Your Guide to a Venture Capital Database

- What a Venture Capital Database Actually Does

- Key Features That Power Your Fundraising Strategy

- Mapping the Global Venture Capital Landscape

- How to Choose the Right Venture Capital Database

- Turning Database Insights Into Investor Meetings

- Using Database Analytics to Spot Investment Trends

- Common Questions About VC Databases

So, what exactly is a venture capital database? At its core, it's a specialized platform that gathers and neatly organizes a mountain of information on investors, VC firms, and the latest market movements. For instance, a quality database might contain detailed profiles on over 25,000 active VC funds and 100,000 individual partners, updated in near real-time.

Think of it less like a phonebook and more like a powerful sonar system for your fundraising journey. It turns the often-random search for capital into a data-driven, strategic mission, helping you zero in on the exact investors who are actively seeking a company just like yours.

What a Venture Capital Database Actually Does

Imagine you’re trying to find a very specific type of fish in a massive ocean, but all you have is a simple fishing rod. That’s what fundraising can feel like without the right tools—a lot of guessing and wasted time. A VC database is your advanced sonar, mapping the entire underwater landscape so you know precisely where to cast your line.

These platforms aren't just static lists of contacts; they are dynamic intelligence engines. They track the critical data points that signal an investor's real interests and current intentions, allowing you to go far beyond generic outreach and connect with VCs who are actually a great fit.

Moving Beyond Simple Contact Lists

A basic spreadsheet of investor names and emails goes stale almost the moment you create it. In fact, industry data suggests that up to 30% of contact information in a static list can become outdated within a single year due to job changes and fund restructuring. A proper VC database, on the other hand, gives you a living, breathing picture of the entire investment world.

- Investment Thesis Tracking: It shows you what industries, technologies, and business models a VC firm is focused on right now. You can instantly find funds that are specifically looking for, say, early-stage SaaS companies in the fintech space with an ARR between $500k and $2M.

- Portfolio Analysis: You can see every company a particular fund has already backed. This is huge—it stops you from wasting time pitching a VC who has already invested in one of your direct competitors, like trying to pitch Pepsi's venture arm if you're a new soda company.

- Funding Stage Specificity: The platform lets you filter investors by their preferred stage, whether it's pre-seed, Series A, or late-stage growth rounds. This ensures you're only talking to people who write the check size you actually need.

Among the many types of financial data sources, a venture capital database is unique, offering laser-focused insights specifically for private market investing and fundraising.

The Power of Actionable Intelligence

Ultimately, the entire point is to replace guesswork with informed strategy. Instead of blasting out cold emails to a list of 500 random VCs, you can build a highly curated list of 50 who have a proven track record of investing in companies just like yours. This data-first approach makes a massive difference in your efficiency and, more importantly, your success rate.

By looking at recent deals, you can spot investors who just raised a new fund and are hungry to deploy that capital. For example, if a firm announces a new $300 million fund, they are under pressure to make their first 5-10 investments within the next 12-18 months. This kind of timing is everything—it helps you focus your energy on the VCs who are in a position to invest right now.

Building this strategic foundation is the key to a much more effective fundraising campaign. It saves you hundreds of hours and connects you with the right partners who can genuinely help your startup take off.

Key Features That Power Your Fundraising Strategy

Let's be clear: not all VC databases are the same. Some are little more than glorified spreadsheets, while others are sophisticated intelligence platforms that can give you a serious edge. Think of it like the difference between a simple map and a live GPS with traffic alerts—one shows you the roads, but the other actually helps you navigate them efficiently.

The best platforms are designed to turn an overwhelming sea of data into clear, actionable insights. They help you shift from a scattergun "spray and pray" approach, which typically yields response rates below 1%, to a focused, surgical strategy that gets you in front of the right people.

Advanced Filtering and Segmentation

At its core, a powerful VC database must let you slice and dice the information with surgical precision. Forget scrolling through endless lists of investors who aren't a fit. You need the ability to build a hyper-targeted shortlist in minutes.

