What Is a Funding Round Unpacked for Founders

So, what exactly is a funding round? At its core, it's the process a startup goes through to raise money from investors. In return for their cash, these investors get a piece of the company, known as equity.

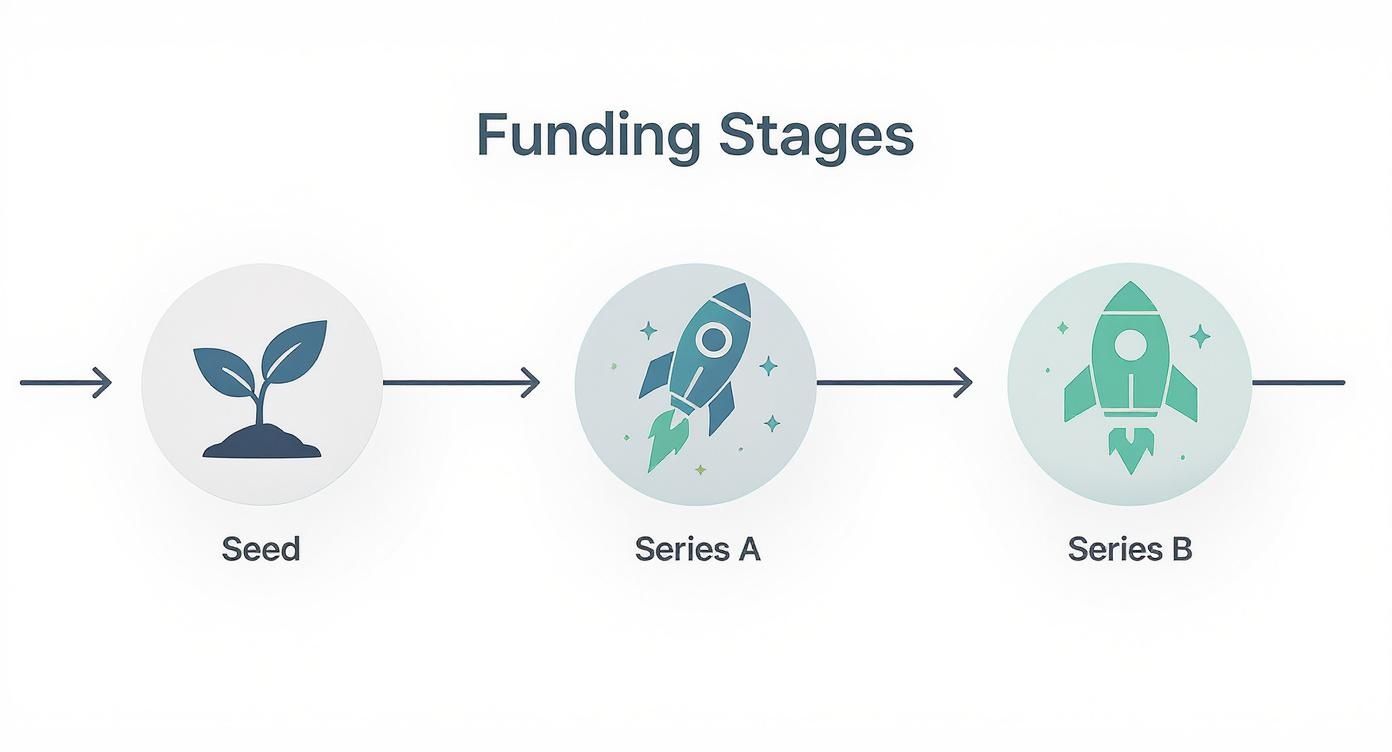

You'll often hear these rounds referred to by specific names like Seed, Series A, or Series B. Each one represents a distinct stage in a company's journey, providing the capital needed to get from an initial idea all the way to a full-blown market expansion. For example, a typical Seed round might raise between $500,000 and $2 million, while a Series A round often falls in the $3 million to $15 million range.

Fueling a Startup's Journey

Picture a startup as a rocket ship on the launchpad. A great idea might be enough to build the frame, but that rocket isn't going anywhere without fuel. A funding round is how the company gets that fuel. It's the moment the founders invite investors to become co-pilots, offering them a stake in the mission in exchange for the capital needed to lift off.

But this isn't just about trading cash for stock. It’s about forming a strategic partnership. When an investor puts money into a startup, they’re placing a bet on the founder's vision, the strength of the team, and the company's potential. This cash injection is what allows a young company to hire crucial team members, build out its product, and start scaling its operations. A practical example is using Seed funding to hire the first two engineers or a dedicated salesperson.

