Mastering Customer Acquisition cost calculation

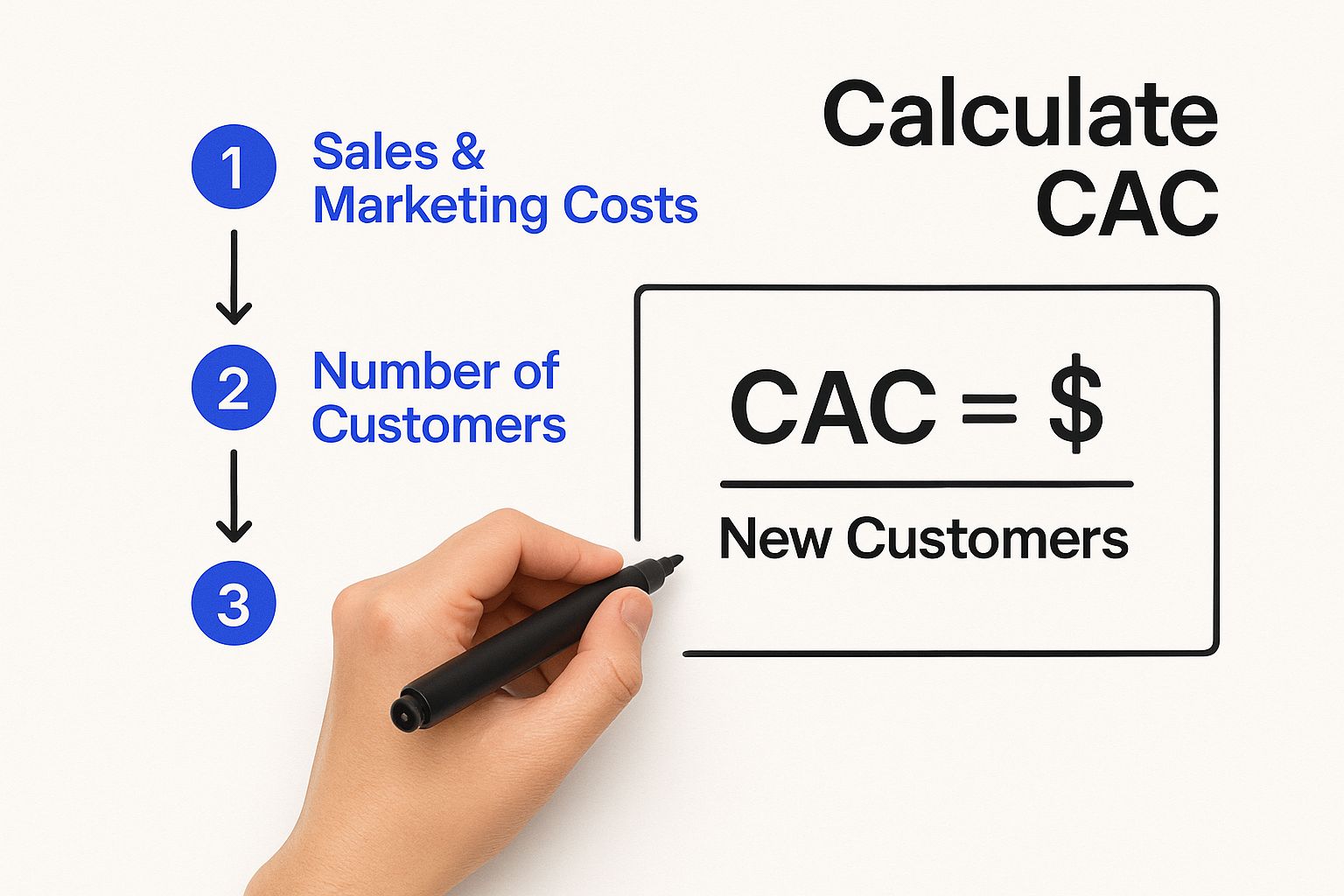

The simplest way to calculate your customer acquisition cost is with one straightforward formula: divide your total sales and marketing spend by the number of new customers you brought in during that same period. This single figure tells you exactly what you're shelling out to win each new customer, making it a vital health check for your business.

