funding data. |

| Ease of Use | Extremely intuitive; designed specifically for a founder's workflow. |

| Primary Limitation | Data is community-driven, requiring users to verify investor fit. |

| Website | https://www.openvc.app |

11. Grants.gov (US Federal Grants Portal)

For founders seeking non-dilutive capital, Grants.gov serves as the centralized, official portal for all federal grant opportunities in the United States, with an average of over $500 billion in grants awarded annually. While not a traditional startup funding database focused on venture capital, it is an indispensable resource for startups in sectors like deep tech, biotech, energy, and defense. The platform provides a searchable database of grants from major agencies like the Department of Energy, National Institutes of Health (NIH), and the Department of Defense.

Its primary function is to act as a single access point for finding and applying for over 1,000 grant programs offered by 26 federal agencies. The platform's "Workspace" feature is designed to help teams collaborate on the complex grant application process, which often involves significant paperwork and adherence to strict guidelines. Navigating this ecosystem requires patience, but the payoff is access to significant capital without surrendering equity, making it a powerful alternative to traditional fundraising.

Key Features & Use Cases

- Best For: R&D-heavy startups in sectors like health, energy, defense, and manufacturing pursuing non-dilutive government funding.

- Unique Feature: It is the single, authoritative source for all discretionary grants offered by the U.S. federal government, ensuring comprehensive and legitimate listings.

- Practical Tip: Register on both SAM.gov and Grants.gov well in advance of any deadline. The registration and validation process can take several weeks, and you cannot submit an application without it. Missing a deadline because of this administrative hurdle is a common and avoidable mistake.

| Feature | Details |

|---|---|

| Pricing | Completely free to use. |

| Data Depth | Extremely detailed grant descriptions, eligibility criteria, and deadlines. |

| Ease of Use | Complex; the user interface and application process have a steep learning curve. |

| Primary Limitation | The application process is bureaucratic and time-consuming, not ideal for fast-moving startups needing quick capital. |

| Website | https://www.grants.gov |

12. SBIR.gov (US SBIR/STTR Programs)

SBIR.gov is the official portal for the U.S. government's Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, often called "America's Seed Fund." This is not a traditional venture capital platform but a critical startup funding database for deep-tech and R&D-focused businesses seeking non-dilutive capital. With over $4 billion awarded annually, it serves as a central hub for finding grant and contract opportunities from federal agencies like the Department of Defense, NASA, and the National Institutes of Health, making it an essential resource for companies innovating in high-impact sectors.

The platform's value comes from its direct access to federal solicitations and a comprehensive, searchable database of historical awards. Founders can analyze which agencies fund technologies similar to theirs and identify successful companies in their space. While the user interface is functional rather than flashy, the availability of bulk data downloads and public APIs allows for sophisticated analysis and integration into internal research workflows.

Key Features & Use Cases

- Best For: Deep-tech, scientific, and R&D-heavy startups looking for non-dilutive government funding.

- Unique Feature: The public APIs and bulk data download capabilities allow for advanced, large-scale analysis of federal R&D funding trends, awarded companies, and agency priorities.

- Practical Tip: Use the "Awards" search to research companies that have previously won grants in your technology area. Analyze their project abstracts and company profiles to understand what makes a proposal successful and identify potential partners or competitors.

| Feature | Details |

|---|---|

| Pricing | Completely free to use. |

| Data Depth | Excellent for government grants, solicitations, and awardee information. |

| Ease of Use | Functional and data-rich, but requires some effort to navigate effectively. |

| Primary Limitation | Does not cover private-sector funding; APIs can occasionally be unavailable. |

| Website | https://www.sbir.gov |

12 Startup Funding Database Comparison

| Solution | Core Features & Data | User Experience & Quality ★ | Value Proposition & Price 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 FundedIQ | Hand-curated startup leads, enriched profiles, real-time buying signals | ★★★★★ Manual validation & GDPR compliant | 💰 $47/mo flat fee, no contract, 60-day guarantee | Growth, creative, content & recruitment agencies | ✨ 40% more reachable emails, weekly fresh leads |

| Crunchbase | Funding & company profiles, AI summaries, integrations | ★★★★ Easy onboarding, strong integrations | 💰 Freemium + paid add-ons | Solo users, small teams | ✨ AI-powered trend signals |

| PitchBook | Deep private market data, Excel/PowerPoint integration | ★★★★★ Institutional-grade quality | 💰 High, contract pricing | Professional funds, bankers | ✨ Extensive global datasets |