Just like a rocket needs different stages to reach orbit, a startup usually goes through several funding rounds. Each one provides the thrust it needs to hit the next major milestone.

It’s About More Than Just the Money

While the cash is obviously important, a funding round brings other incredibly valuable assets to the table. Investors, especially venture capitalists (VCs), come with a ton of experience, deep industry connections, and strategic advice. Their involvement can unlock doors to new customers, key partners, and even the next round of investors.

This support often looks like this:

- Expert Guidance: Founders get access to seasoned entrepreneurs and industry veterans who can offer advice on everything from product development to financial planning. For instance, an investor with a background in SaaS might provide a proven pricing strategy.

- Network Access: An investor's network can be a goldmine for securing top-tier hires, strategic partnerships, and warm introductions to potential clients. A well-connected VC can introduce a B2B startup to decision-makers at Fortune 500 companies.

- Market Validation: Securing funding from a reputable investor sends a powerful signal to the market, which helps attract great talent and build trust with customers. Having a firm like Andreessen Horowitz or Sequoia Capital on your cap table is a powerful endorsement.

The sheer scale of this world is staggering. Global venture funding in Q1 2024 reached $75.9 billion, with the U.S. accounting for over $36.6 billion of that total. Much of that growth was fueled by big bets on AI. You can dig into these global funding trends over on Crunchbase News.

A funding round is when a startup’s potential gets a price tag and its ambition gets a bank account. It’s the shift from a great idea to a funded mission, with partners who believe in the vision.

Ultimately, a funding round isn't a one-and-done deal. It's a strategic cycle. Each round is a checkpoint that validates the business model and marks a critical step toward building a self-sustaining, market-leading company. It's the engine that powers innovation from a napkin sketch to a global player.

Navigating the Startup Funding Lifecycle

A startup’s journey from a bright idea to a market leader isn't a single, giant leap. It’s a series of deliberate steps, each fueled by a specific funding round. This lifecycle isn't just about cashing checks; it's the story of a company's growth, validation, and ever-expanding ambition.

For anyone in the startup world—founders, employees, or investors—understanding this progression is crucial. Each stage comes with its own set of goals, investor expectations, and key metrics that prove a company is ready to climb to the next rung of the ladder. Think of it as a structured path from proving a concept to dominating an industry.

This timeline gives you a bird's-eye view of the typical funding journey, from the first spark of an idea all the way to launching and scaling up.

As the infographic shows, each funding stage is a building block. The company's maturity and capital needs grow together, pushing it toward its next major milestone.

The Idea Stage: Pre-Seed and Seed Funding

Every great company begins somewhere humble—maybe as an idea on a napkin or a concept hashed out in a late-night brainstorming session. The Pre-Seed and Seed rounds are where that initial spark gets the oxygen it needs to become a flame. At this point, the "company" might just be a couple of founders and a rough prototype.

The name of the game here is validation. Founders use this early cash, often from angel investors, friends, and family, to prove their core idea has merit. They’re trying to answer the big, fundamental questions: Does anyone actually have this problem? Does our solution fix it? And, crucially, will people pay for it?

Seed capital is typically spent on a few key things:

- Product Development: Building out the first real version of the product, often called a Minimum Viable Product (MVP). For a software company, this could mean creating a functional app with just its core features.

- Market Research: Getting out of the building to do customer interviews and gather data that confirms people want what you're building. A practical insight is that investors want to see evidence from at least 20-30 potential customer conversations.

- Team Building: Making those first critical hires beyond the founding team.

A successful seed round tells investors that the idea isn't just an idea anymore—it has legs and is ready to start running.

The Product-Market Fit Stage: Series A

Once you've proven the concept, you have to prove you can build a real business around it. That’s the core challenge of the Series A funding round. Investors at this stage are laser-focused on one thing: product-market fit. They need to see a clear sign that you've found a repeatable, scalable way to get customers who absolutely love your product.

This isn’t about having a handful of happy users; it's about having a predictable engine for growth. Metrics suddenly become everything. Investors will pour over your data on user engagement, customer acquisition cost (CAC), and any early revenue you're generating. A SaaS company, for example, might need to show $1 million in Annual Recurring Revenue (ARR) to be a strong Series A candidate. The conversation shifts from "Can we build it?" to "Can we sell it efficiently?"