Why Understanding Your CAC Is Not Optional

Flying blind with your marketing budget is a surefire way to run into trouble. In today's market, knowing precisely what it costs to land a new customer isn't just nice-to-have data—it’s a fundamental survival metric. Without a solid handle on your Customer Acquisition Cost (CAC), you're basically just guessing where to put your money, and that's a dangerous game when every dollar matters.

Think of this metric as the ultimate reality check for your growth engine. It shines a light on whether you're bleeding cash on ad channels that don't deliver or, worse, trying to scale a business model that's fundamentally unprofitable. It's often the key difference between sustainable growth and a high-burn path to nowhere.

The Rising Cost of Gaining Attention

It's no secret that getting new customers in the door has gotten a lot more expensive. Between 2013 and 2021, the average customer acquisition cost shot up by a staggering 222%. This spike is a direct result of climbing digital ad prices—for instance, the average cost per click (CPC) on Google Ads increased by over 40% in just one year—and incredibly fierce competition for a slice of your audience's attention. You can dig deeper into the trends shaping acquisition costs to see the full picture. This new reality makes getting your CAC calculation right more critical than ever.

Your CAC isn't just another marketing metric; it's a core business diagnostic. It directly impacts your pricing, validates your go-to-market strategy, and ultimately helps determine if your company will be around for the long haul.

CAC as a Strategic Compass

Once you truly understand your CAC, you can start making smarter, data-backed decisions instead of operating on gut feelings and assumptions. It gives you the clarity you need to spend your money where it counts.

For example, a practical insight is using CAC to evaluate marketing campaigns. If a new campaign costs $5,000 and brings in 50 customers, its CAC is $100. If your average CAC is $120, this campaign is a clear winner. This clarity helps you:

- Allocate Budgets Wisely: Pinpoint which marketing channels are actually delivering a solid return and double down on what’s working.

- Refine Pricing Models: Make sure your pricing not only covers what you spend to get a customer but also leaves you with a healthy profit. For example, if your CAC is $90, a product priced at $50 is unsustainable without significant repeat purchases.

- Validate Your Growth Strategy: Confirm that your business model can actually scale profitably before you pour a ton of cash into expansion.

At the end of the day, mastering your CAC is about building a business that's both resilient and profitable. It forces a shift in focus from just acquiring customers to acquiring them efficiently—laying the foundation for sustainable success, not just a few good quarters.

Breaking Down the Core CAC Formula

On the surface, calculating your customer acquisition cost looks straightforward. You just divide your total marketing and sales spend over a certain period by the number of new customers you brought in. That gives you the average cost to land each new buyer.

But here's where so many businesses get it wrong. The real trick isn't the division; it's getting an honest, complete total of your costs. It's incredibly easy to just look at your ad spend and call it a day, but that gives you a dangerously misleading number.

What Really Goes into Your Total Costs

To get a true picture of your CAC, you need to be ruthless about tracking every single dollar that contributes to winning a customer. This goes way beyond your Google Ads budget.

Think about it this way—what expenses would disappear if you stopped trying to get new customers? That’s what needs to be in your calculation.

Here are the big ones people often miss:

- Team Salaries: This is almost always the biggest chunk. You have to include the gross salaries, commissions, and benefits for everyone on your marketing and sales teams. A sales rep earning $60,000 might actually cost the company over $75,000 with benefits and payroll taxes included.

- Software and Tools: Add up the costs for your entire tech stack. We're talking CRM, email marketing platforms, SEO tools, analytics software—anything that supports your acquisition efforts.

- Ad Spend: The obvious one. This is your budget for all paid channels, like PPC campaigns, social media ads, and sponsored content.

- Creative and Production Costs: Did you hire a freelancer to write blog posts? A designer for your ad creative? An agency to run a campaign? All of that gets factored in. A one-time video ad production cost of $5,000 should be amortized over the campaign's duration.

Getting an accurate customer acquisition cost calculation is non-negotiable. If you leave costs out, you're just lying to yourself, and that leads to some seriously bad business decisions down the road.

A Practical CAC Calculation Example

Let's walk through a real-world scenario. Imagine a B2B SaaS company calculating its CAC for the third quarter.