- Industry and Sector Focus: Is your startup in B2B SaaS? You should be able to filter for VCs who explicitly state that's their sweet spot. This stops you from wasting time pitching your MedTech company to an investor who only cares about consumer apps.

- Geographic Reach: You can narrow your search to investors in your local area to build face-to-face connections or go global to find funds that have a track record of investing in your specific region.

- Check Size and Stage: This is absolutely critical. A good filter ensures you’re talking to funds that can write the $2 million check you need for your Series A, not pre-seed investors who top out at $100k.

Real-Time Deal Flow and Alerts

The venture world moves at lightning speed. A database with stale, months-old information is practically useless. Top-tier platforms are dynamic, giving you a real-time pulse on market movements.

For instance, getting an alert when a fund in your sector closes a new round is a massive buying signal. It means they have fresh capital ready to deploy and are actively hunting for their next investment. This timing can be the difference between securing a meeting and hearing the dreaded, "Great idea, but we're not making new investments right now."

A top-tier venture capital database acts like a market radar, providing insights that prevent critical mistakes. The ability to quickly analyze an investor's current portfolio can stop you from pitching a VC who has already funded your main competitor—a move that would instantly disqualify you and waste valuable time.

Portfolio Analysis and Conflict Checking

Diving into an investor's existing portfolio is one of the most crucial parts of your homework. A good database simplifies this by giving you a clean, organized look at every company a fund has ever backed.

This feature is a game-changer. It helps you spot potential synergies—maybe they’ve invested in companies that could be future partners—and, more importantly, avoid direct conflicts of interest. Pitching a VC who has already funded your number one competitor is a rookie mistake, and a good database helps you sidestep it entirely.

Ultimately, these aren't just features; they're strategic tools. They help you move beyond guesswork and build a fundraising outreach that is intelligent, data-driven, and far more likely to succeed.

Below is a quick breakdown of the core features you should look for and the strategic advantage each one gives you in your fundraising journey.

Essential Features of a Top-Tier VC Database

| Feature | Description | Strategic Advantage |

|---|---|---|

| Advanced Filtering | The ability to search by industry, stage, check size, geography, and investment thesis. | Creates hyper-targeted investor lists, saving hundreds of hours and increasing response rates from <1% to over 5-10%. |

| Contact Information | Direct and verified email addresses and contact details for partners and key decision-makers. | Bypasses generic "info@" inboxes and gets your pitch directly in front of the right person. |

| Portfolio Company Data | A complete and searchable list of a fund's past and present investments. | Prevents pitching a competitor's investor and helps you find warm introduction pathways. |

| Real-Time Alerts | Automated notifications for new fundraises, exits, and investment activity in your sector. | Provides timely "buying signals" that show which investors have fresh capital and are ready to deploy. |

| Investment Thesis Analysis | Detailed summaries of what a fund looks for, including specific metrics and market trends. | Allows you to tailor your pitch to align perfectly with an investor's stated interests and criteria. |

Having a tool with these capabilities is like having an insider on your team, giving you the context and data needed to make every outreach count.

Mapping the Global Venture Capital Landscape

It’s easy to think your next investor is just around the corner, but in today's market, they might be an ocean away. If you only look for VCs in your city, you’re fishing in a small pond while a whole ocean of capital waits. A great venture capital database is your passport to that ocean, knocking down geographic walls and showing you a world of funding possibilities you never knew existed.

This isn’t just about having a longer list of names. It’s about building a truly global fundraising strategy instead of being stuck within your immediate network. Rather than guessing which international firms might be a good fit, you can zero in on investors who have a proven track record of backing companies just like yours, no matter where they're located.

Identifying Cross-Border Investment Patterns

A top-tier database does more than just list international VCs; it shows you exactly how they operate. You can trace cross-border investment patterns to see which firms are actively putting money to work outside of their own backyards.