A Series A round is the first major institutional test for a startup. It's where a promising project transitions into a legitimate business with a clear path to generating revenue.

Money from this round goes toward building a solid foundation for growth. This means expanding the sales and marketing teams, refining the product based on real user feedback, and locking in that repeatable customer acquisition model. For a closer look, you can explore the different types of startup funding rounds and what makes each one unique.

The Scaling Stage: Series B

With product-market fit in the bag, it's time to hit the accelerator. The Series B funding round is all about one thing: aggressive scaling. The business model is working, the engine is humming, and now it's time to pour fuel on the fire to capture a much bigger piece of the market. Typical Series B rounds can range from $15 million to $50 million.

Series B investors want to back a company that's ready to expand far beyond its initial beachhead of users and build a lasting competitive advantage. The capital is no longer for testing and experimenting—it's for executing at a massive scale.

For instance, when the health benefits platform Thatch raised its $40 million Series B, the company said the money was for deepening integrations, growing its team, and "spreading the word that there's a new way to do healthcare." That’s a classic Series B mission: take a proven model and turn it into an industry powerhouse.

As companies grow and manage larger sums of money, their banking needs also get more complex. Founders with an eye on global expansion often have to consider strategic banking locations for startups, like Hong Kong, to manage their capital effectively.

The Growth Stage: Series C and Beyond

By the time a company is raising a Series C or later round, it's usually a well-known player in its space with annual revenues often exceeding $10 million. These later-stage rounds are less about proving anything and more about cementing market dominance and prepping for a big exit, like an Initial Public Offering (IPO) or a major acquisition.

The checks get much bigger, and the goals become more ambitious:

- International Expansion: Taking the product to new countries and continents.

- New Product Lines: Building and launching new products to sell to an already-established customer base.

- Acquisitions: Buying smaller companies to quickly gain new technology, talent, or market share.

Look at the AI company Anthropic, which pulled in a staggering $4 billion in a single funding round in early 2024. They planned to use that capital to "expand our capacity to meet growing enterprise demand" and push their international expansion—clear signs of a mature company solidifying its top spot. These late stages are all about building an enterprise that lasts.

The Language of Venture Capital

Diving into your first funding round can feel like you've been dropped into a foreign country without a translation guide. All of a sudden, you're hearing words like "pre-money," "cap table," and "dilution" thrown around, and everyone expects you to know exactly what they mean.

Don't worry. This isn't just confusing jargon meant to trip you up. It's the specific language used to hammer out the details of a deal between a founder and an investor. Getting fluent is non-negotiable—these terms directly impact your company’s worth, how much of it you give away, and ultimately, who's in control.

Let’s break down what these concepts actually mean when you’re sitting at the negotiating table.

What's Your Startup’s Price Tag?

At the very center of every funding conversation is valuation—the price everyone agrees your company is worth. This number is the bedrock of the entire deal, but it shows up in two different ways. Getting them straight is critical.

-

Pre-Money Valuation: This is what your company is valued at before an investor’s check clears. Think of it as the price tag you and the investor agree on based on everything you've built so far—your team, your traction, and your potential.

-

Post-Money Valuation: This is your company's value after the investment lands in your bank account. The math is straightforward: Pre-Money Valuation + Investment Amount = Post-Money Valuation. This new, higher number reflects the company’s value now that it's fueled with fresh capital.

Why does this matter so much? Because the investor's ownership stake is calculated based on the post-money valuation. It’s how they determine what percentage of the company their investment buys.

To see this in action, let's look at a simple example.

Pre-Money vs Post-Money Valuation Explained

| Component | Calculation Example | Description |

|---|---|---|

| Pre-Money Valuation | $4,000,000 | The value of the company agreed upon by the founder and investor before the investment is made. |

| Investment Amount | $1,000,000 | The amount of new capital the investor is putting into the company. |

| Post-Money Valuation | $5,000,000 | Calculated as Pre-Money ($4M) + Investment ($1M). This is the company's value after the deal closes. |

| Investor's Equity | 20% | Calculated as Investment ($1M) / Post-Money ($5M). The investor now owns one-fifth of the company. |

As you can see, these two numbers are two sides of the same coin, working together to define the structure of the deal.

Decoding Key Fundraising Terms

Beyond valuation, a few other terms will pop up constantly. Knowing them will give you the confidence to navigate conversations and protect your interests.