First, they need to pull together all their costs from that three-month window:

- Marketing & Sales Salaries (including benefits): $45,000

- Total Ad Spend (Google & LinkedIn): $25,000

- Software Subscriptions (CRM, Email, SEO tools): $5,000

- Freelance Content Writer & Designer Fees: $2,000

Adding that all up, their Total Costs come to $77,000 for Q3.

Next, they dig into their analytics and see they brought in 850 new customers during that same period.

Now for the easy part—the math:

CAC = $77,000 / 850 New Customers = $90.59

So, for every new customer they acquired in Q3, this company spent an average of $90.59. This single metric is a powerful health check for the business. It gives them a concrete benchmark to improve upon and tells them exactly how efficient their growth machine is running.

How to Gather the Right Data for Your Calculation

Your customer acquisition cost calculation is only as good as the data you put into it. The old saying "garbage in, garbage out" has never been more true. This means your first, and arguably most important, job is to build a reliable process for gathering all the necessary numbers.

This isn't just about pulling a few reports. It's about creating a system you can trust month after month to get the full picture.

As you can see, a solid calculation starts with methodically collecting every single financial input. If you miss a cost, your final CAC will be wrong, period.

To make sure your numbers are both accurate and reliable, following strong data management best practices is absolutely essential. This isn't just a box to check; it’s the bedrock of every strategic decision you'll make based on this metric.

Hunting Down Your Total Costs

Let’s be honest: your total marketing and sales expenses are probably scattered everywhere. They live in different software, spreadsheets, and maybe even a few department budgets. You have to play detective and bring it all together.

I always recommend starting with a simple checklist. This becomes your go-to guide every time you run the numbers, ensuring you don't forget a crucial piece of the puzzle.

Here's what you need to track down:

- Ad Spend: The obvious one. Pull your spending reports directly from platforms like Google Ads, Meta Ads, LinkedIn, or wherever you're running campaigns.

- People Costs: This is a big one that gets missed. Work with finance or HR to get the gross salaries—including benefits and commissions—for everyone on your marketing and sales teams.

- Software & Tools: Tally up the subscription costs for your entire tech stack. This means your CRM (like Salesforce), marketing automation (like HubSpot), analytics tools, and anything else you use to attract and convert customers.

- External Help: Don't forget to gather invoices from any agencies, freelancers, or consultants who helped out during the period.

Key Takeaway: The single biggest mistake I see is teams focusing only on ad spend. They completely ignore salaries and tool costs, which can easily make up over 50% of the total acquisition budget. This gives you a dangerously low CAC and a false sense of security.

To help you get started, here's a table outlining the most common costs you'll need to pull together.

Essential Cost Inputs for Accurate CAC Calculation

This table breaks down the typical marketing and sales expenses you absolutely must include to get a comprehensive CAC figure.

| Cost Category | Specific Examples | Where to Find Data |

|---|---|---|

| Paid Advertising | Google Ads, Meta Ads, LinkedIn Ads, TikTok Ads, sponsored content | Ad platform dashboards, agency reports |

| Salaries & Benefits | Marketing team salaries, sales team salaries & commissions, payroll taxes, benefits | Finance/HR department records, payroll software |

| Software & Tools | CRM (e.g., Salesforce), marketing automation (e.g., Mailchimp), analytics tools, SEO software | Subscription invoices, finance department records |

| Content Creation | Freelance writers, video production costs, graphic design services, stock photos | Invoices from contractors, platform subscription receipts |

| External Partners | Marketing agency retainers, PR firm fees, consultant contracts | Monthly invoices, accounting software |

| Overhead | A portion of office rent or utilities allocated to marketing & sales teams | Finance department, internal budget allocations |

Getting a handle on these inputs is the first step toward a CAC metric you can actually trust.

The Importance of a Consistent Time Frame

Once you have all your costs, the next critical step is to align them with the number of new customers you acquired in the exact same period. You can't mix and match. Using a full quarter's worth of expenses with just one month's worth of new customers will throw your entire calculation off.

Pick a time frame—monthly or quarterly are most common—and stick with it. This consistency is what allows you to spot trends, measure the impact of your marketing changes, and accurately forecast for the future.