Let's say you're a fintech founder in London. With a few clicks, you could filter for US-based VCs that have joined at least three Series A rounds for European fintech startups in the last 18 months. Suddenly, you have a targeted list of investors who have already shown they’re hungry for deals like yours. Your outreach is no longer a shot in the dark—it's a smart, well-researched introduction.

Keeping an eye on these global trends is key. The United States is still a powerhouse, but the landscape is always shifting. While Europe has cooled off a bit, emerging markets like India and Southeast Asia have become hotspots for specific sectors like fintech and mobility. Knowing this allows you to strategically target regions where investor appetite for your industry is currently highest.

Connecting with Corporate Venture Capital Arms

Traditional VCs aren't the only players in the game. A good database opens the door to corporate venture capital (CVCs)—the investment divisions of large corporations on the hunt for innovative startups that align with their business. CVCs were involved in deals representing about 36% of the total value in Q2 2025, so they are a serious source of funding.

A venture capital database helps you pinpoint CVCs whose parent companies are in your industry. For example, a logistics startup could identify and target the venture arms of major shipping companies like Maersk or UPS. A pitch to them isn't just about cash; it's about a strategic partnership that could unlock distribution channels, deep industry knowledge, and even a future acquisition.

This strategic fundraising angle is often missed without the right intelligence. A database maps out these corporate connections, helping you find CVCs that offer not just capital but also a major competitive edge. This is especially true for companies working with new tech, a topic we explore in our guide on venture capital for AI startups. When you use a database this way, you're not just looking for an investor—you're looking for a global partner.

How to Choose the Right Venture Capital Database

Picking the right venture capital database is one of the most critical moves you'll make when you start fundraising. It's kind of like choosing your co-pilot for a cross-country flight. The right one has the maps, knows the weather patterns, and keeps you on course. The wrong one? Well, you might just end up lost. The whole point is to find a platform that lines up with your startup’s specific stage, budget, and where you're trying to go.

First things first, where is your startup right now? An early-stage company, still running on ramen and sheer will, has completely different needs than a growth-stage business prepping for a massive Series B. If you're just starting out, a freemium or low-cost option is a perfect way to get the lay of the land without draining your bank account. But as you grow, you'll need deeper, more accurate, and up-to-the-minute data. At that point, investing in a heavy-duty, enterprise-level tool becomes a no-brainer.

Assess Your Fundraising Goals and Budget

Before you even think about signing up for a demo, you need to be brutally honest about what you need this database to do for you. Are you just trying to build a starting list of 100 potential investors? Or do you need sophisticated analytics to keep tabs on who’s funding your competitors?

Your budget is going to be a major deciding factor, of course. Paid platforms can start around $50 per month and go up to $500 per year or more, with the big enterprise solutions costing a whole lot more. But don't just fixate on the sticker price. Think about the value of your time. If a more expensive tool saves your team 20 hours a month of mind-numbing manual research, it’s probably already paid for itself.

Founders often get hung up on the sheer number of investors a database lists. This is a classic mistake. Quality beats quantity, every single time. A clean, accurate list of 5,000 active, relevant VCs is worth infinitely more than a bloated, outdated list of 100,000 contacts with a 40% email bounce rate.