-

A Term Sheet is the first real document you’ll likely see. It's a non-binding agreement that outlines the basic terms and conditions for the investment. Think of it as the blueprint for the final deal—it lays out the major points before the lawyers start drafting the legally binding contracts. It typically includes the valuation, investment amount, and key investor rights.

-

The Lead Investor is the main investor driving the round. They usually contribute the largest chunk of cash, set the valuation and terms, and perform the deepest level of diligence. Securing a great lead investor is a huge signal of confidence that often makes it much easier to attract other investors to participate.

-

Due Diligence is the official "look under the hood" that investors conduct before finalizing an investment. They’ll dig into everything: your financial statements, customer contracts, legal paperwork, and tech stack. A practical insight: this process can take anywhere from 30 to 90 days. It's just like a home inspection before buying a house—they need to be sure there are no hidden skeletons in the closet before they commit their money.

The goal of fundraising isn't just to get the cash. It's to get the cash on the right terms. A bad deal at a high valuation can be far more destructive than a fair deal at a more modest one.

The Founder’s Dilemma: Equity Dilution

One of the most crucial concepts for any founder to internalize is equity dilution. Every time you issue new shares to raise money, the ownership percentage of all existing shareholders—including you—goes down.

Imagine your company is a pizza. In the beginning, you own the whole pie.

When you raise your first round of funding, you don't just give investors a slice of your existing pizza. Instead, you make the whole pizza bigger and give them new slices from it. While your personal slice is now a smaller percentage of the new, bigger pizza, it's also potentially much more valuable. For example, owning 100% of a $1 million company is less valuable than owning 75% of a $5 million company.

This is all tracked on a Capitalization Table, or Cap Table. It’s a simple spreadsheet that breaks down who owns what percentage of your company. Every potential investor will ask to see it, as it's the official scoreboard of ownership. Managing it well from day one is key to maintaining control and keeping everyone motivated for the long haul.

Your Step-By-Step Fundraising Playbook

Raising capital isn't something that just happens—it's the result of a deliberate, well-executed strategy. Too many founders treat fundraising like a one-off event, but it’s much more like a strategic campaign. It unfolds in stages, each demanding its own set of skills and materials.

Think of this as your playbook. We're going to break down the entire journey into a clear, repeatable process. By following these steps, you can sidestep common mistakes, build real momentum with investors, and bring a sense of control to one of the most stressful parts of building a startup.

Phase 1: The Preparation

Before a single investor email leaves your drafts, you need to build an airtight case for your business. This is, without a doubt, the most important part of the whole process because it lays the foundation for every conversation to come. Rushing this stage is a classic rookie mistake.

Your goal here is simple: anticipate every question an investor could possibly throw at you and have a compelling, data-backed answer ready to go. This level of preparation signals that you’re a professional who has thought deeply about your company and its place in the market.

These are your non-negotiables:

- A Bulletproof Pitch Deck: This is your story in visual form. It needs to be a concise, powerful narrative explaining the problem you solve, why your solution is unique, who’s on your team, and what traction you have. Keep it tight—10-15 slides is the sweet spot.

- A Defensible Financial Model: More than just a spreadsheet, this model projects your company’s revenue, expenses, and growth over the next 3-5 years. Every assumption must be logical and something you can confidently defend under pressure. For example, your customer acquisition cost (CAC) should be based on real-world data from initial marketing tests.

- A Targeted Investor List: Don't just spray and pray. Do the research. Build a curated list of investors who actually fund companies in your industry, at your stage, and in your geographical area. A practical tip is to target 50-100 relevant investors.

Phase 2: Investor Outreach

With your materials locked and loaded, it's time to get in front of the right people. Let's be blunt: cold emailing a VC is a long shot. The real key to successful outreach is finding a warm introduction through your network, which massively boosts your odds of landing a meeting. Data shows that warm introductions have a significantly higher success rate—some estimate up to 10x higher—than cold outreach.

A warm intro is simply when someone in your network who knows the investor makes the connection for you. It provides instant credibility and social proof, making VCs far more likely to give your pitch the time of day. Get on LinkedIn and start mapping out your connections to see who can open doors.

Once that intro is made, it’s your turn. Follow up quickly with a concise email that hits these three points:

- A one-sentence description of what your company does.

- A few bullet points highlighting your most impressive traction or milestones (e.g., "15% month-over-month revenue growth").

- Your pitch deck, attached for their review.

This is your first impression. Keep it short, powerful, and professional. Respect their time. If you want to dig deeper into the mechanics of this stage, our complete venture capital funding process guide has you covered.