For example, if you're calculating your CAC for Q2, you must only count the customers acquired between April 1st and June 30th. This discipline is non-negotiable if you want your customer acquisition cost calculation to be both accurate and comparable over time.

Common Mistakes in CAC Calculation to Avoid

It’s surprisingly easy to get your customer acquisition cost calculation wrong, and a flawed number can send your business strategy completely off the rails. One of the most common missteps is simply underreporting costs, which paints a dangerously rosy picture of your marketing and sales efficiency.

Think of this as your field guide to the pitfalls I see companies stumble into all the time—and more importantly, how you can sidestep them.

Forgetting Key Costs

Forgetting to include team salaries is a huge one. This isn't just a small oversight; for many companies, payroll is the single biggest line item in the marketing and sales budget. Leaving it out can make your CAC look 50% lower than it actually is, turning money-losing channels into what you think are big winners.

Another frequent mistake is ignoring the monthly fees for your tech stack. That $300/month CRM subscription, the $150/month email marketing platform, and that $99/month analytics tool? They all add up. These are direct costs of acquiring customers, and they absolutely have to be in the equation.

Misattributing Customer Types

Perhaps the most subtle but damaging error is lumping new and returning customers together. Remember, the whole point of CAC is to figure out what it costs to land a new customer. If you include revenue from existing customers who buy again without any new marketing push, you’ll artificially deflate your CAC.

Let’s look at a real-world scenario. Say you spend $10,000 on marketing in a month and generate 100 sales. On the surface, your CAC looks like a neat $100. But after checking your CRM, you find that 40 of those purchases came from loyal, existing customers. You actually only acquired 60 new customers.

Your true CAC is much, much higher:

$10,000 / 60 new customers = $166.67

That 67% difference is the kind of gap that separates a profitable growth strategy from one that’s quietly bleeding cash.

How to Fix These Common Errors

Getting your numbers right isn't about complex math; it's about discipline. To build confidence in your CAC, you just need to put a few solid processes in place.

- Create a Cost Checklist: Make a simple spreadsheet that lists every possible marketing and sales expense. Include everything: salaries, commissions, software licenses, ad spend, agency fees, and even freelance content creators. Review it every single month to make sure nothing gets missed.

- Segment Your Customers: This is non-negotiable. Use your CRM or e-commerce platform to meticulously separate first-time buyers from repeat purchasers. For any given period, only new customers should go into the denominator of your CAC formula.

- Allocate Salaries Correctly: If you have team members who split their time between acquiring new customers and retaining existing ones, work with your finance department to figure out the right percentage of their salary to include. A practical approach is to estimate time allocation; for example, if a marketer spends 70% of their time on new lead generation, include 70% of their salary in the CAC calculation.

It also helps to have the right people on your team—people who get why this stuff matters. Using tools for sales personality testing can help you build a more data-driven team that values accurate metrics from the get-go.

By turning these tips into habits, you can transform CAC from a fuzzy, feel-good number into a sharp, reliable tool for making smart business decisions.

Making Sense of Your CAC Number

So, you’ve crunched the numbers and have a single figure for your Customer Acquisition Cost. What now? On its own, that number doesn't tell you much. The real magic happens when you put it into context to figure out if you've got a healthy, scalable business or if it's time to head back to the drawing board.

This is the point where you shift from just calculating to thinking strategically. A CAC number is only as good as the insights you can pull from it, and that starts with comparing it to what each customer is actually worth to you.

The LTV to CAC Golden Ratio

The most important relationship you need to get a handle on is the one between your Customer Acquisition Cost (CAC) and your Customer Lifetime Value (LTV). Your LTV is the total revenue you can expect from a single customer over the entire time they do business with you. The LTV:CAC ratio is the ultimate report card for your marketing and sales ROI.

A healthy LTV:CAC ratio is widely considered to be 3:1 or better. Put simply, this means for every dollar you spend to bring in a new customer, you should be getting at least three dollars back over their lifetime. A ratio of 1:1 means you're breaking even at best (and likely losing money after product costs). If your ratio is below 1:1, you're literally paying to lose money on every new customer.