| CB Insights | Predictive analytics, proprietary scoring models | ★★★★ Enterprise-grade security & research | 💰 Premium enterprise pricing | Enterprise clients | ✨ Forward-looking analytics |

| Dealroom | Global startup & ecosystem mapping, API access | ★★★★ Good onboarding, transparent tiers | 💰 Tiered pricing (EUR), onboarding | Governments, corporates, VCs | ✨ Strong European market focus |

| Tracxn | 4.9M+ companies, sector taxonomy, alerts | ★★★★ Broad dataset, analyst support | 💰 Sales-driven, less public pricing | VC firms, analysts | ✨ Free Lite tier to trial dataset |

| Fundz | Real-time alerts, executive contacts, CRM export | ★★★ Practical, trigger-driven workflows | 💰 Affordable vs enterprise platforms | Sales & outreach teams | ✨ Slack/webhook alerts, CRM integrations |

| Gust | Investor directory + startup ops suite | ★★★ Integrated platform, direct applications | 💰 N/A (varied services) | Startups, investors | ✨ Incorporation + fundraising tools |

| Signal by NFX | Free investor matching, warm intro routes | ★★★ Free, founder-friendly | 💰 Free | Early-stage US founders | ✨ Warm intros, firm quality signals |

| OpenVC | Public investor list, pitch analytics, outreach tools | ★★★ Practical fundraising utilities | 💰 Free core + paid upgrades | Founders, startups | ✨ Verified investors + CRM features |

| Grants.gov | US federal grants database | ★★★ Authoritative & comprehensive | 💰 Free | US startups pursuing non-dilutive capital | ✨ Official gov portal with training & workspace |

| SBIR.gov | US SBIR/STTR funding & awards data | ★★★ Central R&D funding source | 💰 Free | US R&D startups | ✨ API access + bulk data downloads |

Making Your Data Actionable: The Final Step

Navigating the landscape of startup funding databases can feel overwhelming. We've explored a wide spectrum of platforms, from the enterprise-grade behemoths like PitchBook and CB Insights to the community-driven accessibility of Signal by NFX and OpenVC. The key takeaway is that the "best" database is not a universal title; it is entirely dependent on your specific mission, budget, and operational workflow.

Your choice is the first domino. The real challenge, and where true value is unlocked, lies in converting raw data into strategic action. A list of 10,000 recently funded companies is just noise until you have a system to filter, prioritize, and engage with the right contacts within those organizations.

Matching the Tool to the Task

To make a confident decision, distill your primary objective. Are you a B2B agency aiming to find high-growth clients who just secured capital and have a budget to spend? Your needs are fundamentally different from a pre-seed founder looking for their first angel investor.

-

For High-Volume B2B Lead Generation: If your goal is to consistently identify and engage with recently funded companies, prioritize platforms that offer advanced filtering, real-time alerts, and curated data. Tools like FundedIQ and Fundz are purpose-built for this, focusing on the signal of a recent funding event to identify companies with immediate purchasing power. Crunchbase, with its robust API, also serves this use case well for teams with development resources.

-

For Founder-Led Investor Outreach: Founders need to prioritize precision over volume. The goal isn't to blast 1,000 investors but to build a hyper-targeted list of 50 who are genuinely aligned with your stage, sector, and thesis. Community-driven platforms like Signal by NFX and OpenVC excel here, offering "warm introduction" pathways and a focus on investor-founder fit. Crunchbase remains a solid, budget-friendly option for initial research.

-

For Deep Market Intelligence & Diligence: If your work requires comprehensive market maps, competitive analysis, or M&A research, the investment in platforms like PitchBook, Dealroom, or CB Insights becomes justifiable. Their extensive historical data, detailed transaction information, and analyst reports provide a level of depth that simpler tools cannot match.

From Data to Dialogue

Once you've identified your targets, the next step is building the bridge to a conversation. After utilizing these databases to identify promising investor leads, the next critical step for founders is often lead enrichment, particularly learning how to find business emails in bulk to build a direct and scalable outreach list. Remember, the data is merely the starting point. The true goal is to initiate meaningful relationships that lead to investment, partnerships, or sales.

Ultimately, the most powerful startup funding database is the one you integrate into a repeatable, efficient process. It's the one that moves from a "list" to a living part of your growth engine. Choose the tool that best fits your core objective, commit to mastering its features, and start turning data into the conversations that will fuel your future.

Tired of sifting through stale data to find your next client? FundedIQ delivers a curated feed of recently funded startups, complete with decision-maker contacts, so you can stop researching and start selling. Try FundedIQ today and connect with companies ready to invest in growth.