Phase 3: The Pitch and Follow-Up

Getting the meeting is a huge win, but it's really just the beginning. The pitch itself is where storytelling and data collide. You need to connect with investors on a human level while backing it all up with hard facts and a crystal-clear vision for the future.

Practice your presentation until it feels like second nature, but be ready to go off-script. Investors will interrupt you. They’ll ask tough questions to test your knowledge and see how you handle pressure. Answer directly, confidently, and honestly.

An investor isn't just funding a business plan; they're betting on the founder. Your ability to articulate your vision, defend your assumptions, and demonstrate resilience during the pitch is as important as the numbers in your deck.

After the meeting, the work isn't over. The follow-up is where deals are won or lost. A practical tip: send a follow-up email within 24 hours summarizing the key discussion points and answering any questions that arose. Stay organized, be responsive, and show persistence—without being annoying.

Phase 4: Due Diligence and Closing

If an investor is genuinely interested after the pitches, they’ll kick off the due diligence phase. This is an intense, often exhausting deep dive where the investor's team scrutinizes every single part of your business to make sure your claims hold up.

They will pour over your financials, your tech stack, your legal structure, and your customer contracts. This is where knowing how to prepare financial reports accurately becomes absolutely critical, as any mistakes can kill the deal on the spot.

Once you pass due diligence, you’ll finally get a term sheet. This document lays out the proposed terms of the investment. It’s absolutely essential to have an experienced startup lawyer by your side to negotiate key points like valuation, board seats, and investor rights before you sign on the dotted line and officially close the round. A common mistake founders make is trying to save money by not hiring expert legal counsel, which can cost them dearly in the long run.

How Global Trends Are Reshaping Fundraising

A funding round never happens in a vacuum. It's a direct reflection of the wider economic climate, investor mood, and the big technology waves sweeping the globe. If you're a founder looking to raise money today, you have to understand these forces.

What worked five years ago might get you laughed out of a room today. Investor appetite changes, what a company is "worth" goes up and down, and certain industries become cash magnets while others go cold. Tying your fundraising strategy to these bigger currents helps you set real expectations, sharpen your pitch, and put your startup in the best possible position to win.

The Rise of the Megaround

One of the biggest changes we've seen lately is the "megaround"—these are enormous funding rounds, often clearing $100 million. Industries like Artificial Intelligence are fueling these massive deals, and they're completely changing the game. When just a handful of companies can suck up billions in capital, it forces every investor to rethink how they spread their money around.

This trend shows a clear market preference for backing proven winners—companies with a real shot at massive scale. For founders, this means the pressure is on. You need to show incredible traction and a path to market dominance earlier than ever before.

Today’s investors are placing fewer, but much larger, bets on companies they believe can define a whole new category. This concentration of cash means that while there's more money at the top, the fight for early-stage funding is getting a lot tougher.

The move toward bigger, more focused rounds is undeniable. Fundraising has always mirrored the economy, but the last decade has been different. For example, the share of small VC deals (under $5 million) recently hit a ten-year low, dropping to 48.6% of all deals from 55.4% just the year before. You can dig into more of this data on the shifting VC landscape over at S&P Global Market Intelligence.

Capital Concentration and Where It’s Going

Venture capital isn't spread out evenly. It's famously clustered in tech hubs like Silicon Valley, New York, and London. In 2023, for instance, startups in California, New York, and Massachusetts alone accounted for over 60% of all venture capital invested in the U.S. This creates a hyper-competitive scene for founders there, but it can be a real challenge for anyone outside those bubbles to get noticed.

That said, the rise of remote work has started to shake things up a bit. Investors are now more open to looking at deals far from the usual stomping grounds, which is creating fresh opportunities for founders in up-and-coming tech cities. Knowing where the money is flowing is key to finding the right investors.

To get an edge, it’s smart to keep an eye on the latest venture capital investment trends and see how these patterns are changing in real time.

How Hot Sectors Affect Valuations

When an industry like AI or climate tech gets white-hot, it sends ripples across the entire startup world. The sky-high valuations and feeding frenzy in these popular sectors can warp expectations for everyone else. Here’s what that often looks like for founders:

- Higher Valuation Expectations: Investors might push for faster growth and bigger potential returns, even if your company isn't in the "it" sector. For example, the median valuation for an AI startup might be 25-50% higher than for a comparable SaaS company in another vertical.