This ratio gives you a clear, no-nonsense verdict on whether your business model can survive in the long run. It answers the most critical question: Are the customers you're fighting so hard to win actually worth the cost?

What Is a Good CAC?

Here's the thing: there's no single "good" CAC number that fits every business. What's fantastic for one company could spell disaster for another. It all comes down to context—your industry, business model, and how much you charge.

- An enterprise SaaS company might be thrilled with a $400 CAC if their average customer pays $500 per month and stays for three years (LTV = $18,000). The LTV:CAC ratio is a stellar 45:1.

- A direct-to-consumer subscription box service charging $20 a month would go under in a heartbeat with a $400 CAC. Even if a customer stays for a year, their LTV is only $240, resulting in an unsustainable 0.6:1 ratio.

This is precisely why looking at industry benchmarks is so helpful. They give you a necessary reality check.

Industry Benchmark Customer Acquisition Costs

Comparing your CAC to industry averages helps you understand if your costs are in a reasonable range or if there's a serious problem. A look at average CAC across different sectors can provide valuable context for your own performance.

| Industry | Average CAC Range | Key Influencing Factors |

|---|---|---|

| Retail | $10 – $30 | High competition, low transaction value, impulse buys. |

| Travel | $7 – $97 | Seasonality, high price sensitivity, long booking cycles. |

| SaaS | $200 – $700 | Complex sales cycles, high LTV, need for demos/trials. |

| Finance | $175 – $350 | High regulation, trust-building, significant customer LTV. |

As you can see, costs are all over the map, often influenced by the complexity of the sales process. SaaS companies, for example, tend to have a higher CAC between $200 and $700 because it takes more time and hands-on effort to close a deal.

For agencies, getting a grip on these benchmarks is essential for setting realistic growth goals. After all, efficient client acquisition is the lifeblood of any agency. You can dive deeper into this with our guide on lead generation for agencies.

Ultimately, analyzing your CAC isn't just about hitting some arbitrary number. It’s about making sure you’ve struck a profitable balance between what you spend and what you earn. This simple shift in mindset turns acquisition from just another expense into a strategic investment measured by its future returns.

Proven Strategies to Lower Your Acquisition Cost

Once you’ve got a solid handle on your customer acquisition cost, the real work begins: bringing that number down. A high CAC isn't a failure; it’s a bright, flashing sign telling you it's time to tune up your growth engine for better efficiency. Lowering this number means every marketing dollar goes further, directly padding your bottom line.

The good news? You have several powerful levers you can pull. This isn't just about slashing budgets; it’s about getting smarter and more targeted in how you attract the right customers.

Sharpen Your Targeting and Conversion Funnel

One of the quickest ways to slash your CAC is to stop throwing money at audiences who will never buy from you. It all starts with refining your ideal customer profile. When you know exactly who you're talking to, your messaging hits harder, your ad spend is more effective, and your conversion rates naturally start to climb.

Our guide on how to identify target customers is a great place to start if you need a more structured approach.

With your audience dialed in, the next focus is Conversion Rate Optimization (CRO). You'd be surprised how small tweaks can produce huge results.

- A/B Test Your Landing Pages: Don't guess what works. Companies like HubSpot have seen conversion rates increase by up to 100% simply by changing the color of a CTA button from green to red. Test different headlines, calls-to-action (CTAs), and images to find the combination that truly connects with your visitors.

- Simplify Your Checkout Process: Every extra form field or unnecessary step is another chance for a potential customer to get frustrated and leave. Baymard Institute data shows that 21% of cart abandonments are due to a long or complicated checkout process.

- Improve Page Load Speed: We live in an impatient world. A one-second delay in page load time can cause a massive drop-off in conversions. Google found that as page load time goes from 1s to 3s, the probability of a visitor bouncing increases by 32%.

Build Low-Cost Acquisition Channels

If your only customer acquisition strategy is paid ads, your CAC is going to be sky-high. The most durable businesses I've seen build a healthy mix of channels, with a serious emphasis on long-term, organic growth.

This is where content marketing and Search Engine Optimization (SEO) become your best friends. Creating genuinely helpful content that solves your audience's problems attracts people who are already looking for a solution like yours—and it costs a fraction of a pay-per-click ad. Better yet, a good piece of content is an asset that can generate leads for months, or even years, to come.