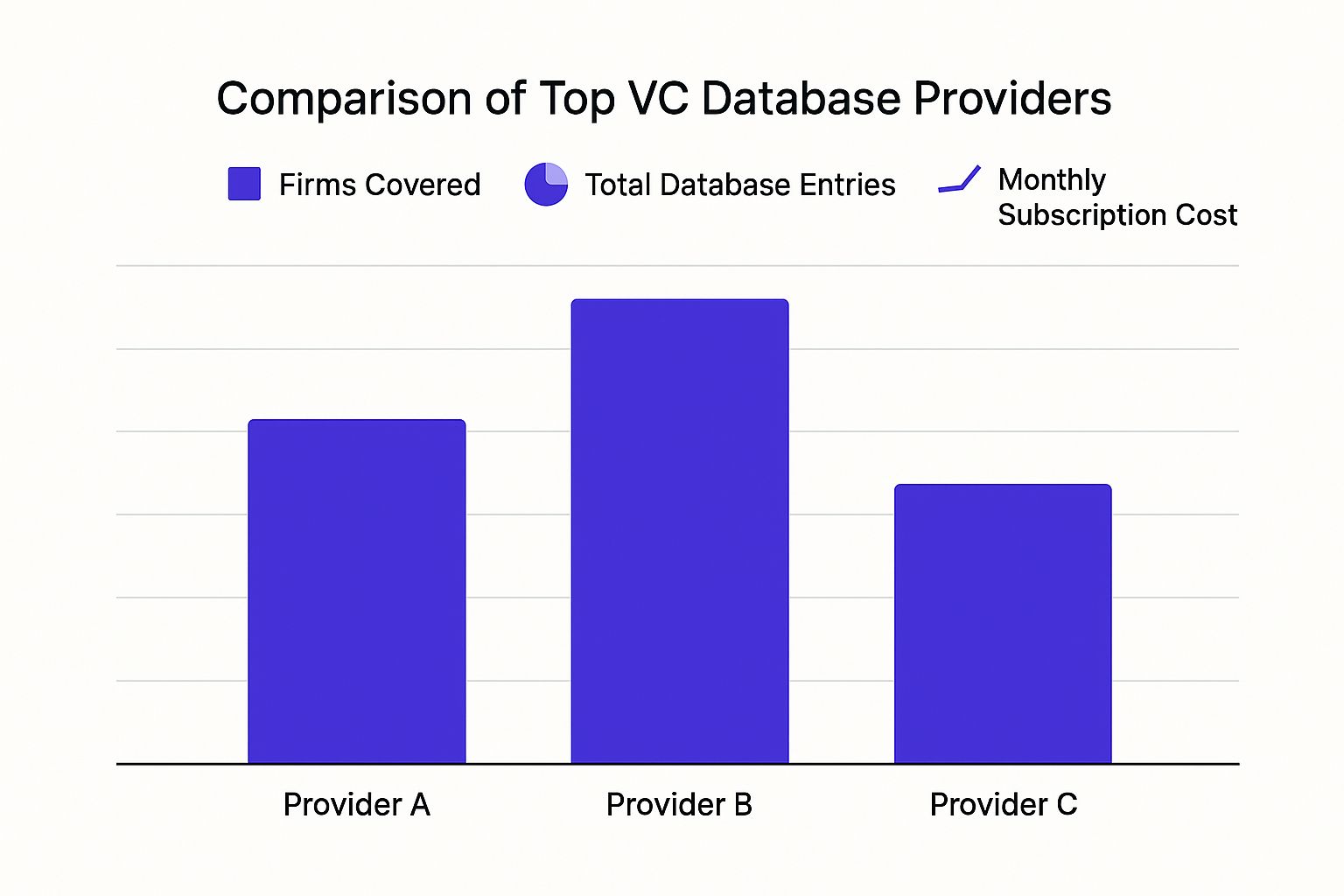

This graphic gives you a sense of how different types of providers stack up when it comes to features, the size of their database, and what they charge.

As you can see, a bigger price tag usually means a bigger dataset. But the best choice for you really depends on whether you need a massive ocean of data or a smaller, curated pool of high-quality leads.

To help you figure out what's right for your stage, let's break down the different tiers of VC databases you'll encounter.