- More Competition: A booming field attracts a flood of new startups, making it that much harder to stand out from the crowd.

- Shifting Investor Focus: VCs might divert their funds to chase the latest trend, which can make it tougher for great companies in less-hyped industries to get funded.

Successfully navigating a funding round takes more than a killer pitch deck. It demands a real awareness of the world outside your office walls. By understanding these global trends, you can position your startup to not just survive, but thrive in a fundraising environment that's always on the move.

Answering the Tough Questions About Fundraising

Even when you've got the fundraising lifecycle down on paper, the reality of raising capital is filled with practical, gut-wrenching questions. It's a journey defined by critical decisions that can feel completely overwhelming. Let's dig into some of the most common things founders find themselves asking when they're out trying to fill their bank account.

How Long Does a Funding Round Actually Take?

Here's the hard truth: raising money is a marathon, not a sprint. Founders consistently underestimate just how much time and energy this process consumes, and that miscalculation can put the entire business on the line. Being realistic is key. From the first email to cash in the bank, you should budget for six months or even longer.

This isn't just six months of back-to-back meetings, though. The timeline breaks down into a few distinct phases, each with its own rhythm:

- Getting Your House in Order (1-2 months): This is all the prep work. You're building your pitch deck, fine-tuning your financial model until it's bulletproof, and meticulously researching a list of investors who are actually a good fit.

- The Outreach Grind (2-4 months): This is the longest, most unpredictable part of the process. It's a cycle of chasing warm introductions, sending cold emails, and navigating the art of the follow-up just to land those first crucial conversations. A founder might pitch to over 100 investors to secure a handful of term sheets.

- The Deep Dive and the Dotted Line (1-2 months): Once an investor is genuinely interested, they'll start kicking the tires with due diligence. If you pass, it's on to the lawyers to hammer out the term sheet and officially close the round.

Should I Choose Debt or Equity Financing?

This is one of the first major forks in the road for any founder. The "right" answer really depends on your company's stage, how you make money, and where you want to be in five years. The two paths couldn't be more different.

Debt financing is pretty straightforward—it's a loan. You borrow cash from a lender and you have to pay it back, with interest, on a set schedule. The huge plus here is that you don't give away a single share of your company. The catch? If you're pre-revenue or don't have a predictable stream of cash coming in, good luck convincing a bank to sign on. A practical option here can be venture debt, which is designed for startups but often comes with higher interest rates.

Equity financing is what this guide is all about. You sell a percentage of your company to investors in exchange for their capital. You don't owe them the money back, but you are giving up a piece of the pie and, often, a bit of control. For high-growth startups aiming for a massive outcome but with little short-term profit, this is the default route.

How Much of My Company Should I Give Away?

Ah, the million-dollar question. Answering it is a delicate balancing act. You have to raise enough capital to survive and hit your next big milestones, but you also want to hold onto as much ownership as you can. It keeps you motivated and leaves you with something to sell in future rounds.

While every single deal has its own quirks, there are some well-trodden benchmarks. For a typical seed round, founders should expect to sell somewhere between 10% and 25% of their company. If an investor is asking for much more than that, it can be a red flag. Giving up too much equity too early can kill your own motivation and make it incredibly difficult to raise more money down the road. For Series A, dilution is often in the 15-25% range.

The trade-off is brutally simple: sell too little equity, and you might run out of cash before you find your footing. Sell too much, and you risk losing control of the very company you're trying to build.

What Happens If We Can't Raise the Next Round?

This is the nightmare scenario that keeps founders up at night, but you absolutely have to be prepared for it. If you go out to raise and come back empty-handed, you're not out of options, but you do have to make some tough calls—fast.

Your number one priority becomes extending your runway, which is just the amount of time you have before the bank account hits zero. This almost always means making deep, painful cuts to your expenses. If that's not enough, you might look for bridge financing—a smaller, short-term loan meant to "bridge" the gap to your next milestone or another shot at fundraising.

In a more difficult situation, you could face a down round, which means raising money at a lower valuation than you did previously. It stings, but it can be the lifeline that keeps the business alive. And if all else fails, the focus has to shift to finding a potential acquisition or, in the worst-case scenario, winding down the company with integrity.

Navigating all of these challenges comes down to finding the right investors at the right time. For agencies that want to connect with startups right after they've secured a new war chest, FundedIQ offers curated lists of high-intent prospects who have the capital to spend. You can skip the guesswork and start conversations that actually lead to deals. Find your next big client at FundedIQ.