Another incredibly powerful and often overlooked channel is a simple customer referral program. Your happiest customers are your best salespeople, so put them to work! Offering a small incentive, like a discount or store credit, can turn word-of-mouth into a predictable, affordable, and high-trust acquisition machine.

Key Insight: A referral from a trusted friend is one of the most potent conversion tools you have. Nielsen data shows that 88% of consumers trust recommendations from people they know above all other forms of marketing. These customers also tend to have a higher LTV and stick around longer.

Double Down on Customer Retention

This might sound backward, but one of the best ways to fix your acquisition economics is to obsess over keeping the customers you already have. The numbers don't lie: acquiring a new customer can cost anywhere from 5 to 25 times more than retaining an existing one.

Even with that stark reality, a shocking 44% of companies focus more on acquisition than retention, according to research by Invesp.

When you nail customer retention, you increase your overall Lifetime Value (LTV). A higher LTV gives you more wiggle room to acquire new customers while still staying profitable. For a deeper look at practical methods, there are many strategies to reduce customer acquisition cost you can implement right away.

Answering Your Top Questions About CAC

Once you get the hang of the basic formula, you'll inevitably run into some real-world questions when you try to apply it to your own business. Let's tackle a few of the most common ones I hear from people.

How Often Should I Calculate CAC?

The right answer here really depends on your business model and how quickly you move.

For most companies, especially in SaaS or ecommerce, calculating CAC on a monthly basis is the sweet spot. It's frequent enough to catch trends and see if that new campaign is actually working, but not so often that you're just drowning in spreadsheets.

But if you’re selling high-ticket enterprise software with a six-month sales cycle, a quarterly calculation is probably more realistic. A monthly view would be too volatile, as one large deal can dramatically skew the numbers. It smooths out the month-to-month noise and gives you a more stable picture.

The bottom line: Whatever you pick, just be consistent. The real power of CAC comes from tracking it over time. A regular, predictable schedule is what transforms it from a simple number into a vital performance metric.

What's the Difference Between Blended and Paid CAC?

This is a big one, and getting it right is key to truly understanding where your customers are coming from.

- Blended CAC: This is the big-picture number we've been talking about. It lumps all your marketing and sales costs together and divides them by all the new customers you got. It doesn't matter if they came from an ad, a Google search, or their best friend's recommendation. It’s your overall acquisition health score.

- Paid CAC: This is where you get specific. You only look at the costs from your paid channels (like Google Ads or Meta Ads) and divide that by the customers you acquired directly from those paid efforts. This tells you exactly how efficient your advertising dollars are.

Imagine your business has a nice, healthy blended CAC of $50. But when you dig in, you find your paid CAC is $150. That’s a huge red flag! It tells you that your organic and referral channels are carrying all the weight and your paid campaigns need a serious tune-up.

How Do I Figure Out CAC for a Specific Channel?

This is how you go from diagnosis to action. To calculate CAC for a single channel, you just have to get good at isolating the costs and customers for that channel only.

Let's walk through a quick example with Google Ads:

- Pin down the costs. Tally up your total ad spend on Google for the month, which was $10,000. If you have a marketing person managing it who spends 25% of their time on Google Ads and has a monthly salary of $5,000, you'll also want to attribute a portion of their salary: $5,000 * 0.25 = $1,250. Your total channel cost is $11,250.

- Count the customers. Jump into your analytics or CRM and find the exact number of new customers who came from a Google Ad. Let's say it's 100 new customers.

- Do the math. Divide your total channel cost by the number of new customers it brought in. In this case: $11,250 / 100 customers = $112.50 CAC for Google Ads.

Getting this granular with your customer acquisition cost calculation is a game-changer. It’s what gives you the confidence to double down on what's working and ruthlessly cut the channels that are just burning cash.

Stop wasting time on dead-end leads. With FundedIQ, you get a direct line to recently funded startups actively looking to invest in growth. Our hand-curated, verified lead lists give your agency the ultimate competitive edge. Start your subscription with FundedIQ today and close more deals, faster.