Comparing Venture Capital Database Tiers

This table offers a comparative look at different types of VC databases to help startups select the right tool for their stage and budget.

| Database Tier | Typical User | Key Features | Price Range |

|---|---|---|---|

| Freemium/Basic | Early-stage founders, bootstrappers | Limited investor profiles, basic search filters, public data only | $0 – $50/month |

| Mid-Tier/Pro | Seed & Series A startups | Verified contacts, advanced filtering, deal flow alerts, some integration options | $50 – $250/month |

| Enterprise-Level | Growth-stage startups, VCs | Real-time data, API access, CRM integration, market trend analysis, dedicated support | $500+/month |

Ultimately, the goal is to match the tool to the task. An enterprise platform is overkill for a pre-seed company, while a basic tool will only hold back a company raising its Series C.

Run an Effective Trial Period

Almost every credible platform will let you take it for a spin with a free trial. Don't just kick the tires—put it through a serious workout. This is your chance to stress-test the tool against what you actually need to do.

Here’s a simple game plan for your trial:

- Build a Test List: Start by picking 10-15 VCs you already know are players in your industry.

- Verify Data Points: Look them up. Is the information about their portfolio companies, recent investments, and stated thesis correct? Check it against their firm’s website or recent news to see if it holds up.

- Test the Filters: Try to run a search for your absolute dream investor. Can you easily narrow things down by industry, the size of check they write, and where they're located?

- Evaluate Contact Info: Export a few contacts and see if they're legit. Bouncing emails are a huge red flag and a dead giveaway that the platform isn't maintaining its data. A good platform should have a bounce rate under 5%.

By the end of a good trial, you should feel confident that the platform is both accurate and easy to work with. Making this choice thoughtfully means you're not just buying another software subscription—you're getting a real partner for your fundraising journey.

Turning Database Insights Into Investor Meetings

Getting your hands on a quality venture capital database is like being given a key to a secret library. Suddenly, you have access to a world of information. But the real work isn't just having the key—it's knowing which books to read and how to use that knowledge to start a conversation that gets you in the door.

The goal isn't just to hoard a list of contacts. It's to kick off genuine conversations that lead to meetings and, fingers crossed, a term sheet. This means ditching the "spray and pray" approach and getting surgical. Every single email should feel like it was written just for them, backed by data that proves you've done your homework.

Building a Tiered Investor List

Don't just dump every potential investor into one giant spreadsheet. The smart move is to segment your prospects into tiers, which helps you focus your energy where it counts most.

Here’s a simple way to think about it:

- Tier 1: The Dream Investors: This is your A-list of 10-20 VCs who feel like a perfect match. Their investment thesis reads like your company's mission statement. These are the folks you'll spend the most time researching and crafting hyper-personalized outreach for.

- Tier 2: Strong Potential: This slightly larger group of 30-50 investors has a track record in similar or adjacent markets. They’re a great fit, and your outreach should still be very personal, even if it starts from a flexible template.

- Tier 3: Good Fit: This is your widest net. Based on your database filters, they're a solid match, but the connection might not be as immediately obvious. Your outreach can be a bit more streamlined here, but still thoughtful.

This tiered system ensures your most precious resource—your time—is invested in the opportunities with the highest chance of paying off.

Crafting Personalized and Data-Driven Outreach

Once your list is tiered, it’s time to reach out. Knowing how to conduct cold outreach effectively is what turns all that data into actual dialogue. The magic is in making each message feel personal, even when you're reaching out at scale.

Your opening line is everything. It needs to immediately show you've done your homework. Mention a recent investment they made, praise a portfolio company's latest milestone, or reference something they said in a podcast. This simple step will instantly set you apart from the 99% of generic emails flooding their inbox.

For instance, imagine you're a fintech startup. You could use your database insights to write something like this:

"Hi [Investor Name], I saw your recent investment in FinTech Innovators and was really impressed by their mission to democratize financial data. At [Your Startup], we're tackling a similar challenge but for the B2B space…"

See the difference? It's specific, respectful, and shows you understand their world.

The market is buzzing right now, so timing is everything. In the first half of 2025 alone, global venture capital funding jumped 25% to $189.93 billion. Investors are busy, but they are absolutely looking for the right deals.

Moving from data crunching to relationship building is a crucial part of the https://fundediq.co/venture-capital-funding-process/. When you use the intel from a VC database to guide your strategy, you stop playing a numbers game and start having the strategic conversations that actually lead to funding.

Using Database Analytics to Spot Investment Trends

A great venture capital database is so much more than a glorified contact list. Think of it less like a phone book and more like a real-time window into the market’s soul. It’s what helps you shift from guessing what investors want to knowing what they’re actively funding right now.

With the right analytics, you can literally follow the money. You can pinpoint VCs who are pouring capital into hot sectors like AI, see which industries are experiencing a sudden surge in deal volume, and even identify investors who just raised a new fund and are hungry to write checks. This kind of intelligence ensures your outreach is not just relevant but perfectly timed.

Analyzing Deal Sizes and Valuations

Knowing the typical deal size in your vertical is a massive advantage when it comes to setting your own valuation. For example, if you discover the average seed round in your space has jumped by 20% over the last year, that’s a powerful piece of data to have in your back pocket during negotiations.

This kind of insight helps you build a rock-solid case for your business model. You can get a much deeper understanding of these dynamics by reading our guide on using startup equity data.

A VC database lets you benchmark your fundraising ask against what’s actually happening in the market. Instead of pulling a valuation out of thin air, you can ground it in what similar companies have successfully raised, which instantly gives your pitch more credibility.

Aligning Your Pitch with Market Dynamics

The venture world is always in motion, and a database gives you the hard data you need to move with it. For instance, recent market analysis revealed a massive trend: AI-focused companies scooped up over 71% of all deployed funds in Q2 2025.

During that same quarter, global venture funding hit $115 billion, a 29% jump from Q4 2024, even as the total number of deals went down. This tells us investors are making fewer but much bigger bets, especially in capital-heavy sectors like AI, where average deal sizes climbed to $19.2 million.

When you dig into this kind of information within a VC database, you can walk into a meeting with confidence. Your pitch will resonate because it's built on the very same trends and numbers that investors themselves are watching every single day.

Common Questions About VC Databases

Even after seeing how valuable a venture capital database can be, it's natural to have a few nagging questions. Let's tackle some of the most common ones head-on so you can feel confident about finding and using the right tool for your fundraising.

Lots of founders, especially early on, ask the big one: is it really worth paying for one of these things?

Are Free Databases Good Enough?

Honestly, free databases are a decent place to start. They can help you get a lay of the land and build a rough, initial list of investors you might want to talk to.

But when you get serious about raising a round, you'll quickly hit their limits. The data is often stale, incomplete, or just plain wrong. A paid subscription isn't just a cost; it's an investment in your own time and effectiveness. You're paying for accuracy and insights that can save you hundreds of hours of frustrating work and significantly boost your odds of actually connecting with the right people.

How Can I Verify Data Accuracy?

The best platforms are obsessed with the quality of their data and are usually transparent about how they maintain it. Look for providers that use a mix of smart technology and actual human researchers to verify their information. Before you pull out your credit card, do a little digging into their process.

Check out user reviews, paying close attention to comments about data quality. And definitely make the most of any free trial period. Pick a handful of investor profiles from the database and cross-reference them with what you can find on LinkedIn or in recent news. If the details line up, that's a great sign you've found a reliable source.

One of the most overlooked uses for a VC database is competitive intelligence. Beyond just fundraising, these platforms are powerful market intelligence tools that can give you a strategic advantage.

Think about it: you can see exactly who is funding your direct competitors and even get clues about their valuations. You can scout for potential partners or acquirers by digging into the portfolios of corporate venture arms. You can even use it for recruiting by identifying executives who have experience at other successful, venture-backed companies in your space.

Ready to accelerate your deal flow? FundedIQ delivers hand-curated lists of recently funded startups with verified decision-maker contacts, giving your agency timely, high-intent prospects every month. Start engaging startups at the perfect moment.